![]()

Part One

Shopper happiness

![]()

01

Delivering shopper happiness

In the 20th century many retailers operated more or less as a logistical extension to the supplier manufacturing and marketing operations. As long as they maintained stock at an appropriate level, extended their store networks and shipped products efficiently across their markets, they thrived at a fairly comfortable pace. This approach worked to the benefit of large suppliers such as Procter & Gamble and Philips who enjoyed a favourable negotiating position. They produced their brands in substantial volumes and were guaranteed to have their products available in all stores. This was the age of traditional consumer marketing. Suppliers estimated the market size, segmented the consumer groups based on socio-demographics and created demand by communicating the product benefits in large advertising campaigns. The media had not proliferated as much as it has today, so suppliers were fairly sure who was watching television and when. Execution of the marketing plan was described in detail in long-term plans and the ‘P’ of physical distribution was one of the details taken care of by suppliers.

Of course, things sometimes got tough. At times, consumer demand fell away abruptly and retailers had to cut back costs, for example when the increase in oil prices in the 1970s led to an economic crisis. Moments such as this made it crystal clear as to which retailers had their house in order: those that had invested in the right marketing-mix elements, had embraced logistical efficiency-improvement concepts and had adjusted their organizational set-up in line with the ever-changing environment. This led to a consolidation of retailers still in evidence in both mature and emerging countries. Retail markets such as office supplies, fashion, home decoration and consumer electronics are dominated by a handful of players. The way that these retailers achieved this position was basically by doing two things very well: 1) in-store execution; and 2) organizational development.

In-store execution is about making an efficient transaction between store staff and customers. It spans a whole range of strategic and tactical decisions on the retail marketing mix, from designing the store layout to efficient labour processes for changing price tags.

Organizational development is concerned with finding and applying the best resources for the retail strategy. For example, a big shift in retail activities and focus occurred when retailers made buyers not only responsible for negotiating the lowest price from suppliers, but also for the long-term health of the category. Retailers also need to adjust their model whenever they see that shoppers have moved their spending to other retail channels. As a result, they may be required to open stores in these new retail channels: for example, when a DIY retailer starts operating garden centres to cater to the demand for garden tools from shoppers who expect an inspirational and natural environment.

These two capabilities – in-store execution and organizational development – were critical success factors for retailers in the 20th century. However, in the retail world of today they have become conditions of being in the retail sector. The 21st century has taught retailers that new capabilities are needed. These relate to a better understanding of how shoppers behave and how choices are made at the moment of purchase (Figure 1.1).

FIGURE 1.1 Perspectives on retail marketing

Understanding the shopper has become essential. As a reflection of societal trends, shoppers have become more vocal in expressing their own individual wants. They demand services tailored to their needs and are less concerned about adhering to what their parents bought or to what leaders of social institutions (such as the church or trade unions) tell them to consider buying. Moreover, the retail landscape has changed; there are more channels with less-defined boundaries (‘channel blurring’). The proliferation of channels has stimulated a decrease in shopper loyalty. At the same time, the wide variety of media that shoppers tune into makes it difficult to reach them through just one channel – and, from a cost perspective, applying consumer marketing across all media channels is not an option. However, consumer marketers realise that people can be found in at least one place: the store.

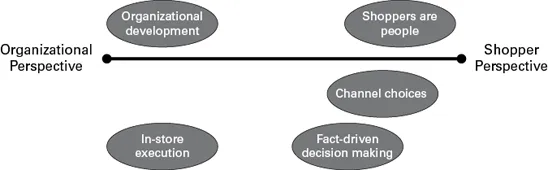

FIGURE 1.2 Evolving perspectives on retail marketing

Therefore, marketers’ attention has shifted from the moment of consumption to the moment of purchase. For suppliers, another reason to move their investment from advertising to in-store marketing is because retailers have become increasingly professionalized, more demanding towards suppliers, and have turned their store names into brands. The consolidation of many retail sectors effectively means that suppliers need to deal with fewer retailers in order to communicate with their shoppers.

In this changing context retailers need to acquire a new set of proficiencies, over and above the operational aspects, in order to shift towards a more shopper-driven perspective in their business (Figure 1.2):

- making decisions in a more fact-driven manner;

- operating within several channels at the same time;

- the skill set to deeply understand shoppers.

Making decisions in a more fact-driven manner

Retailers are not particularly known for their love of making decisions based on facts and figures. They seem to know intuitively that if a competitor reduces prices, then their shoppers also need a price reduction on the same or comparable products. They assume that shoppers compare the products without taking into consideration value-adding elements such as, for example, personal service or the policy of the retailer to only source in a sustainable way. Many retail activities are transactional, repetitive and require short-term focus. Ultimately, as compared with their respective suppliers, retailers often have far lower returns on investments, which gives them a good excuse not to invest in market research.

The amazing paradox in retail is that retailers sit on mountains of data but are not inclined to process the data into meaningful information. I do not want to say that decisions based on intuition are always wrong, on the contrary, but what is wrong is not using available data in order to make a better decision for the retail organization and for the shopper. The department stores, fashion stores and garden centres that buy on the basis of what they feel is the trend are outpaced by retailers that have invented systems that allow them to trial and scale supply of fashionable items. Zara is a great example of how a retailer decides both intuitively and based on facts: the designers at Zara have the authority to order the production of a new range of clothing after observing trends at a fashion show, but production is only scaled up if the sales in the first weeks are good.

Operating in several channels at the same time

The successful retailer of the future will have the capability of operating in several channels at the same time. A grocery chain may choose to operate convenience stores and supermarkets; a fashion store may enable online orders, operate its own stores and set up store-in-store concepts in department stores. The reasons for this are straightforward: the shopper has become less loyal, is more critical and uses digital technology to decide during the shopping journey as to where they can find the best deal.

Channel choice is an outcome of the ‘shopping mission’, which shows why the shopper is undertaking a purchase. For example, a DIY retailer may differentiate between a house renovation trip, a home security trip and a home decorating trip. Mission segmentation enables retailers to put themselves in the shoes of the shopper and to come up with solutions that the shopper is looking for. It helps retailers to think beyond the products and services they currently offer, to absorb best practices from other channels and even to innovate new shopper solutions.

A skill set to deeply understand shoppers

An essential requirement of success is an eagerness to fully understand shoppers and their needs and to master the instruments to do so. I still meet too many retailers who outwardly advertise how delighted they are to serve shoppers but in their meeting rooms and category management plans the shopper hardly plays a role. That said, the litmus test of shopper focus is whether the shopper feels the intent and touch of service. For example, when I shop at Marqt, a Dutch supermarket that stocks natural and organic products, not one but all the staff members I meet take notice of me and greet me warmly. As a shopper this feels better than knowing that they have excellent category management plans. As well as this deep desire to understand and serve shoppers, retailers need to keep introducing new tools that give deeper insight into shopping behaviour, and shoppers’ emotions and motives. While retailers might produce outstanding daily sales reports, these are not sufficient to communicate the voice of the shopper.

In conclusion, in order to be successful retailers need to move from an organizational view to a shopper view of their business. Every action the retailer takes needs to relate to their shoppers’ needs and how their shopper makes decisions. Optimization of in-store execution and organizational development can help retailers to accomplish this. However, note that optimization of the instruments of the retail marketing mix is not an objective in itself.

The emotional shopper

Traditional economic theory assumes that all consumers are rational. The economic models work on the premise that consumers have access to all information, understand it and calculate the benefits of all product characteristics before maki...