![]()

PART ONE

Mindset + Knowledge = Wealth

![]()

CHAPTER 1

Start Now

With this book, you will become motivated and educated. You will get started in real estate. From this book, you will see that real estate investing still leads you to a lifetime of wealth and personal fulfillment. No matter what financial goals you set for yourself, no matter how little cash, credit, or income you currently possess, if you choose to, you can build your fortune in real estate.

You can still build wealth in real estate.

Just Say No to Excuses

“But hold on,” you might say. “You can’t be talking to me. In my town, property prices have climbed sky-high. Besides, I don’t think I have enough cash, credit, or time to get started. And even if I did, real estate seems too difficult. I don’t know how to begin.”

As I travel throughout the country and talk with would-be property investors, I repeatedly hear excuses. But it may surprise you to learn that I’ve heard similar excuses repeated over and over for 30 years.

Naysayers Thrive in All Times and Places

When times are good, people fret over the deals they’ve missed. When markets slow down, folks claim that real estate no longer makes a good investment. Either way, they always find some way to color the future bleak (see Box 1.1).

Yet, since the early 1970s I have seen all types of booms and busts. I have seen 18 percent mortgage interest rates. I’ve lived through the multiple turmoils of double-digit rates of inflation, the disastrous 1986 Tax Reform Act (which reduced profitable real estate tax shelter techniques), and the recent market of sky-high prices. Yet I (and nearly all other savvy investors) have figured out how to make money in every one of these markets and all of the other types of markets in between.

For the past several years, the media have headlined the so-called subprime mortgage meltdown, increasing foreclosures, and a growing inventory of listings for sale. Just as occurred during previous decades—and previous housing cycles—financial journalists fail to recognize that we have once again entered a great buyers’ market.

You can make money in all types of markets.

Box 1.1 People Who Believe the Forecasts of Doom and Gloom End Up with a Pile of Regrets

Among all the lessons history teaches, none proves more certain than the fact that property prices will go up. Regardless of how high you think prices are today, they will be higher 10 years from now and much, much higher 20 or 30 years into the future. Don’t talk yourself into believing that “property prices have reached a peak.” Before you accept the “sky is falling” clamor of so-called economic experts, take a quick trip through some of their Chicken Little predictions from years gone by:

• “The prices of houses seem to have reached a plateau, and there is reasonable expectancy that prices will decline” (Time, December 1, 1947).

• “Houses cost too much for the mass market. Today’s average price is around $8,000—out of reach for two-thirds of all buyers” (Science Digest, April 1948).

• “If you have bought your house since the War ... you have made your deal at the top of the market.... The days when you couldn’t lose on a house purchase are no longer with us” (House Beautiful, November 1948).

• “The goal of owning a home seems to be getting beyond the reach of more and more Americans. The typical new house today costs about $28,000” (Business Week, September 4, 1969).

• “Be suspicious of the ‘common wisdom’ that tells you to ‘Buy now . . . because continuing inflation will force home prices and rents higher and higher’” (NEA Journal, December 1970).

• “The median price of a home today is approaching $50,000. . . . Housing experts predict that in the future price rises won’t be that great” (Nation’s Business, June 1977).

• “The era of easy profits in real estate may be drawing to a close” (Money Magazine, January 1981).

• “In California . . . for example, it is not unusual to find families of average means buying $100,000 houses. . . . I’m confident prices have passed their peak” (J. E. English and G. E. Cardiff, The Coming Real Estate Crash, Warner Books, 1980).

• “The golden age of risk-free run-ups in home prices is gone” (Money Magazine , March 1985).

• “If you’re looking to buy, be careful. Rising home values are not a sure thing anymore” (Miami Herald, October 25, 1985).

• “Most economists agree . . . [a home] will become little more than a roof and a tax deduction, certainly not the lucrative investment it was through much of the 1980s” (Money Magazine, April 1986).

• “We’re starting to go back to the time when you bought a home not for its potential moneymaking abilities, but rather as a nesting spot” (Los Angeles Times, January 31, 1993).

• “Financial planners agree that houses will continue to be a poor investment” (Kiplinger’s Personal Financial Magazine, November 1993).

• “A home is where the bad investment is” (San Francisco Examiner, November 17, 1996).

• “Your house is a roof over your head. It is not an investment” (Karen Ramsey, Everything You Know About Money Is Wrong, Reagan Books, 1999).

• “The trends that have produced the housing boom . . . have nearly run their course. This virtually guarantees . . . plummeting home prices and mass foreclosures . . .” (John Rubino, How to Profit from the Coming Real Estate Bust, Rodale, 2003).

• “Ten years from now, property prices will almost certainly be less than they are today . . .” (Money Magazine, January 2006).

Property Offers Multiple Possibilities

To make money and build wealth with property, you can always locate opportunities. But first develop an educated, entrepreneurial mindset. The idea of a single real estate market or a one-size-fits-all investment strategy runs opposite to reality. Like a chameleon, the savviest real estate investors change their colors to match the ever-changing mortgage lending and property environments. During recent years, for example, many beginning property investors have pursued one or more of the following possibilities:

• Foreclosures, preforeclosures, REOs (bank-owned foreclosures referred to as real-estate owned).

• Self-storage units.

• Fix and flip.

• Condominiums, townhouses.

• Condominium conversions.

• Office condominiums.

• Office buildings.

• Shopping centers, freestanding retail.

• Mobile home/RV parks.

• Gentrifying (turnaround) neighborhoods.

• Properties located in lower-priced areas of the country (and the world).

• Emerging growth areas such as Charlotte, North Carolina.

• Vacation and retirement areas.

• Two- to four-unit rental apartment buildings.

• Multiunit apartment buildings.

These examples merely touch upon the possibilities you will discover throughout this book, but they illustrate one theme that I have advocated throughout my career:

Q. When’s the best time for you to invest in real estate?

A. Today.

But don’t jump to the wrong conclusion. When I say “Invest today,” I do not mean that you can never go wrong. Rather, I mean that there’s never a wrong time to invest if you execute the right strategy. And that’s what you will learn in this book.

You Must Believe It to See It

Why do the great majority of people miss the wide-ranging possibilities and oversized rewards that property offers? After talks with hundreds of would-be investors, the evidence clearly reveals that most people won’t envision the future and they won’t believe in themselves.

As a result, most people don’t believe in their ability to actually make big money in real estate. These negative thinkers erect a wall of excuses that blocks their possibilities. This wall prevents them from seeing the profit potential that lies in front of them. So, will you join the ranks of the naysayers? Or will you open your mind to a promising future?

The time to start really is now.

Envision the Future

Place yourself in the future. Imagine that you’re browsing property web sites or reading the real estate classified ads 10 years from today. You compare listing prices then to those of today.

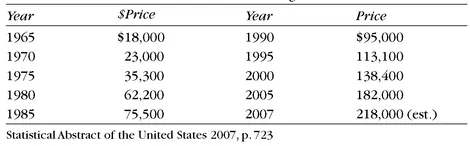

Are property prices higher or lower than they are today? Are rent levels higher or lower than they are today? If you believe in the continuing growth of the United States, you must believe that just as with every past decade, today’s property prices and rent levels will look cheap relative to where they will stand 10 years from now (see Table 1.1).

Reprogram Your Self-Talk

Ask yourself whether you really want to benefit from those near certain increases in property values. Or would you prefer to merely watch others reap these profits? If you want to succeed—yet feel blocked by excuses—reprogram your self-talk.

Table 1.1 Historical Growth in Median Housing Prices

What Is Self-Talk? In his mind-opening book,

What To Say When You Talk to Yourself (Pocket Books, 1986, p. 25), Shad Helmstetter writes,

You will become what you think about most. Your success or failure in anything, large or small, will depend on your mental programming—what you accept from others, and what you say when you talk to yourself.

After years of study, this nationally renowned psychologist has found that as a matter of habit, most of us drown our optimism in a sea of negative self-talk. Evaluate your own thoughts. Do you accept the negative as “true” or “the way things really are”? Do you focus on risks rather than opportunities? Ponder these familiar excuses that you’ve either said to yourself or heard others say hundreds of times:

• I can’t remember names.

• I’m always losing things.

• No matter what I do, I just can’t keep the weight off.

• I never have enough time.

• I’m too disorganized.

• I’m no good at math.

• I’m always running late.

You must believe it to see it.

Now think: When you program yourself with negative selfdescriptions, will you initiate productive efforts to change these or other undesirable traits and habits? Of course not! And the same result stands true for those beliefs (self-talk) that block you from starting in real estate. Once again, think about these excuses that I frequently hear:

• Prices are too high.

• Prices are softening.

• I can’t afford to invest.

• I missed so many good opportunities. Now it’s too late.

• I can’t get financing because of credit problems.

• It’s impossible to find positive cash flow properties.

• I ...