![]()

Appendix 1

Some Highlights on Bank Practices: Packaged Products, Bundling, and Tying

Bundling and tying are distinct practices with the common purpose of cross-selling to customers. When these products are available only as a bundle, we have pure bundling. Mixed bundling is when products are available separately and can be offered at a discount relative to their individual prices. Bundling products can be differentiated with the help of the following criteria:1

–The level of customization and integration between the different products and services involved;

–The underlying degree of expertise with the service provider for each of the products and services involved; and

–The value added for the customer, which is the ultimate goal of bundling.

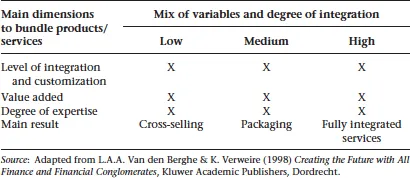

Many types of bundled services are developed at great speed in the market for financial services. Although it is not always easy for an outside observer to evaluate the degree of integration and customization as well as the level of expertise of the service providers and consequently the value added for the customer, some broad lines are clearly observable. The graph below gives a visual picture of the different types of bundling.

Table A1.1 Types of bundling: a representation

Two extreme cases can be observed, and between them a wide range is possible. At one end of the spectrum stands cross-selling with the lowest degree of integration and customization, with a limited scope of different expertise involved and a relatively low level of value added. Here, the emphasis of the supplier’s strategy is more on the volume of business and this from a perspective of transactional marketing.

At the other extreme, we find the fully integrated services with a high degree of integration and customization, many experts involved, and a high value added for the customer. Here, the supplier is looking for a competitive edge in tailoring different complementary products and services, such as personalized from a lifetime perspective or built around specific needs or events. This is a typical approach for relationship marketing and builds customer loyalty. Such an approach supposes a great deal of individual information per client, long-term planning in relation to the life cycle of the client with different event scenarios, and a dynamic approach for flexible updating and adaptation.

In between, all types of packaging can be found, with intermediate positions on the level of integration, customization, expertise, and value added. It must be said that products produced in different factories are unbundled and re-bundled to tailor them to the needs of specific client segments in order to offer them an integrated personalized solution.

The main idea for the future is to work with modular concepts. These modules form the building blocks around which new financial products can be built. This new approach allows for some standardization (there are only a few modules), but on the other hand, the combination of different modules and other features makes it possible for a financial firm to develop products tailored to the specific needs of a customer. For the moment, this is at best in the planning phase: a small number of companies are thinking of applying this idea in practice shortly.

Tying is another bank practice in which the purchase of one product is conditional on the purchase of another. In other words, tying occurs when two or more products are sold together in a package, and at least one of these products is not sold separately. Product tying is a common strategy for retail banks throughout the EU. Because it is relatively expensive and difficult for banks to win new customers, they often decide to focus their growth strategy on increasing cross-selling to existing customers. Product tying offers a simple way of increasing cross-selling. Such product ties are found in a range of core retail banking products, such as:

•Selling a current account to a consumer buying a mortgage or personal loan;

•Selling payment protection insurance or life insurance to a mortgage customer; or

•Selling a current account to an SME taking out a business loan.

The main advantages for financial institutions that sell packaged products, product bundles, or who tie products, are essentially concerned with the amount of cross-selling, since the customer is sold a number of products at the same time to meet a range of needs. For example, mortgages are usually accompanied by home insurance and possibly life assurance. The customer may also be required to open a current account if they are not already customers of the institution providing the mortgage. From the customer’s point of view, this does simplify the process, since all products can be purchased at the same time. The financial institution hopes that this bundle of products is going to strengthen its ties with the customer. Packaged products or bundles are most effective when they are meaningful to the customer and his or her needs, and also when the value of the bundle is more than the total value of the individual products. However, in many situations, it is difficult for the customer to assess the relative value of each of the components of the bundle.

![]()

Appendix 2

How Some Retail Banks Describe their Retail Banking Activities

In the following Tables A2.1–2, we illustrate how several large banks around the world describe their retail banking activities in their own words.

This group of banks certainly does not constitute an exhaustive list of institutions that provide detailed information on their retail banking activities. However, it is interesting to look at the passages cited here because they are representative of the information provided by some large banking organizations that identify distinct retail business segments on their website, even though some of them do not refer to such activity with this term but mostly explain their activity for individuals, families, and businesses.

We outline the key sentences to give a flavor of the different retail banking styles; in particular, we outline some profile information, the vision and mission, and the key values and beliefs. All this is taken and adapted from the banks’ websites on May 12, 2014.

Table...