eBook - ePub

Building Wealth

An Insider's Guide to Real Estate Investing

Charles Hibble

This is a test

Condividi libro

- 82 pagine

- English

- ePUB (disponibile sull'app)

- Disponibile su iOS e Android

eBook - ePub

Building Wealth

An Insider's Guide to Real Estate Investing

Charles Hibble

Dettagli del libro

Anteprima del libro

Indice dei contenuti

Citazioni

Domande frequenti

Come faccio ad annullare l'abbonamento?

È semplicissimo: basta accedere alla sezione Account nelle Impostazioni e cliccare su "Annulla abbonamento". Dopo la cancellazione, l'abbonamento rimarrà attivo per il periodo rimanente già pagato. Per maggiori informazioni, clicca qui

È possibile scaricare libri? Se sì, come?

Al momento è possibile scaricare tramite l'app tutti i nostri libri ePub mobile-friendly. Anche la maggior parte dei nostri PDF è scaricabile e stiamo lavorando per rendere disponibile quanto prima il download di tutti gli altri file. Per maggiori informazioni, clicca qui

Che differenza c'è tra i piani?

Entrambi i piani ti danno accesso illimitato alla libreria e a tutte le funzionalità di Perlego. Le uniche differenze sono il prezzo e il periodo di abbonamento: con il piano annuale risparmierai circa il 30% rispetto a 12 rate con quello mensile.

Cos'è Perlego?

Perlego è un servizio di abbonamento a testi accademici, che ti permette di accedere a un'intera libreria online a un prezzo inferiore rispetto a quello che pagheresti per acquistare un singolo libro al mese. Con oltre 1 milione di testi suddivisi in più di 1.000 categorie, troverai sicuramente ciò che fa per te! Per maggiori informazioni, clicca qui.

Perlego supporta la sintesi vocale?

Cerca l'icona Sintesi vocale nel prossimo libro che leggerai per verificare se è possibile riprodurre l'audio. Questo strumento permette di leggere il testo a voce alta, evidenziandolo man mano che la lettura procede. Puoi aumentare o diminuire la velocità della sintesi vocale, oppure sospendere la riproduzione. Per maggiori informazioni, clicca qui.

Building Wealth è disponibile online in formato PDF/ePub?

Sì, puoi accedere a Building Wealth di Charles Hibble in formato PDF e/o ePub, così come ad altri libri molto apprezzati nelle sezioni relative a Business e Real Estate. Scopri oltre 1 milione di libri disponibili nel nostro catalogo.

Informazioni

Argomento

BusinessCategoria

Real EstateChapter 1

Designing Your Own Real Estate Investment Strategy

Now it’s time to develop a real estate investment strategy that fits your investment goals, your investment style, your current financial situation, and even your special skills, talents, and interests.

First, when developing a workable strategy, ask yourself the following questions:

- Does your current schedule provide time to build sweat equity or manage a property?

- Do you want to be a landlord?

- Does property ownership fit your lifestyle, i.e., do you travel a lot, etc.?

- Does property ownership fit into your overall investment strategy?

- Does property ownership reflect your investment style?

- Other than cash, what skills, talents, and/or interests do you bring to the table?

By answering these six questions, you’ll develop a better feel for how real estate investments can best fit into your life and know which investments are suited for your investment style, lifestyle, and personal traits and characteristics.

Next, think about your current investments and your approach to investing in general. Let’s take a quick look at some investment fundamentals to keep in mind when designing your personal real estate investment strategy.

Diversification

Diversification is nothing more than “Don’t put all your eggs in one basket.” (Mom was right!) Diversification is an important consideration in the development of any collection of assets—stocks, bonds, mutual funds, CDs, and gold coins—how you divvy up your assets (your investment portfolio) counts when it comes to making money.

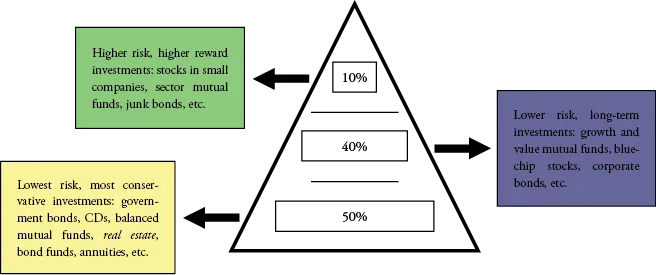

Many financial gurus use the pyramid model to describe how a diversified asset portfolio might look.

A conservatively diversified investment portfolio

If you have a greater risk tolerance or a twenty- to thirty-year time horizon before you intend to dip into your savings, you might want to juice up the top and middle layers of the pyramid to generate more reward at some increased risk.

Look at your assets—your IRA, 401(k), stock, and bond holdings—all paper assets. A small investment in real estate diversifies you out of paper and into something tangible—real estate. It’s a different kind of investment in a completely different market (from stocks and bonds), and plain and simple, real estate adds real diversification to virtually any collection of paper assets.

Preservation of capital

Straight up? Hold on to what you got. The last thing you want to do is worry about your nest egg losing value. Real estate is a terrific investment for investors concerned about keeping what they have and those with short investment time horizons.

Real estate investments help preserve capital in several ways:

- Property holds its value better, even when the stock and bond markets are tanking.

- Property usually increases in value at a faster rate than paper assets.

- Property offers flexibility to you, the private investor, by providing a number of investment strategies for changing financial times and your personal circumstances, i.e., rental property for monthly income to buying houses to fix up and sell quickly.

Property ownership is not only one of the best tools for growing wealth but also one of the best tools for preserving what you’ve already got.

Leveraging

Leveraging is simply using other people’s money to make money for yourself. Your home is a perfect example. You put down a small amount of money on your home and borrowed the rest from a mortgage lender. Now, ten years later, your home is worth twice what you paid for it. So who keeps all of that increase in property value? You, the smart investor.

Let’s say you put down $10,000 on your home when you bought it for $120,000 ten years ago. Today, the house is appraised at $200,000. In fact, you made a profit of $80,000 on a $10,000 outlay. You put up $10,000 and walk away with $80,000 when you sell. That’s the power of leveraging—one of the most appealing aspects of real estate investing.

Increased control of your investments

Buy $5,000 of IBM, and you’re at the mercy of IBM’s management to make the right business decisions and to operate ethically and legally. (Remember Tyco, WorldCom, Enron, etc.) You have no control over your investment dollars.

Invest that same $5,000 in a fixer-upper—fix it up and sell it for a tidy little profit. It’s your investment, your money, and you’re in control.

Where’s your money now?

Before entering the investment real estate market, it’s always a good idea to figure out where you are at the moment—what financial experts call a portfolio analysis, which is just a fancy way of asking, “How much money do you have, and where is it?”

If you’ve got money in anything from a passbook savings account to mutual funds, to stocks and bonds, to cash stuffed in a coffee can, guess what? You have an asset portfolio. So step one in becoming a real estate investor is to analyze your current financial situation.

A fresh coat of paint, a bit of landscaping and a good cleaning can lead to big profits.

Pay particular attention to the following:

- How much cash you have available. This is called your liquidity. Money stashed in an IRA, 401(k), some annuities, and other investments isn’t liquid, that is, you can’t get at it without paying some really stiff penalties. So focus on things like stocks and bonds (outside of your IRA), CDs and other cash instruments, money market accounts, passbook savings, and the cash buried in the backyard—money you can inve...