- English

- ePUB (mobile friendly)

- Available on iOS & Android

An Introduction to Value-at-Risk

About this book

The value-at-risk measurement methodology is a widely-used tool in financial market risk management. The fifth edition of Professor Moorad Choudhry's benchmark reference text An Introduction to Value-at-Risk offers an accessible and reader-friendly look at the concept of VaR and its different estimation methods, and is aimed specifically at newcomers to the market or those unfamiliar with modern risk management practices. The author capitalises on his experience in the financial markets to present this concise yet in-depth coverage of VaR, set in the context of risk management as a whole.

Topics covered include:

- Defining value-at-risk

- Variance-covariance methodology

- Portfolio VaR

- Credit risk and credit VaR

- Stressed VaR

- Critique and VaR during crisis

Topics are illustrated with Bloomberg screens, worked examples and exercises. Related issues such as statistics, volatility and correlation are also introduced as necessary background for students and practitioners. This is essential reading for all those who require an introduction to financial market risk management and risk measurement techniques.

Foreword by Carol Alexander, Professor of Finance, University of Sussex.

Frequently asked questions

- Essential is ideal for learners and professionals who enjoy exploring a wide range of subjects. Access the Essential Library with 800,000+ trusted titles and best-sellers across business, personal growth, and the humanities. Includes unlimited reading time and Standard Read Aloud voice.

- Complete: Perfect for advanced learners and researchers needing full, unrestricted access. Unlock 1.4M+ books across hundreds of subjects, including academic and specialized titles. The Complete Plan also includes advanced features like Premium Read Aloud and Research Assistant.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Information

Defining Risk

The Elements of Risk: Characterising Risk

- Market risk – risk arising from movements in prices in financial markets. Examples include foreign exchange (FX) risk, interest rate risk and basis risk. In essence market risk applies to ‘tradeable’ instruments, ones that are marked-to-market in a trading book, as opposed to assets that are held to maturity, and never formally repriced, in a banking book.

- Credit risk – something called issuer risk refers to risk that a customer will default. Examples include sovereign risk, marginal risk and force majeure risk.

- Liquidity risk – this refers to two different but related issues: for a Treasury or money markets’ person, it is the risk that a bank has insufficient funding to meet commitments as they arise. That is, the risk that funds cannot be raised in the market as and when required. For a securities or derivatives trader, it is the risk that the market for assets becomes too thin to enable fair and efficient trading to take place. This is the risk that assets cannot be sold or bought as and when required. We should differentiate therefore between funding liquidity and trading liquidity whenever using the expression liquidity.

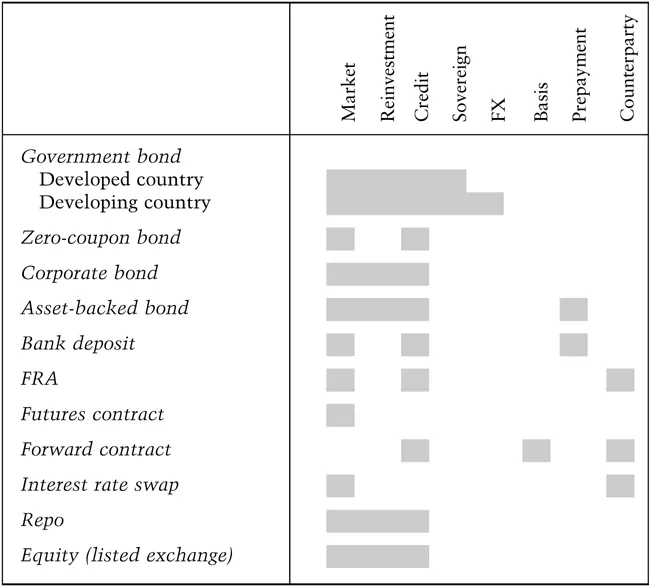

- Operational risk – risk of loss associated with non-financial matters such as fraud, system failure, accidents and ethics. Table 1.1 assigns sources of risk for a range of fixed interest, FX, interest rate derivative and equity products. The classification has assumed a 1-year horizon, but the concepts apply to any time horizon.

Forms of market risk

- Currency risk – this arises from exposure to movements in FX rates. A version of currency risk is transaction risk, where currency fluctuations affect the proceeds from day-to-day transactions.

- Interest rate risk – this arises from the impact of fluctuating interest rates and will directly affect any entity borrowing or investing funds. The most common exposure is simply to the level of interest rates but some institutions run positions that are exposed to changes in the shape of the yield curve. The basic risk arises from revaluation of the asset after a change in rates.

- Equity risk – this affects anyone holding a portfolio of shares, which will rise and fall with the level of individual share prices and the level of the stock market.

- Other market risk – there are residual market risks which fall in this category. Among these are volatility risk, which affects option traders, and basis risk, which has a wider impact. Basis risk arises whenever one kind of risk exposure is hedged with an instrument that behaves in a similar, but not necessarily identical manner. One example would be a company using 3-month interest rate futures to hedge its commercial paper (CP) programme. Although eurocurrency rates, to which futures prices respond, are well correlated with CP rates, they do not invariably move in lock step. If CP rates moved up by 50 basis points but futures prices dropped by only 35 basis points, the 15-bps gap would be the basis risk in this case.

Other risks

- Liquidity risk – in banking, this refers to the risk that a bank cannot raise funds to refinance loans as the original borrowing becomes past due. It is sometimes also referred to as rollover risk. In other words, it refers to the risk of an inability to continue to raise funds to replace maturing liabilities. There is also another (related) liquidity risk, which refers to trading liquidity. This is the risk that an asset on the balance sheet cannot be sold at a previously perceived fair value, or cannot be sold at all, and hence experiences illiquidity.

- Credit risk – the risk that an obligor (the entity that has borrowed funds from you) defaults on the loan repayments.

- Counterparty risk – all transactions involve one or both parties in counterparty risk, the potential loss that can arise if one party were to default on its obligations. Counterparty risk is most relevant in the derivatives market, where every contract is marked-to-market daily and so a positive MTM is taken to the profit & loss (P&L) account. If the counterparty defaults before the contract has expired, there is risk that the actual P&L will not be realized. In the credit derivatives market, a counterparty that has sold protection on the third-party reference name on the credit derivative contract and which subsequently defaults will mean the other side to the trade is no longer protected against the default of that third party.

- Reinvestment risk – if an asset makes any payments before the investor's horizon, whether it matures or not, the cash flows will have to be reinvested until the horizon date. Since the reinvestment rate is unknown when the asset is purchased, the final cash flow is uncertain.

- Sovereign risk – this is a type of credit risk specific to a government bond. Post 2008, there is material risk of default by an industrialised country. A developing country may default on its obligation (or declare a debt ‘moratorium') if debt payments relative to domestic product reach unsustainable levels.

- Prepayment risk – this is specific to mortgage-backed and asset-backed bonds. For example, mortgage lenders allow the homeowner to repay outstanding debt before the stated maturity. If interest rates fall prepayment will occur, which forces reinvestment at rates lower than the initial yield.

- Model risk – some financial instruments are heavily dependent on complex mathematical models for pricing and hedging. If the model is incorrectly specified, is based on questionable assumptions or does not accurately reflect the true behaviour of the market, banks trading these instruments could suffer extensive losses.

Risk estimation

- Can the user accept the assumption of normality – is it reasonable to assume that market movements follow the normal distribution? If so, statistical tools can be employed.

- Does the value of positions change linearly with changes in market prices? If not (as is typical for option positions where market movements are not very small), simulation techniques will be more useful.

Risk Management

Table of contents

- Cover

- Series Page

- Title Page

- Copyright

- Dedication

- Table of Contents

- Foreword

- Preface

- Preface to the first edition

- About the author

- Epigraph

- Chapter 1: Introduction to Risk

- Chapter 2: Volatility and Correlation

- Chapter 3: Value-at-Risk

- Chapter 4: Value-at-Risk for Fixed Interest Instruments

- Chapter 5: Options: Risk and Value-at-Risk

- Chapter 6: Monte Carlo simulation and Value-at-risk

- Chapter 7: Regulatory issues and stress-testing

- Chapter 8: Credit risk and credit Value-at-Risk

- Chapter 9: A review of Value-at-Risk

- Exercises

- Appendix: Taylor's Expansion

- Abbreviations

- Selected bibliography

- Index

- Other Titles by the Author