![]()

Part One

The World of Corporate Treasury

THE TREASURY OF A CORPORATION is often called its lifeblood, and with good reason. Treasury is responsible for the money of the organisation and its flow, reaching funds where and when it is needed, in the right form.

The term treasury has been used for centuries, with the first noted use of the word from the term tresorie, which means “room for treasure.” Those treasures have since been replaced with money and assets that companies own and use to generate value for stakeholders—shareholders, customers, employees, and partners.

Money and assets exist in different forms, and move around, sometimes exceedingly quickly and sometimes very slowly. In an increasingly global and connected world, the Treasurer, who has direct responsibility for the Treasury, is faced with the numerous challenges of handling the funds, assets, liabilities, and cash flows of the firm across locations, each of which has different regulatory and market environments, optimising the use of these resources and ensuring availability to support the business.

Over time, with increasing complexity in business environments, the Treasurer’s role has increased, with chief financial officers (CFOs) also taking on additional responsibility for the function. With complexity, however, comes the need to simplify the support and financial structure to ensure that the firm’s functioning is smooth and the environment to encourage business growth is built.

This book aims to do precisely that: decipher the complexity of the treasury world and today’s environment, and simplify them for practitioners, so that they have a strong foundation of key treasury activities and functions.

Treasurers are the core of a company’s management, and on the way toward achieving business leadership, the firm needs to ensure that it has achieved treasury leadership, which will pave the way and set the stage for financial outperformance. The treasuries of all of the world’s leading organisations are cases in point—each one of them has built, achieved, and maintained treasury leadership.

Part One of this book answers some of the questions associated with treasury functions and responsibilities:

- What does a treasury look like—what do the employees in a treasury function do?

- What do a chief executive officer and a CFO expect of their Treasurer?

- What does a Treasurer consider his or her primary responsibility?

- What does a typical day in the treasury department of a global firm look like?

- What is treasury culture?

- What are the core attributes of a good treasury design?

- Why are operations, processes, and control so critical to a firm’s work?

We begin by looking at treasury in an organisational context.

![]()

Chapter One

Role of Treasury in a Global Corporation

AS BUSINESSES GROW AND BECOME more complex and competitive, and markets become closer and more interrelated, the dimensions that need the attention of a transnational corporation’s board and management increase dramatically.

While the core business and operations themselves require direct attention, the money that needs to flow through the veins and arteries of the organisation as well as its various dimensions require detailed expertise and focus, a team that understands the working of money and markets, from both a tactical and a strategic standpoint.

That is where the Treasury team puts up its hand to support the chief executive officer (CEO), chief financial officer (CFO), the board, and the business units in ensuring that the business side of the company works unhindered, by setting a broad monetary platform for businesses to grow and outperform.

INTRODUCING TREASURY LEADERSHIP

We first introduce the concept of Treasury Leadership, wherein Treasury positively influences the performance of the firm and drives the organisation toward industry and segment leadership. Treasury Leadership creates an environment that fosters excellence of capital building, execution, and support across all aspects of Treasury and works with the business to produce outperformance.

Treasury Leadership is hence translated into being a path-breaking and cutting-edge Treasury comprised of:

- Best practices in Treasury management

- Most efficient turnaround times

- Highest degree of control

- Most motivated and skilled employees with a great work–life balance

- Zero defects or errors on processing

- Optimum cash and liquidity

- Highest visibility of firm-wide cash flows

- Ability of the business to set newer standards for industry performance

- Firm’s outperformance over competition through well-managed Treasury processes, funding, and risk management

- Most stable and environment-proof risk management

- Great partnership with other group functions to increase firm value

- Treasury seen as an attractive function to work in

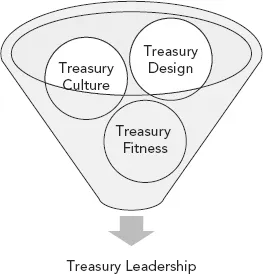

The three components of Treasury Leadership (depicted in Figure 1.1) are:

1. Treasury Design. Creating the right processes, structures, and approaches at the right place with the right infrastructure and the right people

2. Treasury Culture. Enabling an atmosphere of knowledge and positive teamwork to ensure highest work and motivational standards

3. Treasury Fitness. Assessing the functioning of the Treasury, similar to a fitness test for the human body, to identify potential pain points and to prevent any significant potential breakdown

We cover the concept of Treasury Design and Treasury Culture in Part One and introduce Treasury Fitness in the online content.

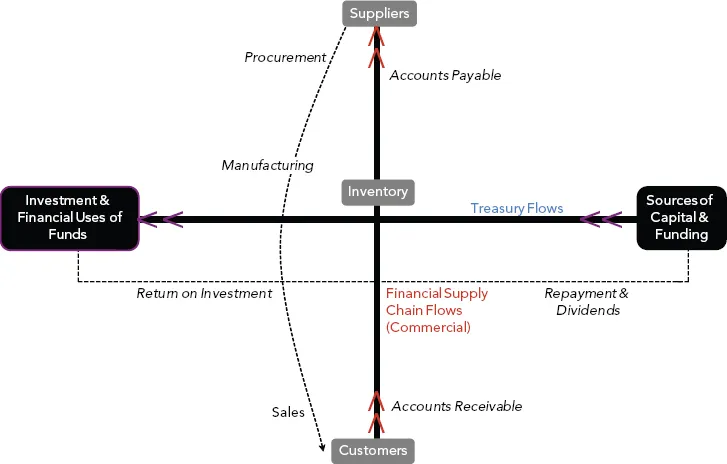

The world of Treasury deals with the flow of money—the flow of money through the balance sheet, from sources of capital to its financial uses. The idea that Treasury will be the storehouse of money or capital for the firm is extended here: Treasury flows work in tandem with the business of the firm, through the supply chain. Suppliers provide raw materials that are held as inventory, converted to finished products through the manufacturing and production process, and finally sold and delivered to the customer. The flow of money is in the opposite direction to the flow of goods or services, and forms the basis of the financial supply chain flows, or commercial flows, of the organisation. Money due to the supplier becomes an accounts payable, which finally gets paid out. Money owed to the firm by the customer becomes an accounts receivable, until it gets realised and money is paid into the firm’s account. Many of these terms will be further elucidated in later chapters.

The funding and movement of money associated with these commercial flows is done through Treasury. Figure 1.2 shows the essence of Treasury flows and their linkages with those of the financial supply chain.

The entire process requires capital in order to run. Until the customer pays the firm, the inventory, operations and supplies need to be funded. Proceeds from sales received across locations need to collected and deposited, so that payments can be made from those or other locations for purposes of running the business. Accounts need to be maintained in these locations, perhaps in different currencies, and these accounts need to be managed. Trade transactions need to be funded, and documents must be prepared and used. The entire aspect needs to be planned and executed, and this forms the basis of one of treasury’s key roles, which is to handle transactions as part of cash management, managing the cash and funds of the organisation.

It is preferable to use the firm’s own money to make these payments, and hence the monies need to be moved efficiently from one location to another, making them available where they are needed. Where it is not possible to use the firm’s own cash, alternative arrangements need to be made—for example, borrowing from a local bank. Even if access to these funds becomes difficult, the firm still has to keep running—ensuring that there is money available when required ensures liquidity for the firm. Excess cash needs to be invested securely to generate return for the firm until such time that the cash is needed. Long-term projects require capital—this needs to be arranged at the least possible cost and putting least pressure on the firm’s cash flows. The organisation needs to be creditworthy, and the financials of the firm have to be aligned to ensure that the performance is consistent with or better than expectations in order to sustain and improve the creditworthiness of the firm and hence its ability to generate liquidity and lower its cost of funding. This calls for managing the balance sheet efficiently, and with the right structure. This entire set of activities, the second of treasury’s key roles, covers managing the balance sheet and the firm’s liquidity (which is another aspect of cash management).

As the firm moves across borders, sells or buys from another country, or exposes itself to other counterparties and undertakes financial transactions, it exposes itself to risk or uncertainty that the business and financial objectives will not be met because of a change in some factors—perhaps market movements, defaults of trade partners or banks, or internal errors. The management of these risks forms the third of treasury’s primary roles.

How do the Treasurer and his or her team at Treasury achieve these goals? What do they have to do to make sure that their job is done and the support provided to the firm and to business and other functions is robust? How do they fit into the global context of the organisation?

We answer some of these questions in the book.

ORGAN...