![]()

Chapter 1

An Introduction to Swaps

The interest rate swaps market has experienced tremendous growth since what is commonly regarded as the first swap was executed in 1981. In that year Salomon Brothers intermediated a cross-currency swap between the World Bank and IBM in a transaction that at the time was unique and provided considerable advantage to both counterparties. The growth in the market since then manifests itself not only in the vast increase in the notional outstanding of interest rate swaps but also in the varied users and uses of swaps. The purpose of this chapter is to provide a broad overview of the swaps market. We will focus on products and conventions in the market.

1.1 Overview

Most discussions on swaps start with some analysis of the so-called comparative advantage argument: one counterparty has a relative advantage borrowing on, say, a fixed rate basis and another has a relative advantage borrowing on a floating rate basis. The argument then goes that it makes sense for these two guys to borrow funds in their relatively advantaged manner, then get together and swap their cash flows, exchanging fixed cash flows for floating ones, and vice versa, should they actually prefer to raise funds in their non-advantaged manner.

But let’s leave it at that. This comparative advantage argument may very well have been the motivating factor behind the genesis of the swaps market over 30 years ago but doesn’t play a huge role today.1 Nowadays the swaps market is so liquid and vast that when an investor executes a swap, a dealer who takes the other side does not need to first line up yet another counterparty on the other side. These days if someone wants to do a swap, he approaches any one of a number of major swap dealers to do the trade.2 And nearly as fast as one could execute a Treasury trade, one can now execute a swap.3

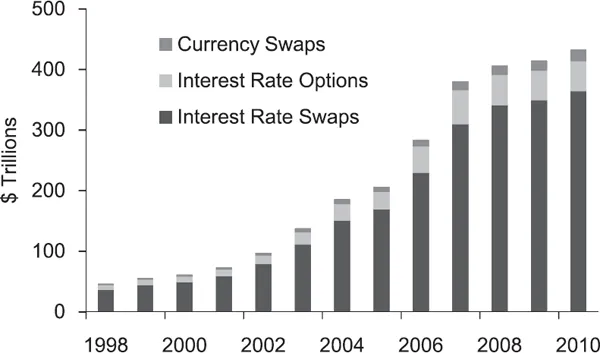

A good way to start looking at the swaps market is to see just how big it is and just how much it has grown over time. One measure of the size and growth of the swaps market is to look at how the outstanding notional (or fictitious principal) on all trades has changed from year to year. Figure 1.1 shows just how rapid this growth has been. The outstanding notional of interest rate swaps, interest rate options, and currency swaps combined first crossed the $100 trillion threshold in the year 2003 and crossed $400 trillion by 2008. By comparison, the outstanding amount of U.S. Treasury securities in 2008 was on the order of magnitude of $5.7 trillion.4 This is a bit of an apples and oranges comparison since the outstanding notional of derivatives relates more to trading volume (and does not account for the fact that some outstanding trades offset one another, meaning the net risk in the marketplace may be far less than suggested in Figure 1.1), and the outstanding amount of Treasuries is not indicative of trading volume. But hopefully this leaves the impression that the swaps market is pretty big.

Figure 1.1: Growth of the Swaps Market. Amounts Outstanding of OTC Interest Rate Swaps, Interest Rate Options, and Currency Swaps

Source: Bank for International Settlements.

Although the market has standardized or “plain vanilla” trades, it has the advantage that its products can be completely tailor-made or customized to reflect almost any interest rate or currency outlook and/or to create any risk exposure profile. The traditional uses of swaps include liability hedging, balance sheet management, and asset hedging. The nontraditional uses include speculation, with both macro and relative value trading in the swaps market popular. That is, investors now use the swaps market itself to express views that they have in the market. In addition, the swaps market has become a benchmark by which the relative richness or cheapness of other asset classes (e.g., mortgages and agency debentures) can be ascertained and a vehicle through which views on these assets can be expressed.

1.2 Swaps

A swap is a contractual agreement between two counterparties that agree to exchange streams of payments over time. If both streams of payment are made in the same currency, then the trade is known as an interest rate swap; if the streams are made in two different currencies, then the swap is referred to as a cross-currency swap. We will spend virtually all of our time focusing on interest rate swaps, and we will further restrict our attention to swaps denominated in U.S. dollars (USD).

Interest rate swaps are subdivided into two subcategories: a coupon swap or fixed-floating swap or plain vanilla swap refers to a swap in which one stream is a fixed rate of interest, and the other is a floating rate of interest. In a basis swap, both streams are floating rates of interest.

1.2.1 Fixed-Floating Swaps

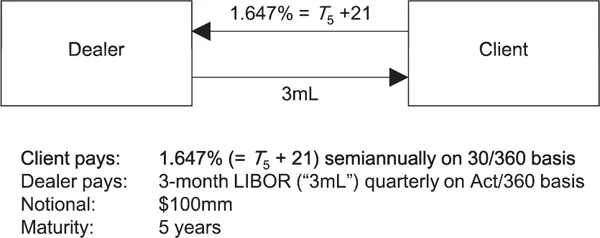

The structure and terms of a plain vanilla swap with standard market conventions are shown in Figure 1.2. One counterparty, known as the client, pays a fixed rate of interest equal to 1.647% semiannually on a 30/360 (pronounced “thirty three-sixty”) basis, and the other counterparty, known as the dealer, pays 3-month LIBOR, a floating rate of interest, quarterly on an Act/360 (pronounced “actual three-sixty”) basis.5 Instead of saying “30/360,” people will sometimes say “bond,” and instead of saying “Act/360,” people will sometimes say “money.”6 Oftentimes when people speak about swaps, they will use terms like this since they are quicker to say, and every second counts when the market is moving and it is desirable to execute a trade quickly. In fact, when referring to the payment frequency and day count convention in a standard swap, sometimes people will abbreviate this even further by saying something like “semi bond versus threes.” Saying “threes” surely takes less time than saying “3-month LIBOR paid quarterly on an Act/360 basis.” And for counterparties that deal with each other frequently and are comfortable that these standard conventions always apply when they transact swaps with one another, they may not even bother to discuss standard payment and day count conventions before doing a swap.7

Figure 1.2: A Plain Vanilla Swap

The swap in Figure 1.2 has a maturity of five years and the notional, or fictitious principal, upon which payments are made is $100mm.8 Note that there will be a total of ten payments made by the client (the first of which is in six months) and 20 payments made by the dealer (the first of which is in three months) over the life of the swap. Final payments will occur five years after the effective date, or start, of the swap. The actual payments made on the fixed and floating side in the swap are

Fixed Payment = Fixed Rate × Notional × (Bond Days/360) Floating Payment = 3-month LIBOR × Notional × (Act/360),

(1.1)

where Bond Days is the number of bond days in the semiannual period (i.e., the number of days assuming interest is accrued on a 30/360 basis), and Act is the number of actual days in the quarterly period (see Appendix C for more details on day count conventions).

Example

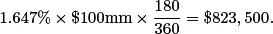

Suppose the swap depicted in Figure 1.2, a $100mm 5-year swap with a fixed coupon of 1.647% semi bond versus 3-month LIBOR quarterly Act/360, has an effective date of August 13, 2010, and a maturity of August 13, 2015. Of the ten semiannual periods on the fixed side, the last period is from February 13, 2015, to August 13, 2015. There are 180 bond days in this semiannual period, and thus the final fixed payment in the swap is

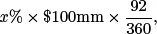

Of the 20 quarterly periods on the floating side, the last period is from May 13, 2015, to August 13, 2015. There are a total of 92 actual days in this quarterly period. Denoting the final LIBOR setting in the swap by x%, the final payment on the floating side of the swap is

a quantity that will not be known until the LIBOR setting date in May 2015.

A standard swap has no upfront cash flows; that is, there is no “price” that is paid by either counterparty to get into the trade. The fixed rate is set when the trade is executed such that the swap has a net present value of zero (which we will denote NPV = 0).9 Note that Figure 1.2 shows that the fixed rate in the swap, which is 1.647%, is also expressed as T5+21, where T5 represents the yield of the on-the-run 5-year Treasury at the time the swap is executed.10 Thus the swap rate (also called the par swap rate), the fixed rate set in the swap when it is first executed such that the trade has zero net present value to either side, is equal to the yield of the on-the-run 5-year Treasury plus some spread. In this case the spread is 21 basis points (bps).11 The swap spread for a swap of a given maturity is defined as the spread in bps that is added to the yield of the on-the-run Treasury of comparable maturity to obtain the swap rat...