eBook - ePub

Aspects of the Economic Implications of Accounting

Gerald H. Lawson

This is a test

Compartir libro

- 404 páginas

- English

- ePUB (apto para móviles)

- Disponible en iOS y Android

eBook - ePub

Aspects of the Economic Implications of Accounting

Gerald H. Lawson

Detalles del libro

Vista previa del libro

Índice

Citas

Información del libro

This monograph is concerned with individual, though related, aspects and economic implications of historic cost (HC) accounting indices. The conceptual basis of the model that is advocated as a yardstick for assessing such implications, including potential corporate financial policy consequences, namely, a multiperiod cash flow-market value (CF-MV) model, is elaborated and evaluated at some length.

Preguntas frecuentes

¿Cómo cancelo mi suscripción?

¿Cómo descargo los libros?

Por el momento, todos nuestros libros ePub adaptables a dispositivos móviles se pueden descargar a través de la aplicación. La mayor parte de nuestros PDF también se puede descargar y ya estamos trabajando para que el resto también sea descargable. Obtén más información aquí.

¿En qué se diferencian los planes de precios?

Ambos planes te permiten acceder por completo a la biblioteca y a todas las funciones de Perlego. Las únicas diferencias son el precio y el período de suscripción: con el plan anual ahorrarás en torno a un 30 % en comparación con 12 meses de un plan mensual.

¿Qué es Perlego?

Somos un servicio de suscripción de libros de texto en línea que te permite acceder a toda una biblioteca en línea por menos de lo que cuesta un libro al mes. Con más de un millón de libros sobre más de 1000 categorías, ¡tenemos todo lo que necesitas! Obtén más información aquí.

¿Perlego ofrece la función de texto a voz?

Busca el símbolo de lectura en voz alta en tu próximo libro para ver si puedes escucharlo. La herramienta de lectura en voz alta lee el texto en voz alta por ti, resaltando el texto a medida que se lee. Puedes pausarla, acelerarla y ralentizarla. Obtén más información aquí.

¿Es Aspects of the Economic Implications of Accounting un PDF/ePUB en línea?

Sí, puedes acceder a Aspects of the Economic Implications of Accounting de Gerald H. Lawson en formato PDF o ePUB, así como a otros libros populares de Negocios y empresa y Negocios en general. Tenemos más de un millón de libros disponibles en nuestro catálogo para que explores.

Información

CHAPTER 1

ASSESSING ECONOMIC PERFORMANCE ON A CASH FLOW-MARKET VALUE BASIS

1.1 Introduction: economic consequences of accounting

The notion of “economic consequences of accounting” that is adopted in this monograph is somewhat broader than that which is the focus of a great deal of contemporary empirical research in accounting, namely, the possible effects of accounting policy changes on stock market prices. Not to put too fine a point on it, all disclosures or decisions that are ordinarily based on ex post or ex ante profit or profitability measures reflecting generally accepted accounting principles (GAAP) are potentially germane to the discussions contained in the chapters which follow.

Implicit in the expression “economic consequences of accounting” is the presumption that “conventional” profit and profitability measures based on GAAP are not a neutral arbiter in decision-making contexts and/or that they are characterised by an inherent degree of inaccuracy which may, in some circumstances, cause sub-optimal choices, e.g., the choice of proposals or plans, which, in “an economic sense,” do not represent the most profitable alternative or which, as independent schemes, are actually unprofitable. If conventional profit and profitability measures cannot always be relied upon to distinguish between profitable and unprofitable situations, or as ranking criteria, they do not deviate from appropriately-specified economic measures of performance in a consistent manner that is amenable to direct scale adjustments. Hence, any such micro- and macro- policy inferences and expectations as are based on inter-industry, inter-company and inter-period conventional accounting performance measures should be treated with the utmost caution.

Whereas the concept of performance measured in accordance with generally accepted accounting principles enjoys extensive operational usage, the notion of performance measured in accordance with generally-accepted principles of financial economics is still at an embryo stage. Existing, well-established, economic principles nevertheless offer a rigorous conceptual foundation for the cash flow-market value model which is adopted here as an “economic accounting method.” As elaborated hereafter, a cash flow-market value model can be applied in practice at any desired level of aggregation, e.g., at the level of individual firm or industry or sector etc., either as a decision making-planning system, or, as a means of measuring ex post economic performance from the standpoint of a firm as an economic unit and / or from an ownership standpoint.

In the chapters which follow, the cash flow-market value model that is specified below is mainly used as a means of measuring the extent to which historic cost measures of ex post and ex ante performance deviate from the corresponding values that are measured in accordance with the cash flow-market value accounting model. The magnitude of any such deviations should, in turn, elucidate the question of whether they are operationally significant. Put another way; does the size of the deviations between conventional accounting and cash flow-market value measures imply that the pursuit of an objective cast in conventional accounting form, e.g., the maximisation of earnings per share, will result in a decision sub-set that typically deviates from the sub-set that would be taken in the pursuit of the wealth maximisation (economic) objective? The analogous ex post issue raises a two-fold question:

• is the message about achieved performance that is conveyed by the conventional accounting model for all practical purposes much the same as that which is signalled by the cash flow-market value model; or, alternatively,

• do the respective achieved performance messages conveyed by the historic cost accounting model and the cash flow-market value model conflict in ways which are cross-sectionally and/or temporally inconsistent?

The distinction that is made in the penultimate paragraph between the performance of a company as an economic entity and performance from an ownership standpoint prompts a further consideration. This is, namely, a possible means of measuring, or of assessing, the efficiency of the financial policies whereby a company delivers the returns from economic activity to its shareholders and lenders. This is the subject of chapter 2.

1.2 Specification of a cash flow-market value accounting model

If a cash flow-market value model (hereafter CF-MV model) is to be used as a yardstick for gauging the nature, extent and possible effects of the (widely-assumed) inaccuracy of the conventional historic cost accounting model (hereafter HCA model), the former model ought, arguably, to possess most, or all, of the generally-accepted attributes of a satisfactory accounting model. These attributes have to do with such familiar notions as distributable income, capital maintenance, representational faithfulness, compliance with recognition criteria etc., and can obviously be addressed in more concrete terms following the formulation of a CF-MV model itself.

The rationale for a CF-MV basis of accounting lies in the widely-held assumption that the value and continuity of a business enterprise and the returns it can provide for its owners depend upon its expected cash flow-generating capacity. This implies that the past performance of a going concern and ex post ownership returns ought to be measurable on a cash flow basis. A distinction, which is crucial from an operational standpoint, between a pure cash flow accounting model and a cash flow-market value (CF-MV) accounting model can, however, be made.1

Two paramount objectives of external financial reporting are thus a relevant starting point for a specification of a CF-MV model which can be used as a yardstick for gauging the nature, extent and possible effects of the widely-assumed inaccuracy of the historic cost accounting model. These are:

• the disclosure of such information as facilitates the formation of investor expectations about the main determinant of a firm’s market value, namely, its future cash flow generating capacity; and,

• the measurement of ex post periodic income.

1.3 Cash flow statements, market values and the formation of expectations about future cash flows

The stream of cash flows generated by a business enterprise (hereafter ‘entity’) is divided between lenders and stockholders in a ratio which reflects its dividend and debt-financing policies. This partitioning of (entity) cash flows also divides total (entity) market value into the market values of its debt and equity.

The distinction between entity and claimholder cash flows on the one hand, and between entity and claimholder market values on the other can be expressed as two simple identities. As argued hereafter, these distinctions should be explicitly allowed for in reporting performance as a guide to the formation of expectations and in measuring ex post income.

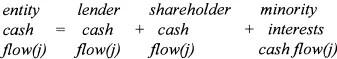

For any year j, an entity’s cash flow identity, allowing for minority interests (if any), is defined as:

or, in more compact shorthand form,

ENCFj = LCFj + SHCFj + MICFj;

or, in more detailed accounting form,

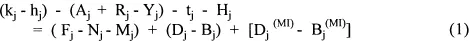

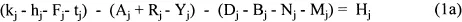

where, in year j,

Kj - hj | = operating cash flow represented by cash collected from customers, kj, and operating payments, hj; |

Aj + Rj - Yj | = replacement investment, Aj, growth investment, Rj, and the proceeds from assets displaced, Yj; |

tj | = corporate income tax payments; |

Hj | = liquidity change, i.e., change in cash and cash equivalents; |

Fj | = interest payments; |

Nj | = medium and/or long-term debt raised (-ve) or repaid (+ve); |

Mj | = short-term debt raised (-ve) or repaid (+ve); |

Dj | = dividends paid to shareholders; |

Bj | = equity capital raised (-ve) or repaid (+ve); |

Dj(MI) | = dividends paid to minority interests; and, |

Bj(MI) | = equity capital raised (-ve) from, or repaid (+ve) to, minorities. |

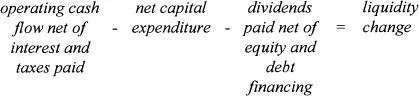

The latter cash flow identity can be contrasted with the cash flow classification prescribed by the FASB (1987), namely,

i.e.,

The FASB cash flow classification can be criticized in at least four respects because of its failure fully to give effect to established principles of financial economics:

(i) | It erroneously treats contractual interest payments as an operating cost and thereby fails to allow for the “Fisher effect”, i.e., the fact that contractual interest payments embody a significant element of lenders’ principal which is repaid accordingly.2 Moreover, in that contractual interest payments are a function of (discretionary) financial policy, as opposed to operating activity, e.g., sales and production, it can in fact be contended that contractual interest payments should be wholly excluded from the operating cash flow sub-category. Either way the FASB classification generally understates “true” operating cash flow and does not therefore facilitate direct inter-company operating cash flow comparisons. |

(ii) | In treating tax payments as a constituent of operating cash flow, rather than as a separate variable, it fails to recognize that tax payments are also a function of a company’s financial policy. Moreover, the separate disclosure of taxes facilitates a direct assessment of their effective incidence in accordance with well-established principles of tax neutrality. |

(iii) | It wrongly treats the periodic change in cash balances as a dependent variable. A long-established principle of financial economics is that a firm’s liquidity level should be a function of transactions, precautiona... |