![]()

PART I

International Trade Theory

International trade has grown steadily over the past 300 years, although it declined during the Great Depression and between World Wars I and II. From 1945 to 1980, international trade grew faster than ever before due to decreases in trade barriers during the Great Depression and the two wars, and the significant decline in transportation costs. During this period, developing countries primarily exported agricultural goods and commodities to the advanced industrialized countries and imported manufactured products. Beginning in the 1980s, many emerging economies like China, India, and Brazil began to liberalize their trade policies and actively entered the global markets. China became a major exporter of textiles and apparel, and other countries such as Malaysia, Turkey, Mexico, South Korea, Indonesia, and Thailand moved into manufacturing trade. Multinational corporations began to establish subsidiaries and moved some of their production activities to these countries. American companies first moved the production of apparel, shoes, and toys to developing countries, followed by the assembly of cars and electronic goods, to take advantage of lower less-skilled labor costs. Today many companies rely on foreign sources for high-skilled activities, such as programming, software development, chip design, and financial analysis.

Currently, according to the World Trade Organization (WTO), the top exporter of agricultural products is the European Union (EU), comprising 38 percent of global exports, followed by the United States, Brazil, China, and Canada. The EU is also the top exporter of fuels, mining products, and cars. The EU, China, Japan, and South Korea are the principal exporters of steel and iron. China is the world’s largest exporter of office and telecommunication equipment, textiles, and clothing. The EU is the leading exporter of cars, followed by Japan, the United States, and Canada. A major portion of global trade is in services, which includes transportation, travel, communications, construction, insurance, financial, computer and information technologies, and other business services such as operational leasing, technical and professional services, and cultural and recreational services. The United States, the United Kingdom, China, Germany, and Japan are the largest exporters of these services.1

1https://www.wto.org/english/res_e/statis_e/wts2016_e/wts16_toc_e.htm. (accessed June 21, 2017)

![]()

CHAPTER 1

The Basics of a Market: Supply and Demand and Equilibrium

To understand the basis for international trade, we need to explain how the price of a product is determined and why does the price change. Every product or service has a market composed of producers (suppliers) and consumers (demanders) of the product. The interaction of the suppliers and demanders determines the price and the quantity sold of a product.

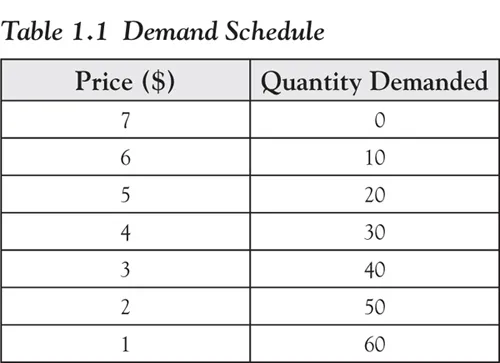

Demand

To have a demand for a product, a consumer must want the product, can afford to buy the product, and finally has plans to purchase the product. Holding other variables constant, the most important determinant of the quantity demanded of a product is the price of the product. As the price of a product rises, a consumer will be less willing to buy the product and will look to buy an alternative product that is less expensive. Conversely, as the price of the product falls, a consumer will be more willing to buy the product as opposed to the more expensive alternative. This is expressed as the law of demand which states: holding everything else constant, an increase in the price of a product leads to a decrease in the quantity demanded of the product, and a decrease in the price of a product leads to an increase in the quantity demanded of the product. Table 1.1 is a representative demand schedule for a product.

To arrive at the market demand for the product we add all the individual demands for the product. In addition to the price, there are other determinants that affect the demand for a product. These include tastes and preferences, income, the price of other goods, number of buyers, and expected future prices. Any changes in these variables will result in a change in the demand for the product. For example, if people’s income increases, they will be able to afford to buy more of a product, so the demand for the product will increase. If a product has a close substitute, then a rise in the price of a substitutable product will increase the demand for the product. For example, if the price of Pepsi Cola increases, the quantity demanded of Pepsi Cola decreases, and the demand for Coca Cola increases. If a product has a complement, then a rise in the price of a complement will decrease the demand for the product. For example, if the price of printers increases, the quantity demanded of printers decreases, and the demand for ink cartridges decreases. If consumers’ tastes and preferences for a product change, then the demand for the product will change. For example, if studies show that consuming diet sodas increases the chance of liver cancer, then the demand for diet sodas will decrease. Changes in the number of buyers also results in a change in the demand for a product. An increase in the number of buyers increases the market demand, while a decrease in the number of buyers decreases the market demand. Finally, changes in expected prices in the future affect the current demand for the product. If consumers expect a decrease in the price of a product in the future, they will postpone their purchases today, leading to a decrease in the current demand for the product and vice versa.

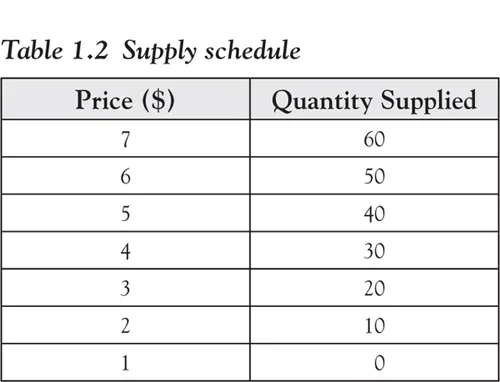

Supply

A producer must be able and willing to produce a good if it is profitable. The most important determinant of the quantity supplied of a product is the price of the product. As the price of a product rises, holding the cost of producing the product constant, the greater the potential for profits, which leads a firm to produce more of the product and vice versa. This is summarized in the law of supply: holding everything else constant, an increase in the price of a product leads to an increase in the quantity supplied of the product and a decrease in the price of a product leads to a decrease in the quantity supplied of the product. Table 1.2 is an example of the supply schedule of a product.

In addition to the price of the product, other variables affect the supply of a product. These include the price of inputs, changes in technology, the price of related goods, expected future prices, taxes, subsidies, government regulations, and the number of suppliers. Changes in input prices will change the supply of a product. For example, if the price of steel in car manufacturing rises, then the cost of car production increases and a car company will decrease the supply of cars. Changes in technology that result in a decrease in production costs will increase the supply of a product. Changes in the price of related goods will also change the supply. If Ford Motor Company observes that the price of SUVs has risen relative to sedans, it will increase the quantity supplied of SUVs and decrease the supply of sedans. Changes in expected price in the future will affect supply. If a company expects a higher price in the future, it will withhold the supply of the product today to take advantage of higher prices in the future. Companies consider business taxes as costs, so if taxes increase, then supply decreases.

Conversely, a subsidy is a direct payment to companies by the government, so an increase in production subsidies leads to an increase in supply. Government business regulations that lead to higher costs decrease the supply. Finally, an increase in the number of producers leads to an increase in market supply.

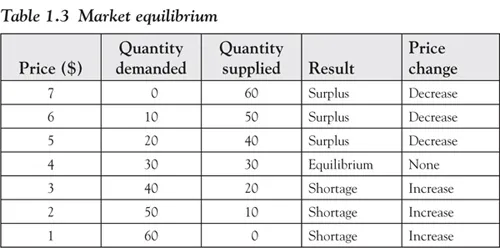

Market Equilibrium

Let us examine how the suppliers and demanders interact with each other in the market using the data in Table 1.3.

At a price of six dollars, the quantity demanded is equal to 10 and the quantity supplied is equal to 50. In other words, the producers are willing to supply a larger quantity than consumers are willing to purchase, resulting in a surplus or excess supply of the product. To reduce this excess supply of the product, the firms will lower the price. If the suppliers lower the price to five dollars, the quantity demanded increases to 20, but there will still be a surplus of 20 units, which puts pressure on the suppliers to further reduce the price. The price will continue to decrease until the quantity demanded equals the quantity supplied.

At a price of two dollars, the quantity demanded is equal to 50, while the quantity supplied is equal to 10. That is, consumers are willing to purchase a larger quantity of the product than producers are willing to supply, resulting in a shortage or excess demand for the product. Because of this shortage, some consumers will be willing to pay a higher price for the product. If the price rises to three dollars, the quantity supplied will increase to 20, but there will still be a shortage of the product. The price will continue to increase until the quantity supplied equals the quantity demanded.

At the price of four dollars, the quantity demanded is equal to 30, which is also equal to the quantity supplied, and the market will be in equilibrium, which means there is neither a shortage nor a surplus, and thus no pressure for the price to change.

Changes in supply or demand will move the market out of equilibrium, creating either a shortage or a surplus, which leads to changes in a new equilibrium price and quantity of the product. An increase in demand with no change in supply leads to a shortage and a rise in price and quantity, while a decrease in demand with no change in supply leads to a surplus and a fall in price and quantity. An increase in supply with no change in demand leads to a surplus and a decline in price and a rise in quantity, while a decrease in supply with no change in demand leads to a shortage and a rise in price and a decline in quantity.

Suppose the equilibrium domestic price of the product is four dollars, but the world price is two dollars. The consumers in the domestic market will prefer to purchase the product at the lower world price. The domestic suppliers will then be forced to lower their price to two dollars. The decrease in the price of the product leads to an increase in the quantity demanded to 50 and a decrease in the quantity supplied to 10. The shortage will be supplied by imports of 40 units.

But now let the world price be six dollars, meaning the rest of the world is willing to pay a higher price for the product. The domestic producers will then increase the quantity supplied to 50 units. This increase in the price will decrease the quantity demanded to 10. The resulting surplus of 40 units will then be exported.

Thus, the difference between the domestic price and the world price of a product is the basis for imports and exports. A product is imported if the international price is lower than the domestic price, and it is exported if the international price is higher than the domestic price.

![]()

CHAPTER 2

The Basis for Trade: Absolute Advantage and Comparative Advantage

Mercantilism

During the seventeenth and eighteenth centuries, mercantilism was the dominant doctrine of international trade. According to this doctrine, a country’s wealth was measured in terms of its holding of gold and silver. Mercantilists believed that exports would lead to inflows of gold and silver, and imports would lead to outflows of these precious metals. Thus, to increase a nation’s wealth, the country should increase its exports and decrease its imports. Mercantilists viewed trade as a zero-sum game, in which one country’s gain was at the expense of another country. Based on this mercantilist doctrine, governments placed a variety of taxes and restrictions on imports and provided incentives and funding to encourage exports. Governments also gave exclusive rights to individual companies to engage in trade. These trade monopolies like the Hudson Bay Company and the Dutch East India Trading Company generated high profits, which, in turn, contributed to the wealth of the rulers.

Today, a different kind of mercantilism has emerged, where the accumulation of gold is replaced with jobs. The so-called neo-mercantilists believe that exports generate jobs and imports destroy domestic jobs. So, a trade surplus will increase the number of jobs and national income. Like the mercantilists, they view free trade as a zero-sum game and lobby the government to enact policies that aggressively promote exports and limit imports.

In the late eighteenth and early nineteenth centuries, some philosophers and political economists, such as David Hume, Adam Smith, and David Ricardo, began to criticize the doctrine of mercantilism. Hume argued that a trade surplus and the accumulation of gold and silver increased the nation’s money supply. The increase in the money supply would then lead to an increase in the prices of goods. The higher prices of goods would make exports more expensive and imports cheaper, leading to a decline in exports and a rise in imports, and the elimination of the trade surplus.

Adam Smith and the Theory of Absolute Advantage

Adam Smith was a Scottish philosopher and political economist who, in 1776, published his now famous book, An Inquiry into the Nature and Causes of the Wealth of Nations. In Book IV, he criticizes mercantilism and maintains that the wealth of a nation does not increase by accumulating gold and silver, but rather by the number of goods and services available for consumption through trade. In his words,

If a foreign country can supply us with a commodity cheaper than we ourselves can make it, better buy it of them with some part of the produce of ou...