1.0 Introduction

An upbet can only win or lose at the moment the bet expires and not at any time leading up to the expiry of the bet.

Examples of upbets are:

1. Will the price of the CBOT US Sep 10 year Notes future be above $114 at 1600hrs on the last trading day of August?

2. Will the Dow Jones Index be above 12,000 at 1600hrs on the last trading day of the year?

3. Will the LIFFE Euribor Dec/Sep spread be above 10 ticks at settlement on the last day of November?

4. Will a non-farm payroll number be above +150,000?

Examples 1, 2 & 3 enable the bettor to make a minute by minute assessment of the probability of the bet winning. Example 4 is a number (supposedly) cloaked in secrecy until the number is announced at 13.30 hrs on a Friday.

In all the above examples the bet always has a chance of winning or losing right up to the expiry of the bet although the probability may be less than 1% or greater than 99%. The Notes could be trading two full points below the strike the day before expiry but it is possible, although highly improbable, for them to rise enough during the final day to settle above the strike. Conversely the Notes could be trading a full two points higher than the strike the day prior to expiry and still lose although the probability of losing may be considered negligible.

Ultimately the upbet is not concluded until the bet has officially expired and until then no winners or losers can be determined.

Downbets too can only win or lose at expiry. Although in many circumstances the downbet is simply the reverse of the upbet, the downbet has been treated with the same methodology as the upbet in order that other bets, e.g. the eachwaybet, can be analysed within a uniform structure. Also a separate treatment of downbets will provide a firmer base on which to analyse the sensitivity of downbets.

1.1 Upbet Specification

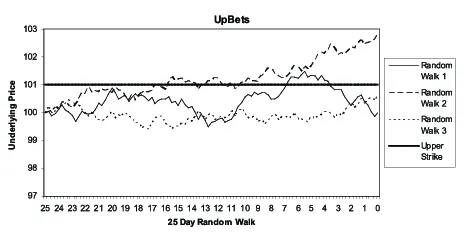

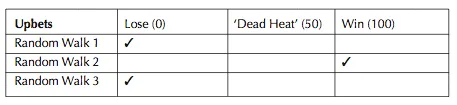

Fig 1.1.1 presents three different random walks that have been generated in order to illustrate winning and losing bets. All the upbets start with an underlying price of $100, have twenty-five days to expiry and a strike price of $101.

1. Random Walk 1 (RW1) flirts with the $101 level after five days, retreats back to the $100 level, rises and passes through the $101 strike after eighteen days and then drifts to settle at a price around $100. The buyer of the upbet loses.

2. RW2 travels up to the $101 level after the eighth day where it moves sideways until, with nine days to expiry, the underlying resumes its upwards momentum. The underlying continues to rise and is around the $102.75 level at expiry, well above the strike of $101, so is consequently a winning bet with the seller ending the loser.

3. RW3 drifts sideways from day one and never looks like reaching the strike. RW3 is a losing bet for the backer with the underlying settling around $100.50 at expiry.

1.2 Upbet Pricing

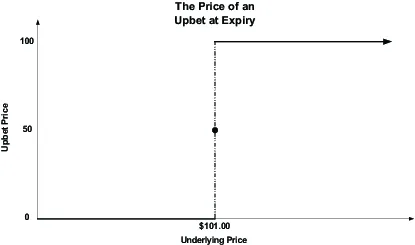

Fig 1.2.1 illustrates the expiry price profile of an upbet. One of the features of binaries is that at expiry, bets have a discontinuous distribution, i.e. there is a gap between the winning and losing bet price. Bets don’t ‘almost’ win and settle at, say 99, but are ‘black and white’; they’ve either (except in the case of a ‘dead heat’) won or lost and settle at either 100 or zero respectively.

1. If the upbet is in-the-money, i.e. in the above example of Fig 1.1.1 the underlying is higher than $101, then the upbet has won and has a value of 100.

2. Alternatively if the upbet is out-of-the-money, i.e. the underlying is lower than $101, then the upbet has lost and therefore has a value of zero.

3. In the case of the underlying finishing exactly on the strike price of $101, i.e. the upbet is at-the-money, then the bet may settle at 0, 50 or 100 depending on the rules or contract specification.

Figure 1.2.1

One issuer of binaries may stipulate that there are only two alternatives, a winning bet whereby the underlying has to finish above $101, or a losing bet whereby the underlying finishes below or exactly on $101. A second company might issue exactly the same binary but with the contract specification that if the underlying finishes exactly on the strike then the bet wins. A third company may consider that the underlying finishing exactly on the strike is a special case and call it a ‘draw’, ‘tie’ or ‘dead heat’, whereby the upbet will settle at 50. This company’s rules therefore allow three possible upbet settlement prices at the expiry of the bet.

N.B. Throughout the examples in this book the latter approach will be adopted whereby in the event that a bet is a ‘dead heat’, or in other words, where the underlying is exactly on the strike price at expiry, then it is settled at 50.

1.3 Upbet Profit & Loss Profiles

The purchaser of a binary option, just like a conventional option, can only lose the amount spent on the premium. If Trader A paid 40 for an upbet at $1 per point then Trader A can lose a maximum of just 40 ¥ $1 = $40. But with a binary not only the loss has a maximum limit but the potential profit has a maximum limit also. So although Trader A’s loss is limited to $40, his profit is limited to (100 – 40) ¥ $1 = $60. As a general rule the profit and loss of the buyer and seller of any binary must sum to 100 ¥ $ per point.

In Figs 1.3.1 and 1.3.2 respectively Trader A’s and Trader B’s P&L profiles are illustrated. Both traders are taking opposite views...