![]()

1

INTRODUCTION

About the author

After five years of working for an organization owned by New Zealand’s four major trading banks, being responsible for the all bank ATM and POS networks and the card management systems, both debit and credit, Peter, along with partners, established a consultancy and services partnership – GFG Group. Peter has developed an international footprint either as an individual or as a team leader completing assignments in over 30 markets. He has a balance of experience due to undertaking assignments in developed markets such as Australia, Japan, Hong Kong, Canada, United Kingdom and New Zealand as well as across emerging markets such as Iraq, Bangladesh and Vietnam plus equally challenging markets of India and the Philippines.

Peter has developed extensive business and technical knowledge from delivering payment solutions, many of which involved the delivery of transactional switching services. Peter has played key roles in significant projects such as the:

• first significant deployment of payment cards into the Russia (SBRF) market;

• initial design and business case for the Maldives interoperable payment system (National Payment System);

• Smart Communication’s Smart Money (Philippines) mobile payment system – as the architect as well as project (integration) director;

• ISC’s interoperable payments network in IRAQ;

• establishment of the Bahrain near real-time payment service.

Through these projects and many other assignments Peter truly demonstrates an understanding of the payments business, from system conception, design and development to implementation at both the business and technology levels. He understands the importance of transactional messaging systems (interoperability), the need for integrity in a payment service and the requirement to authenticate and secure payment data.

The content of this book is derived from this broad-ranging career in payments.

Who should read this book?

Peter has been asked over the years, by new entrants to the payment industry, how do I learn about payment systems? Are there courses or books that can be read? There are, and there are many opinion pieces and large amounts of content on the web, but most of it is topic specific and much opinion based.

This book is intended to address this gap. It is intended to be read by those entering the industry, such a technologists, business executives, and investors who are not interested in building a payment system, at least not immediately, but because of their careers or business interests require a level of understanding.

Because of the evolutionary nature of payments, this book looks from the past to the future so the reader can understand the industry dynamics. Not all readers will agree with Peter’s projections for the future but it may help readers to define their own projections. If that happens an objective has been achieved.

Peter suspects payment systems are a difficult subject to comprehend, although people use payment services every day. As individuals or as participants in businesses, in small incremental steps, we determine which new technology-driven innovations will be successful.

This book is intended to assist the reader to navigate the payments landscape.

![]()

2

CONTEXT OF PAYMENTS

An understanding

Payment systems have changed dramatically over the last three to four decades, as electronic payments as a collective has become the dominant delivery mechanism. What was once solely a financial institution (bank) domain has broadened to where other parties have a major influence. Retailers have always been involved, but have become a strong lobby group, pressurizing the central monetary authorities to regulate to their advantage. Mobile operators have seen payments as an opportunity to extend their dominance, and with the encouragement of their own association (GSMA) and funding from various donor organizations, have attempted to enter the payments space, particularly in the emerging markets.

There has been the growth in third-party providers who have serviced the gaps in the market created because of the banks’ preference not to provide a holistic service. Banks have looked to outsource or divest from various services, especially as the range of delivery channels has grown. Finally, the internet has been accepted as a legitimate platform from which to conduct commerce. The internet has presented the opportunity for services such as PayPal to enter the payments industry. We are seeing a variety of other organizations, which are not so easy to categorize, such as Google, Apple, Square and Amazon, becoming or attempting to become payment industry players.

In the last few years, Faster (Direct) Payment services have been introduced with the potential to challenge the card schemes and place pressure on cheques and cash usage. Although initially designed for the person-to-person market, the SME (small-, medium-size enterprise) sector is showing signs of being an early adopter. As the transaction limits are increased, corporate interest has increased beyond customer bill payments.

I sometimes think the payment industry (it was once only a sector of banking) is in a state of disorder (disruption) owing to the overwhelming attention from parties who believe they can make their fortune with minimal knowledge of the business, as revolutionaries supported by a superior understanding of how technology can be applied.

The disruption process results in a considerable amount of noise and wheel spinning, delivering slow progress at best. The reasons for this are possibly:

• The banks are considered conservative organizations, seen by many as slow to innovate. In part this is a fair comment and in some respects banks could claim this as a virtue considering they are custodians of our money. When they act otherwise we have outcomes such as the Global Financial Crisis (GFC). However, in the 1980s and 1990s, banks were innovators in the area of payments with the introduction of ATMs and POS (Point of Sale), extending the range of payment cards, telephone banking, and introducing cost saving technology in their back offices, etc. The reason banks have not been seen as innovators in recent years is the smart card and mobile-based technology solutions have not had the supporting business cases, with the associated risks having been assessed as too high. This is not to say banks have not taken to market their own internet-based solutions delivered across the PC, Tablet and mobile user platforms.

• Payments, as an industry, have attracted many technology-based solutions looking for a problem to solve. Smart cards are a primary example; NFC (Near Field Communications, i.e. mobile wallets) is looking like another. Many new payment initiatives are driven by technologists, with little understanding of the business and the associated market demands (I once placed myself in this category). Software solutions are often over-engineered, oversold and trying to address too many issues. Smart Cards are now will established, based on satisfying a core need. The need that had to be addressed was fraud. All the other financial services that were originally envisioned for Smart Cards having been forgotten, with mobile banking stealing the limelight. Proximity or contactless (tap and go) payment is also gaining traction, which indicates a bright future for NFC (at least on plastic).

• The retail industry, like the banks, is struggling with the technology options now available. Bricks and mortar retail outlets are being replaced with online sales channels. How retailers engage with their customers is currently a perplexing issue. Payment is part of the engagement equation, but how the payment industry responds will only be known once retailers settle on a new marketing and engagement model.

A new payment method must originate from one of the following:

• a new method of commerce being introduced such has been seen with the internet;

• a need to improve the efficiency of an existing payment method, such as cheques, cards and cash;

• a need to minimize the payment risk of an existing payment method as was the case for EMV (chip and PIN) over magnetic stripe and signature for cardholder validation;

• a customer’s perceived need requiring fulfilment.

Are the emerging faster payment services the future? This is a question worth asking and it will be examined later.

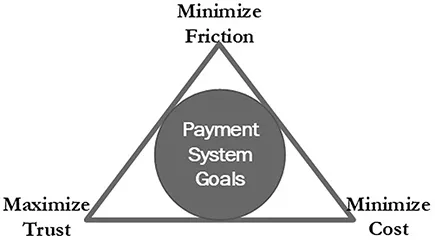

To simplify the subject and to conceptualize, I see three interconnecting success factors that are core to any payment service (Figure 2.1).

In Figure 2.1, ‘Trust’ relates to security and confidentially of the payment process and safeguarding the identity of the payer; addressing fraud and preventing identity theft.

‘Friction’ relates to the efficiency of the payment process, enabling it to be seamless in the purchasing experience. The new terminology is ‘frictionless payments’.

The ‘cost’ of a payment transaction is always a contentious issue, but simply relates to volume. Consumer payments are a numbers game. As volume goes up cost should diminish simply through the economies of scale that are being achieved.

A payment method that delivers on the first two elements has a high possibility of achieving the third through the support of the payment participants.

Payment is the activity or process that supports (or enables) commerce. It is not the ‘main act’ but if payment cannot be made the commercial process will fail.

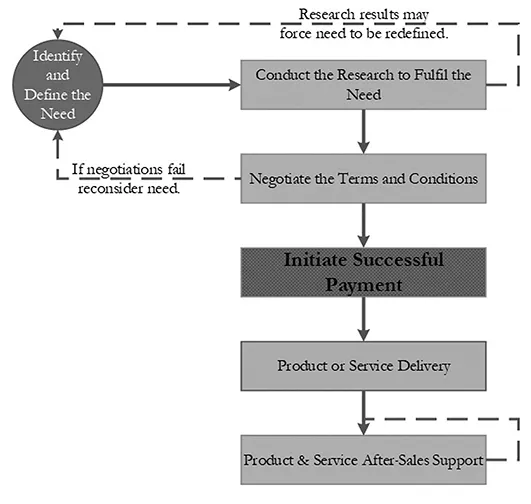

Figure 2.2 illustrates the steps related to making a purchase and the positioning of payment in the process.

Obviously, the duration of each step relates to the type of product and service being purchased, and in the case of supermarket shopping you might make several purchases but only one payment. You might argue there is no negotiation, but you might select a brand/product based on the price and quality.

FIGURE 2.1 Payment system success factors

FIGURE 2.2 Purchasing chain

The biggest change in commerce has come from the emergence of the internet and e-commerce. E-commerce could be argued as the internet enabling mail order and catalogue sales channels to broaden their target market. The payment providers, especially the card schemes were late in recognizing that the front-end payment process needed to be re-engineered, so PayPal and similar services moved into the space. This should be a lesson to the established providers – adapt quickly or miss out.

Why is a payment system so important?

The payment system is a critical component of a national economy. Commence is severely inhibited if an efficient supporting payment system has not been deployed.

An excellent analogy is to compare the payment system to a nation’s transportation network. Roads, rail and air networks allow goods to be transported from the points of production to their point of distribution and then through the delivery channels to the end user (customer).

Poor or non-existent transportation links restrict economic development. Producers need to deliver their products to market. Modern transportation links enlarge the market place for producers. This enables producers to incre...