eBook - ePub

Corporate Governance, Firm Profitability, and Share Valuation in the Philippines

This is a test

Compartir libro

- 78 páginas

- English

- ePUB (apto para móviles)

- Disponible en iOS y Android

eBook - ePub

Corporate Governance, Firm Profitability, and Share Valuation in the Philippines

Detalles del libro

Vista previa del libro

Índice

Citas

Información del libro

This study examines 73 publicly listed companies in the Philippines to determine the relationship between the quality of corporate governance practices and company performance. It concludes that as a company's corporate governance practices improve, there is likely to be positive and significant impacts on its market capitalization, market valuation, and profitability. The study was jointly conducted by the Asian Development Bank, the Institute of Corporate Directors, and the University of Asia and the Pacific.

Preguntas frecuentes

¿Cómo cancelo mi suscripción?

¿Cómo descargo los libros?

Por el momento, todos nuestros libros ePub adaptables a dispositivos móviles se pueden descargar a través de la aplicación. La mayor parte de nuestros PDF también se puede descargar y ya estamos trabajando para que el resto también sea descargable. Obtén más información aquí.

¿En qué se diferencian los planes de precios?

Ambos planes te permiten acceder por completo a la biblioteca y a todas las funciones de Perlego. Las únicas diferencias son el precio y el período de suscripción: con el plan anual ahorrarás en torno a un 30 % en comparación con 12 meses de un plan mensual.

¿Qué es Perlego?

Somos un servicio de suscripción de libros de texto en línea que te permite acceder a toda una biblioteca en línea por menos de lo que cuesta un libro al mes. Con más de un millón de libros sobre más de 1000 categorías, ¡tenemos todo lo que necesitas! Obtén más información aquí.

¿Perlego ofrece la función de texto a voz?

Busca el símbolo de lectura en voz alta en tu próximo libro para ver si puedes escucharlo. La herramienta de lectura en voz alta lee el texto en voz alta por ti, resaltando el texto a medida que se lee. Puedes pausarla, acelerarla y ralentizarla. Obtén más información aquí.

¿Es Corporate Governance, Firm Profitability, and Share Valuation in the Philippines un PDF/ePUB en línea?

Sí, puedes acceder a Corporate Governance, Firm Profitability, and Share Valuation in the Philippines de en formato PDF o ePUB, así como a otros libros populares de Betriebswirtschaft y Unternehmensführung. Tenemos más de un millón de libros disponibles en nuestro catálogo para que explores.

Información

Categoría

BetriebswirtschaftCategoría

Unternehmensführung1. INTRODUCTION

1.1 ASEAN Corporate Governance Scorecard

The ASEAN Corporate Governance Scorecard (ACGS) is a benchmarking tool based on international best practices for assessing the corporate governance performance of publicly listed companies in the six participating member countries of the Association of Southeast Asian Nations (ASEAN). Launched in 2011, it was an initiative of the ASEAN Capital Markets Forum (ACMF), composed of capital market regulators from the ASEAN member countries, in collaboration with the Asian Development Bank.

The objectives of ACGS are to raise the corporate governance standards of ASEAN publicly listed companies (PLCs), encourage long-term sustainability and resilience of firms, complement the other ACMF initiatives, and promote ASEAN as an asset class to foreign investors. Prior to the design of the ACGS, all six participating countries (Indonesia, Malaysia, the Philippines, Singapore, Thailand, and Viet Nam) already had their national scorecards. Although these scorecards were generally based on international standards, there were obvious differences in assessment methodology, focus areas, and questions. This meant that results of these scorecards were not comparable. In short, there were national champions, but no regional ASEAN champions.

The design of the ACGS is based on the following principles:

(i)reflect global principles and internationally recognized good practices in corporate governance applicable to PLCs;

(ii)encourage PLCs to adopt higher standards and aspirations;

(iii)be comprehensive in coverage;

(iv)identify governance gaps, but also feature good governance practices;

(v)be applicable to different markets in ASEAN;

(vi)provide accurate assessments beyond minimum compliance; and

(vii)provide robust quality assurance to ensure independent and reliable assessment.

The countries participating in the ACGS are Indonesia, Malaysia, the Philippines, Singapore, Thailand, and Viet Nam.

The ACGS covers the five main corporate governance principles promoted by the Organisation for Economic Co-operation and Development:

(i)rights of shareholders,

(ii)equitable treatment of shareholders,

(iii)role of stakeholders,

(iv)disclosure and transparency, and

(v)responsibilities of the board.

The ACGS was introduced in the Philippines in 2013 under the auspices of the Securities and Exchange Commission (SEC).1 Corporate governance assessment based on the ACGS has since been conducted annually by the Institute of Corporate Directors (ICD), the SEC-appointed domestic ranking body in the Philippines.

1.2 ASEAN Corporate Governance Scorecard Performance

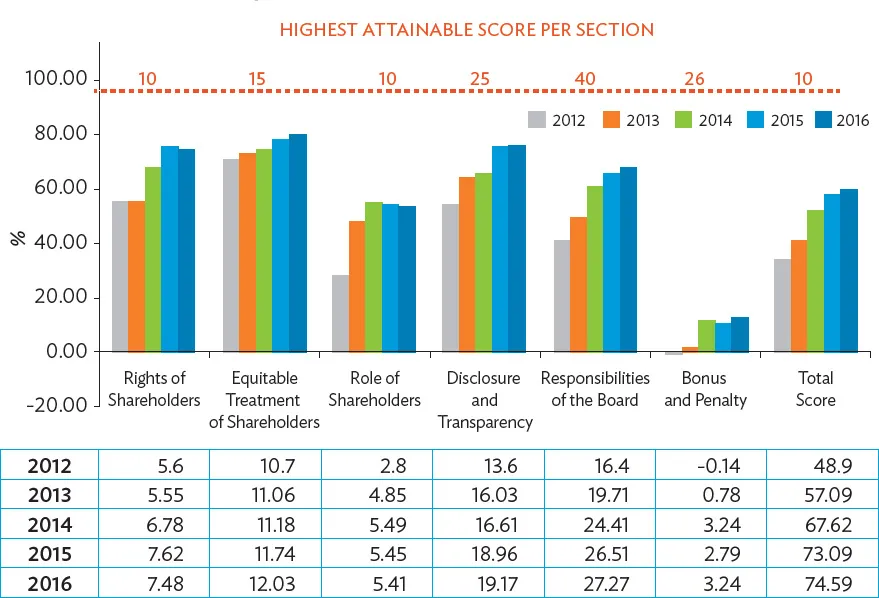

From 2012 to 2016, the Philippines steadily improved its corporate governance standing under the ASEAN Corporate Governance Scorecard (ACGS) (Figure 1). Philippine PLCs as a group recorded a low total score of 48.9 during the first ACGS assessment in 2012. This was partially due to the fact that Philippine PLCs were not aware of the requirements of the ACGS, hence the decision of the SEC to join ACGS on a pilot basis. This prompted greater engagements by the SEC and the ICD with the PLCs to explain the requirements of the ACGS and the differences with the national scorecard of the Philippines as well as promote stronger commitment in adopting and implementing the governance practices embedded in the ACGS. Over the following years, a steady improvement was achieved in the total score as well as in the scores in all the five areas of assessment under the ACGS. By 2016, the total score averaged 74.6.

However, the performance for the different areas of assessment was uneven. PLCs in the Philippines generally perform well in the Rights of Shareholders (Part A) and Disclosure and Transparency (Part D) sections. The results in the Part A for 2015 shows that the average score of Philippine PLCs (7.62) was only behind Thailand (9.06), and better than Singapore (7.37) and Malaysia (6.20).2 Some leading practices include disclosure of voting and vote tabulation procedures in companies’ information statements, and minutes of annual shareholders meetings indicate that resolutions adopted during the meetings and are made publicly available the next working day. Although Philippine PLCs also perform well in Equitable Treatment of Shareholders (Part B), the average score of 11.74 in 2015 is still relatively lower than Thailand (14.75), Malaysia (13.04), and Singapore (12.73).

The sections that require most attention and improvement are Role of Stakeholders (Part C) and Responsibilities of the Board (Part E). The average scores for both sections have seen some improvements from 2012–2016 but have also consistently remained the sections with the lowest scores throughout the 5 years of assessment. In 2015, the average score of Philippine PLCs in Part C (5.45) was lower than Thailand (8.09), Indonesia (6.96), Malaysia (6.70), and Singapore (5.70). Similarly, the average score of Philippine PLCs in Part E (26.51) is lower than the average score in most other ASEAN countries including Singapore (29.71), Thailand (29.68), and Malaysia (29.22). According to the 2015 report, one area for improvement in Part C of Philippine PLCs is providing specific contact details to stakeholders so that they can raise possible violations of their rights. General contact details typically found on company websites are insufficient. Commitment to stakeholders should be facilitated with easy communication. For Part E, areas that require improvement include: (i) the board should be composed of at least 50% independent directors, (ii) companies should have a policy that limits to five board seats in publicly listed companies that an independent or nonexecutive director may hold simultaneously, and (iii) companies should also have a term limit of 9 years or less for its independent directors (footnote 2). Some of these issues are already included in the Corporate Governance Blueprint of the Philippines (discussed below). Engagement on their importance and assessment of compliance will be important to prompt improvement.

1.3 Corporate Governance Philippine Regulatory Reform

In the years covered by the study, three key corporate governance policies were developed and implemented in the Philippines. First, in 2013, the SEC required all PLCs to issue an annual corporate governance report, which consolidated all their governance policies and practices into one report for easy reference. The report was mandatory and due to be submitted by June of every fiscal year. In addition, in October 2013, to improve transparency, the SEC required all PLCs to upload their annual corporate governance reports on their respective websites. Prior to this, disclosures by Philippine PLCs were not centralized: some information were posted on their websites, some were posted through the Philippine Stock Exchange, and some were disclosed through the SEC. As a result of this requirement, investors now have a one-stop reference for all disclosures of a PLC.

Second, in 2015, SEC published the Philippine Corporate Governance Blueprint to serve as a 5-year roadmap for building a stronger corporate governance framework. This initiative was supported by ADB and was developed through a robust process that combined using the OECD principles as reference point for international best practice and through consultation with local PLCs, governance advocates, academe, and corporate governance stakeholders. Using the globally accepted principles of corporate governance, the blueprint made the corporate governance regulatory framework geared not only toward compliance, but also toward addressing challenges faced by companies in the country.

Many of the recommendations contained in the blueprint are consistent with the best practices espoused by the ACGS, which include the following:

(i)Release of the information statements 28 days before the annual shareholders meeting. Rationale and explanation of each agenda item that requires shareholders’ approval should be provided.

(ii)Right of shareholders to nominate candidates to the board. In publicly listed companies, full disclosure of the background and experience of the candidates to the board (including other board positions) is expected.

(iii)Material or significant related party transactions (RPTs) and similar matters involving conflicts of interest should be disclosed fully, accurately, and in a timely fashion.

(iv)Mechanisms enhancing employee performance are encouraged. Programs and relative information on the welfare and development of the employees should be available.

(v)Companies should have a formal and transparent board nomination process. There should also be succession planning for key management positions.

(vi)There should be a right mix of backgrounds and competencies in the board; thus, companies should have a board diversity policy and are encouraged to have female independent directors.3

Finally, in 2016, the SEC revised and issued the Corporate Governance Code for PLCs. This code encouraged and steered companies to apply practices at par with global standards in order to attract foreign investments. It also addressed the perceived “overregulation” of SEC by opting for a “comply or explain” approach, providing more flexibility for companies. This is a market-based approach that requires PLCs to disclosed non-compliance, which then relies on investors to provide feedback and challenge the management, if necessary.

The revised code focuses on five key areas:

(i)the board’s governance responsibilities,

(ii)disclosure and transparency,

(iii)internal control system and risk management framework,

(iv)cultivating a synergistic relationship with shareholders, and

(v)duties to stakeholders.

With 16 principles and 67 best practice recommendations, the code raised corporate governance standards of Philippine PLCs, and fostered a conducive governance system accountable to shareholders and stakeholders.

These policies, complemented with intense engagement led by SEC and ICD with the PLCs, contributed to the improvement in the average score of Philippine PLCs from 48.9 in 2012 to 74.6 in 2016, thus making the Philippines one of the most improved countries. In fact, in 2015, 11 Philippine PLCs were ranked in the top 50 ASEAN PLCs, which placed the Philippines second behind Thailand, which had 23 PLCs in the top 50.4 This achievement demonstrated that Philippine PLCs are able to stand toe to toe with other PLCs in the ASEAN region and subscribe to international corporate governance best practices, contrary to the belief of some local stakeholders who felt that said international best practices would stifle innovation and entrepreneurship.

The improving performance of Philippine PLCs motivated the SEC to formulate policies that would further strengthen the governance framework and implementation by companies from various industries. In support of this effort, ICD undertook the quantitative assessment in the next section. After 5 years assessing corporate governance practices, ICD felt the need to evaluate the impact of the ACGS scores on the financial performance of Philippine PLCs.

2. RESEARCH PROBLEM

The study sought to determine the impact of the quality of corporate governance practices on the market capitalization, market valuation, and profitability of publicly listed companies (PLCs) in the Philippines.

3. OBJECTIVES OF THE STUDY

The study aims to

(i)measure the quality of corporate governance practices of Philippine PLCs using the ASEAN Corporate Governance Scorecard (ACGS) score,

(ii)measure the market capitalization of Philippine PLCs using data from the Philippine Stock Exchange (PSE),

(iii)measure the market valuation of Philippine P...