![]()

Chapter 1

The Contract of Sale (Bay’)

Learning outcomes

At the end of this chapter, you should be able to:

1 Define a sale contract and identify its main constituent elements and important conditions.

2 Explain the differences between the subject matter of a sale and its price and the consequences of this difference.

3 Demonstrate knowledge of valid and void conditions.

4 Distinguish a sale contract from a promise to sell and identify prohibited sales and practising.

5 Explain issues related to price determination.

6 Understand and explain the juristic opinions on the contentious contracts of bay’ al-urbun, bay’ al-dayn, bay’ al-’einah, and tawarruq.

Introduction

Islam allows the parties the freedom to exchange or sell and purchase their properties and services. It only stipulates that people should not take each other’s property in an unfair (batil) way. Fairness is a dominant issue in exchange/sale of properties. Unfair (batil) ways include usury, gambling, ambiguities in agreements that can be exploited by the parties, fraud, false measurement, bribery, and theft. Exchanges of properties, if done properly, could become tools for the redistribution of wealth in a society. The Qur’an commands that properties should be exchanged through trade (tijarah) and with mutual consent (tarad). It states: “O ye who believe! Do not devour your property among yourselves unlawfully, but let there be among you trade by mutual consent.”1

The Arabic word for sale is Bay’, which literally means exchange (mubadalah) and applies to both sale and purchase. Legally, sale is defined as an exchange of a property for another, one of which is called the object, and the other the price. Sale can also be defined as an acquisition of ownership over a property in return for a consideration or compensation (‘iwad). Sale (Bay’) is the most extensively used contract in the market. It covers activities ranging from the ordinary day-to-day sale and purchase of necessities to the sale of shares in the stock market and international trade among nations. Advanced and complicated entities such as a company, a firm, a partnership (musharakah), a mudarabah, and multinational companies are formed in order to sell and purchase goods, commodities, or services. Nations sell and purchase through imports and exports. In contrast to sale, all other transactions take secondary positions. The significance of a sale contract could be understood from the fact that, unlike other contracts, the Qur’an specifically refers to it. The Qur’an states: “But Allah has permitted trade (bay’) and forbidden usury.”2

The Prophet (pbAbuh) is reported to have said: “The best earning is where a person earns through his own efforts and all sale transactions that are free from deception and cheating.”3

In another hadith it is stated: “Sale is constituted by mutual consent.”4

The effect of a sale contract is to transfer the ownership of the sold property from the seller to the purchaser and the ownership of the price from the purchaser to the seller. Sale allows both the parties to use their acquired properties in any way they like within the limits of the Shari’ah.

The Pillars of a Sale Contract

According to the Hanafii jurists, a sale contract has two pillars: offer and acceptance. They argue that the parties to a contract and the subject matter of a contract are not the pillars but are the requirements of a sale contract. They argue that offer and acceptance show consent and necessarily include and imply the existence of the parties and the subject matter. The majority of the Fiqh schools, on the other hand, argue that there are three pillars to a sale contract. They are expression (sighah), which includes offer and acceptance, the contracting parties (al-’aqidan), and the subject matter (mahal al-’aqd) or the property on which a sale contract is concluded.

Expression in a Sale Contract

Expression includes offer and acceptance. According to the Hanafiis, the party who first expresses his willingness to make a contract is making an offer (ijab). The party who first expresses his consent could be a buyer or a seller. The expression of willingness coming from the other party is termed acceptance (qabul). In contrast, according to the majority of the Fiqh schools, offer is a statement that comes from the seller who, as an owner of a property, offers it for sale. The statement that comes from the buyer, according to them, amounts to acceptance. According to them, even if the first statement comes from the buyer and the second statement from the seller, the latter is considered offer and the former is acceptance.

Offer and acceptance could be expressed verbally, by acts when we buy items with a price tag in a supermarket without uttering words, by gestures such as in a stock exchange where shares are sold and purchased, or through writings. They can also be made through modern means of communications such as fax and Internet, which are considered written exchanges. Furthermore, exchange of offer and acceptance through machines that dispense food and drink, or coins, are considered to be written exchanges.

The conditions for the expression:

- The offer and acceptance must be clear and should not be ambiguous.

- The acceptance must be unconditional. It must be made to correspond with the offer. A sale contract is not valid if there is any variation between offer and acceptance. For example, there is no agreement between offer and acceptance when a seller wants to sell his goods for cash and the purchaser wants to pay by instalments for the same price or when the seller wants the price in Ringgit and the purchaser wants to pay in Euros.

- The connection between the offer and acceptance should take place in the session of a contract (majlis al-’aqd).5

- Both offer and acceptance should be made in the past or present perfect tenses.

The Parties to a Sale Contract

There should be more than one party to a sale contract. There is no sale contract when the same person acts as a buyer and a seller, except when a father, guardian, or judge sells their own property to a minor or purchases a minor’s property from him.

The condition for the parties:

Both the seller and the purchaser should have complete legal capacity. A sale transaction can only be concluded by parties who have attained the age of majority and have the requisite legal capacity (ahliyyah). A child, a lunatic person, or a prodigal (safih), for instance, cannot conclude a sale contract. They are in need of guardians to act on their behalf. According to the Hanafiis, the age of majority is 18 for males and 17 for females, whereas to the other schools, it is 15 for both males and females.6 A person who has reached the age of majority can distinguish between useful and harmful, profitable and unprofitable sale transactions. He may, therefore, decide whether to conclude a sale contract or not without an approval from the guardian.

The Subject Matter and the Price in a Sale Contract

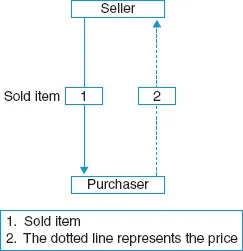

If a person exchanges a computer for 500 kg of rice, which one is the price and which one is the subject matter or the thing sold? In order to answer this question we must first understand the definitions of the subject matter and the price. The subject matter or the thing sold (mubee’) is the principal object of a sale contract. It is a well-defined, particularised, and specific thing. The people purchase them in order to use and benefit from them. The price (thaman), on the other hand, is a medium of exchange that facilitates the acquisition of the properties. Although a price should be known and fixed, it is not a particularised or specific thing because any banknotes or coins of a certain currency may serve as a price. For example, when a specific car is sold for RM 10,000, the car is known and specified, whereas RM 10,000 could be made of any notes of any denominations. Figure 1.1 shows the sold item and the price.

A price or money (thaman) is a medium of exchange, a store of value, and a unit of accounting. Some properties have these attributes of money and could always be used as a price. These comprise gold coins (dinar) and silver coins (dirham) and, by analogy, all currencies. There are other types of properties that are always the thing sold and cannot be used as a price. This group comprises nonhomogeneous properties such as land, houses, trees, cars, and so forth. These properties cannot be used as prices because they cannot become units of accounting. When these properties are sold they must be specified and particularised....