![]()

1

Introduction

For as long as some sort of trade-centered economy and society has existed for mankind, people have been financing those activities, either directly or through the sort of intermediaries that we now know as banks or financial institutions. Historically, there have always been two types of financing available for businesses which are trying to raise capital to fund their activities.

That sounds somewhat simplistic but ‘debt’ and ‘equity’ have always been the fundamental financing classes tapped into by businesses, despite the many investment vehicles most businesses have access to.

We begin this section by looking at the characteristics of debt and equity and then conclude by defining the scope of the mezzanine product group.

1.1 THE BI-POLAR WORLD OF FINANCE

There are many different ways in which businesses can raise money, the primary ones being ‘debt’ and ‘equity.’ As I mentioned above, that sounds somewhat basic, and I guess it is, looking at the many product choices firms have these days. However, the two groups point at a fundamental difference as we know it in corporate finance. Let’s first look at the characteristics of both groups and then at the individual products that are included in these groups. After that, we will look more closely at the hybrid or mezzanine product group.

Although debt and equity are often characterized by referring to the products that feature their characteristics, i.e., stocks and bonds, the true nature of the difference lies much deeper; in the nature of the cash flow claims of each product.

The first big distinction has to do with the debt claim, which entitles the holder to a contractual set of cash flows to finance the repayment of the principal amount as well as the interests on a period-to-period basis. An equity claim, on the other hand, only holds a residual claim on the cash flows of the firm, i.e., after all expenses and other commitments are honored.

This is the fundamental difference, although the tax code and legal qualifications have contributed to the creation of further distinctive characteristics between both groups.

The second distinction, which can be seen as a direct consequence of the first distinction, is a logical result of the contractual claim that debt holders have versus the residual cash flow claim of equity holders. Debt claims have priority over equity claims, hence the qualification of equity owners as residual cash flow owners. That is true for both the principal amount and interest payments, and is valid until the instrument reaches maturity, even in the case of a bankruptcy or liquidation of the firm (claim by the debt holders on the firm’s assets).

The tax laws in most countries make a distinction between the tax treatment of interest versus dividends. Interests paid are tax deductible when paid by the borrowing firm and are therefore cheaper on a net (after tax) basis. Dividends, however, are not tax deductible, as they are considered to be paid out of net cash flows.

Additionally, debt instruments have a fixed maturity, i.e., the principal amount becomes due at a certain point in time, together with the interests which have not yet been paid. (We will ignore, for the time being, perpetual bonds, which are, in essence, 99/100 year renewable instruments). Equity instruments are perpetual or infinite, i.e., they continue to exist until the firm decides to buy them back and retire them, or to liquidate the firm completely.

Lastly, because equity owners are the residual cash flow owners, they are given control over the assets of the firm and its operational direction. Debt investors usually have a more passive role, often with no power of veto over major decisions in the firm. However, in recent years debt owners have done a pretty good job of getting their foot in the door, by using positive and negative covenants in their loan agreements to have (some level of) control over major transactions that would impact their position in the firm, often by making their investment more risky (i.e., due to increased leverage) or by damaging their chances of being repaid.

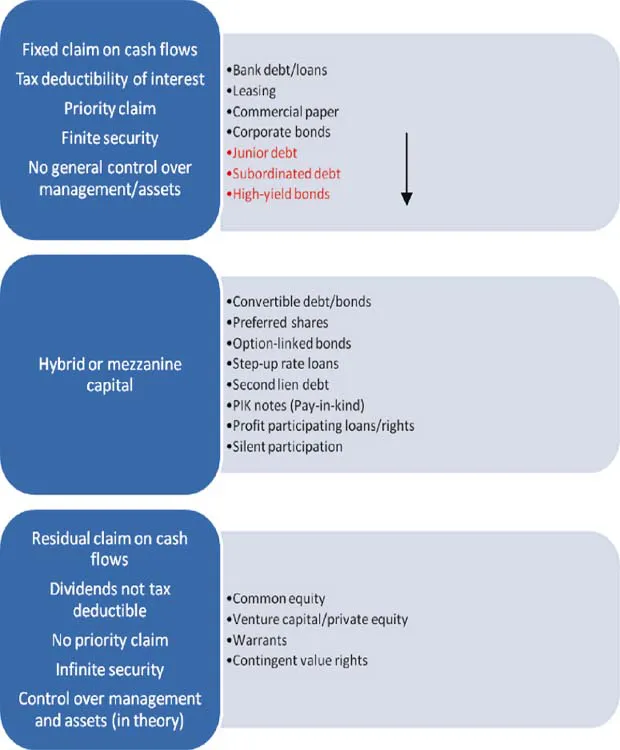

In short, debt is characterized by a contractual claim on the firm, benefiting from tax-deductible interest payments, with a finite lifetime and a priority claim on cash flows in both going concern situations and bankruptcy or liquidations. Equity, on the other hand, has a residual cash flow claim on the firm, is an infinite security, where dividend payments do not come with tax deductibility, has no priority, but provides control over the management and assets of the firm (in theory). Securities that have characteristics of both are termed hybrid or mezzanine capital, a definition which we will refine later in this chapter.

Figure 1.1a brings the categories and characteristics together but requires some explanation. Starting from the debt and equity positions we have already discussed (which make up boxes 1 and 3), the figure substantiates those two financing classes by indicating which types of instruments can be classified as being either debt or equity and further introduces the hybrid capital category (box 2) with an indicative set of products included.

For the sake of completeness, and to provide a level playing field, I will review most of the products mentioned at this stage. Additionally, all terms are explained in the glossary, which can be found at the end of this book, and which includes a review of all technical terms used in this book, regardless of whether they have already been explained in the core text.

Box 1, which reflects the debt products, includes the following instruments:

(1) Bank debt or loans which are fixed-income instruments with a fixed or floating interest rate and a pre-determined maturity. Often these loans are secured and therefore repayment is secured by collateral.

(2) Leasing, which is a form of asset financing where banks or specialized leasing institutions provide the financing for a specific (im)movable asset. The asset also serves as collateral in case the lessee (the person who has requested the finance) is unable to meet the lease payments. Two main categories exist, i.e., financial (or capital) and operational leases. In an operational lease, the lessor (or owner) transfers only the right to use the property to the lessee. At the end of the lease period, the lessee returns the property to the lessor. In case of a financial lease, the lessee has an option to acquire the asset (often at the end of the lease contract). Technical criteria distinguish operational from financial leases, and there are numerous accounting implications that are beyond the scope of this book. The distinction is also under review by the IASB (accounting body governing IFRS/IAS statements) which has been in its final phase for some time now (at the time of publication). For our purposes the distinction matters less as both types involve the lessee making payments to the lessor, which include a repayment of the loan underlying the asset purchase by the lessor. The lease payments include much more, i.e., insurance, depreciation, maintenance costs etc.

(3) Commercial paper: when companies want to raise debt they traditionally have two options, they raise bank debt or issue a corporate bond (which can be listed or raised through a private placement). In both cases the firm will face significant costs, either because of the fees that come with bank debt or in terms of the capital raising fees it will have to pay to the investment bankers raising capital for the company. In case of bank debt those expenses can be as significant as 3–6% of the amounts looked for. In the case of a bond this can be anywhere between 3 and 7% depending on the investment bank one uses, the region where capital is raised and the amount sought. A cheaper alternative for organizations is to raise debt directly in the market through commercial paper. Commercial paper is an unsecured instrument that allows companies to raise short-term debt (quite often the maturity will not exceed 270 days or nine months) often to finance current assets such as inventory, account receivables and other short-term liabilities. Because this type of instrument is unsecured, it can only be used by significantly creditworthy companies. In practice, the instrument is open to companies with an A credit rating or higher.

(4) The next category in box 1 is junior debt, which can be qualified as those instruments that are ‘junior’ to other debt obligations a company has. That is, they are ranked lower on the repayment schedule than the more ‘senior’ debt instruments a company has committed to. They are also often unsecured.

(5) Subordinated debt: Subordinated debt (which is mostly unsecured) is debt that is ranked lower than other debt instruments a company is committed to. In that sense they are also ‘junior’ as a debt instrument and aren’t backed by a security. Subordination can happen in two ways: the first is contractually – the loan contract will explicitly indicate that the interest and principal of this instrument will only be repaid after all other senior instruments have been repaid first. The subordination can also happen structurally – when the conditions and maturity of the loan have been structured in such a way that all other loans will be repaid before the structurally subordinated loan will be repaid. That can happen because the maturity of the loan is further in the future than all other loans and/or the interest is rolled up towards the instrument’s maturity. In the meantime, all other senior lenders will be repaid.

(6) High-yield bonds (aka junk bonds) are debt instruments with a poor credit rating (in practice a non-investment grade rating which comes down to BB+ (S&P and Fitch), Ba1 (Moody) or lower categories.

In box 3, which is the equity box, one can find common equity, the mother of all equity instruments. Equity provided by private equity firms and venture capital firms fits into this category as well. Warrants, once converted, entitle the holder to a certain pre-determined stake, in most cases, in the equity of the firm which issued the warrants. A warrant can therefore be qualified as an instrument that entitles the holder to purchase or receive common equity in the warrant’s issuing company. Contingent value rights are like an option where the holder of the rights is entitled to buy additional shares in the issuing company when certain events happen, under pre-determined conditions and pricing. This often happens after an acquisition or restructuring, where shareholders of the ...