![]()

Chapter 1

A Framework for Excellence in Private Banking

One of the strangest lessons of the financial crisis was that despite the large number of people who were aware of the direction in which things were going and the many warnings sounded, the outcome was in a sense unavoidable because there were too many short-term—and short-sighted—incentives that were not aligned with long-term goals. As a business, wealth management poses interesting intellectual challenges: How can long-term goals of capital preservation and appreciation be matched with short-term market fluctuations? Another question is how do we achieve this while serving one of the most demanding client groups in a fast-growing and highly competitive market? This “culture of excellence” demands that one accepts basic assumptions, attitudes, practices, and concepts upon which to build a business capable of satisfying the most demanding clients. The best time to do that is not when business is booming; the foundations must be laid well in advance to take advantage of the opportunities provided by a crisis or recession.

Is it possible to change systems and alter the incentive structure based on one single event or a particular insight? Rarely is this the case. Too often, institutions tend to stick with the paradigm that they have chosen and, furthermore, fail to communicate it or to inspire employees. Often, individuals are not even aware of the bigger picture and how they fit into it. People in banking generally know what is expected of them based on a job description and performance objectives. But sometimes they lack the understanding of how they, or their function, fit into the bigger picture, along with the bank’s vision and the general direction the industry is taking. If a broader frame of reference is lacking, people have a more difficult time adjusting to the extreme fluctuations that may characterise private banking today. Achieving a “culture of excellence” in private banking isn’t merely an exercise involving surveys to find ways to improve client satisfaction, or about putting pressure on employees to meet particular goals. It goes right to the basic foundations of the business. It requires redefining the concepts and terms that are often taken for granted. Then, and only then, is it possible to get to the point of asking how structures and processes can be improved to create value for all parties involved.

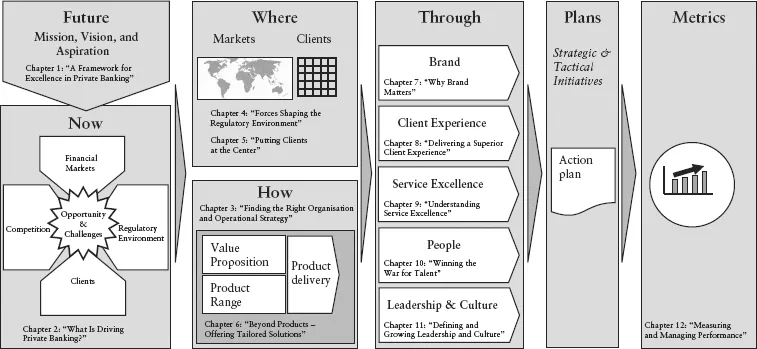

Before going into more detail about specific topics, it is worthwhile to lay out the framework of this book. The way in which the book is structured can also serve to develop a strategy for a private bank. This framework will look at the following questions: What makes a successful private bank? Which aspects are important? How do these fit together? How should important goals be achieved?

To successfully steer a company striving for excellence, and particularly a bank, the vision and mission statement offer vital direction, but it doesn’t stop there. As outlined in Figure 1.1, there needs to be an honest appraisal of the business in its current state and how it really is performing. It also must ask tough questions regarding where and how it can best employ its resources, targeting which client groups and in which markets. Geography, the regulatory environment, and competition all play a role. In an ideal world, full data transparency would allow the market to be sliced and segmented so as to identify the most advantageous segments. In practice, knowledge of client behaviour is limited to the past, and the future is the realm of forecast and conjecture. Even the best strategy will be limited by what can be known. Running a bank therefore requires a mixture of managing and improving on what the bank already is doing, as well as transformational leadership, meaning venturing into new and unfamiliar territory. All of this requires measuring the performance on a regular basis to keep grounded. It’s no use formulating high-flown mission statements that have no basis in reality.

The framework shown in Figure 1.1 offers a schematic approach to the steps necessary to take a bank from a simple vision to really achieving its concrete goals. This is done through a process that, hopefully, will lead to excellence—by definition something that also requires defining strategy, honing it, and constantly seeking to either reaffirm it or, as necessary, to make adjustments. What is “excellence,” and how can it be measured to know whether or not a bank is achieving it? To make it easy to understand the process that went into writing this book, the chapters are arranged in the same order as this overview: “future,” “now,” “where and how,” “through,” “plans,” and finally, “metrics.” These same elements correspond to the chapters, aiming to provide structure to a process that in practice is unlikely to be as neat as shown here. The chart represents an ideal to give guidance on the road to excellence. It does not rule out that there will be obstacles, detours, and unexpected bumps along the way.

The seven elements together define a strategy to achieve excellence. They can be further used to refine or to adjust an existing strategy or to guide a new business, an established one entering a new area, or, for example, one that aims to consolidate an existing business. The vision states how the bank would like to see the future. But first the current situation must be assessed, the now. Then management must decide where the bank wants to compete. This can include geographic regions or client segments that offer the most promising potential. Once that is accomplished, decisions must be made on how the bank will reach those markets and clients with a strong product range with a family of value propositions and excellent delivery. Then it must begin to implement that vision through its brand, people, performance management, and frontline processes. With the support of planning and information supplied by metrics, the process can be used on an ongoing basis to implement strategy, assess it, and alter it when needed.

VISION AND MISSION

The ideals and goals contained in the vision and mission statements take into account aspects of most chapters in this book. These are the inspirational elements that form the bedrock that defines a company’s existence. Anyone who has worked in a corporate environment will be familiar with the concept of company vision and mission statements. Ideally, the vision gives a sense of the company’s future aspirations. It gives a sense of purpose. Yet the reality often falls short of the ideal. Looking at existing vision and mission statements in all industries, no pattern emerges save for the fact that many companies want to be “number one,” or “the best,” or the “leading supplier.” Nevertheless, while companies have used or abused the concepts of vision and mission statements, it is possible to create meaningful ones that confer tangible benefits. It helps to recall that the vision is about leadership and painting a picture of the future that should explain why a company wants to create something. A mission is about management—managing how the company will achieve that vision. The mission serves as the link that takes a company from its vision to setting and meeting concrete targets. A vision describes a better future without saying exactly how the company will get there. The mission turns the vision into a concrete endeavour.

PRESENT STATUS

Along the path to excellence, the “now” shown in Figure 1.1 represents the current state of affairs. Chapter 2, “What Is Driving Private Banking?,” examines opportunities and challenges posed by the four main factors driving the industry. These include markets, the regulatory environment, clients, and competition. How these issues are dealt with and the success that individual banks have in facing changes in these major areas will be a determining factor in how they approach all the areas outlined here.

WHERE AND HOW?

To understand the “where” and “how” in the process, especially as it pertains to near-term developments, Chapter 3, “Finding the Right Organisation and Operational Strategy,” takes a detailed look at how this aspect of the business is changing. Companies are reviewing their basic strategies, and in some cases, this is driving them to consider alterations to their business models. These might be “pure-play” private banks joined together with other businesses as part of a larger “universal” bank, or it could include larger organisations that choose to focus on individual parts of the business. Equally important in terms of such developments, Chapter 4, “Forces Shaping the Regulatory Environment, ” provides an overview of the main changes that are key in terms of how banks can ensure that their business is transparent and meets stringent guidelines in terms of both local markets and international business. This is a major consideration when it comes to the discussion of where energy and resources should be deployed.

Chapter 5, “Putting Clients at the Centre,” examines long-term trends that determine whom banks serve. Changes with regard to the client mix and client expectations are key factors driving the business, and they will continue to do so in the future. While it is possible to segment clients by wealth level, risk preference, or any number of other variables, in all cases each client has a right to expect a tailored, customised service suited to his or her personal goals. This is discussed in Chapter 6, “Beyond Products—Offering Tailored Solutions.” Looking at how the changing market environment has affected clients’ preferences for certain types of instruments along with changes in the regulatory environment that also affect both the way needs are addressed and the types of solutions offered, it is a foregone conclusion that products and services must be suited to individual clients. This requires tailoring solutions to ensure that these best match clients’ needs.

PROCESSES, PEOPLE, AND PLANS

Allocating responsibilities allows goals to be achieved. But it is not the steps alone that are needed. There also has to be a way to give any story meaning by keeping in mind that all facets of this process are in some way intertwined. There are various ways that a bank can address the “thru” section of the path to excellence. A bank reaches its markets and clients through its brand. Especially in private banking, where brand is a relatively new focus, it is essential to understand what the brand stands for and how it can be reinforced. Chapter 7, “Why Brand Matters,” looks at these aspects, while Chapter 8, “Delivering a Superior Client Experience,” focuses on how clients perceive the bank, including by way of “touchpoints” that they encounter through advertising and by visiting the company premises. Chapter 9, “Understanding Service Excellence,” explores the idea that everyone working in an organisation is a client, even of other employees within the organisation. Much of this involves “processes.” Amid all the efforts to cultivate excellence, people, however, play the biggest role. Thus Chapter 10, “Winning the War for Talent,” takes a popular industry phrase as its title to explain how escalating demand for staff, especially in fast-growing markets, is influencing the industry as a whole.

All these factors can contribute to an optimal result if they are viewed objectively. It requires planning to ensure that the processes and, more important, the people work together to achieve the goals. Chapter 11, “Defining and Growing Leadership and Culture,” looks at how styles of leadership have evolved and how leadership can be encouraged, even in those who might consider themselves to be narrow specialists. Leaders must not only plan, but delegate. Planning is the art of turning goals into manageable steps.

METRICS

Every private banking “story” has a beginning, a middle, and an end. Very likely achieving goals in the quest to obtain excellence will prove that the process is self-perpetuating. To ensure that the bank is on track with regard to the strategy it has selected, targets are required. These need to be measured on a regular basis. Such targets can comprise key performance indicators (KPIs), for example. It is not necessary to measure 20 to 40 different parameters. A handful will do. They should be used to track developments in each region, market cluster, or organisational entity where the bank is active. At the management level, a relatively small number of KPIs tell the story. This is the focus of the final chapter of this book, Chapter 12, “Measuring and Managing Performance.”

CONCLUSION

This framework should serve as the unifying map to guide the reader through the different discussions in this book. By means of the steps outlined here, excellence gains a concrete dimension. It can be evaluated and analysed, and deficiencies can be addressed and strong points reinforced. Excellence then becomes more than just a word. It is something that can be strived for and, with effort, achieved. Without any plan, even the most inspiring vision will lead nowhere. Planning is the art of turning goals into manageable steps. By following a clear path and with a great deal of hard work, the desired aims can be achieved. The following chapters offer some insights into this process.

![]()

Chapter 2

What Is Driving Private Banking?

There are numerous forces at work shaping the private banking industry. Market volatility following the financial crisis of 2008 has led to a demand for simpler, more transparent types of investments among clients. Regulatory matters are also affecting the business. Concerns about the safety and soundness of banks have increased the pressure for stricter regulations to protect clients and to ensure that banks are adequately capitalised. As for clients, growth in nontraditional markets along with a shift taking place as a new generation takes over wealth planning also have affected how the business develops.

Competition, too, is undergoing change. Today’s competitor is no longer interested only in clients but also in securing the necessary talent to serve these clients in a market in which demand for relationship managers has increased. Where capital is concerned, banks that can demonstrate that they are able to exceed regulatory minimum requirements are at an advantage. Those that lack capital or the size necessary to compete in new markets are likely to join a wave of consolidation already underway in the industry.

How these forces together are shaping the industry makes private banking both exciting and challenging. The clock cannot be turned back. Private banks must accept that the world is changing and must seek to adapt. This chapter explores the issues that are critical for an understanding of how the industry will evolve in the future...