eBook - ePub

The Economics of the Global Stock Exchange Industry

J. Floreani,M. Polato

This is a test

Condividi libro

- English

- ePUB (disponibile sull'app)

- Disponibile su iOS e Android

eBook - ePub

The Economics of the Global Stock Exchange Industry

J. Floreani,M. Polato

Dettagli del libro

Anteprima del libro

Indice dei contenuti

Citazioni

Informazioni sul libro

This book is an economic analysis of the stock exchange industry. The authors draw on theories from micro- and industrial economics to provide a detailed analysis of the industry structure, the strategic behaviour of key participants and the performance of stock exchanges.

Domande frequenti

Come faccio ad annullare l'abbonamento?

È semplicissimo: basta accedere alla sezione Account nelle Impostazioni e cliccare su "Annulla abbonamento". Dopo la cancellazione, l'abbonamento rimarrà attivo per il periodo rimanente già pagato. Per maggiori informazioni, clicca qui

È possibile scaricare libri? Se sì, come?

Al momento è possibile scaricare tramite l'app tutti i nostri libri ePub mobile-friendly. Anche la maggior parte dei nostri PDF è scaricabile e stiamo lavorando per rendere disponibile quanto prima il download di tutti gli altri file. Per maggiori informazioni, clicca qui

Che differenza c'è tra i piani?

Entrambi i piani ti danno accesso illimitato alla libreria e a tutte le funzionalità di Perlego. Le uniche differenze sono il prezzo e il periodo di abbonamento: con il piano annuale risparmierai circa il 30% rispetto a 12 rate con quello mensile.

Cos'è Perlego?

Perlego è un servizio di abbonamento a testi accademici, che ti permette di accedere a un'intera libreria online a un prezzo inferiore rispetto a quello che pagheresti per acquistare un singolo libro al mese. Con oltre 1 milione di testi suddivisi in più di 1.000 categorie, troverai sicuramente ciò che fa per te! Per maggiori informazioni, clicca qui.

Perlego supporta la sintesi vocale?

Cerca l'icona Sintesi vocale nel prossimo libro che leggerai per verificare se è possibile riprodurre l'audio. Questo strumento permette di leggere il testo a voce alta, evidenziandolo man mano che la lettura procede. Puoi aumentare o diminuire la velocità della sintesi vocale, oppure sospendere la riproduzione. Per maggiori informazioni, clicca qui.

The Economics of the Global Stock Exchange Industry è disponibile online in formato PDF/ePub?

Sì, puoi accedere a The Economics of the Global Stock Exchange Industry di J. Floreani,M. Polato in formato PDF e/o ePub, così come ad altri libri molto apprezzati nelle sezioni relative a Business e Corporate Finance. Scopri oltre 1 milione di libri disponibili nel nostro catalogo.

Informazioni

Argomento

BusinessCategoria

Corporate Finance1

Securities Industry and Exchange Industry: Organization and Value Chain

1 Introduction

The securities and exchange industry performs an important function within the financial system. By facilitating the execution of orders it enhances the liquidity of securities markets, and therefore allows the efficient allocation of capital flows to investment opportunities.

The exchange industry addresses the demands of two types of customers: issuers seeking finance at a low cost of capital, and investors wishing to trade bearing lower transaction costs and at reliable prices. The utility functions of issuers and traders are tightly linked by cross-externalities which make their relationships resemble a typical feature of two-sided platforms. Although the organizational set-up of the securities industry entails concerns about market microstructure and the quality of securities prices, we do not specifically address these topics in this book, apart from occasional references in this chapter to the relevant literature. Rather, we focus on the organization of the industry, describing the demand side, the supply side and the production process.

Securities exchanges are the main actors moving this process, operating within organizational and governance arrangements which have significantly changed over time. In particular, almost all exchanges have moved from a mutual governance setting to a demutualized status. However, technological development and regulatory advances have also substantially improved competition within the industry, stimulating the entry of new entities; incumbents have reacted by merging, giving rise to a consolidation process leading to the creation of a few large exchanges. Thus, actual competition and potential competition have both contributed to reshape the basic structure of the industry.

In this chapter our purpose is to sketch the main features of the securities and exchange industry, paying particular attention to its main functions and the features of the production process; we go on to develop the various introductory points we make here in more detail throughout the book. The chapter is organized as follows: section 2 clarifies the concept of the exchange industry and identifies its constituent parts. In particular, we provide a representation of the securities industry’s value chain, identifying its main functions and the linkages between them. In section 3 we analyse the demand and supply side of the industry, while in section 4 we explore exchanges’ functions in light of the two-sided platform literature. In section 5 we discuss the public-interest feature of the exchange production, and in section 6 we outline the relations between competition, market microstructure and industry organization. In section 7 we outline the main issues surrounding the identification of the relevant market within the industry. In section 8 we offer some conclusions.

2 The securities and exchange industry

It is not easy to define the securities and exchange industry due to the considerable flexibility which characterizes it. Assuming a retrospective approach and, in particular, looking back at the last two decades, it should be immediately clear that the securities and exchange industry has showed a high degree of sensitivity to changes in both the economic and competitive landscape. These changes triggered impressive transformations in the morphology of the industry. We will have occasion later to extensively discuss the forces driving changes in the industry, since the topic is central to our analysis, but for the moment it is sufficient to draw attention to the fact that the borders of the industry have been widely expanding during the last few years as a by-product of both financial innovation and technological advances; the array of products and services offered has increased, and access by new market operators has been encouraged.

Despite the foregoing note of caution, we may define the securities and exchange industry by adopting an industrial organization approach, thereby clarifying the main concerns of industrial organization. Broadly speaking, it is well known that the study of industrial organization deals with the functioning of markets and industries and, in particular, the way firms compete with each other. More precisely, the field is concerned with how production is harmonized with the demand for goods and services through an organizational system, and how imperfections occurring in this mechanism may affect the optimal allocation of resources.1 Although the organizing mechanisms may vary from a traditional to a central planning or a free market approach, industrial organization primarily deals with the market system setting. But the field of industrial organization is not just restricted to the study of how markets work; it also embraces a far larger perspective that sheds light on firms’ strategies and market interactions. Industrial organization studies are, therefore, concerned with topics such as price competition, product positioning, product differentiation, research and development and so on.

When it comes to addressing the notion of industrial organization in a more systematic way, one should tackle a number of issues which are centred on the concept of market power. This poses some relevant questions about how firms acquire and maintain market power, the implications of market power and the role of public policies in addressing the adverse effects of that power.

The aforementioned features of industrial organization apply to any kind of industry, each, however, having its own set of distinctive features. The exchange industry should be defined and analysed within the same framework. From this perspective we shall define which goods or services are exchanged in the industry (the production), the nature of the firms involved and their competitive strategies, the very distinctive features of the market as an organizational mechanism, and the role of regulators which extends far beyond mere antitrust policies.

Before proceeding with the analysis, we have to remark that this methodological approach is somewhat unusual in the field of securities industry studies, despite almost all of the relevant research being obviously interconnected with industrial organization matters. Dealing with efficiency matters, or examining the economics of regulation, is a means of shedding light upon very challenging issues which are integral to the industry’s structure. The changing nature of competition and falling barriers to entry affect the strategies of financial firms and market operators, and have implications for the functioning of securities markets and, at the same time, their regulators. There is a reciprocal effect as well, since firms’ behaviour drives change that affects the industry’s structure. The concept of securities trading as an industry triggering efficiency and regulatory implications is well grounded.2

Moreover, the fact that barriers of any kind – a central topic in the industrial organization approach – may undermine the efficiency of securities markets is also well known.3 What is still lacking in the literature is a systematic in-depth analysis of the constituent parts of the industry’s structure and organization and their links with the strategic behaviour of firms: these are precisely the topics that we are going to address in the following pages.

Starting with a definition of production we have to bear some caveats in mind. First of all, production in the securities and exchange industry is multi-faceted, comprising as it does a wide array of goods and services which are complementary. While the securities industry is mainly involved in the provision of investment services (the core services), financial firms provide a great variety of complementary services. The latter are intended to increase the utility deriving from the consumption of the core services. Finally, the services provided may entail a high degree of customization and may be produced according to a variety of organizational settings.

Bearing these premises in mind, it may be said that the securities and exchange industry is primarily concerned with the exchange of securities. More precisely, production comprises services that are aimed at ameliorating the exchange of securities. While intuitively sketching the features of the production process, this definition still suffers from an excessive degree of generality. Rather, it is convenient to distinguish between those services which are strictly essential for the exchange (trading)4 of securities to materialize and which define the so called exchange industry (or inner industry), and an ample array of services complementing them. The latter comprise the broader securities industry. Therefore, the functions of the securities industry may be summarized as follows:

a)Realization and organization of securities trading (exchange industry or inner industry).

b)Elimination or reduction of information asymmetries between the buyer and seller of securities.

c)Reconciliation of the diverging preferences and different attitudes of the parties involved, thus increasing the willingness to trade.

d)Provision of a wide scope of advisory services (for example, supporting investment decisions, asset allocation and issuance of securities).

e)Portfolio management.

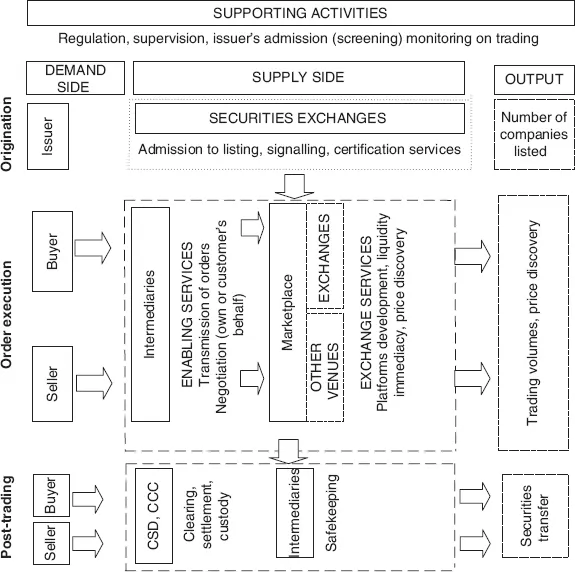

We can, therefore, think of the exchange industry as the central nucleus of the securities industry. The production (that is origination) of the goods which are traded (the securities) should not, in fact, be regarded as part of the securities industry. However, the securities and exchange industry is directly involved in facilitating both the origination of securities and their distribution in the primary market.5 Throughout this work we will be dealing mainly with the exchange industry. In order to gain a better understanding of the functioning of the exchange industry we should take care with the terminology and definitions employed, and describe the main activities involved in the provision of investment services. For a refined representation of the industry it would be useful to apply the value chain approach, identifying the demand side, the supply side comprising both main activities and supporting activities or functions, and the output. This approach is unusual in our field of study. However, it would be very useful for the purposes of this work which is centred on the industrial organization of exchange trading. Figure 1.1 depicts the basic constituents of the industry, and the links between each stage that give shape to the value chain.

Figure 1.1 The exchange industry value chain

The main (or base) functions shaping the value chain are concerned with origination, trading (order matching and execution) and post-trading. Origination refers to the admission of issuers to listing; trading refers to the process through which buyers and sellers of securities find (and agree upon) feasible contracts. Post-trading refers to the process through which market participants clear and settle their own obligations. Base functions are concerned with the implementation of platforms and all the relevant organizational arrangements. In order to permit the smooth functioning of its main activities and the linkages between them, the exchange industry provides a complex superstructure comprising supporting activities in which there are regulatory and supervisory activities that are performed by both regulators and market operators.

Platforms perform an important function throughout the entire economy by reducing transaction costs that may arise in matching the needs of entities that would benefit from interacting. Indeed, several industries are populated by businesses presenting this very feature. Examples have been provided in the relevant literature, but here we develop the topic with reference to platforms that bridge the needs of typical customers within the exchange industry, namely issuers and buyers and sellers of securities. In today’s exchange industry trading occurs on electronic platforms that define a virtual marketplace for buyers and sellers getting together. Moreover, investments in platforms define the competitive space among providers and are one of the most important value drivers. Service providers in the exchange industry do not just engage in implementing trading platforms. Rather, they arrange all the organizational settings which comprise rules and procedures for admission to listing, trading and post-trading activities and market surveillance. Both platforms and organizational arrangements give shape to what we may define as market infrastructures.

3 The demand and the supply side

The demand side of the exchange industry combines the demands of two different kinds of customers, namely issuers of securities on the primary market, and buyers and sellers on the secondary market. Since securities exchanges put together two parties (issuers on the one hand and buyers and sellers on the other) they should be regarded as two-sided markets with the relevant implication that their strategic behaviour, along with interdependencies between the two parties, needs to be carefully analysed.

The first side of market demand comprises issuers (corporate, sovereign and others) seeking admission to list their securities. Basically, the issuer, in exchange for a fee, requires scrutiny by the entity responsible for the admission to listing, which could be a securities exchange or a supervisor. The decision to admit its securities to listing would imply that the issuer has been deemed trustworthy by the market. When listing its securities an issuer seeks access to finance on convenient terms. To this end, we may think of the cost of capital as being a decreasing function of the credibility of the certification process and complying with standards which follow the admission to listing.6

Moreover, by applying for admission to listing the issuer expresses a demand for liquidity on its securities, provided that the greater the liquidity the greater the appetite of investors for those securities, and thus the easier it is for the issuer to raise new finance. The other side of market demand comprises buyers and sellers of securities who require services in order to facilitate their negotiation. The utility function of the two parties is rather complex, with two kinds of services entering it.

First of all, they require exchange services, as it would not be feasible or might prove too costly due to market imperfections to find autonomously a suitable counterparty. To this end, buyer and seller agree to make use of the services and facilities provided by a market operator, which would improve the investor’s utility by permitting him to find a counterparty in as short a time as possible and at reasonable costs.

Therefore, what we simply label as exchange services need, properly, to be seen as a bulk of different services each adding to the investor’s overall utility. In particular, we should refer to liquidity services, immediacy services and price discovery. Investors need liquidity in order to trade at low costs and without suffering losses. A liquid market enables buyers and sellers to exchange securities with immediacy and without causing significant movements in their prices. Finally, the market is organized in such a way as to discover and disclose the price at which buyers and sellers may complete the trade. There is, therefore, a clear relation between the utility functions of issuers and buyers and sellers on the secondary market. Increases in market liquidity will attract even more issuers demanding admission to listing. In turn, increases in the number of companies listed will result in spillovers on the investor side.

Moreover, investors’ needs comprise intermediation services which are intended to make the trade smoother and more efficient. In this sense, intermediation services are a true complement of exchange services since the efficiency of intermediation (intended in a broader way to comprise economic efficiency, professionalism and loyalty by the intermediary) would raise the utility of exchange services. Here, the involvement of the financial firm may range from the simplest (and, in a certain sense, mechanical) services, such as the transmission of orders to the marketplace or negotiation on behalf of the customer, to services that add more value, such as advice on portfolio management. As will become clear, analysing the utility function of investors is a far from easy task. A great deal, in particular, is involved in understanding the interactions between intermediation services and exchange services. The interplay of these two kinds of services is conditioned by a variety of factors such as the market structure on the supply side of the exchange services and, perhaps most important, the loyalty of intermediaries.

Looking at the exchange industry value chain, we now introduce the supply side of the market, defining the nature and functions of the firms (or other entities) populating the exchange industry. We have to distinguish different types of suppliers which may be engaged both in main activities and supporting activities. Their productive processes are strictly interrelated, and i...