![]()

1. THE OVERVIEW

The ‘money-go-round’

Businesses use money to make money.

• Money is brought into the business;

• to buy the things the business needs;

• to create products or services to sell to customers;

• on which the business can earn a profit;

• so there is additional money available to invest;

• so the business can buy more of the things it needs;

• so it can make more products or deliver more services to customers;

• so it can make even more profit;

• so that there is yet more money available to invest …

It’s a profit-generating ‘money-go-round’.

Before looking at ‘the numbers’ it’s helpful to look at the above process in a little more detail starting with the different types of long-term finance the business might use.

WHERE DO BUSINESSES GET THEIR MONEY FROM?

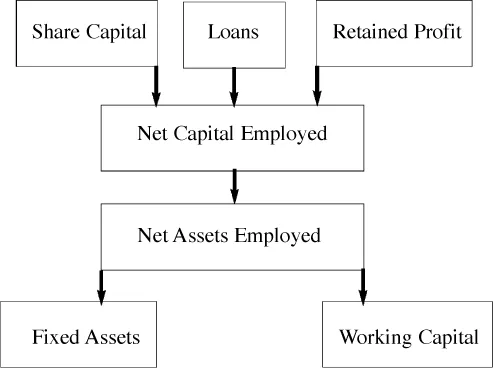

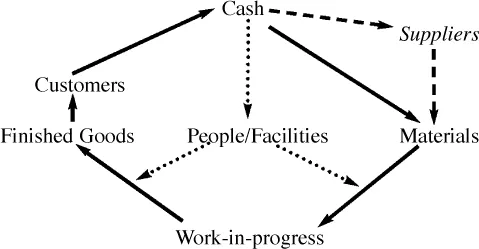

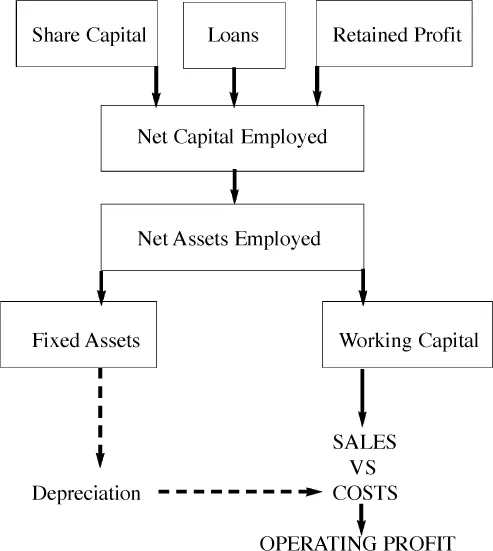

Every business has to have some form of long-term finance to provide them with the capital to buy the things they need. This finance usually consists of a combination of Share Capital, Loans and Retained Profits.

Share Capital

The shareholders own the business but will appoint a board of directors to run the business on their behalf. They buy shares in the hope of earning an income on their investment (dividends) and growth in the value of their investment as a result of increasing share prices. As owners, they are the risk-takers and therefore last in the ‘pecking order’ when it comes to getting a share of the profits. [For more on the implications to the business of having shareholders to satisfy see Appendix 1, Share Capital.]

Loans

When money is borrowed, a contract is signed committing the business to pay interest and repay the capital as and when it falls due. To ensure contractual obligations are met, the lender will look for some form of security or collateral.

If the business is unable to use the borrowed money profitably to generate the profits and cash to make the agreed payments the bank may move in, sell off some of the business assets to recover the debt and there may be no business left. Hence borrowing money brings financial risk into the business so this risk needs to be managed. [For more information on the financial implications of taking on loans see Appendix 2, Loans.]

Retained Profit

If the business can make sufficient profit to cover all their costs, there will be money left over for reinvestment. This is the most cost-effective way to grow the business as it results in additional funding being made available without having to attract additional share capital (with resulting pressures from shareholders for higher dividends and more growth) or having to increase the financial risk and interest costs to the business by taking on more loans. So profit is not a dirty word. Far from it. The more long-term finance that can be generated internally the better.

The total amount of long-term finance is known as Net Capital Employed.

The relative proportions supplied by shareholders as opposed to lenders is referred to as gearing and will influence the business’ financial risk.

WHAT DO THEY USE THE MONEY FOR?

The management team will determine the way in which the funds raised are invested. These decisions will reflect the design of the products or services and the way the business is being run. Some of the items purchased, for example equipment, will be ‘one-off’ items intended to be of use to the business over a number of years (i.e. Fixed Assets), whereas others such as materials and labour will be of a ‘repeat purchase’ nature (i.e. Working Capital).

The total amount invested in Fixed Assets and Working Capital is known as Net Assets Employed.

Fixed Assets (also known as Non-current Assets)

The selection of these items is a strategic decision as it sets out the way the business intends to make products or deliver services for potentially many years into the future. As a result, the authorisation process for such capital expenditure is challenging (see Chapter 8, Capital Investment Appraisal).

Fixed assets are purchased with the intention of keeping them and using them over a number of years to provide the business with a chosen capability for making and delivering products or services. Therefore it makes sense that rather than putting the total cost of these items into the calculation of profit in the year of purchase, the cost is ‘spread’ over the useful life to the business to produce an annual charge against profit. This charge is known as depreciation or amortisation. [For more information on the importance of choosing the right capability and the accounting treatment for these Fixed Assets, see Appendix 3.]

Working Capital

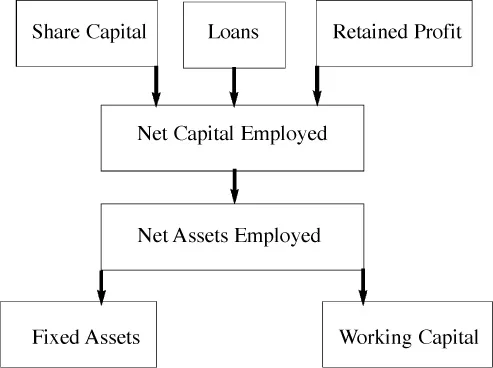

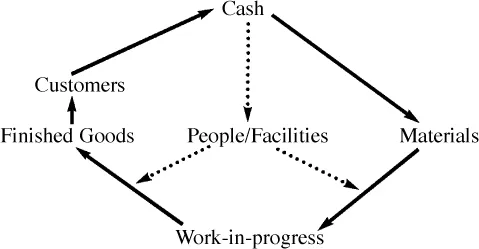

Revenue expenditure provides the business with the materials, labour, bought-in services and expenses it needs to produce its products or deliver its services. Although the aim is to ‘pull’ these costs through the business as quickly as possible by turning them into products or services customers pay for, at any point in time some will be ‘trapped’ in the Working Capital Cycle.

This cycle follows the flow of cash through the business and back into cash again.

Cash is used to buy materials and pay for the cost of converting them into the products or services the market wants. Goods or services are then sold and cash comes back into the business.

The cycle is usually more complex as materials may be purchased on credit (delaying the outflow of cash) and customers may have negotiated credit with the business (delaying the inflow of cash).

The amount of money tied up in the cycle at any point in time is therefore determined by taking the amount of cash being held; plus the value of inventory (materials plus work-in-progress plus finished goods); plus the value of goods or services that have been delivered to customers but not yet paid for; less the amount of credit from suppliers (i.e. the invoice value of materials that have been received and are therefore in inventory but for which the business has not yet paid.)

A detailed explanation of the cycle and Working Capital terminology is given in Appendix 4, Working Capital.

ARE THEY MAKING MONEY?

The fixed assets and working capital are then put to use to make products or services that can be sold. The total value of sales, or invoices raised in a period, may be referred to as turnover or revenue.

The next step is to compare the value of sales with the costs incurred in making those products or delivering those services to determine whether the business has made a profit. Included in these costs is not just the cost of materials, labour, expenses etc. but also depreciation, that ‘fair and reasonable allocation’ of the amount of money invested in providing the business with its capability, as explained above. If the business has got it right, the market will reward it for choosing to organise itself appropriately with selling prices exceeding costs. [Different approaches to calculating product or service costs are explained in Chapter 7, Costing.]

The profit figure at this stage is often referred to as Operating Profit as the financing costs have yet to come.

Deducted from the Opera...