Pitch the Perfect Investment

The Essential Guide to Winning on Wall Street

Paul D. Sonkin, Paul Johnson

- English

- ePUB (disponibile sull'app)

- Disponibile su iOS e Android

Pitch the Perfect Investment

The Essential Guide to Winning on Wall Street

Paul D. Sonkin, Paul Johnson

Informazioni sul libro

Learn the overlooked skill that is essential to Wall Street success

Pitch the Perfect Investment combines investment analysis with persuasion and sales to teach you the "soft skill" so crucial to success in the financial markets. Written by the leading authorities in investment pitching, this book shows you how to develop and exploit the essential, career-advancing skill of pitching value-creating ideas to win over clients and investors. You'll gain world-class insight into search strategy, data collection and research, securities analysis, and risk assessment and management to help you uncover the perfect opportunity; you'll then strengthen your critical thinking skills and draw on psychology, argumentation, and informal logic to craft the perfect pitch to showcase your perfect idea. The ability to effectively pitch an investment is essential to securing a job on Wall Street, where it immediately becomes a fundamental part of day-to-day business. This book gives you in-depth training along with access to complete online ancillaries and case studies so you can master the little skill that makes a big difference.

It doesn't matter how great your investment ideas are if you can't convince anyone to actually invest. Ideas must come to fruition to be truly great, and this book gives you the tools and understanding you need to get it done.

- Persuade potential investors, clients, executives, and employers

- Source, analyze, value, and pitch your ideas for stocks and acquisitions

- Get hired, make money, expand your company, and win business

- Craft the perfect investment into the perfect pitch

Money managers, analysts, bankers, executives, salespeople, students, and individual investors alike stand to gain massively by employing the techniques discussed here. If you're serious about success and ready to start moving up, Pitch the Perfect Investment shows you how to make it happen.

Domande frequenti

Informazioni

PART 1

THE PERFECT INVESTMENT

CHAPTER 1

How to Value an Asset

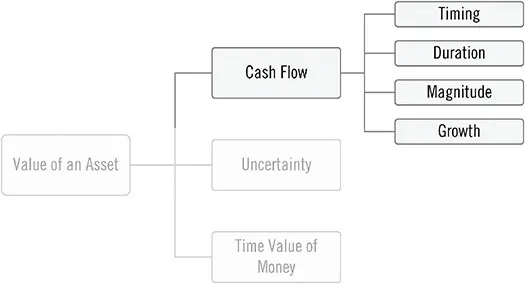

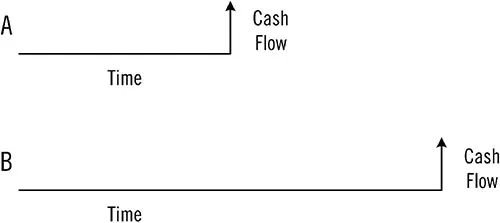

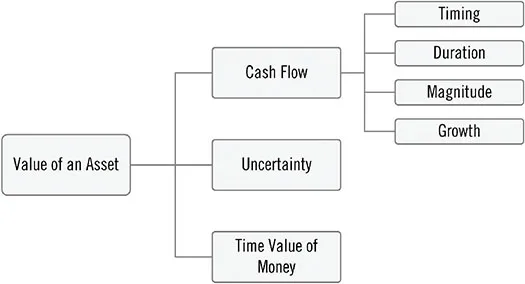

Three Primary Components of Value

Four Subcomponents of Cash Flow