![]()

Chapter 1

Introduction

Bribery and corruption has an impact on everyone, and while the impact is not immediately recognizable to most of us, the global impact cannot be underestimated. From developing countries in Africa, Latin America, and Asia to the United States, Western Europe, and the United Kingdom, bribery and corruption continues to create an uneven playing field in international trade, commerce, and the process of government. Problems range from the small payment demanded by a customs official to inappropriately process an import package, to multimillion-dollar payments to secure a large government contract. These are just two examples of the myriad of scenarios that businesses face in the international market place.

“A part of the culture.” “The cost of doing business.” “Our competitors are doing it.” “Not a big deal.” These refrains are just a few of the reasons given to make corrupt payments. Only in recent years have we begun to see a change. One would be very hard-pressed to identify a country that has not banned corruption within its own borders. Even the most remote, undeveloped, totalitarian regime has laws on the books against bribery (albeit selectively enforced). However, it was only just over 30 years ago that the United States took a strong stand against corruption outside its borders. The Foreign Corrupt Practices Act of 1977 (FCPA) was an attempt to level the playing field by preventing corrupt payments to foreign government officials for the purposes of gaining new business.

For many, many years the FCPA was the only game in town. Even then, most businesses either hadn't heard of it or didn't see it as a significant deterrent. Enforcement was rare, and when heard about, usually involved exotic locales and large payments to government insiders. And so was the case of the FCPA for many years. Bribery and corruption remained global scourges, and there were additional attempts to level the playing field and reduce their effects. The Organization for Economic Cooperation and Development (OECD) Convention on Combating Bribery of Foreign Public Officials in International Business Transactions (OECD Anti-Bribery Convention) in 1997 was a significant step forward and at least notionally gained worldwide support.

As the new century arrived, the tide began to change. The FCPA had always had teeth—too many teeth, argued some. But it was enforcement and the advent of modern corporate compliance programs that began to turn the tide and start a wave of focus on bribery and corruption that still surges forward. Billions of dollars in fines, penalties, disgorgement of profits, and professional fees signal that we are in a world that has bribery and corruption firmly in the center of any international company's radar. The United Kingdom passed a law that many believe surpasses the FCPA in its breadth and limitations. Whether viewed as the beginning of a new era of shrinking bribery and corruption or simply as regulatory enforcement stepping over the line, the current regulatory environment demands attention.

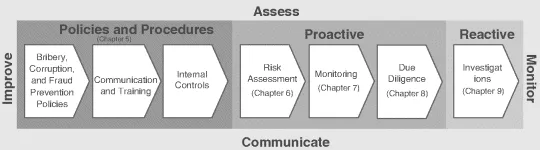

The objective of this book is to help businesspeople understand the relevant bribery and corruption legislation, enforcement environment, and how to effectively manage the associated risks. First, we lay the groundwork by discussing bribery and corruption legislation both in the United States and around the world. We focus on laws limiting foreign bribery and corruption as the area of domestic bribery and its enforcement is much more mature and outside the scope of this book. We then discuss bribery and corruption policies, procedures, and monitoring. These chapters focus on establishing an anti-corruption compliance program. Understanding and establishing an effective anti-corruption environment through focused internal controls, training, risk assessment and monitoring is the goal. We discuss how to respond to common corruption challenges, appropriately investigate issues, and mitigate corruption concerns. We have also supplemented the book with geographic and industry profiles of corruption challenges.

Figure 1.1 shows the elements of an Anti-Corruption Compliance Program and is the framework of this book. Each of the elements are described in detail throughout the book.

A casual search of the Internet for bribery and corruption guidance results in an ever-expanding number of articles, books, blogs, courses, seminars, and software products that are there to assist businesses respond to bribery and corruption risks. This book was written to be a practical guide to businesspeople who are trying to understand their company's risks and how to respond. There are other resources that will provide much more legal analysis on the statutes and the implications of resulting cases.

Bribery and corruption has a very detrimental effect on an economy. The World Bank has estimated that 0.5 percent of gross domestic product (GDP) is lost through corruption each year.1 Engaging in corrupt practices also creates a very unfavorable business environment by encouraging unfair advantage and anti-competitive practices. In addition to allowing organized crime to flourish, corruption is one of the primary obstacles to the economic development of a country; it undermines the rule of law, weakens trust in public institutions, and challenges democratic principles.2 For example, Transparency International, a nonprofit international organization that tracks global corruption, estimates that former Indonesian leader Suharto embezzled anywhere between $15 and $35 billion from his country and that Ferdinand Marcos in the Philippines, Joseph-Désiré Mobutu in Zaire, and Sani Abacha in Nigeria may have embezzled up to $5 billion each.3

Saddam Hussein's regime engaged in very widespread corruption highlighted by corrupt payments it received as a result of the United Nations' “oil-for-food program” that was designed to alleviate the economic sanctions against Iraq for the benefit of its people. Well-known companies from around the world were involved in this program, and there have been a string of prosecutions and settlements in the years since it ended.

The impact of bribery and corruption can't be understated.

Although anti-corruption laws have been enacted by many countries, the FCPA and U.K. Bribery Act are generally the most expansive in terms of proscribed activities and jurisdictional reach. The FCPA is the most aggressively enforced by several orders of magnitude. Accordingly, these are the laws that most global companies use as the standards for their anti-corruption compliance programs. Consult with your legal counsel concerning local bribery laws that might apply to the jurisdictions where you do business, but know and understand the FCPA and U.K. Bribery Act and use them as the foundation for your global anti-corruption compliance program, including anti-corruption policies, procedures, controls, and training activities.

The FCPA makes it unlawful for U.S. persons and companies to pay bribes to foreign government officials (non-U.S.) for the purpose of obtaining or retaining business or for any improper advantage. The FCPA prohibits direct and indirect bribe paying through intermediaries. The FCPA also requires U.S. and non-U.S. companies with securities listed in the United States (issuers) to adhere to its books and records provisions. These provisions, which were designed to operate in tandem with the anti-bribery provisions of the FCPA, require issuers to make and keep detailed books and records that accurately and fairly reflect the transactions of the corporation and to devise and maintain an adequate system of internal accounting controls.4 In practice, the accounting provisions have been interpreted very broadly to include false accounting or record keeping for any illegal act, including commercial bribes paid both within and outside the United States.

We discuss the U.K. Bribery Act, which came into effect on July 1, 2011, at length in the book. It remains to be seen whether the act will be enforced in a similar way as the FCPA. Serious Fraud Office (SFO) officials have painted a picture of strong enforcement using a practical approach. The question of jurisdiction and how it will be enforced is of particular concern. Some say the U.K. authorities will try to start off with a bang and bring a big case. What will happen remains to be seen, but our expectation is that the U.K. Bribery Act has further changed the landscape of anti-corruption enforcement and will continue in the vein of FCPA enforcement.

Enforcement Trends

For many years the FCPA was not a statute that the U.S. Department of Justice (DOJ) aggressively or significantly utilized to prosecute international bribery. In fact, there are few reported decisions of such prosecutions in the first 20 to 25 years in the life of the statute. In the past few years, however, the number of DOJ prosecutions and Securities and Exchange Commission (SEC) enforcement actions has steadily increased from a few in 2004 to over 70 in 2010. More important, DOJ officials have steadily warned that this trend will only continue.

For example, in a November 2010 FCPA conference, Deputy Attorney General Lanny Breuer indicated that we were in a “new era” of FCPA enforcement and warned that those worried about more aggressive anti-bribery enforcement “are right to be more concerned.” Mr. Breuer added that “[o]ur FCPA enforcement is stronger than it's ever been—and getting stronger.” He noted figures indicating that the DOJ had recently imposed more than US$1 billion in criminal penalties in FCPA-related cases in any single 12-month period and that more individuals were going to jail.

At other recent conferences, Mr. Breuer and other DOJ officials have indicated the importance of companies having effective FCPA compliance programs that prevent fraud and corruption. The importance of effective FCPA compliance programs is highlighted by the recent enactment of the U.K. Bribery Act of 2010, wherein a defense to a prosecution under that act is having “adequate procedures.”5 Such procedures refer to a company having an effective anti-corruption/bribery compliance program in place.

Global companies are challenged on how to compete for business in countries where the norm is to demand/seek/make (bribe) payments to obtain and retain business, yet seek to be compliant with the FCPA and other broad-based laws. U.S. regulators have focused on industries, and a central theme of these agreements has been building or strengthening anti-corruption compliance programs. Industries investigated have included oil and gas, medical devices, tobacco, telecommunications, and aerospace and defense. In addition to comments by DOJ officials outlined earlier, Cheryl J. Scarboro, chief of the SEC's newly formed FCPA Unit, said that the SEC “will continue to focus on industry-wide sweeps, and no industry is immune from investigation.”6

The 2008 Siemens corruption investigation, which led to the largest fine (US$1.6 billion) so far imposed by regulators from different countries, is a recent example of international cooperation among governments in attacking global corruption. The OECD's Anti-Bribery Convention, which sets forth standards for anti-corruption legislation, explains confronting conflicting jurisdictions, “when more than one Party has jurisdiction over an alleged offense described in this Convention, the Parties involved shall, at the request of one of them, consult with a view to determining the most appropriate jurisdiction for prosecution.”7

Anti-Corruption Compliance Programs

A well-thought-out and comprehensive anti-corruption compliance program is the benchmark that leading companies are utilizing to manage their corruption risks. It can be a challenge to reach this benchmark i...