Chapter 1

What Is Trend Trading?

In This Chapter

Understanding the importance of trend

Knowing why you should trade with the trend

Using a trading method that works

Trend trading is taking trades in the direction the market is moving. That sounds very simple, but it’s deceivingly difficult. Many factors determine whether your trade in the current direction of the market will become successful. The important issue isn’t whether you’re taking a trade in the current direction of the market but whether the market will continue to move in your direction after you place your order.

In this chapter, I explore how to determine the trend, clue you in to the importance of the trend, and show you why trading with the trend is so profitable.

Figuring Out What the Trend Is in the First Place

Trend trading begins with determining the trend. The trend of the market is defined as the long-term direction of the market. But how do you determine what that direction is?

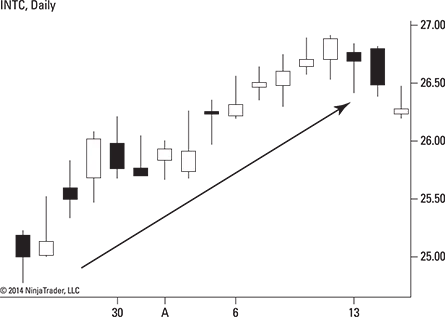

You can look at a chart, such as the one in Figure 1-1, and see that from the left side of the chart to the right side of the chart, the market has been moving up. Based on that observation, you may say that the trend is up.

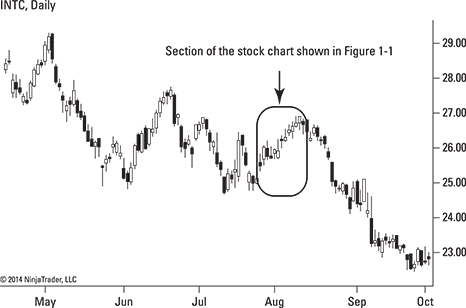

On the other hand, if you look at that same market but change the beginning point of the chart to include more history, such as illustrated in Figure 1-2, you may say that the market is actually in a downtrend.

Looking at the direction of the market on these two charts illustrates two points:

- Trend is always relative to the scale of the chart. No one trend exists for any market.

- Determining the trend can be very subjective. You need a tool to measure trend for you to make the determination of the trend an objective measurement, not a subjective personal evaluation.

In Chapter 6, I share with you several objective tools for measuring trends, specifically the ADX indicator, Bollinger Bands, and moving averages.

Knowing Why the Trend Works

Trend trading is one of the most popular approaches to trading. It’s been around for decades because it’s a proven approach to making money in the markets.

Understanding why trend trading works may give you more confidence in trading the trend. Trend trading has a rationale behind it that has its roots deep in human psychology. I explore those roots in the following sections.

Being a follower by nature

Human beings are naturally social creatures. Part of what comes with that is developing social structures to get along and function as a group. For the sake of organization and to prevent chaos in the group, people naturally tend to set up leaders (the minority) who guide the rest of the group (the majority).

This dynamic finds its way into chart patterns as well. The financial markets move because people are buying and selling. That buying and selling is based on people’s ideas, beliefs, and feelings. Therefore, the patterns you see in the charts are maps of human nature.

Following the leader

The nature of the masses is to follow, so most traders are waiting for someone to initiate a move in the market. Then and only then will they jump onboard. After the leaders (the professional traders) make their commitment to buy or sell the market, the masses have a tendency to follow them, further pushing the market in the direction of the professionals’ trades and creating a trend.

Although many people may not like the idea of being followers, there’s nothing wrong with this in trading. The average retail trader simply doesn’t have enough financial clout to begin a trend. Large institutions often start trends by trading enormous volume, taking positions, and continuing to add to them. That creates a momentum that can start a sustainable trend.

Jumping into a trend established in this way can be a great way to trade because a high probability exists that the large commitment of money made in a given direction will create momentum for the market to keep moving in that direction for the long term. You want to join that trend as soon as possible because a trend can end at any time.

Understanding Why You Should Trade with the Trend

Because this book is about trend trading, it seems appropriate to ask why the topic is relevant and important. The rationale to trend trading is if the market is already moving up, it’s given at least some evidence of its bullish bias so it makes sense to follow that.

For this reason, trend trading is also called “trend following” because instead of guessing which way the market is going to move, you wait for it to establish a direction. After that’s clear, you simply jump onboard and follow the trend that has already begun.

Trends make your life easier

“An object in motion tends to stay in motion” is part of Newton’s first law of motion. You can certainly argue that such a law of physics doesn’t directly apply to the financial markets. However, when large financial institutions managing enormous amounts of money make a commitment to a market, that market will indeed often continue in that direction.

Such institutions aren’t able to bring all of their financial power into a market at one time without disrupting the pricing structure of that market. In other words, if they were to use all of their buying power at once, it would create such a demand versus supply imbalance that the price of that market would skyrocket. The institution would have to pay exponentially higher prices as the asks evaporated and the bids moved up in an almost parabolic fashion.

Everyone wants to buy at as low a price as possible, so institutions leg into a position slowly over time in an effort to hide their intentions and keep the prices they have to pay for that market low.

The best time to enter a trend is as early in the trend as possible. The famous saying, “the trend is your friend,” is countered by, “the trend is your friend until the end.”

Identifying a trend is one of the easiest chart patterns to recognize. You can clearly look at a chart and see whether the market is moving up or down. As opposed to more sophisticated and complicated chart patterns, a trending market is the easiest pattern to spot.

Trend trading is also simple for traders. In assuming you’ve correctly identified a long-lasting trend, there isn’t much for you to do after you’ve entered the trade. Trends are long-term moves, so the best thing you can do as a trend trader is to hold tight and enjoy the ride. You don’t need to micromanage the trade.

Trends can make you more money

Trend trading is a good style of trading, not only for its simplicity but also for its profitability.

To evaluate the effectiveness of my trading, I measure the following ratios:

- Win/loss ratio: The number of my winning trades divided by the number of my losing trades

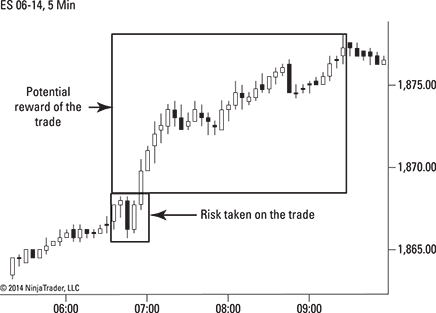

- Risk/reward ratio: The amount of money I initially risk on a trade (from my entry to my stop loss) versus the amount of money I make on a trade

Of course, I like to have more winners than losers. But I also want to make more money on my winning trades than the amount I lose on my failed trades. When you’re winning trades make a lot more money than your losing trades, it makes the losing trades much easier to handle.

Because trends are long-term moves, the rewards of successful trend trades are much bigger than the amount of risk taken on the trade. This is good for you both financially and psychologically.

The psychology of trading is a vital aspect to being successful. Losses can be hard to take and can create a distressing emotional state in which it’s hard for you to trade with a clear mind. On the other hand, the perfect trade method doesn’t exist, so all trading methods experience losses. How you mentally handle those losses is a vital part of determining whether you’ll survive and thrive as a profitable trader.

Figure 1-3 illustrates an example of the small risk compared to the potential large reward of a successful trend trade.