![]()

PART One

Family Office Fundamentals

![]()

CHAPTER 1

The Family Office Industry

We often tell our ultra-wealthy clients that they have been in the get-rich business and we are in the stay-rich business.

—Paul Tramontano (CEO of Constellation Wealth Advisors, a top 50 multi-family office who we recently interviewed)

Chapter Preview: The family office industry can be challenging to learn about. This chapter will provide you with a high-level, 10,000-foot view of the family office industry. It will cover the basics of how the industry operates and serve as a foundation upon which the rest of the book will build upon.

The family office industry is secretive. While speaking at the Latin American Family Office Summit recently, I was reminded by Thomas Handler (interviewed later in this book) of an adage I hear used often in the industry: “A submerged whale does not get harpooned.” This quote sums up why so many family offices are so secretive and difficult to learn more about. Many family offices and ultra-high net worth individuals see that media attention and press often attracts sales professionals, possibly compliance headaches, and others looking only to harvest ideas or competitive angles on the family's operating business.

The goal of this book and chapter is to show you exactly how family offices operate, provide their services, and invest their capital.

WHAT IS A FAMILY OFFICE?

See the video “What Is a Family Office?” at

www.FamilyOfficesGroup.com/Video3.A family office is a 360-degree financial management firm and personal chief financial officer for the ultra-affluent, often providing investment, charitable giving, budgeting, insurance, taxation, and multigenerational guidance to an individual or family. The most direct way of understanding the purpose of a family office is to think of a very robust and comprehensive wealth management solution that looks at every financial aspect of an ultra-wealthy person's or family's life.

Single Family Office Definition: A single family office is a full-balance-sheet 360-degree ultra-affluent wealth management and CFO solution for a single individual or family.

The Security and Exchange Commission (SEC) recently defined single family offices as “entities established by wealthy families to manage their wealth, plan for their families' financial future, and provide other services to family members. Single family offices generally serve families with at least $100 million or more of investable assets. Industry observers have estimated that there are 2,500 to 3,000 single family offices managing more than $1.2 trillion in assets.”

John Gryzmala, a single family office executive we recently interviewed, states: “The definition of the single family office for me is: an entity or an individual that helps relieve the family members of certain, if not all, mundane tasks that they would prefer not dealing with, be it investments, be it household staff, be it insurance, be it handling legal issues, trusts and estates issues, and tax planning. That's it. So however you want to structure it to handle and help you, the family member, with those issues is my definition of the single family office.”

Multi-Family Office Definition: A multi-family office is a full-balance-sheet, 360-degree ultra-affluent wealth management and CFO solution for multiple individuals and families.

Multi-family offices can serve anywhere from two clients to 500-plus ultra-wealthy individuals and families. In both the single family and multi-family office, what is really being offered is a full balance sheet financial management solution to ultra-high net worth individuals. The implementation of the family office model is diverse. In both single and multi-family offices, a very narrow set of services could be offered so that one family office has just one or two functions, while others can provide a fully comprehensive solution. Every family's model is unique as a result of its budget, needs, and wants also being unique.

It is important to note that many hybrid models are very much closed-door single family offices, yet they serve just two to three families and never accept outside money. This is an exception to the rule, but important to fully understanding how the industry operates.

Traditional wealth management firms advise on your investments and sometimes help you make insurance-related or budget-related decisions. Most wealth management firms are not specialists in taxation, charitable giving, or even in multigenerational wealth management. Family offices can provide those solutions and more with a single team, allowing several diverse experts to speak with one another in order to create a cohesive plan for preserving and/or growing the wealth of the ultra-high net worth client.

There is a constant debate over the definition of a “true” family office. Some professionals believe single family offices are the only authentic family offices, and multi-family offices are simply wealth management firms in disguise. Others believe that you must have $250 million to launch a single family office, though there are many successful single family offices with as little as $50 million. I believe that a family office is defined by how it operates and what solution it provides to the family, not by its asset size. A hedge fund is a hedge fund and a venture capital firm is a venture capital firm, based on the structure of their investments, fees, and purpose, not by their asset size; the same goes for family offices.

This will be covered in more detail later in this book, but it is important to note that some multi-family offices start out as single family offices and gradually add more clients. The recent rising costs of talent and compliance has driven up interest in converting single family offices into multi-family offices.

THE FAMILY OFFICE UNIVERSE

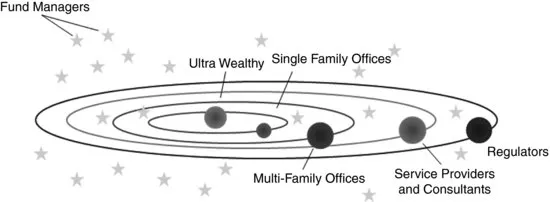

It is helpful to look at the family office industry and think about how closely aligned different parties are to the central needs of ultra-wealthy clients. The diagram in Figure 1.1 depicts how closely aligned the goals of various parties are to the needs and goals of ultra-wealthy clients.

You can see that there is a symmetrical ring around the ultra-wealthy. That first ring represents single family offices that focus solely on the needs of an ultra-wealthy individual or single family.

The second ring represents multi-family offices that are almost completely aligned with the ultra-wealthy client; at the same time they need to please several or even hundreds of other ultra-wealthy clients as well, so they are not 100 percent aligned with the goals of a single ultra-wealthy client, but close.

The third and fourth rings represent service providers and regulators. The service provider grouping includes consultants, placement agents, traditional wealth management firms, and general accountants or tax attorneys. While a tax attorney is surely more focused on ultra-wealthy client needs than is a regulator (as depicted later in this chapter), all of these groups are, for the most part, not focused on and built around the needs of ultra-wealthy clients or family offices.

The stars within the Family Office Universe diagram represent the tens of thousands of fund managers and investment professionals who are constantly trying to seek capital from family offices. They are sometimes connected to multi-family offices or service providers, or they are disconnected from the industry to the extent that they don't really understand what a family office is or how most of the ultra-wealthy are having their capital managed.

THE HISTORY OF FAMILY OFFICES

Single family offices have existed in different forms for thousands of years. In the article “Family Offices in Europe and the United States” by Dr. Steen Ehlern, the managing director of the Ferguson Partners Family Office, noted that the merchants of ancient Japan and the Shang dynasty in China (1600 B.C.) both used multigenerational wealth management strategies. There are also several accounts of “trusts” being set up for the first time during the Crusades (A.D. 1100). Later, many wealthy banking families of Europe, including the Medicis Bardis and Rothschilds, were said to have used a family office–like structure. These organizations often offered their services to other wealthy families, and in the late 1800s and 1900s they started to look more like modern day multi-family office operations. These operations grew out of single family offices that were asked to serve connected business families and out of private banks and early trust company establishments that were looking to serve more affluent clientele.

Even now the family office industry is relatively obscure and not very well understood. While everyone in the financial industry has a rough idea of what a hedge fund is (or at least knows that they exist), many finance professionals don't know what a family office is or what it does. When it comes to the general public, knowledge of a family office or its operations is close to nonexistent.

Looking at the growth of the hedge fund industry, I believe the model really started to take off between 1970 and 2000. The family office industry is on a parallel growth track, and our market research and interviews have uncovered that we are just 10 years into a 30-year surge of growth in the family office space. For example, I recently spoke on stage at an event with a wealth management professional who has 17 years of experience; while he was very successful and bright and did know what a hedge fund was, he did not know what a family office was. If someone who works in wealth management is not aware of the family office industry, many of the ultra-wealthy are not either. There are more than 10,000 family offices in the industry; I predict that the industry will double in size by 2020.

The wealthy will continue to expand their wealth, and family offices will continue to grow in numbers. That growth is accompanied by an increasing need and desire among the wealthy for wealth management services. Around the globe, more and more wealthy families are looking for something similar to the family offices seen in the United States and Western Europe.

I was fortunate to recently record an interview with one of the founding fathers of the modern-day family office industry, Charles Grace. Charles is a director at the Threshold Group. He is known for founding Ashbridge Investment Management and for building the first open-architecture platform for family office investment management. Charles not only knows the history of the family office industry but also has helped shape it as well. Here is a short excerpt from that interview:

Richard Wilson: Charles, you have been in the family office industry for over 50 years, which is longer than anybody else we are interviewing for this book and our monthly newsletter. So how have you seen the industry evolve?

Charles Grace: It used to be that family offices were based in the financial office of the operating company. There was perhaps a dedicated accountant in there that took care of the operating company. So that was the beginning, and then some of the wealthier families set up distinct offices that were not necessarily housed in the operating company, but which were a part of it, and they provided services to the family. Not too long ago, maybe, say, I don't know, 20 years ago, some of these larger family offices started to provide services to other families and the founding family. And a couple of names that come to mind are us, the Rockefellers, and there were a couple of others that built a multi-family office business on a family office, and so that was the first level of development.

Next came the trust companies. The trust companies were always in this business too, not as family offices, but as a part of the trust work—trust and investment work—and they were always there as competitors in this business and still are. Then along came the brokers; while the brokers were very transaction-oriented in the early days, they found out that they wanted to provide more advice than transactions because transactions were very cyclical. They became involved in the family office's business and they started selling the family office business model. They provide ot...