eBook - ePub

Unlocking Company Law

Susan McLaughlin

This is a test

Condividi libro

- 532 pagine

- English

- ePUB (disponibile sull'app)

- Disponibile su iOS e Android

eBook - ePub

Unlocking Company Law

Susan McLaughlin

Dettagli del libro

Anteprima del libro

Indice dei contenuti

Citazioni

Informazioni sul libro

Unlocking Company Law is the ideal resource for learning and revising Company Law. This 4th edition has been extensively updated, and this, along with its many pedagogical features, makes it the ideal companion for students studying Company Law.

Each chapter in the book contains:

• aims and objectives;

• activities such as self-test questions;

• charts of key facts to consolidate your knowledge;

• diagrams to aid memory and understanding;

• prominently displayed cases and judgments;

• chapter summaries;

• essay questions with answer plans.

In addition, the book features a glossary of legal terminology, making the law more accessible.

Domande frequenti

Come faccio ad annullare l'abbonamento?

È semplicissimo: basta accedere alla sezione Account nelle Impostazioni e cliccare su "Annulla abbonamento". Dopo la cancellazione, l'abbonamento rimarrà attivo per il periodo rimanente già pagato. Per maggiori informazioni, clicca qui

È possibile scaricare libri? Se sì, come?

Al momento è possibile scaricare tramite l'app tutti i nostri libri ePub mobile-friendly. Anche la maggior parte dei nostri PDF è scaricabile e stiamo lavorando per rendere disponibile quanto prima il download di tutti gli altri file. Per maggiori informazioni, clicca qui

Che differenza c'è tra i piani?

Entrambi i piani ti danno accesso illimitato alla libreria e a tutte le funzionalità di Perlego. Le uniche differenze sono il prezzo e il periodo di abbonamento: con il piano annuale risparmierai circa il 30% rispetto a 12 rate con quello mensile.

Cos'è Perlego?

Perlego è un servizio di abbonamento a testi accademici, che ti permette di accedere a un'intera libreria online a un prezzo inferiore rispetto a quello che pagheresti per acquistare un singolo libro al mese. Con oltre 1 milione di testi suddivisi in più di 1.000 categorie, troverai sicuramente ciò che fa per te! Per maggiori informazioni, clicca qui.

Perlego supporta la sintesi vocale?

Cerca l'icona Sintesi vocale nel prossimo libro che leggerai per verificare se è possibile riprodurre l'audio. Questo strumento permette di leggere il testo a voce alta, evidenziandolo man mano che la lettura procede. Puoi aumentare o diminuire la velocità della sintesi vocale, oppure sospendere la riproduzione. Per maggiori informazioni, clicca qui.

Unlocking Company Law è disponibile online in formato PDF/ePub?

Sì, puoi accedere a Unlocking Company Law di Susan McLaughlin in formato PDF e/o ePub, così come ad altri libri molto apprezzati nelle sezioni relative a Law e Corporate Law. Scopri oltre 1 milione di libri disponibili nel nostro catalogo.

Informazioni

1

Introduction to company law

AIMS AND OBJECTIVES

After reading this chapter you should understand:

■ The scope of ‘company law’

■ The relationship between core company law, insolvency law, securities regulation and corporate governance

■ The sources of company law

■ The importance in the study of company law of foundation course legal knowledge and skills

■ The historical development of the registered company and its statutory framework

■ The arguments for and against limited liability

■ The influence of the European Union on UK company law

■ The rationale behind the Companies Act 2006 and subsequent developments

1.1 Who this book is for

This book is written primarily for undergraduate law students studying company law. It aims to guide students to an understanding of:

■ the scope of company law and how it is linked to other specialist legal subjects such as securities regulation and insolvency law;

■ the sources of company law;

■ key legal principles of company law;

■ key moot, or unsettled, issues in company law.

It is also written to assist students to develop their ability to:

■ understand and appreciate the context in which company law operates;

■ apply key principles of company law to solve problem questions;

■ interpret legislation;

■ use precedents to construct logical and persuasive arguments and discuss moot points of law;

■ think reflectively and critically about the strengths, shortcomings and implications of various aspects of company law.

Company law and company law scholarship have grown rapidly in volume in recent years making it unrealistic to cover the whole of even ‘core’ company law (a term explained in the next section) in what is usually little more than two terms if students are to achieve understanding rather than acquire a superficial level of knowledge. Three filters commonly used to limit the volume of material covered are adopted in this book, which focuses on:

■ companies formed to run businesses for profit, not companies formed for charitable or other non profit-making purposes;

■ registered limited liability companies with a share capital rather than other types of registered company such as unlimited companies or companies limited by guarantee;

■ the Companies Act 2006, with limited coverage of securities regulation (also known as capital markets law or financial services law) or insolvency law.

Whilst students choose to study company law for a number of reasons, all share the aim of successfully completing their assessment(s). The activities and sample essay questions in each chapter of this book are designed to help you to test your knowledge and understanding and develop a successful approach to answering company law questions.

1.2 What we mean by ‘company law’

1.2.1 Core company law

core company law

The law governing the creation and operation of registered companies

The focus of this book is what is sometimes referred to as ‘core company law’, which is essentially the law governing the creation and operation of registered companies. It is very easy to identify core company law today as it is almost all contained in the 1,300 sections and 16 schedules of the Companies Act 2006, regulations made pursuant to that Act, and cases clarifying the application of the statutory rules and principles.

That said, the Companies Act 2006 is not a comprehensive code of core company law in the sense of a body of rules that has replaced all common law rules and equitable principles previously found in cases. Certain aspects of core company law, such as remedies available for breach of directors’ duties, remain case-stated law distinct from statute law and many cases interpreting provisions of past Companies Acts remain relevant today. The Companies Act 2006 is also not the only current statute containing core company law. Key relevant statutes and the role of case law in core company law are considered in section 1.3 under the heading ‘Sources of company law’.

Limits of core company law

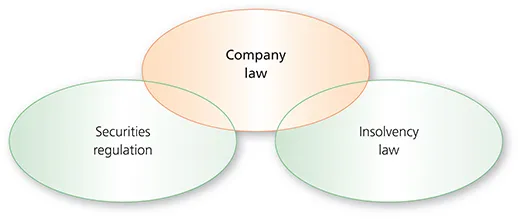

A more comprehensive review of law relevant to companies would include insolvency law and securities regulation (the latter is part of a larger body of law known as capital markets law or financial services law) to the extent that they apply to companies. In the last 30 years, each of these areas of law has become a highly developed and voluminous legal subject in its own right. Realistically, not even the parts of each relevant to companies can be covered in any depth in a company law textbook of moderate length and no attempt is made here to do so. Students interested in those subjects specifically can find references to texts providing a good starting point for their studies at the end of this chapter.

Figure 1.1 Company law includes parts of securities regulation and insolvency law.

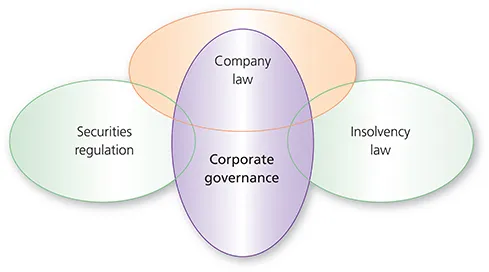

Corporate governance has also emerged as a subject of study in its own right over the last 30 years, so much so that it is appropriate to say a few words about it in the context of setting out what we mean by core company law. Corporate governance is not a legal term, rather, it is a label, or heading under which the questions how, by whom and to what end corporate decisions are or should be taken, are analysed and reflected upon. Issues such as the role law plays and how far the law can and should be used to achieve effective or good corporate governance arise as part of those analyses and reflections.

Those who support extensive use of law and regulation backed up by law to achieve effective corporate governance are said to support the ‘juridification’ of corporate governance. Those against include those who are said to prefer ‘private ordering’. Core company law and corporate governance overlap to the extent that a large part of core company law is a body of rules and principles establishing how and by whom corporate decisions may lawfully be made or are legally required to be made.

Core company law textbooks differ in the extent to which they deal with insolvency law, securities regulation and corporate governance. The approach taken in this book to each is set out in the following three sections.

Figure 1.2 Corporate governance.

1.2.2 Insolvency law

Even though in theory they could, companies do not tend to continue in existence forever. They either outlive their usefulness or become financially unviable. Before a company ceases to exist, or is ‘dissolved’, to use the legal term, its ongoing operations are brought to an end, its assets are sold and the proceeds of sale are used to pay those to whom it owes money. This process is called ‘winding up’ or ‘liquidating’ the company.

Some companies that are wound up or liquidated are able to pay all their debts in full, that is, they are ‘solvent’, yet the law governing winding up of solvent companies is set out in the Insolvency Act 1986 (and rules made pursuant to that Act, the most important of which are the Insolvency Rules 2016). The explanation for this is that most winding ups involve insolvent companies and when, in the mid-1980s, the law governing insolvent company winding up was moved out of company law legislation into specific insolvency legislation, it made sense to deal with solvent winding up in the same statute. This avoided the need for duplication of those winding-up provisions relevant to both solvent and insolvent companies in both the Companies Act 1985 (now replaced by the Companies Act 2006) and the Insolvency Act 1986.

Note that insolvency is an umbrella term relevant to both companies and individuals but in the UK the term bankruptcy is used only to refer to the insolvency of individuals, not companies. It is legally incorrect to refer to a company going bankrupt.

Insolvency law is a highly detailed and specialised area of legal practice requiring study of specialist texts for a full understanding of its scope and complexity. That said, the two key formal processes forming the core of insolvency law are administration (a process designed to facilitate the rescue of financially troubled companies) and liquidation (the process by which companies are wound up). Administration is outlined in Chapter 15 and liquidation is examined in Chapter 16.

During the administration and liquidation processes, administrators and liquidators have various powers, including powers to bring legal actions and to review and challenge the validity of certain transactions entered into by the company. Clearly, it is important for anybody seeking to understand the rights of those who deal with companies and the law governing directors (because many of these legal actions and transactions involve directors), to have a basic understanding of these powers. For this reason the relevant provisions of the Insolvency Act 1986 are included in Chapter 16.

Finally, in the case of a winding up, once the assets of the company have been turned into money and any and all contributions secured, the liquidator is required to follow a statutory order of distribution which determines the priority of payment of different types of creditors. Given the significance of this statutory ordering to the decision whether or not to deal with a company, and the terms on which to do so, the statutory order of distribution on liquidation is also covered in Chapter 16.

1.2.3 Securities regulation

It is difficult to decide which, if any, part of securities regulation to include in a core company law textbook. The aim of securities regulation is essentially to provide protections to those who decide to invest their money in securities. The term ‘securities’ covers a complex range of investment products, including products unrelated to companies. A student of core company law is concerned only with securities taking the form of shares and corporate bonds.

Securities regulation is part of what is often called finance law. For our purposes, finance law can be viewed as made up of three parts: banking law; the regulation of those who conduct investment business and the markets on which investments are traded; and, increasingly, the regulation of companies whose securities (shares and bonds) are offered to the public.

Consequently, basically, securities regulation is only relevant to those companies with shares or bonds traded or ‘listed’, i.e. bought and sold, on stock exchanges. As only a very small minority of UK companies have shares or bonds that are traded/listed, it is very important to appreciate that it is a very small number of companies that need to engage with and comply with securities regulation. Securities regulation does not apply to over 99 per cent of registered companies.

Regulatory shortcomings highlighted by the global financial crisis of 2008 and its aftermath resulted in extensive, ongoing reform of finance law globally. Reform of finance law applicable in the UK resulted from both UK and EU initiatives. Most of the changes related to the regulation of banks and there was a re-alignment of regulatory responsibilities. The re-alignment was effected by the Financial Services Act 2012. A ‘macro-prudential authority’ was established, called the Financial Policy Committee (FPC), with two key regulators sitting underneath it, the Prudential Regulation Authority (PRA), which is a subsidiary of the Bank of England, and the Financial Conduct Authority (FCA). The Financial Services Authority (FSA) was abolished and its functions were split between the PRA and the FCA. The key securities regulator in the UK...