![]()

CHAPTER 1

Introduction

The remarkably strong growth that Azerbaijan’s economy enjoyed since the start of the new millennium came to an abrupt halt when international oil prices plummeted in 2014. Since then, the government has been energetically seeking new sources of growth beyond oil, the economy’s mainstay.

Because of the low level of technology used in the oil industry, Azerbaijan’s oil reserves were not fully exploited by the former Soviet Union. Since independence in 1991, however, there has been significant oil exploration and development in the Caspian Basin bordered by Azerbaijan. The country also has sizable agriculture land: 57.7% of the total land area and nearly half of this is arable.

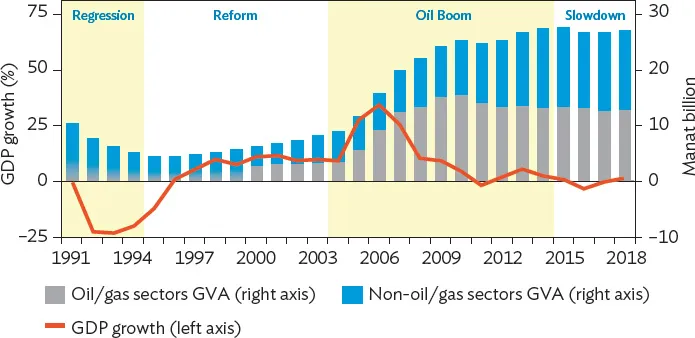

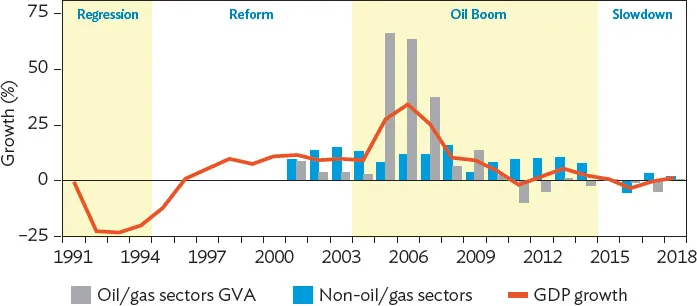

Since independence, Azerbaijan’s economic development has undergone four distinct stages: regression (1991–1994), reform (1995–2003), oil boom (2004–2014), and slowdown from 2015 (Figure 1.1).1 It was during the oil boom that the oil and gas sector became the main contributor to the country’s strong economic growth up to the collapse in oil prices (Figure 1.2).

1.1 Rapid Economic Transformation

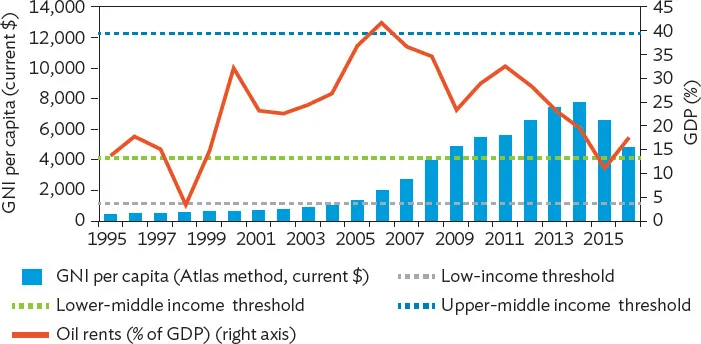

Azerbaijan has undergone a significant economic transformation since independence. The economy collapsed with the breakup of the former Soviet Union, and by 1995 gross domestic product (GDP) was less than half the 1990 level . But Azerbaijan rose to the challenges it faced, quickly transforming itself into an upper-middle-income country by 2009, when annual average gross national income per capita was $6,093.2 The poverty rate fell from 60% in 1995 to 13.2% in 2008 and to 4.9% in 2015. Azerbaijan is now classified as a high human development country by the United Nations Human Development Index, with its index in 2017 at 0.757.3

Oil remains pivotal to Azerbaijan’s economic success. GDP growth started to accelerate from 1995 before plateauing at about 10% in 2000–2004. When oil prices subsequently soared, the oil industry lifted GDP. Oil rents exceeded 15% of GDP during 2004–2014, averaging 28% during the period and peaking at 42% in 2006 (Figure 1.3). Azerbaijan’s economy grew fastest during 2005–2010, with annual average GDP growth of 18%. The slump in oil prices since 2014 caused income per capita and the share of oil revenue in the country’s GDP to fall.

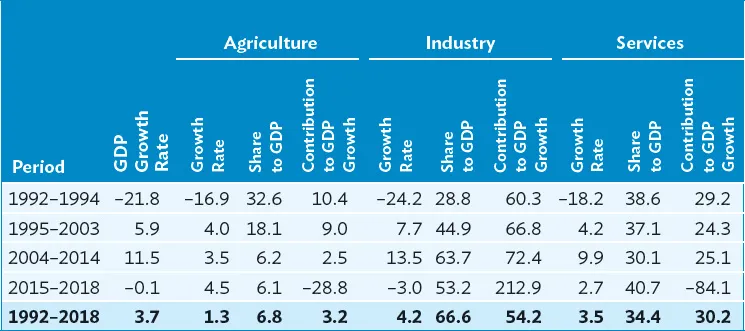

During the oil boom years, industry contributed most to GDP growth in both oil and non-oil sectors, averaging 70.9% of total growth over that period (Table 1.1). When oil prices started to fall, GDP growth contracted to –0.8% in 2015, but industry (oil and non-oil) continued to contribute the bulk of GDP, at 248.5%, while the contribution of services and agriculture to GDP growth fell dramatically. Despite adverse economic circumstances, the growth rate of the agriculture sector has, however, slowly picked up, climbing from an annual average of 3.5% during the oil boom to 4.5% during the economic slowdown.

Table 1.1: Major Production Sectors, 1992–2018 (annual average %)

GDP = gross domestic product.

Note: Financial intermediation services were indirectly measured and included in the services sector.

Sources: Estimates based on State Statistical Committee data; and UN Statistics Division database.

The 2008 global financial crisis had a sharp impact on the economy, with GDP growth decelerating to 0.1% by 2011. Plummeting oil prices, weak regional growth, devaluations in the Azerbaijan manat, and a contraction in oil and gas production quickly reversed some of the gains of the oil boom.

Investment as a share of GDP peaked at 24.1% during the slowdown. But because these investments were mostly in hydrocarbons, the investment growth rate fell sharply, contracting 11.1% during this period because of the oil price shock (Table 1.2). Both investment and savings were quite high before the slowdown, when consumption buffered the economy. In late 2016, global oil prices started to pick up and Azerbaijan’s oil exports began to rebound in 2017.

Table 1.2: Expenditure Components, 1991–2017 (annual average %)

Note: Share to GDP and Contribution to GDP Growth Rate do not sum to 100% because of rounding.

Sources: Estimates based on State Statistical Committee data; and Asian Development Bank. 2010 and 2017. Key Indicators for Asia and the Pacific. Manila.

In addition to the economic challenges that Azerbaijan has faced since independence, it has had to deal with a war with the separatist region of Nagorno-Karabakh that broke out in the late 1980s and ended in 1994. The effects of this undermined the country’s early postindependence economic progress. After the war, Azerbaijan still faced major social concerns. The incidence of poverty in the mid-1990s was high, with more than 60% of the population considered poor. In 1995, real per capita GDP was just 39% of its 1990 level. It was at this low point that Azerbaijan embarked on a strategy to rehabilitate oil production through an ambitious investment plan.

1.2 Oil Boom 2004–2014

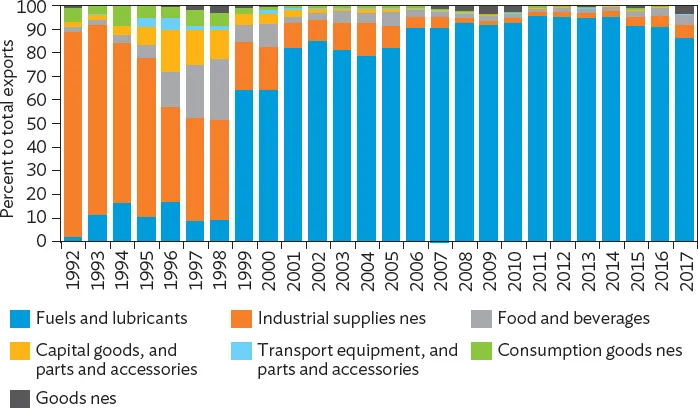

The first wave of foreign investments in oil and gas exploration in the Caspian Sea in the mid-1990s transformed Azerbaijan into an exporter of fossil fuels, setting off the next stage of the country’s economic development. By 1994, 10% of total exports came from oil; by 2017, the share was 76%, (gas exports in that year accounted for 11% of total exports) (Figure 1.4).

Azerbaijan’s first major oil contracts for exploration and production with international firms were signed in 1994; these were production sharing agreements between the State Oil Company of Azerbaijan Republic (SOCAR) and international oil companies. In the following year, the country’s stabilization and structural reform program got underway to help secure macroeconomic and financial stability, gain better control of inflation, and reduce the fiscal deficit. By the early 2000s, chronically high inflation had been brought under control. The completion of the Baku–Tbilisi–Ceyhan oil pipeline in 2005 marked the country’s transition to being a significant oil-based economy, as it was in the early 20th century.

Boosted by huge oil revenue, the economy enjoyed robust growth rates; large foreign reserves, which peaked at $15.8 billion in 2014; more revenue for social protection; and lower foreign debt. Continued inflows of foreign direct investment into the oil industry were largely behind Azerbaijan reaching upper-middle-income status by 2009.

In 2006, economic growth accelerated to 34.5% on the back of a 63.2% rate of growth in the oil and gas sector—this was the highest rate of GDP growth of any country worldwide in that year, according to the World Bank’s World Development Indicators. But there was clearly no prospect of sustaining that level of growth after the global financial crisis triggered a global economic slowdown. And by 2011, growth in Azerbaijan had withered to 0.1%, with the oil and gas sector contracting 9.2%.

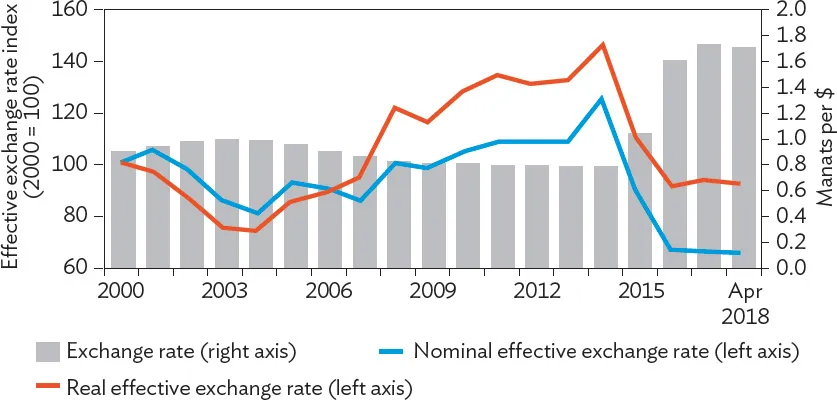

The new Azerbaijan manat was issued on 1 January 2006 to strengthen reforms and to put the economy on a more stable footing. The new currency appreciated until it was hit by falling oil prices, losing 56% against the dollar by 2016. Since then, the exchange rate has stabilized on the Central Bank of Azerbaijan tightening policy, increasing oil revenue, and low imports (Figure 1.5).

Azerbaijan started to show signs of Dutch disease since the new currency was introduced.4 High oil prices from the country’s fast-growing oil and gas industry resulted in a strong exchange rate against the dollar. After the new currency was issued, inflation rose to 16.7% in 2007 and 20.8% in 2008, and average monthly nominal wages rose by 21% in 2006 and 45% in 2007. Inflation, higher wages, and the sharp inflow of foreign currency into Azerbaijan, including foreign direct investment, triggered a rise in imported goods and the consumption of nontradable goods and services. This resulted in a decline in the competitiveness of the country’s manufacturing and agriculture exports, and a continuing expansion in oil and gas exports.

1.3 Slowdown from 2015 to 2017

It is important to assess the effects of a sharp decline of global market prices of oil on the macro economy. This section presents how Azerbaijan responded to the shock and began its journey toward diversification. From 2015 to 2017, the government swiftly responded to the fall in oil prices by reducing production.5 Because of worsening bank balance sheets and increasing dollarization, the central bank closed troubled banks; restructured state-run International Bank of Azerbaijan, which was in financial difficulties;6 and lowered limits on dollar lending. The measures triggered aftershocks in the form of rising inflation, a big drop...