- English

- ePUB (mobile friendly)

- Available on iOS & Android

Principles of Group Accounting under IFRS

About this book

The new International Financial Reporting Standards (IFRS) 10, 11, and 12 are changing group accounting for many businesses. As business becomes increasingly global, more and more firms will need to transition using the codes and techniques described in Principles of Group Accounting under IFRS. This book is a practical guide and reference to the standards related to consolidated financial statements, joint arrangements, and disclosure of interests. Fully illustrated with a step-by-step case study, Principles of Group Accounting under IFRS is equally valuable as an introductory text and as a reference for addressing specific issues that may arise in the process of consolidating group accounts.

The new international standards will bring about significant changes in group reporting, and it is essential for accountants, auditors, and business leaders to understand their implications. Author Andreas Krimpmann is an internationally recognized authority on the transition from GAAP to IFRS, and this new text comes packaged with GAAP/IFRS comparison resources that will help make the changes clear. Other bonus resources include an Excel-based consolidation tool, checklists, and a companion website with the latest information. Learn about:

- Definitions, requirements, processes, and transition techniques for IFRS 10, 11, and 12 covering group level accounting

- Practical implementation strategies demonstrated through a clear case study of a midsize group

- Key concepts related to consolidated financial statements, joint ventures, management consolidation, and disclosure of interests

- Comparisons between GAAP and IFRS to clarify the required changes for international firms

Whatever stage of the consolidation process you are in, you will appreciate the professional perspective in Principles of Group Accounting under IFRS.

Frequently asked questions

- Essential is ideal for learners and professionals who enjoy exploring a wide range of subjects. Access the Essential Library with 800,000+ trusted titles and best-sellers across business, personal growth, and the humanities. Includes unlimited reading time and Standard Read Aloud voice.

- Complete: Perfect for advanced learners and researchers needing full, unrestricted access. Unlock 1.4M+ books across hundreds of subjects, including academic and specialized titles. The Complete Plan also includes advanced features like Premium Read Aloud and Research Assistant.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Information

F

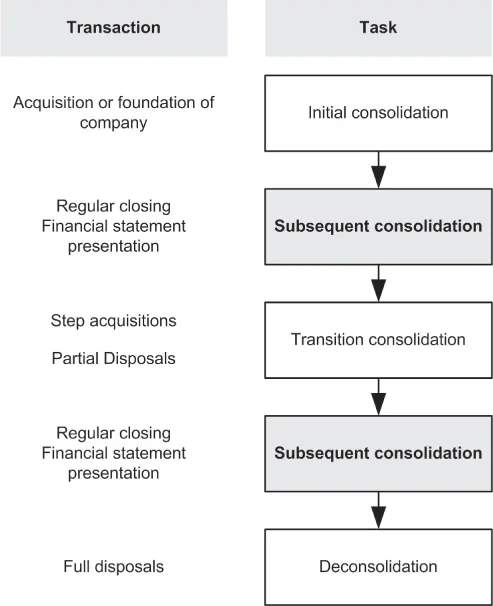

SUBSEQUENT CONSOLIDATION

About this chapter:

1. BASICS

- Consolidation procedures In general IFRS 10.B86 requires elimination of all group-internal transactions. The eli...

Table of contents

- Cover

- Title Page

- Copyright

- Table of Contents

- Dedication

- LIST OF FIGURES

- LIST OF TABLES

- PREFACE

- INTRODUCTION TO THE BOOK

- A: THE CASE STUDY

- B: LEGAL REQUIREMENTS FOR CONSOLIDATED FINANCIAL STATEMENTS

- C: DEFINITION OF GROUPS

- D: PREPARATION OF CONSOLIDATED FINANCIAL STATEMENTS AND ANNUAL REPORTS

- E: INITIAL CONSOLIDATION

- F: SUBSEQUENT CONSOLIDATION

- G: ASSOCIATED COMPANIES

- H: JOINT ARRANGEMENTS

- I: CHANGES IN CONTROL

- J: DISPOSALS AND DECONSOLIDATION

- K: SPECIAL AREAS

- L: MANAGEMENT CONSOLIDATION

- M: CONSOLIDATED FINANCIAL STATEMENTS

- N APPENDIX I: FAIR VALUE MEASUREMENT

- APPENDIX II: IFRS – US-GAAP COMPARISON

- APPENDIX III: IFRS

- GLOSSARY

- REFERENCE LIST

- INDEX

- End User License Agreement