![]()

CHAPTER 1

Introduction and Overview

1.1 Context and Aim of the Study

South Asian and Southeast Asian economies have grown rapidly during an era of a fragile world economic growth beset by risks and uncertainties. This progress has been fueled by expanding regional production networks, integration with the global economy, foreign direct investment (FDI), falling trade and investment barriers, a commodity boom, and heightened demand from a rising Asian middle class. The results have been positive; the South Asian and Southeast Asian regions are among the most dynamic in the world and have produced impressive socioeconomic improvements.1 While challenges remain, these regions are on the right path.

However, trade and investment between these two regions, while making progress, has been constrained by bottlenecks and gaps in trade infrastructure, financial markets, trade facilitation, trade barriers, and limited regional cooperation. The growth of trade between South Asia and Southeast Asia has been remarkable—increasing nearly 22 times from $4 billion to $90 billion from 1990 to 2013. But Southeast Asia’s share of South Asian trade rose from 6% to only 10% over the same period, whereas South Asia’s share of Southeast Asian trade doubled from about 2% to 4%. The same story applies to cross-regional investment. Southeast Asia only accounted for 15% of total South Asian FDI outflows during 2009–2013, and South Asia only received 9% of Southeast Asian FDI. This suggests that there is significant potential for trade and investment growth between the two regions. In particular, FDI-driven supply chain networks that are a key driver of trade expansion in Southeast Asia have yet to develop much in South Asia. Small and medium-sized enterprises (SMEs) that account for over half the employment in South Asian and Southeast Asian economies have limited presence in trade. Furthermore, excluding Singapore, outstanding portfolio investment from Southeast Asia to South Asia was small, totaling only about $775 million in 2012 while outstanding portfolio investment from South Asia to Southeast Asia was only about one-seventh of this figure. These developments are described in more detail in Chapter 2.

In the aftermath of the 2007–2009 global financial crisis, it has become clear that Asian economies must rely more on domestic and regional demand to secure sustainable and inclusive growth.2 Increased connectivity between South Asia and Southeast Asia can play an important role in achieving this goal by improving efficiency and productivity via more efficient industries based on comparative advantage, enlarging the effective market size, and increasing access to it. Better connectivity—through hard and soft infrastructure—lies at the heart of unlocking the full benefits of closer economic ties between the two regions.

This study focuses on how improved connectivity can enhance economic integration between the two regions. Broadly defined, connectivity covers both physical connectivity or hard infrastructure and associated policy-related and institutional connectivity or soft infrastructure.3 In this study, physical infrastructure includes that related to transport and energy, while software includes the critical areas of financing of infrastructure, trade facilitation, trade and investment reforms, and institutions for coordination. The study thus provides a background for considering strategic cross-border infrastructure investments and policy reforms.

The time is ripe for a study of connectivity between South Asia and Southeast Asia. The recent political and economic reform process in Myanmar—a key land bridge between these two regions—now makes possible connectivity that was not feasible a few years ago. This is particularly the case for land-based transportation—both highways and railroads—and energy infrastructure. Myanmar can benefit from opening up and becoming a bridge between South Asia and Southeast Asia. The country has several sources of comparative advantage, including rich natural resource endowments (for example, petroleum, potential hydropower, natural gas, coal, timber, minerals, and precious stones), abundant low-cost labor for export-oriented industries, and historic sites with tourism potential. These potential gains include contributing to achieving inclusive and sustainable growth, integrating into regional production networks, and contributing to processes of political reconciliation in the regions.

Also, the start of negotiations in 2013 on a Regional Comprehensive Economic Partnership (RCEP) has aided the prospect of further trade and investment liberalization between the Association of Southeast Asian Nations4 (ASEAN) member states and major regional economies (including India). This is important in the context of India’s Look East policy. In addition, many South Asian and Southeast Asian economies are contemplating second-generation economic reforms to sustain inclusive growth.

There is heightened policy interest in the process of cross-regional integration, and particular interest in further developing economic relationships between South Asia and Southeast Asia. The implementation of the ASEAN–India free trade agreement (FTA) has facilitated cross-regional trade and investment liberalization. Nonetheless, such economic integration faces numerous challenges, including problematic cross-border infrastructure links, ubiquitous difficulties related to weak trade facilitation, a shortage of infrastructure financing, numerous non-tariff barriers (NTBs) and barriers to FDI, relatively limited preferential coverage, and weak institutional coordination. In short, while economic integration efforts have made progress, the process has a long way to go before it can reach its full potential. This study charts a path to get there.

This report sets out key issues in relation to improving connectivity between South Asia and Southeast Asia, traces their implications, and delineates possible policies. It is based on research conducted over one and a half years by staff and consultants of the Asian Development Bank (ADB) and the Asian Development Bank Institute (ADBI). The consultants include specialists in land and sea transport, energy trade, trade facilitation, infrastructure finance, and institutional aspects. Another set of specialists prepared the country papers.

Chapter 2 reviews the evolving economic ties between the two regions and identifies benefits and costs to greater economic integration. Chapter 3 analyzes the current situation of cross-border transport infrastructure between the two regions, identifies bottlenecks and investment projects that could relieve those bottlenecks, and estimates their likely benefits and costs. Chapter 4 examines the potential for energy trading between the two regions and identifies some specific projects. Chapter 5 assesses the environment for financing cross-border infrastructure investment, including the capacity of regional financial markets and issues related to increasing the share of private financing of such projects, including public–private partnerships (PPPs). Chapter 6 reviews trade facilitation in the two regions and identifies policy initiatives to improve the free flow of trade. Chapter 7 examines national and regional trade policy reforms that can promote trade and investment between the two regions. Chapter 8 reviews the institutional risks associated with attempts to improve cross-regional connectivity, and identifies national and regional policy reforms to address them. Chapter 9 assesses the impacts of greater cross-regional integration, using a computable general equilibrium (CGE) model approach.

The structure of this chapter is as follows. Section 1.2 provides a qualitative description of the benefits and costs of greater economic integration and cooperation between the two regions. Section 1.3 summarizes the overall analytical approach and geographical scope of the study. Sections 1.4 to 1.10 summarize the findings of the individual chapters of the report. Section 1.11 concludes.

1.2 Rationale for Greater Economic Integration and Cooperation

A fundamental insight of economics is that international trade improves an economy’s aggregate income. According to the World Bank, in the 1990s per capita real income grew more than three times faster for developing countries that lowered trade barriers (5.0% per year) than for other developing countries (1.4% per year) (as cited in OECD 2010). This result follows largely from the reallocation of production factors from less to more efficient activities along the lines of a country’s comparative advantage.

Moreover, empirical studies underscore the importance of investments in public infrastructure—physical and institutional—that can support the shift to new areas of economic activity consistent with an economy’s evolving factor endowments and factor prices, as well as complementary policies such as trade facilitation and trade finance.

While economic relations between South Asia and Southeast Asia are at an early stage, they have great potential.5 Potential benefits of closer economic integration and cooperation include:

• Greater economic integration expands the market for goods and services, thereby increasing the scope for economies of scale and greater competition.

• Specialization in regionally competitive industries generates a more efficient productive structure in all economies, thereby enhancing regional competitiveness.

• Integration facilitates the extension or movement of production networks from Southeast Asia and South Asia, where development of such networks has lagged, to take better advantage of wage differentials.

• Increased competition within the integrated region could lead producers outside the region to reduce their prices as well, lowering import prices to the region and improving its terms of trade.

• A more integrated region could attract more FDI with its benefits of technology and knowledge transfer, higher productivity, and market access. The entry of export-oriented FDI and foreign buyers is an important means to connect firms with regional production networks and supply chains.

• Large and comprehensive FTAs enable deeper and wider integration among member countries than would be feasible within a multilateral framework. Well-designed agreements, with modern and flexible rules of origin and international standards, can play a role in reducing trade costs for the spread of production networks.

• Cooperation on infrastructure and trade facilitation (for example, transport, customs clearance, and product standards) and services (for example, financial and labor services) would likely lead to a reduction in trade costs and result in welfare gains well in excess of gains from mere tariff liberalization.

• There are potential gains from greater cooperation among existing regional institutions. For example, stronger coordination between the Greater Mekong Subregion6 (GMS), the South Asia Subregional Economic Cooperation7 (SASEC) group, and the Bay of Bengal Initiative for Multi-Sectoral Technical and Economic Cooperation (BIMSTEC)8 group could serve as a platform for developing longer and stronger economic corridors, anchored by cross-border infrastructure projects, and better management of the cross-border spread of infectious diseases as well as reducing drug and human trafficking.

• Finally, greater connectivity can provide the basis for more inclusive growth with greater potential for reducing poverty and closing development gaps. This includes minority groups that have been marginalized in the past, leading to conflict situations. Such developments could have broader benefits of promoting stability and enhancing peace and security in the region, including aspects related to water supply, labor mobility, and possibly defense.

Financial integration can also provide benefits by reducing funding costs and expanding available resources to fund needed investments such as infrastructure projects. This is particularly important for countries with less developed financial markets and institutions. Stable and efficient regional financial markets can help channel savings from around Asia and the rest of the world into productive investments throughout the region.

Certainly, the process of closer intra-regional economic integration generates potential benefits but may entail some additional costs that need review and mitigation measures. For instance, some sectors and regions will lose due to greater competition, and there may be increases in regional inequalities. Also, closer intra-regional economic ties and faster growth may entail pollution, environmental degradation, and immigration issues. Regional economic integration may also hasten the spread of disease and crime and could exacerbate fears of migration, ethnic tensions, and other security-related issues.

Financial integration can also create costs from the increased exposure of economies with immature financial systems to external financial shocks, especially “sudden stops” (rapid and large-scale capital outflows) that can severely affect the real economy. Thus, financial development and integration must be sequenced properly and coordinated with improved national and regional financial surveillance and regulatory institutions.

The analysis in this report suggests that the benefits of greater economic integration far outweigh the costs, especially since they spread the advantages of economic development to isolated areas. Nonetheless, institutional mechanisms will be needed to compensate losers in the integration process and to address some of the undesirable side effects mentioned above. This is likely to require cooperation at the regional level.

1.3 Analytical Approach

Relationship of Study Components

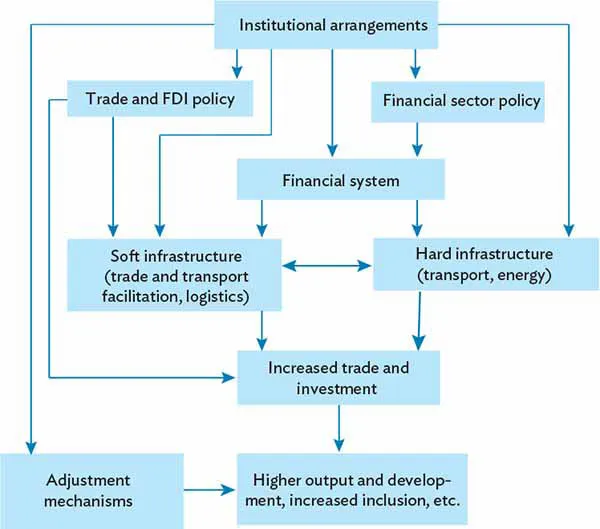

Much can be done in South Asia and Southeast Asia to reduce impediments to cross-regional trade and investment and to improve global competitiveness. This report identifies and analyzes measures that could be promulgated by South Asian and Southeast Asian countries and regional groupings to accomplish this—including policies for trade facilitation, regional trading agreements, and investment in infrastructure. Achievement of a comprehensive approach to improving cross-regional integration requires policy interventions at different levels. Figure 1.1 shows the relationships of the key elements that are analyzed in this study.

Figure 1.1: Key Elements for Promoting Cross-Regional Connectivity

FDI = foreign direct investment.

Source: Compiled by authors.

First, increased trade and investment are expected to result from improvements in both hard and soft infrastructure. Hard infrastructure includes improvements in transport (roads, railroads, and ports) and energy (generation and transmission facilities). Soft infrastructure includes trade and transport facilitation, inclu...