eBook - ePub

Valuation

Measuring and Managing the Value of Companies, University Edition

Tim Koller, Marc Goedhart, David Wessels

This is a test

Condividi libro

- English

- ePUB (disponibile sull'app)

- Disponibile su iOS e Android

eBook - ePub

Valuation

Measuring and Managing the Value of Companies, University Edition

Tim Koller, Marc Goedhart, David Wessels

Dettagli del libro

Anteprima del libro

Indice dei contenuti

Citazioni

Informazioni sul libro

M c KINSEY'S TRUSTED GUIDE TO TEACHING CORPORATE VALUATION, NOW IN ITS 25 TH YEAR

Valuation, University Edition, Sixth Edition, is filled with the expert guidance from M c Kinsey & Company that students and professors have come to rely on. New to the fully revised and updated Sixth Edition:

- New case studies that clearly illustrate how vital valuation techniques and principles are applied in real-world situations

- Expanded content on advanced valuation techniques

- New content on the strategic advantages of value-based management that reflect the economic events of the past decade

For twenty-five years Valuation has remained true to its core principles and offers a step-by-step approach to valuation, including:

- Analyzing historical performance

- Forecasting performance

- Estimating the cost of capital with practical tips

- Interpreting the results of a valuation in light of a company's competitive situation

- Linking a company's valuation multiples to the core drivers of its performance

The University Edition contains End-of-Chapter Review Questions, helping students master key concepts from each chapter.

Wiley also offers an Online Instructor's Manual with a full suite of learning resources for professors and students.

www.wileyvaluation.com

Domande frequenti

Come faccio ad annullare l'abbonamento?

È semplicissimo: basta accedere alla sezione Account nelle Impostazioni e cliccare su "Annulla abbonamento". Dopo la cancellazione, l'abbonamento rimarrà attivo per il periodo rimanente già pagato. Per maggiori informazioni, clicca qui

È possibile scaricare libri? Se sì, come?

Al momento è possibile scaricare tramite l'app tutti i nostri libri ePub mobile-friendly. Anche la maggior parte dei nostri PDF è scaricabile e stiamo lavorando per rendere disponibile quanto prima il download di tutti gli altri file. Per maggiori informazioni, clicca qui

Che differenza c'è tra i piani?

Entrambi i piani ti danno accesso illimitato alla libreria e a tutte le funzionalità di Perlego. Le uniche differenze sono il prezzo e il periodo di abbonamento: con il piano annuale risparmierai circa il 30% rispetto a 12 rate con quello mensile.

Cos'è Perlego?

Perlego è un servizio di abbonamento a testi accademici, che ti permette di accedere a un'intera libreria online a un prezzo inferiore rispetto a quello che pagheresti per acquistare un singolo libro al mese. Con oltre 1 milione di testi suddivisi in più di 1.000 categorie, troverai sicuramente ciò che fa per te! Per maggiori informazioni, clicca qui.

Perlego supporta la sintesi vocale?

Cerca l'icona Sintesi vocale nel prossimo libro che leggerai per verificare se è possibile riprodurre l'audio. Questo strumento permette di leggere il testo a voce alta, evidenziandolo man mano che la lettura procede. Puoi aumentare o diminuire la velocità della sintesi vocale, oppure sospendere la riproduzione. Per maggiori informazioni, clicca qui.

Valuation è disponibile online in formato PDF/ePub?

Sì, puoi accedere a Valuation di Tim Koller, Marc Goedhart, David Wessels in formato PDF e/o ePub, così come ad altri libri molto apprezzati nelle sezioni relative a Business e Finance. Scopri oltre 1 milione di libri disponibili nel nostro catalogo.

Part One

Foundations of Value

1

Why Value Value?

The guiding principle of business value creation is a refreshingly simple construct: companies that grow and earn a return on capital that exceeds their cost of capital create value. Articulated as early as 1890 by Alfred Marshall,1 the concept has stood the test of time. Indeed, when managers, boards of directors, and investors have forgotten it, the consequences have been disastrous. The financial crisis of 2007–2008 and the Great Recession that followed provide the most recent evidence of the point. But a host of other calamities, from the rise and fall of business conglomerates in the 1970s to the collapse of Japan's economy in the 1990s to the Internet bubble, can all to some extent be traced to a misunderstanding or misapplication of this guiding principle.

Today these accumulated crises have led many to call into question the foundations of shareholder-oriented capitalism. Confidence in business has tumbled.2 Politicians and commentators push for more regulation and fundamental changes in corporate governance. Academics and even some business leaders have called for companies to change their focus from increasing shareholder value to a broader focus on all stakeholders, including customers, employees, suppliers, and local communities. At the extremes, some have gone so far as to argue that companies should bear the responsibility of promoting healthier eating and other social issues.

Many of these impulses are naive. There is no question that the complexity of managing the coalescing and colliding interests of myriad owners and stakeholders in a modern corporation demands that any reform discussion begin with a large dose of humility and tolerance for ambiguity in defining the purpose of business. But we believe the current debate has muddied a fundamental truth: creating shareholder value is not the same as maximizing short-term profits. Companies that confuse the two often put both shareholder value and stakeholder interests at risk. Indeed, a system focused on creating shareholder value isn't the problem; short-termism is. Banks that confused the two at the end of the last decade precipitated a financial crisis that ultimately destroyed billions of dollars of shareholder value, as did Enron and WorldCom at the turn of this century. Companies whose short-term focus leads to environmental disasters also destroy shareholder value, not just directly through cleanup costs and fines, but via lingering reputational damage. The best managers don't skimp on safety, don't make value-destroying decisions just because their peers are doing so, and don't use accounting or financial gimmicks to boost short-term profits, because ultimately such moves undermine intrinsic value that is important to shareholders and stakeholders alike.

What Does It Mean to Create Shareholder Value?

At this time of reflection on the virtues and vices of capitalism, we believe that it's critical that managers and boards of directors have a new, precise definition of shareholder value creation to guide them, rather than having their focus blurred by a vague stakeholder agenda. For today's value-minded executives, creating shareholder value cannot be limited to simply maximizing today's share price for today's shareholders. Rather, the evidence points to a better objective: maximizing a company's collective value to current and future shareholders, not just today's.

If investors knew as much about a company as its managers do, maximizing its current share price might be equivalent to maximizing value over time. But in the real world, investors have only a company's published financial results and their own assessment of the quality and integrity of its management team. For large companies, it's difficult even for insiders to know how financial results are generated. Investors in most companies don't know what's really going on inside a company or what decisions managers are making. They can't know, for example, whether the company is improving its margins by finding more efficient ways to work or by simply skimping on product development, maintenance, or marketing.

Since investors don't have complete information, it's easy for companies to pump up their share price in the short term. For example, from 1997 to 2003, a global consumer products company consistently generated annual growth in earnings per share (EPS) between 11 percent and 16 percent. Managers attributed the company's success to improved efficiency. Impressed, investors pushed the company's share price above those of its peers—unaware that the company was shortchanging its investment in product development and brand building to inflate short-term profits, even as revenue growth declined. In 2003, managers had to admit what they'd done. Not surprisingly, the company went through a painful period of rebuilding. Its stock price took years to recover.

This does not mean that the stock market is not “efficient” in the academic sense that it incorporates all public information. Markets do a great job with public information, but markets are not omniscient. Markets cannot price information they don't have. Think about the analogy of selling a house. The seller may know that the boiler makes a weird sound every once in a while or that some of the windows are a bit drafty. Unless the seller discloses those facts, it may be very difficult for a potential buyer to detect them, even with the help of a professional house inspector.

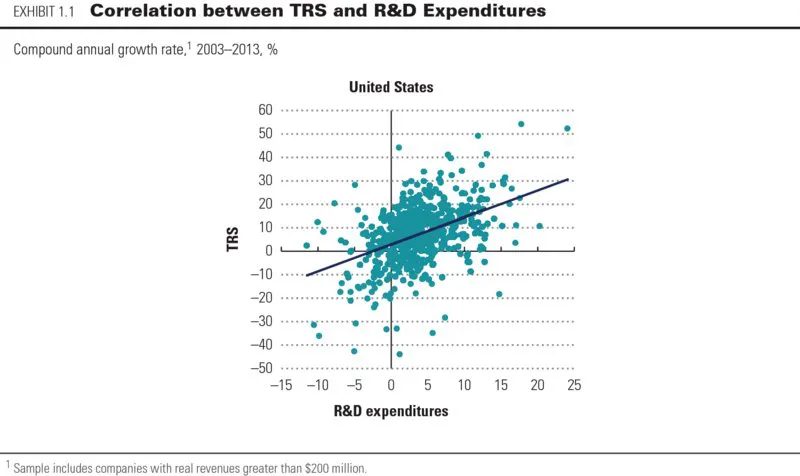

Despite such challenges, the evidence makes it clear that companies with a long strategic horizon create more value. The banks that had the insight and courage to forgo short-term profits during the last decade's real-estate bubble earned much better returns for shareholders over the longer term. Over the long term, oil and gas companies known for investing in safety outperform those that skimp on such investment. We've found, empirically, that long-term revenue growth—particularly organic revenue growth—is the most important driver of shareholder returns for companies with high returns on capital.3 We've also found that investments in research and development (R&D) correlate powerfully with positive long-term total returns to shareholders (TRS), as graphed in Exhibit 1.1.4

Creating value for both current and future shareholders means managers should not take actions to increase today's share price if those actions will damage it down the road. Some obvious examples include shortchanging product development, reducing product quality, or skimping on safety. Less obvious examples are making investments that don't take into account likely future changes in regulation or consumer behavior (especially with regard to environmental and health issues). Faced with volatile markets, rapid executive turnover, and intense performance pressures, making long-term value-creating decisions can take courage. But it's management's and the board's task to demonstrate that courage, despite the short-term consequences, in the name of value creation for the collective benefit of all present and future shareholders.

Can Stakeholder Interests Be Reconciled?

Much recent criticism of shareholder-oriented capitalism has called on companies to focus on a broader set of stakeholders beyond just its shareholders. It's a view that has long been influential in continental Europe, where it is frequently embedded in corporate governance structures. And we agree that for most companies anywhere in the world, pursuing the creation of long-term shareholder value requires satisfying other stakeholders as well. You can't create long-term value without happy customers, suppliers, and employees.

We would go even further. We believe that companies dedicated to value creation are healthier and more robust—and that investing for sustainable growth also builds stronger economies, higher living standards, and more opportunities for individuals. Our research shows, for example, that many corporate social-responsibility initiatives also create shareholder value, and that managers should seek out such opportunities.5 For example, IBM's free Web-based resources on business management not only help to build small and midsize enterprises; they also improve IBM's reputation and relationships in new markets and develop relationships with potential customers.

Similarly, Novo Nordisk's “triple bottom line” philosophy of social responsibility, environmental soundness, and economic viability has led to programs to imp...