- English

- ePUB (mobile friendly)

- Available on iOS & Android

Mathematics and Statistics for Financial Risk Management

About this book

Mathematics and Statistics for Financial Risk Management is a practical guide to modern financial risk management for both practitioners and academics.

Now in its second edition with more topics, more sample problems and more real world examples, this popular guide to financial risk management introduces readers to practical quantitative techniques for analyzing and managing financial risk.

In a concise and easy-to-read style, each chapter introduces a different topic in mathematics or statistics.As different techniques are introduced, sample problems and application sections demonstrate how these techniques can be applied to actual risk management problems. Exercises at the end of each chapter and the accompanying solutions at the end of the book allow readers to practice the techniques they are learning and monitor their progress.A companion Web site includes interactive Excel spreadsheet examples and templates.

Mathematics and Statistics for Financial Risk Management is an indispensable reference for today's financial risk professional.

Frequently asked questions

- Essential is ideal for learners and professionals who enjoy exploring a wide range of subjects. Access the Essential Library with 800,000+ trusted titles and best-sellers across business, personal growth, and the humanities. Includes unlimited reading time and Standard Read Aloud voice.

- Complete: Perfect for advanced learners and researchers needing full, unrestricted access. Unlock 1.4M+ books across hundreds of subjects, including academic and specialized titles. The Complete Plan also includes advanced features like Premium Read Aloud and Research Assistant.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Information

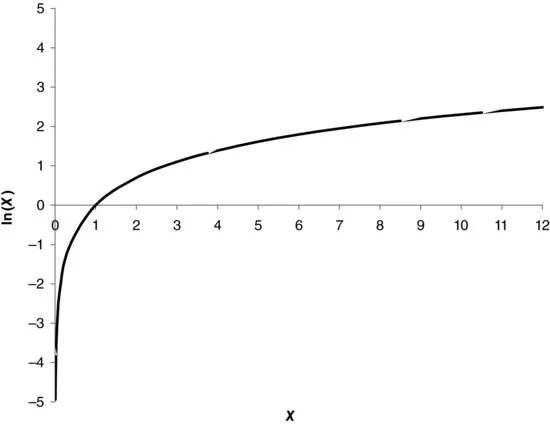

| R | ln(1 + R) |

| 1.00% | 1.00% |

| 5.00% | 4.88% |

| 10.00% | 9.53% |

| 20.00% | 18.23% |

Table of contents

- Cover

- Series

- Title Page

- Copyright

- Preface

- What's New in the Second Edition

- Acknowledgments

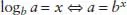

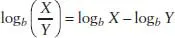

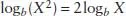

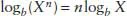

- Chapter 1: Some Basic Math

- Chapter 2: Probabilities

- Chapter 3: Basic Statistics

- Chapter 4: Distributions

- Chapter 5: Multivariate Distributions and Copulas

- Chapter 6: Bayesian Analysis

- Chapter 7: Hypothesis Testing and Confidence Intervals

- Chapter 8: Matrix Algebra

- Chapter 9: Vector Spaces

- Chapter 10: Linear Regression Analysis

- Chapter 11: Time Series Models

- Chapter 12: Decay Factors

- Appendix A: Binary Numbers

- Appendix B: Taylor Expansions

- Appendix C: Vector Spaces

- Appendix D: Greek Alphabet

- Appendix E: Common Abbreviations

- Appendix F: Copulas

- Answers

- References

- About the Author

- About the Companion Website

- Index