![]()

Chapter 1

Philanthropy History and Statistics

The fragile state of our economy has had a severe effect on nonprofit organizations and how they operate. However, it has also provided us the opportunity to witness and reaffirm the deep philanthropic values of individuals in our country. Understanding a bit about the history and recognizing how our philanthropic culture is evolving will be very useful information as we begin to dive into the strategies and solutions for success in today's economy.

Individuals continue to be the single most important source of philanthropic contributions. Individual giving accounts for 88 percent of the total estimated U.S. charitable giving of $298.42 billion in donations made in 2011.1 Additionally, donors are keenly aware of the increased needs that have arisen as a result of our depressed economic state. There has been an increase in giving specifically in the areas of human services, health organizations, and public-society benefit organizations. Loyal high net worth individuals have displayed an understanding of the immediate need organizations have to increase programs and services in our current environment. Statistics show them pulling back on growth project support like capital campaigns and long-term investments and increasing support for general operating expenses.2

What are the roots of this deep philanthropic nature and how has it brought us to where we are today?

American Philanthropy

American generosity can attribute much of its origins to our Judeo-Christian religious tradition, influential philanthropists, our government, and taxes. The first American settlers were compelled by the inclination to unite and satisfy local needs, such as the building of churches and schools. Barn raisings, in which the local farmers gathered to join together to help in building the essential structures for new couples, were routine. This experience, plus the fact that so many early settlements were religious in nature, set the precedent for our tradition of charity and individual efforts to promote the common good.

The French economist Alexis de Tocqueville wrote in his 1835 book Democracy in America, “In no country in the world do the citizens make such exertions for the common weal.” Andrew Carnegie, who acquired an enormous fortune as a result of his work in the steel industry, was by 1901 devoting himself totally to philanthropy, which he said was the responsibility of every wealthy individual. He took seriously his famous saying, “The man who dies rich, dies disgraced.” By the time of his death, Carnegie had given away 90 percent of his fortune. He, John D. Rockefeller, and others established America's first private, grant-giving philanthropies.

In 1914, Frederick H. Goff established the Cleveland Foundation, our nation's first community foundation; it was quickly followed by many others. Just 16 years later, 21 cities had community foundations with assets exceeding $100,000. Today, there are more than 600 community foundations possessing assets in excess of $25 billion and in total, more than 76,000 grant-making foundations that give away over $45 billion annually!

In addition to the examples these incredible philanthropists were setting, the country was experiencing the advent of the personal income tax. It began in 1913 and was followed by the decision four years later that individuals could take a tax deduction for charitable giving. This event in our history created a tremendous spur to charitable contributions. As millions of Americans found themselves subject to the income tax for the first time during World War II, and given the patriotic spirit of the era, from 1939 to 1945, charitable contributions increased fivefold. Since then, charitable giving has continued to increase. During World War I, Americans gave the Red Cross more than $400 million, an enormous sum in pre-inflation dollars.

Additionally, during the Great Depression, the national government assumed a role in philanthropy that it has never entirely relinquished, though its focus has altered decade to decade. Funding was given to antipoverty and civil rights efforts, job training programs, and other social programs.

Now we have come to a point in our history where donors recognize the power of philanthropy. They are exhibiting confidence and dependence on the nonprofit sector as the primary provider for solutions to persistent needs and are focused on supporting broad-based non-governmental solutions. In a recent study more than 94.5 percent of high net worth households stated that they are more confident in the ability of nonprofit organizations over the state or federal government to solve domestic or global problems.3 So, let's take a look at what these strong philanthropic values have translated into statistically for nonprofit organizations.

Examining the Statistics

The development and evolution of American philanthropy is the envy of the world, and deservedly so. Many foreign countries are currently struggling to build a culture of philanthropy as they too feel the effects of economic crises and uncertainty and experience a retraction of government support.

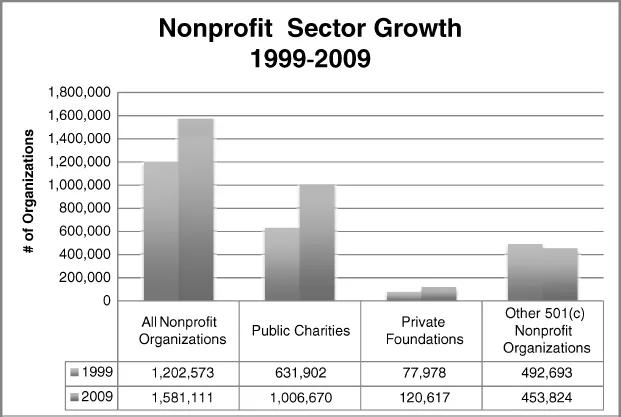

According to Independent Sector (www.independentsector.org), in America 1.2 million charities and nonprofits support more than half of all hospitals, 58 percent of social service providers, 46 percent of all colleges and universities, 87 percent of libraries, and 86 percent of museums and public gardens. According to the National Center for Charitable Statistics, as of January 2010 there were 1,581,111 tax-exempt organizations registered with the IRS, up from 1,202,573 in 1999. This number includes public charities, private foundations, associations, chambers of commerce, and fraternal organizations. The number of public charities over this 10-year time period rose by 59.3 percent, making up 63.7 percent of all tax-exempt organizations. Private foundations increased by 54.7 percent, making up 7.6 percent of the total.

As recently as 2007, before the current recession, public charities reported more than $1.4 trillion in total revenues, nearly $1.3 trillion in total expenses, and nearly $2.6 trillion in total assets.

The depth of the economic crisis required nonprofits to increase their provision of services and assistance. Demand has increased for health and social services, counseling, and scholarships for schools. A 2008 Giving USA survey showed that the need for social services was up about 54 percent. The need for services continued to increase and caught some nonprofits in a bind, since giving was down. The same Giving USA survey indicated that more than 60 percent of social service organizations were taking steps to cut costs by cutting staff and reducing costs and services, due to funding shortages.

So, what happened to charitable giving during this time? According to Giving USA 2009, the giving climate could have been worse. Although people kept giving, they did seem to be more selective on where they gave. Overall, giving exceeded $307.6 billion, but giving was down by 2 percent from levels experienced in 2007. This was the first decline recorded by Giving USA since 1987, when we experienced a stock market crash and major systemic shock to our markets and the economy; individual giving dropped 2.7 percent, or 6.3 percent adjusted for inflation. Corporate giving dropped 4.5 percent or 8 percent in inflation-adjusted dollars. The 2010 study conducted by Giving USA revealed overall giving rose by 2.1 percent on an inflation-adjusted basis. Individuals, companies, and philanthropic institutions made gifts and pledges totaling an estimated $290.89 billion in 2010, an increase of 2.1 percent on an inflation-adjusted basis over a revised estimate of $284.85 billion the year before. As stated in the 2012 Giving USA Study, total giving from 2009 through 2011 increased by an estimated 7.1 percent. Individual giving rose by an estimated 8.5 percent, and charitable bequests rose an estimated 12.2 percent after seeing a decrease of 5.8 percent in 2010. The 2010 increase was the first since 2007, when the recession started, leading to the biggest decline in giving in more than 40 years.

Even as we move through this challenging economy, our culture of philanthropy as a country continues to be strong and a priority. More than 98 percent of high net worth households gave to charity in 20094 and the 2012 Giving USA Report reported that the total estimated charitable giving in the United States rose 4 percent, representing $298.42 billion in charitable gifts. However, our current economic state continues to have a severe effect on nonprofit organizations because inflation-adjusted giving from individuals is at an almost flat 0.8 percent growth rate.

Summary

Our philanthropic culture remains strong with healthy support and confidence of individuals in the nonprofit sector. However, there is a limited number of dollars and the competition for these dollars is growing. Amidst the current economic climate, many nonprofit organizations began implementing initiatives to cut costs, jettisoning mediocre programs and focusing on what they do best. With more than one million charities in the United States, to survive has become a Darwinian exercise—one must be fit, which translates to maximizing efficiencies internally with streamlined operations and administration, assessing costs associated with fundraising and programmatic initiatives, creating transparency of expenses and policies, performing prudent practices around endowment management and spending—serving as prudent fiduciaries and stewards of donor contributions and, most importantly, effectively communicating vision, goals, and impact.

Next up, Chapter 2 addresses one of the first things for organizations to focus on when taking steps toward evolving and thriving in this competitive environment: the roles and responsibilities of the board as fiduciaries.

Notes

1. Giving USA Foundation, Giving USA Report 2012.

2. The 2010 Study of High Net Worth Philanthropy sponsored by Bank of America Merrill Lynch.

3. The 2010 Study of High Net Worth Philanthropy sponsored by Bank of America Merrill Lynch.

4. The 2010 Study of High Net Worth Philanthropy sponsored by Bank of America Merrill Lynch.

![]()

Chapter 2

Fiduciary Responsibility

Nonprofits have a fundamental obligation to conduct their affairs, financial and otherwise, in a responsible and transparent manner. It's not only sound practice; it is intrinsic to the long-term vitality and success of the organization. The new normal that has evolved after enduring this economic jolt has resulted in heightened visibility and acute awareness of the compliance and noncompliance of prudent fiduciary practices. Board members carry the front line responsibility as fiduciaries protecting and preserving the prudent practices of the organization. Accountability and transparency are the buzz words in our new reality and the board members are responsible not only for ensuring that the organization is in compliance, but making sure it is staying ahead of the curve in meeting the expectations of the IRS, the donors, and the community it is serving.

Nonprofit board members as fiduciaries should be focused on protecting the public interest: preserving donor intentions, fulfilling legal requirements, creating and maintaining legal documents such as bylaws and policies, maintaining the integrity of the organization by avoiding conflicts of interest, and ensuring effective leadership. As a fiduciary, board members have an obligation to the organization legally, strategically, and financially.

What Is a Fiduciary?

In general, a fiduciary is anyone who acts for the benefit of another; in which the beneficiary relies on the fiduciary with trust and in which the fiduciary must behave with good faith, ...