![]()

PART ONE

Market Analysis and Forecasts

• “Overview of the U.S. Real Estate Market” analyzes the national and major metro markets, both in terms of macroeconomic fundamentals and real estate market drivers such as supply, demand, rent levels, and vacancies.

• “Forecasting the U.S. Market” projects real estate market fundamentals for major metros around the country. We forecast the NCREIF index based on our proprietary models using data from leading data and information providers.

• “Recession Simulation and Its Effects on Real Estate” analyzes the effects of two different types of economic downturns on property markets: a short and shallow downturn and a severe prolonged recession. This is scenario planning writ large with detailed simulations down to the property sector and metro level.

• “Subprime Fallout: The Impact on Commercial Real Estate” addresses the shock to the economy and investigates ramifications to the commercial real estate industry.

• “Capital Markets: Dramatic Shifts and Opportunities” assesses the current seizure in capital markets and the real and possible effects on commercial real estate. It looks at the challenges of reduced capital and also the potential opportunities created in the process.

• “The Bid-Ask Problem and Game Theory” assesses the dramatic fall in transaction volume since the beginning of the subprime fallout and the yawning gap between sellers and buyers. It utilizes a game-theoretic model to explain how this has occurred and how transactional liquidity may resume.

![]()

CHAPTER 1

Overview of the U.S. Real Estate Market

Tim Wang and David Lynn

Spring 20082

A major transition for U.S. commercial real estate occurred in 2007. Triggered by the subprime fallout and credit crisis, the outsized investment returns of the past several years came to an end. With tightening lending and underwriting standards, speculative investments and construction projects are likely to be more limited, resulting in more constrained supply and healthier fundamentals over the long term. Looking forward, we anticipate that 2008 and 2009 will be fraught with challenges as well as opportunities.

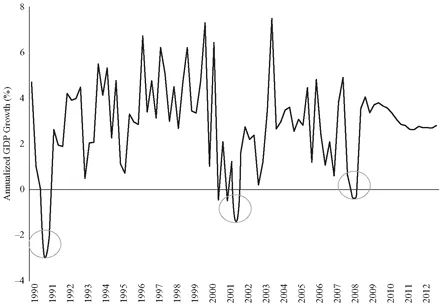

OUTLOOK FOR U.S. ECONOMY: NEAR-TERM SLOWDOWN

The U.S. economy is going through a slowdown, if not a recession, as a result of the subprime fallout and residential housing market downturn. Real gross domestic product (GDP) growth declined from 4.9% in the third quarter to 0.6% in the fourth quarter of 2007.3 Job growth, turning slightly negative in the first two months of 2008, has been decelerating since mid-2007 and is likely to be sluggish through year-end. In 2007, 1.1 million new jobs were created, compared to 2.1 million new jobs created in 2006.4 The 2007 year-end unemployment rate rose to 5.0% according to the Bureau of Labor Statistics, the highest level since 2005. While government and corporate spending remain solid, personal consumption is beginning to show weakness. Lackluster consumer spending could possibly lead to a mild recession in early 2008 (Exhibit 1.1).

EXHIBIT 1.1 Consumer Spending: Annualized GDP

Source: ING Clarion Research & Investment Strategy and Moody’s Economy.com, as of January 2008.

The credit crunch and housing market downturn are the biggest risks to U.S. and global economic growth. The largely stalled credit pipeline and financing activities have severely curtailed investment and M&A projects. The for-sale housing market continues to soften due to tightening lending standards, low affordability, and excess supply in many regions. Home prices have fallen approximately 10% year-over-year in most markets, causing negative wealth effects and weakening consumer spending power.5 Some potential buyers—even those with strong credit—are holding off on purchases, waiting for even bigger discounts. We expect that the housing market will not reach the bottom until 2009.

Recently, crude oil has exceeded $100 per barrel and retail gasoline prices remain elevated at over $3 per gallon, another drag on consumer spending. Although the core consumer price index (CPI) is running at about 2.5% annually, surging energy and commodity prices and the declining value of the U.S. dollar are adding inflationary pressures.6 A rising inflation rate could lead to higher interest rates thereby decreasing demand for commercial real estate.

U.S. REAL ESTATE: FINDING VALUEIN A CHANGING MARKET

U.S. Real Estate Fundamentals

U.S. commercial real estate fundamentals are generally sound with solid rent growth, albeit at a slower pace than in recent years, and stabilizing vacancy rates in most core markets. Within the next several months, demand for space is expected to soften, along with the slowing U.S. economy, before reaccelerating in 2010-2011. In 2008, vacancy rates have risen moderately. Rent growth is expected to remain positive during the economic slowdown, but will increase at a slower pace.

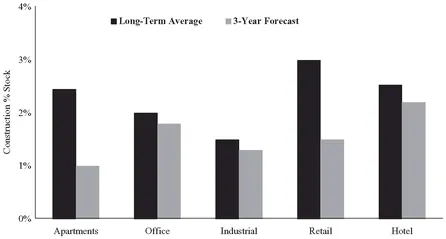

On the supply side, construction pipeline forecasts across all property types are below their long-term averages (Exhibit 1.2). Higher construction costs and more stringent local entitlement processes have restrained the supply pipelines. Although construction activity has picked up, demand is expected to outpace supply over the next five years, which should bode well for new and existing investments. Profitable opportunities should exist for selected core investments and well-sponsored value-added and development projects.

EXHIBIT 1.2 Construction Pipeline Forecasts (as of 2007)

Source: ING Clarion Research & Investment Strategy, TWR, REIS, and Smith Travel as of 2007Q4.

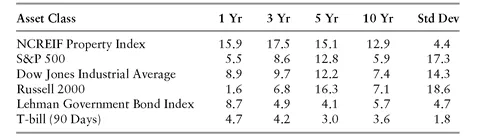

Private real estate investment continues to generate competitive risk-adjusted returns relative to other asset classes. In 2007, the private real estate index (NCREIF Property Index) achieved a strong total return of 15.9% (Exhibit 1.3). Office and hotel properties outperformed other property types. Office markets in the East and West and industrial markets in the West had significant gains. Looking forward, we expect that core real estate investment returns will likely be in the high single digits (between bonds and equities).

EXHIBIT 1.3 Historic Asset Class Performance (% annualized returns)

Source: ING Clarion Research & Investment Strategy, NCREIF, NAREIT, and MorningStar as of December 31, 2007.

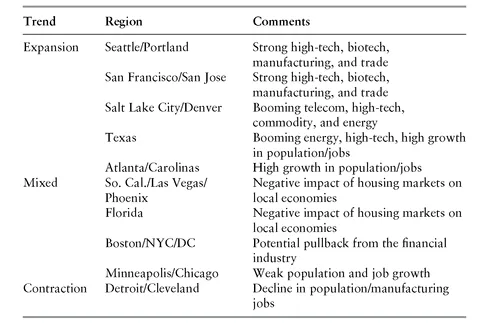

EXHIBIT 1.4 Bright Spots in the Economic Landscape

Source: ING Clarion Research & Investment Strategy and Moody’s Economy.com, 2008.

Regional Outlook

We analyze major markets based on trends and forecasts in population growth, job growth, gross metro product (GMP), fundamentals of local economies, and health of the residential housing markets (Exhibit 1.4).

Despite the gloomy outlook of the U.S. economy in the near term, there are several expanding regions showing above-average growth and relatively healthy fundamentals (Exhibit 1.5). These markets are typically driven by high-tech, biotech, energy, commodities, international trade, housing affordability, and quality of life. Such factors may make these regions especially suitable for value-added and development investment projects.

Multifamily Market Outlook

Multifamily Market Fundamentals U.S. apartment market fundamentals are sound, supported by favorable demographic trends, a declining for-sale housing market, and a restrained construction pipeline. Members of the 75-million-strong echo boomer7 cohort are entering the workforce and will constitute the primary demand for apartments as the population of primary renters (age 19-35 years) expands by 3.2 million over the next four years. Because of tightening lending standards, fewer renters will be able to afford homes, helping to boost apartment demand in the near term.

EXHIBIT 1.5 Growth Drivers by Region

Source: ING Clarion Research & Investment Strategy as of January 2008.

During 2007, the national apartment vacancy rate dropped 20 basis points (bps) to 5.6% according to Reis, Inc.; however, that rate is forecast to edge up to over 6.0% in 2008 and 2009 as job growth slows. Effective rent growth in 2007 was strong at 4.5%, with markets such as New York, San Francisco, San Jose, Stamford, northern New Jersey, and Seattle experiencing the largest rent increases. Looking forward, we expect apartment rent growth to slow to approximately 3-4% annually over the next five years. Transaction volume in 2007 w...