- English

- ePUB (mobile friendly)

- Available on iOS & Android

About this book

A detailed guide to the new era of IPO investing

Typically generating a great deal of interest, excitement, and volatility, initial public offerings (IPOs) offer investors and traders with opportunities for both short-term and long-term profits. In the Third Edition of High-Profit IPO Strategies, IPO expert Tom Taulli explains all facets of IPO investing and trading, with a particular emphasis on the industries that are fueling the next generation of IPOs, from social networking and cloud computing to mobile technology.

In the past year alone, many of these types of IPOs have provided enormous opportunities for nimble traders as prices have fluctuated widely for several months following the offering. This new edition reflects the new IPO environment and presents you with the insights needed to excel in such a dynamic arena.

- Discusses more sophisticated IPO trading strategies, explores the intricacies of the IPO process, and examines the importance of focused financial statement analysis

- Contains new chapters on secondary IPO markets, reverse mergers, and master limited partnerships

- Provides in-depth analysis of other major industries generating worthwhile IPOs

- Covers IPO investing from basic terms to advanced investing techniques

Comprehensive in scope, the Third Edition of High-Profit IPO Strategies offers investors and traders with actionable information to profit in this lucrative sector of the financial market.

Frequently asked questions

- Essential is ideal for learners and professionals who enjoy exploring a wide range of subjects. Access the Essential Library with 800,000+ trusted titles and best-sellers across business, personal growth, and the humanities. Includes unlimited reading time and Standard Read Aloud voice.

- Complete: Perfect for advanced learners and researchers needing full, unrestricted access. Unlock 1.4M+ books across hundreds of subjects, including academic and specialized titles. The Complete Plan also includes advanced features like Premium Read Aloud and Research Assistant.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Information

Part I

IPO Fundamentals

Chapter 1

Getting IPO Shares

Risk

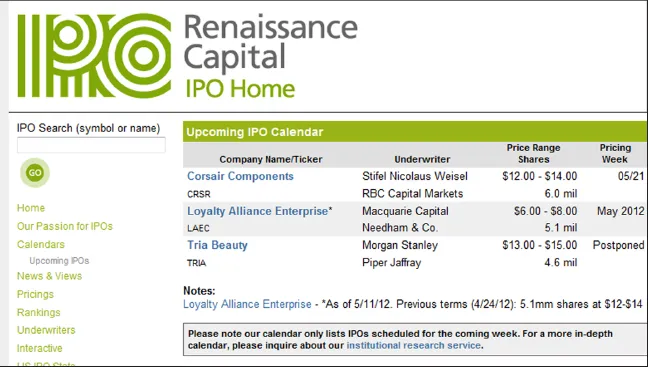

The Calendar

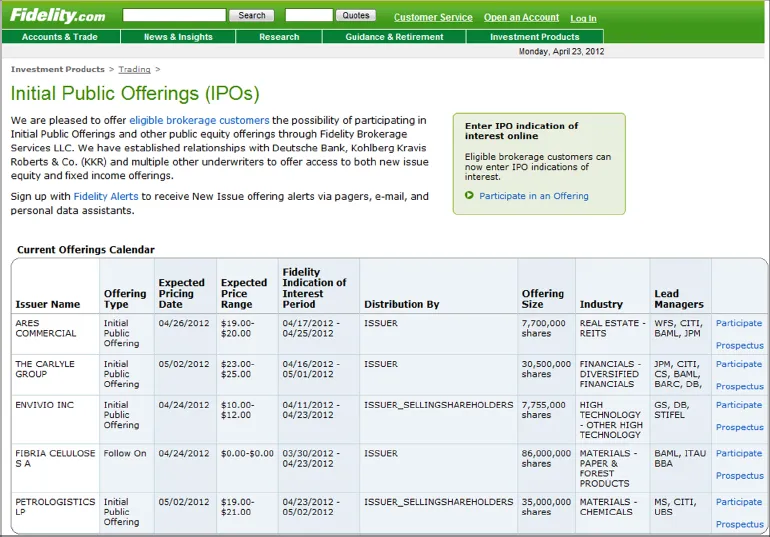

Online Brokers

- Alerts. This is an e-mail system that will indicate when an IPO is available. There will also be e-mails for when offers are due, the effectiveness of the offering, the pricing, and the share allocation.

- Q&A. A customer must answer a variety of questions (which are based on securities regulations). Essentially, these are meant to flag a so-called restricted person, a customer who has some type of connection to the financial services industry that may forbid him or her from participating in the IPO.

- Review the preliminary prospectus. This is done by downloading the document.

- Enter an indication of interest. This is the maximum number of shares to buy in the offering. You will not be able to indicate a price since it has yet to be determined. Instead, the deal will have a price range, such as $12 to $14.

- Effectiveness. On the day the deal is declared effective, you will get an e-mail to confirm your indication of interest. You can also withdraw the offer before the transaction is priced, which usually happens within 24 hours.

- Allocation. You will receive an e-mail showing the number of shares you have purchased. In the case of Fidelity, the allocation is based on a propriety system that evaluates a customer’s relationship, such as the level of trading and other activities with the firm. According to the website at www.fidelity.com: The allocation methodology is done as fairly and equitably as possible. The size of a customer’s indication of interest is not considered during allocation other than the fact that we will not allocate more than the customer requested. Therefore, you should only enter an indication of interest for the amount of shares you are interested in purchasing as entering a larger number will not help you receive additional shares and there is always the possibility that you could be allocated everything you ask for.

- Check your account. Make sure you received the allocation. Mistakes do happen.

- Trading. You can sell the shares at any time. But again, you may be penalized for flipping them. According to Fidelity: If customers sell within the first 15 calendar days from the start of trading in the secondary market, it will affect their ability to participate in new issue equity public offerings through Fidelity for a defined period of time.

Build Relationships with the Syndicate Firms

Dutch Auction

Table of contents

- Cover

- Contents

- Title

- Copyright

- Foreword

- Introduction

- Part I: IPO Fundamentals

- Part II: IPOs for Investors

- Part III: IPO Sectors

- Part IV: Other IPO Investments

- Conclusion

- Appendix A: The Underwriting Process

- Appendix B: Analyzing the Financial Statement Items

- Glossary

- About the Author

- Index

- Wiley End User License Agreement