![]()

Part I

Investors and Risk

![]()

Chapter 1

Basic Principles

1.1 Investors

Before beginning our analysis, it is worthwhile noting that this book ultimately aims to help a particular type of individual: investors.

These individuals, who have capital to invest deriving from various sources (savings, inheritance, proceeds from the sale of real estate, etc.), are those most concerned by what follows.

They want to invest this sum of money so it yields a profit, thereby increasing their capital over time. So investors look first and foremost for a return, which may take the form of regular income, capital gains, or both at once.

At this stage, it should be noted that the expected return for the given time horizon must be positive in order to achieve the desired growth. It must also be higher than average inflation so that investors can preserve their purchasing power over time, and therefore their real wealth. Furthermore, net return—that is return after tax—should ideally be taken into account.

So, along with the risk of capital loss, inflation is one of the two greatest risks for investors, as it can seriously affect their capital over time. As such, it is worth defining more precisely.

1.2 Inflation

Inflation can be defined as an increase in general price level, with the chief consequence of a decrease in consumer purchasing power. Conversely, deflation is defined as a decrease in general price level.

Salaries, retirement pensions and other social security benefits are generally indexed to inflation, thus enabling consumers to maintain their purchasing power over time. As Marc Faber suggests, “to explain inflation to your children, buy a $100 US bond and frame it, then watch its value diminish to almost nothing over the next 20 years”.1

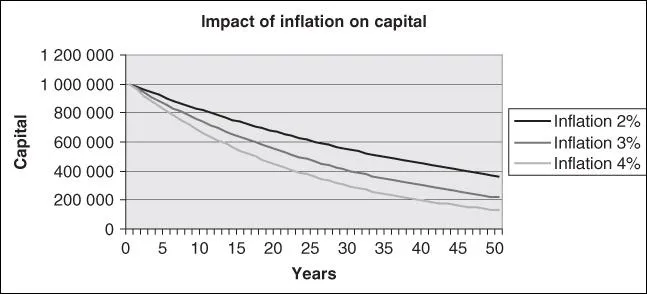

As shown by the graph below (Figure 1.1), inflation can indeed strongly affect the value of assets over time. Excluding any investment generating annual interest and considering an inflation rate of only 2%, the capital's value is halved in about 35 years. With an inflation rate of 3%, this period drops to 23 years and at a rate of 4%, “only” 17 years are necessary to halve the initial capital. The importance of investing money at a rate which covers at least that of inflation is obvious.

The objective generally fixed by central banks for inflation is around 2%. However, in absolute terms, this figure should be revised upwards from an investor's point of view, considering the product categories most relevant to consumers in the price index. Indeed, when focusing on price increases for food, housing, energy or health-related spending, the average rate of inflation appears to be much higher.

In general, a market basket is used to calculate price changes. This basket includes a representative selection of goods and services consumed by private households. It is subdivided into various categories of expenditure, and each main category is weighted according to the share it represents in household expenditure. The following examples are of the consumer price index calculation for Switzerland2 and England3 (Table 1.1).

Ultimately, the impact of inflation depends on the category of the population being considered and its type of consumption. In light of this, an interesting tool has been made available in the UK. Individuals can make use of a personal inflation calculator4 to calculate inflation specifically based on their own personal expenditure, which can then be compared to national inflation.

Table 1.1 Allocation of items to IPC and CPI divisions in 2010

| Food and non-alcoholic beverages | 11.063% | 10.8% |

| Alcohol and tobacco | 1.784% | 4.0% |

| Clothing and footwear | 4.454% | 5.6% |

| Housing and household services | 25.753% | 12.9% |

| Furniture and household goods | 4.635% | 6.4% |

| Health | 13.862% | 2.2% |

| Transport | 11.011% | 16.4% |

| Communication | 2.785% | 2.5% |

| Recreation and culture | 10.356% | 15% |

| Education | 0.669% | 1.9% |

| Restaurants and hotels | 8.426% | 12.6% |

| Miscellaneous goods and services | 5.222% | 9.7% |

Generally speaking, an annual rate of 2% is the minimum conceivable threshold and a rate of 3% is more realistic.

By setting a target rate of return of 2%, investments may only just cover inflation, while a target of 3% will begin to generate a certain level of growth. It is interesting to note that Graham, in his work written in the 1950s, already believed “that it is reasonable for an investor […] to base his thinking and decisions on a probable (far from certain) rate of future inflation rate of, say, 3% per annum”.5

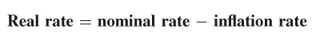

So investors must bear in mind that their final return, which we will call the real rate, should be calculated in the following way:

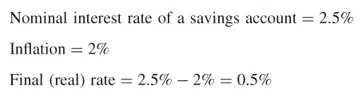

Example:

Our Advice

Given that periods of deflation also exist, we ultimately suggest allowing for an average inflation rate of 2%. The important thing is to take this minimum threshold into account in the investment process.

1.3 Choices for Investors in Terms of Investments

Investors may choose to invest in an asset with virtually no risk. This investment, commonly known as a risk-free rate investment, offers a very low return, usually only partially covering inflation, except of course during periods of deflation.

However, a feature of this type of investment is that it is always positive, generating capital growth which, though modest, is stable over time. Some investors settle for this type of low return investment, even though their purchasing power may be affected over time.

For other investors, a risk-free rate investment is not enough. Investment in other asset classes must therefore be considered in order to improve returns and avoid capital being affected by inflation in the...