eBook - ePub

Energy Finance and Economics

Analysis and Valuation, Risk Management, and the Future of Energy

- English

- ePUB (mobile friendly)

- Available on iOS & Android

eBook - ePub

Energy Finance and Economics

Analysis and Valuation, Risk Management, and the Future of Energy

About this book

Thought leaders and experts offer the most current information and insights into energy finance

Energy Finance and Economics offers the most up-to-date information and compelling insights into the finance and economics of energy. With contributions from today's thought leaders who are experts in various areas of energy finance and economics, the book provides an overview of the energy industry and addresses issues concerning energy finance and economics.

The book focuses on a range of topics including corporate finance relevant to the oil and gas industry as well as addressing issues of unconventional, renewable, and alternative energy.

- A timely compendium of information and insights centering on topics related to energy finance

- Written by Betty and Russell Simkins, two experts on the topic of the economics of energy

- Covers special issues related to energy finance such as hybrid cars, energy hedging, and other timely topics

In one handy resource, the editors have collected the best-thinking on energy finance.

Frequently asked questions

Yes, you can cancel anytime from the Subscription tab in your account settings on the Perlego website. Your subscription will stay active until the end of your current billing period. Learn how to cancel your subscription.

No, books cannot be downloaded as external files, such as PDFs, for use outside of Perlego. However, you can download books within the Perlego app for offline reading on mobile or tablet. Learn more here.

Perlego offers two plans: Essential and Complete

- Essential is ideal for learners and professionals who enjoy exploring a wide range of subjects. Access the Essential Library with 800,000+ trusted titles and best-sellers across business, personal growth, and the humanities. Includes unlimited reading time and Standard Read Aloud voice.

- Complete: Perfect for advanced learners and researchers needing full, unrestricted access. Unlock 1.4M+ books across hundreds of subjects, including academic and specialized titles. The Complete Plan also includes advanced features like Premium Read Aloud and Research Assistant.

We are an online textbook subscription service, where you can get access to an entire online library for less than the price of a single book per month. With over 1 million books across 1000+ topics, we’ve got you covered! Learn more here.

Look out for the read-aloud symbol on your next book to see if you can listen to it. The read-aloud tool reads text aloud for you, highlighting the text as it is being read. You can pause it, speed it up and slow it down. Learn more here.

Yes! You can use the Perlego app on both iOS or Android devices to read anytime, anywhere — even offline. Perfect for commutes or when you’re on the go.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Yes, you can access Energy Finance and Economics by Betty Simkins,Russell Simkins in PDF and/or ePUB format, as well as other popular books in Business & Finance. We have over one million books available in our catalogue for you to explore.

Information

CHAPTER 1

An Introduction to Energy Finance and Economics

BETTY J. SIMKINS

Williams Companies Professor of Business and Professor of Finance, Oklahoma State University

RUSSELL E. SIMKINS

Manager of Proposal Services, College of Engineering, Architecture, and Technology, Oklahoma State University

He who loves practice without theory is like the sailor who boards ship without a rudder and compass and never knows where he may be cast.—Leonardo da Vinci, 1452–1519An investment in knowledge always pays the best interest.—Benjamin Franklin

SO WHY A BOOK ON ENERGY FINANCE AND ECONOMICS?

The purpose of this book is to provide the latest information and insights into the finance and economics of energy, based on contributions written by academics and practitioners who are experts in various areas of energy finance and economics. We strive to bridge the theory–practice gap, as the quote from Leonardo da Vinci emphasizes, between the scientific and technological foundations of energy and the real-world applications in the fields of finance and economics. Theory and practice go hand in hand, so that students and practitioners can better understand the what, why, and how of energy finance and economics to aid them in performing at a higher level no matter where “they may be cast.” Likewise, investing in knowledge will lead to success for anyone working in the energy industry or a related area, as the Benjamin Franklin quote suggests.

The book is intended to be useful to both educators and executives interested in the broad topic of energy finance and economics, but it will be relevant to energy users in general. To our knowledge, this is the first book to provide this breadth of coverage on this topic. We strive to provide accurate and nonbiased information by experts in each of the subject areas. Surveys, an example of which is described in Chapter 7, have shown that, in general, the public is very misinformed about what influences the prices of energy in our society. This is indeed unfortunate because learning the basics is fundamental to both citizens and politicians who make important decisions regarding energy. There is a desperate need for more education on energy, and we believe this book is a step in the right direction.

What do we mean by energy finance and economics? By this, we mean the finance and economics of energy involving the principles and tools necessary to conduct sound decision making and analysis. This also includes a broad understanding of the complex topics related to energy for a solid foundation. By linking both the economics and finance of energy in the book, we are striving to break down the silo mentality that sometimes separates two fields, especially in education, so that the knowledge flows freely between these two areas.1

This leads to the learning objectives of the book, which are:

- To gain basic knowledge and key concepts of energy supply and demand, terminology, industry structure, and related concepts.

- To analyze geopolitics and world energy use and learn about the outlook for the U.S. and global energy needs over the next 30 years and beyond.

- To understand energy applications that all professionals should know for best practices in financial analysis. These include understanding the basics such as accounting standards that apply to oil and gas companies, financial statement analysis, capital budgeting and risk analysis for energy projects, valuation, financing, and related topics including renewable energy.

- To explore value creation and decision making in the energy industry.

- To learn about the types of energy derivatives and markets and utilize key hedging techniques that are useful for energy risk management.

- To provide a firm understanding of the importance of the energy industry and the role that alternative energy sources can provide (and not provide) in meeting our future energy needs.

- To analyze case studies related to energy financial analysis, such as the economics of buying a hybrid vehicle, Southwest Airlines’ decision to retrofit their fleet of Boeing jets with blended winglets to save on fuel costs, and the economics of a wind energy project, among others.

- More broadly, to achieve a strong foundation in leading best practices that apply to the field of energy finance and economics.

THE CHALLENGES OF ENERGY TRANSITIONS AND THE TRICKY TRADEOFFS

Past energy transitions to inherently attractive fossil fuels took half a century; moving the world to cleaner fuels could be harder and slower.—Richard A. Kerr (2010)

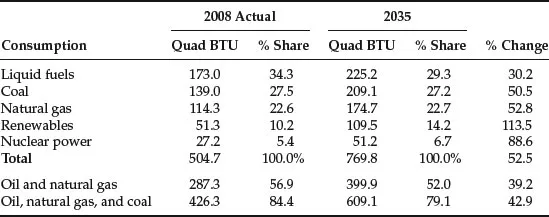

There has been a large push for renewable energy (wind, solar, etc.) worldwide with the corresponding Chicken Little warnings that we are running out of oil. Contrary to what most people believe, peak oil has not happened, and there is no braking point in sight.2 Oil and natural gas supply capacity is growing worldwide at an unprecedented level that may outpace consumption, according to Maugeri (2012). As later discussed in Chapter 3 of the book, most forecasts of future global energy demand through the year 2035 show that sustaining even modest economic growth worldwide will require massive new investments in energy, particularly oil and natural gas (see for example, EIA 2012 and API 2012).3 The latest projections of global energy needs in the year 2035 by the Energy Information Administration (EIA) indicate the energy mix shown in Exhibit 1.1.4 This forecast assumes a 3.4 percent annual rate of growth in the global economy. As shown, oil, natural gas, and coal should still dominate the energy mix by providing 79.1 percent of global energy needs, as compared to 84.4 percent in 2008. Renewable energy is expected to grow from 10.2 percent in 2008 to 14.2 percent by 2035.

Exhibit 1.1 Future Global Energy Demand

The good news is that having an increasing supply of oil and natural gas helps give us time to do the research and development necessary to shift to a more renewable-based economy. It also gives us time to solve a major challenge of renewables—building the infrastructure necessary to get the renewable energy where it is needed. It took the United States almost a century to build the system we have today to transport oil and gas efficiently throughout our country. It can easily take a similar time period to build new systems to take advantage of renewables.

Another challenge for renewables is that for the first time in the history of the world, we are attempting to move to new energy sources that are “less useful and convenient than the currently dominant sources: fossil fuels” (Kerr 2010). Historically, we have always moved to a more convenient and economic fuel, which makes the transition easier. In the 1800s, we shifted from wood to coal and then in the 1900s, from coal to oil. Shifting to renewables will require behavioral changes by all consumers of energy.

Another challenge for renewables lies largely with their inconvenience relative to fossil fuels and lack of infrastructure to get the energy from where it is produced to where it is needed. Whereas oil and natural gas can be transported easily by truck, rail, or pipeline to the point of use, wind and solar power do not have that flexibility. There is also a large difference in the energy density. Liquid hydrocarbons have very high energy content per volume, or what we call “high energy density,” compared to renewables. On a weight basis, oil has three times the energy of biomass and almost five times as much on a volume basis. In addition, wind and solar production is intermittent, whereas fossil fuel power plants operate 75 to 90 percent of the time. To make these renewables more attractive, they have been pushed hard with government tax incentives and subsidies to encourage their development.

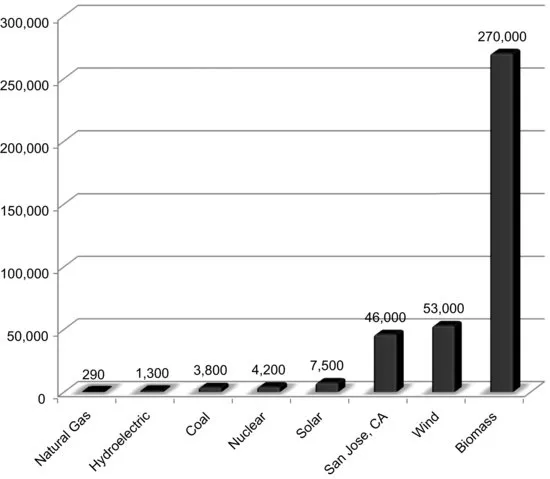

Exhibit 1.2 Land Area Needed to Provide Energy Sources in San Jose, California, Compared to Land (in Hectares) the City Occupies

Source: Based on research by Cho (2010), D. Spitzley, and the University of Michigan Center for Sustainable Systems, National Academy of Sciences, Department of Energy.

Another challenge involves land. When the amount of land used to produce energy is considered, oil yields from 5 to 50 times as much power as a solar facility. Wind and solar farms have large land footprints as does planting crops for bio-fuels. This is illustrated in Exhibit 1.2, which compares the amount of land that the city of San Jose occupies in comparison to the amount of land needed for various energy sources to provide San Jose’s power (see Cho 2010).

Clearly, there are many challenges ahead in energy but also many opportunities. This book is structured to cover core concepts and applications to help educate us for this journey.

SUMMARY OF THE BOOK CHAPTERS

As described earlier, the purpose of this book is to provide a broad coverage of energy finance and economics in order to educate practitioners and students alike. To achieve this goal, the book is organized into the following four sections:

| Part One | An Overview of Energy Finance and Economics |

| Part Two | Financial and Economic Analysis in the Energy Industry |

| Part Three | Energy Risk Management and Related Topics |

| Part Four | Case Studies |

Next, we provide a brief description of the author(s) and the chapters in the book.

Part One: An Overview of Energy Finance and Economics

Chapters 2 through 7 provide an excellent background by covering core topics: geopolitics, energy economics, myths and realities about sustainable energy, an introduction to the petroleum industry, the economics of renewables, and a survey of consumers’ understanding of what drives energy prices.

Chapter 2, “Geopolitics and World Energy Markets,” by Robert W. Kolb, provides insights into the story of energy, which is intertwined with international politics, all with dramatic effect on energy markets. Given the crucial nature of geopolitics, this chapter is a must-read for anyone interested in energy finance and economics. The ...

Table of contents

- Cover

- Table of Contents

- Series

- Title

- Copyright

- Dedication

- Acknowledgments

- CHAPTER 1: An Introduction to Energy Finance and Economics

- PART ONE: An Overview of Energy Finance and Economics

- PART TWO: Financial and Economic Analysis in the Energy Industry

- PART THREE: Energy Risk Management and Related Topics

- PART FOUR: Case Studies

- Index

- End User License Agreement