eBook - ePub

Quantitative Trading with R

Understanding Mathematical and Computational Tools from a Quant's Perspective

Harry Georgakopoulos

This is a test

Compartir libro

- English

- ePUB (apto para móviles)

- Disponible en iOS y Android

eBook - ePub

Quantitative Trading with R

Understanding Mathematical and Computational Tools from a Quant's Perspective

Harry Georgakopoulos

Detalles del libro

Vista previa del libro

Índice

Citas

Información del libro

Quantitative Finance with R offers a winning strategy for devising expertly-crafted and workable trading models using the R open source programming language, providing readers with a step-by-step approach to understanding complex quantitative finance problems and building functional computer code.

Preguntas frecuentes

¿Cómo cancelo mi suscripción?

¿Cómo descargo los libros?

Por el momento, todos nuestros libros ePub adaptables a dispositivos móviles se pueden descargar a través de la aplicación. La mayor parte de nuestros PDF también se puede descargar y ya estamos trabajando para que el resto también sea descargable. Obtén más información aquí.

¿En qué se diferencian los planes de precios?

Ambos planes te permiten acceder por completo a la biblioteca y a todas las funciones de Perlego. Las únicas diferencias son el precio y el período de suscripción: con el plan anual ahorrarás en torno a un 30 % en comparación con 12 meses de un plan mensual.

¿Qué es Perlego?

Somos un servicio de suscripción de libros de texto en línea que te permite acceder a toda una biblioteca en línea por menos de lo que cuesta un libro al mes. Con más de un millón de libros sobre más de 1000 categorías, ¡tenemos todo lo que necesitas! Obtén más información aquí.

¿Perlego ofrece la función de texto a voz?

Busca el símbolo de lectura en voz alta en tu próximo libro para ver si puedes escucharlo. La herramienta de lectura en voz alta lee el texto en voz alta por ti, resaltando el texto a medida que se lee. Puedes pausarla, acelerarla y ralentizarla. Obtén más información aquí.

¿Es Quantitative Trading with R un PDF/ePUB en línea?

Sí, puedes acceder a Quantitative Trading with R de Harry Georgakopoulos en formato PDF o ePUB, así como a otros libros populares de Commerce y Comptabilité. Tenemos más de un millón de libros disponibles en nuestro catálogo para que explores.

Información

Categoría

CommerceCategoría

Comptabilité1 | An Overview |

My primary intent in writing this book is to provide the reader with basic programming, financial, and mathematical tools that can be successfully leveraged both in industry and academia. I cover the use of the R programming language, as well as the R environment as a means for manipulating financial market data and for solving a subset of problems that quants and traders typically encounter in their day-to-day activities. The chapters that follow should be treated as a tutorial on a recommended set of tools that I have personally found useful and that have served me well during the last few years of my career as a quant trader/developer. I am writing this book from the vantage point of a quant practitioner and not that of an academic. A significant portion of the content is based on my lecture notes from a graduate level class in quantitative finance that I teach on a part-time basis at Loyola University in Chicago.

This is an introductory-level book. No prior programming experience or advanced mathematical knowledge is assumed. Having said this, some chapters will tend to flow easier if you have had some prior exposure to the following topics. On the math side, I recommend a review of basic calculus, linear algebra, statistics, and probability.1 On the programming side, familiarity with VBA, Python, and SQL2 is helpful.

This book is also aimed at practitioners and seasoned traders who want to learn more about how to conduct data analysis on financial data and how to write useful R scripts to automate some of their workflow.

Trading and programming are vast topics in their own right, and by no means will I attempt to give a thorough explanation of each concept. You will not become an expert programmer by reading this book, nor will you make a ton of money in the markets by following my advice. This book will, however, provide tools and ideas that can assist in the analysis, implementation, and presentation of trading strategies and other related quantitative topics. Figure 1.1 provides an illustration of the items I will address in subsequent chapters.

The mission statement

I will attempt to take a somewhat fuzzy concept—that of creating a trading strategy—and provide plausible answers to some questions that will naturally arise. Questions like the following: How can I automate some of my trading ideas? What programming language should I use and why? What are the mathematical, financial, and programming tools needed to evaluate my strategy? Where do I get the data to test a trading strategy? How do I know that my strategy is any good? How do I present my results to others?

Figure 1.1 Topic graph.

Most books on programming can be used as references. You go to the index and find the topic that interests you, and then you simply go to that particular page for further information. To get the most out of this book, I recommend that you do not follow this approach. Rather, start from the beginning and read all the chapters in a linear fashion. There is a method behind this madness. I intend to expose you to a methodology of thinking about quantitative finance and to give you the confidence to tackle some of the real-world problems that naturally arise in this context. And you will accomplish all this, while utilizing R to automate the required tasks.

It is prudent to form a mental map of where we are headed and what obstacles lie in our path. One of our end goals will be to obtain the necessary programming skills so as to tackle some very specific problems that quants and traders typically care about. The other end goal will be to manipulate financial data and to use mathematical techniques to evaluate trading strategies.

For the purpose of making these goals more concrete, I will bake them directly into a mission statement. Here is a first attempt at such a statement:

We will come up with an automated trading strategy that will trade a portfolio of liquid instruments in the market. The strategy will be efficient, robust, and scalable. Furthermore, the strategy will be profitable and have low risk.

Here are some questions that might arise after reading the mission statement:

1.What is a market?

2.What is meant by instruments, and furthermore, what is meant by liquid instruments?

3.What is a trading strategy, and how does one go about formulating such a thing?

4.How is profitability of a trading strategy defined?

5.What is risk? Specifically, how can one quantify risk in the context of a trading strategy?

6.How can a trading strategy be automated?

7.What is meant by efficiency?

Financial markets and instruments

A market is either a physical or a virtual place where transactions occur between participants. In ancient Greece, the Athenian citizens would gather in the agora3 and trade honey, olive oil, other agricultural products, and works of art in exchange for similar items. Transactions would be carried out with in-kind merchandise and currency. Similar marketplaces existed all over the ancient world. In those physical markets, as in today’s physical markets, participants would have to physically meet and agree both on the price and the terms of delivery before a transaction was confirmed.

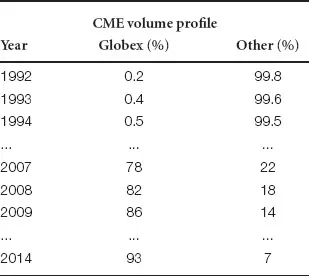

Today, many of the physical marketplaces of the world are giving way to virtual ones. Take amazon.com, ebay.com, and alibaba.com as examples of this trend. These are vast online marketplaces where buyers and sellers interact and transact entirely via computer. Similar trends have been occurring in the financial markets over the last few years. The old floor pits of the futures, stocks, and options exchanges are giving way to electronic platforms. Table 1.1 lists approximate electronic versus floor trading volume percentages on the CME exchange. Globex refers to the Chicago Mercantile Exchange (CME) electronic platform.

An organized market’s primary objective is to bring together participants who are willing to trade their goods and services at an agreed-upon price. A secondary objective of a successful marketplace is to facilitate the orderly conduct of such transactions. Electronic financial markets certainly fit this description.

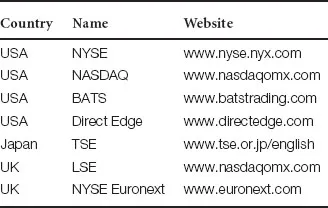

Over the years, literally hundreds of financial exchanges and alternate electronic venues have popped up all over the globe. Some of the more notable stock trading venues are outlined in Table 1.2.

Some of the more notable futures exchanges are listed in Table 1.3.

Such exchanges enable the efficient and orderly transaction of standardized financial contracts. Financial instruments are stocks, futures, bonds, currencies, vanilla options, exotic options, swaps, swaptions, and so forth. Some of these instruments have become more popular than others [35]. The E-mini financial futures and eurodollar contracts traded on the CME, for example, are some of the most liquid contracts in the world. Investors and traders rely on these to manage their market and interest rate risks on a daily basis. The following table lists the average daily volumes of a few of these CME futures contracts [36].

Table 1.1 Globex volume estimates by year

Table 1.2 Popular stock exchanges

Table 1.3 Popular futures exchanges

Liquidity is really a measure of how easy it is to buy or sell a certain quantity of an instrument at a favorable price. Liquidity can be loosely thought of as a proxy for transacted volume. Investors and traders love liquid products because they can potentially trade a lot of size in those products without adversely affecting the price.

Table 1.4 Active contract volumes

Trading strategies

Financial institutions are some of the most heavily regulated entities on the planet.4 This is both a good and a bad thing. It is bad, because this tends to stifle competition and innovation. It is good, because this enables market participants to have more confidence in the validity, and fairness of their transactions. Having confidence in the validity of ones trades is a very important concept. This is what enables investors and traders to invest large amounts of time and money in the development of electronic trading platforms that actively participate in these electronic marketplaces. Trading strategies arise when an investor or a trader spots an opportunity that can be legally exploited by placing buy or sell orders for certain financial instruments. These transactions have to be offset at a later point in time in order for the trader to realize a profit on the trades. Trading strategies have holding periods that can range...