![]()

1

Practice Procedures

1.1 Organisation and structure

In business terms, the term ‘practice’ is a word used to describe the office of a private firm comprising professional people practising in their dedicated fields of work. In the construction industry, these people practise in the fields of cost management, quantity surveying, project management and the commercial management of construction projects. The services a firm can offer might extend to cost and advisory services for the various engineering disciplines associated with a construction project, and the management of occupied buildings. The firm’s business potential is driven by demand derived from the number of clients seeking the services, which relies on the economic status of the locality, nation and construction industry at any time.

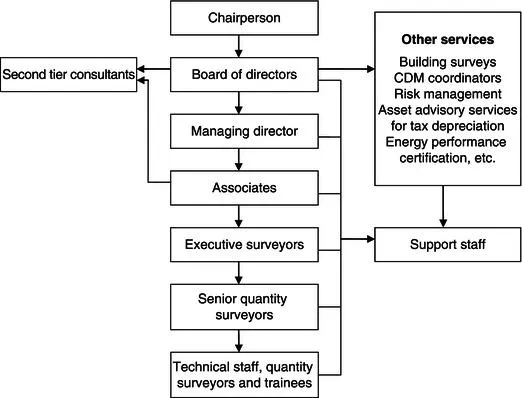

The creation of a firm requires private equity, which is the value of assets less any associated liability and is created from a partnership(s) or investor(s) who buys a portion of equity in the business. Firms or practices vary in size, ranging from partnerships with few employees to large businesses employing staff under a hierarchical management structure. In England, Wales and Scotland, partnerships comprising two or more individuals are required to trade as a corporate body under the Limited Liability Partnerships Act 2000, and in Northern Ireland under the Limited Liability Partnerships Act (Northern Ireland) 2002. These partnerships have legal existence that trade independently of their members; each partner is not personally liable for the others’ actions by way of negligence or default. Larger practicing firms usually comprise a chairperson, directors, other professionals and technical staff to assist in the running of the business. The hierarchical management structure of a large firm practicing in cost management is shown in Figure 1.1.

Figure 1.1 demonstrates the delegation of authority and levels of responsibility, which usually depend on qualifications, length of service, experience and expertise in certain fields of work. Collaborative teamwork is usually encouraged throughout the structure, with workshops allowing staff members with specialised skills to share their knowledge and aid career development of others, irrespective of their position or title. For example, a senior quantity surveyor who may have experience with infrastructure such as road construction and highway maintenance may provide training on estimating the costs of works to anyone with limited skills in the subject. Support staff includes secretaries, administrators and accountants who have the computer and office skills vital to the business structure and who assist technical and professional staff to set up and run projects. In addition, support staff usually manage the business’s quality control system to handle documents including:

- Logging and recording awarded projects

- Digital and hard copy control of drawings and documentation

- Filing methods for managing computer and office space

- Maintaining records of business development

- Arranging meetings

- Updating the firm’s policies and procedures file

- Coordinating the flow of information for distribution.

In order to carry out business dealings, a firm requires legal recognition and the acknowledgement of its responsibilities at common law. In order to create a legal identity, it is necessary for the firm to register its business. In the United Kingdom this is with Companies House, a regulatory body for company registration that maintains company records as required by the Companies Act 2006. It might also be necessary to register for value added tax (VAT) if turnover is in excess of the stated threshold, as services tax will be chargeable to clients on invoices raised by the firm. Firm members may be self-employed with each responsible for their own taxation and insurance payments. However, if firm members are not self-employed but are employees, it will be necessary to register them with a system whereby tax is deducted from each wage payment as pay-as-you-earn (PAYE). PAYE addresses tax deductions and national insurance contributions payable to the tax office when they are deducted from the salary payments of employees.

The premises of a firm must be suitable for trading and, if not owned by the firm, an agreement with a property owner must be in place. This agreement defines obligations of the firm as a tenant, and the responsibilities of the owner/tenant that must include insurance cover for the building including fire damage and building contents. The firm must also purchase public liability insurance in the event of an injury or accident to a visitor whilst on the premises and employers’ liability insurance in case an employee becomes injured or ill whilst in their place of work.

1.1.2 Marketing and regulating

In order for a firm to market itself as reputable, it must be regulated by and affiliated with at least one regulatory body. The prominent regulatory body for quantity surveyors/cost managers is the Royal Institution of Chartered Surveyors (RICS). The RICS is the leading international body that regulates members and firms to ensure ethics and professional conduct are maintained. Professional members are termed ‘Chartered Surveyors’, and the Institution has the largest network of quantity surveyors worldwide. Founded in 1868, the RICS is a regulating body that recognises qualifications in land, property and construction. It has in excess of 100,000 professional members worldwide (as at 2013), of which 40% are quantity surveyors. The Institution has a number of Professional Groups, including Quantity Surveying and Construction and Project Management, which share an interest with the cost management of construction projects. Other construction Professional Groups are Building Control and Building Surveying. The Institution has aims that:

- Promote research for development

- Regulate and maintain membership ethics and standards

- Carry out market surveys with comments and forecasts for business and governments

- Improve and promote the various professions through educational links

- Publish books appropriate to the business of the RICS.

Approximately one-third of members are in the student class. This class offers students career advice and help with studies but, in addition, opportunities to build a network of contacts in the industry via RICS matrics that aim to provide an active programme of social and charity events. Students enrolling on this route must have commenced one of the accredited (cognate) courses. These include Higher National Certificates and Diplomas (HNC/HND), or degree courses relevant to the profession which can act as stepping-stones towards chartered status.

Membership criteria

The traditional method for obtaining chartered status is along the graduate route. It requires candidates to graduate with a cognate degree and complete a structured training programme combined with work experience. Traditionally, a postgraduate starts structured training and experience towards completing the RICS acclaimed APC (Assessment of Professional Competence), which is the measure of an acquired qualification linked with practical training and experience in a relative field of work, e.g. quantity surveying. Students enrolled on cognate courses can begin the APC pathway whilst studying or in employment; it involves regular meetings with a counsellor who is a member of the RICS. The structured training and work experience minimum timeframe for training is two years. During this time, the student records their training and experience in a logbook and produces a mandatory record that includes details of professional development. This information is collated as part of a Critical Analysis Report which is issued as a final submission. Subject to the submission being acceptable, as a final assessment the candidate attends a professional interview with a RICS panel that discusses the Report and tests the candidate’s understanding of professional practice and ethics. The panel later completes its assessment with a recommendation for membership or a deferral. If successful, the student is invited to enrol as a professional member and, if accepted, receives chartered status and is permitted to use the initials MRICS. Alternative routes to the graduate pathway are Associate, Senior Professional, Adaptation and Academic. These are suitable for persons with various levels of experience, qualifications or who are members of affiliated organisations with the entry requirements varying.

Individuals and companies may apply for chartered status and, once accepted, are bound by the Rules of Conduct for maintaining ethical standards. The RICS is self-regulating and responds to the needs of the profession. As a result, membership routes may change from time to time, so those interested in becoming members ought to become acquainted with current information which can be found on the RICS website, www.rics.org.

Professional and ethical standards

A fundamental and core belief of the RICS is for its individual members to inspire confidence in the way they do things that is demonstrated by a clear set of professional and ethical standards which guide behaviour. To ensure uniformity of standards, the RICS produces a set of standards which were streamlined in 2012 where each member is expected to:

- Act with integrity – by being honest and straightforward in all that the member does

- Always provide a high standard of service – by ensuring that a member’s client or other to whom the member has a responsibility receives the best possible advice, support or performance of the agreed terms of engagement

- Act in a way that promotes trust in the profession – by acting in a manner, whether it is in a professional capacity or in private life, that promotes the member, firm, member’s organisation and the profession in a professional and positive way

- Treat others with respect – by treating people from all walks of life with courtesy, politeness and consideration including being aware of cultural sensitivities and business practices

- Take responsibility – by the member being accountable for all their actions, not blaming others if things go wrong and, if suspecting something isn’t right, being prepared to do something about it.

The RICS has a separate guide entitled ‘Rules of Conduct for Firms’ that sets out standards of professional conduct for a firm to trade when it is regulated by the RICS. The rules are not a repeat of obligations required under common law, such as the methods dealing with discrimination or employment law and occupational health and safety, as the Institution is not empowered to legislate. The rules are the result of a root-and-branch review of regulations created by the Institution that adopt a set of ‘principles-based Rules’. These Rules regulate firms through ‘proportionality, accountability, consistency, targeting and transparency’ to provide a level of protection for the public and uphold the reputation of the profession. Practicing firms are required to have at least one principal as a RICS professional member who is eligible to register the firm and confirm observation and compliance with byelaws and regulations. Members and firms that comply with the regulations can use the RICS logo on their letterheads and advertisements to demonstrate chartered status. This also acts as a marketing tool which attracts clients to a firm that is regulated by a reputable source.

A further guide entitled ‘Rules of Conduct for Members’ follows the same scope for firms and is published for individual use as a reference for maintaining personal and professional standards. The Rules have a theme of enforcing a member’s understanding of their responsibilities that include: acting with competence and integrity when providing their services which must be in a timely manner regarding customer care; avoiding conflicts of interest; remaining solvent; and cooperating with a RICS Regulatory board including supplying information if so requested. Members are also required to plan, undertake, evaluate and record as evidence the details of continual professional development (CPD). CPD is a method of personal development for learning and involves training gained from, for example, private study, coursework, workshops, etc in order that members remain competent in their chosen fields of work.

Professional indemnity insurance

A fundamental rule of the ‘Rules of Conduct for Firms’ is the mandatory requirement for firms to ensure that previous and current work is suitably covered by professional indemnity insurance. Broadly, this insurance provides a level of protection in the event of an occurrence leading to misfortune that is possible to recover under a limited financial sum stated in a policy provided by an insurance company. Policies may be general where they outline the amount of cover applicable for any event, or may be provided specifically with a named client and/or particular project which could apply for projects or services where long-term arrangements exist. The objective of the cover is to ensure a firm is protected from a financial burden it could not afford to pay in the event of a claim or expenses payable to a third party, such as a court or legal professional who would address the event. RICS Regulations state that a member firm must have a policy that is current to meet ‘each and every’ claim, including civil liabilities. A civil liability might apply in a situation when a business is sued in tort (a civil wrong) for an event that only becomes apparent after a prolonged period with far-reaching consequences for persons other than those named in the agreement for services between the firm and its client. Insurance companies deal with these claims as remote events that include the public, individuals or businesses affected directly or indirectly by an event giving rise to a claim. This scenario presses the need for a policy clause to include a run-off period for a specified number of years in the event of the insolvency of one or both parties to the agreement for services. Each policy must be worded and underwritten by a listed insurer and it is prudent to include adequate cover for the actions of past and present employees who carried out duties for a client in the name of the firm, as...