- English

- ePUB (mobile friendly)

- Available on iOS & Android

About this book

Stay liquid, think global, and better manage resources with this authoritative guide

Working Capital Management is a comprehensive primer on keeping your business financially competitive in the face of limited access to short-term funds. With detailed insight applicable to each phase in the business cycle, this authoritative guide helps managers revamp current practices for more efficient use of assets and liabilities, including more stringent monitoring and planning of collections, disbursements, and balances. Readers will learn how to minimize investments in idle resources, and how to maximize the use of forecast data to better identify risk and the optimal use of available funds. Case studies illustrate the practical applications of the ideas presented, with particular attention given to cash budgeting, forecasting, banking relationships and other common scenarios with specific requirements.

Managing a company's short-term resources is both an art and a science. Effectively maintaining funds for ongoing activities – and keeping those funds liquid, mobile, and available – is a masterful skillset lacking in business. Working Capital Management offers practical advice for managers in this challenging position, providing guidance that helps them:

- Learn the specific metrics at work in capital management, and the problems that they can cause

- Improve cash management with robust fraud protection and better use of short-term instruments

- Manage the issues that arise from accounts receivable, inventory, payables, information management, and international sources

- Develop an effective management system for key points in the working capital cycle

The recent liquidity crisis in the U.S. has thrown the spotlight onto those companies that have adjusted well to credit contraction and the weakened economy, and these success stories – some of which are noted in the book – demonstrate that a positive business outcome can be accomplished. Working Capital Management provides a clear look at a complex issue, with practical, actionable, sustainable advice.

Frequently asked questions

- Essential is ideal for learners and professionals who enjoy exploring a wide range of subjects. Access the Essential Library with 800,000+ trusted titles and best-sellers across business, personal growth, and the humanities. Includes unlimited reading time and Standard Read Aloud voice.

- Complete: Perfect for advanced learners and researchers needing full, unrestricted access. Unlock 1.4M+ books across hundreds of subjects, including academic and specialized titles. The Complete Plan also includes advanced features like Premium Read Aloud and Research Assistant.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Information

CHAPTER 1

Concepts in Working Capital Management

- Explanation of the basic concepts of working capital.

- Appreciation for the problems in assigning management responsibility for working capital.

- Consideration of traditional and modern ideas of working capital management.

- Understanding the essential focus of cost in working capital management.

- Applying working capital concepts to a successful company (Best Buy).

WORKING CAPITAL CONCEPTS

Description of Working Capital Accounts

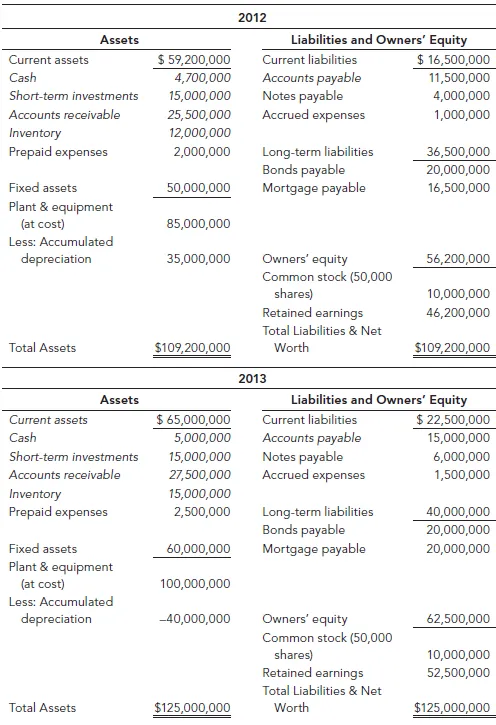

- Cash accounts and short-term investments. These account categories include cash on hand and in bank accounts, and any short-term investments that are expected to be turned into cash within one year. We'll review the management of cash in Chapters 3 and 4, and of short-term investments in Chapter 5.

- Accounts receivable. This category of current assets includes all credit sales where the customer is expected to pay by a future date specified on an invoice. Most companies have small amounts of uncollectible credit sales, and an account called “allowance for doubtful accounts” may be deducted from accounts receivable to reflect this experience. We'll examine receivables in Chapter 6.

- Inventory. Most companies hold some combination of raw materials, work-in-process (that is, partially manufactured and assembled), and finished goods. There are various accounting practices for valuing inventory and management concepts regarding inventory, which will be discussed in Chapter 7.

- Payables. The accounts payable account represents the amounts owed to creditors for purchases. Payroll is the other significant component of payables. Issues regarding payables will be reviewed in Chapter 8.

- Other working capital accounts. Prepaid expenses and accrued expenses often appear on balance sheets. Prepaid expenses are assets paid in advance of expenses as incurred; an example is insurance paid in advance of the incurrence of the expense. Accrued expenses are costs that have been incurred as of the date of a balance sheet but not paid; an example is payroll for employees whose expense has been incurred but not yet paid. These balance sheet accounts are not specifically discussed in subsequent chapters.

- The infrastructure of working capital. Infrastructure involves those activities that are essential for managers to proceed. These include international working capital (Chapter 9), information and working capital (Chapter 10), and management of the working capital cycle (Chapter 11). Chapter 11 also provides a quick recommendations summary. Chapter 12 introduces the working capital cases that follow.

Ideas Basic to Working Capital

- The term bank refers to commercial banks, although other financial services companies and some vendors provide many of the services described. Vendors are noted when the relevant topic is discussed; for example, payroll services are provided by four leading firms that are noted in Chapter 8. Freight invoice auditing firms are also discussed in that chapter, but there are so many companies in that business that we have not attempted to list them.

- Float is critical to an understanding of working capital. The concept of float refers to funds in the process of collection or disbursement. While the complete elimination of float is impossible, the calculation of the amount of float is critical in considering alternative processes. For example, in Chapter 3 we examine the bank product of lockboxing.1 In deciding on the use of this service, we need to know the potential to save collection float a...

Table of contents

- Cover

- Series

- Title Page

- Copyright

- Dedication

- Preface

- Acknowledgments

- Chapter 1: Concepts in Working Capital Management

- Chapter 2: Working Capital Ratios and Other Metrics

- Chapter 3: Cash—Management and Fraud Prevention

- Chapter 4: Cash—Credit and Short-Term Financial Instruments

- Chapter 5: Managing Bank Relationships

- Appendix to Chapter 5: Selecting Noncredit Banking Services

- Chapter 6: Accounts Receivable and Working Capital Issues

- Chapter 7: Inventory and Working Capital Issues

- Chapter 8: Payables and Working Capital Issues

- Chapter 9: International Working Capital

- Chapter 10: Information and Working Capital

- Chapter 11: Managing the Working Capital Cycle

- Chapter 12: Introduction to Working Capital Cases

- Cases on Working Capital Management

- Appendix I: Basic Financial Concepts

- Appendix II: Websites of Working Capital Organizations*

- Glossary

- About the Author

- Index

- End User License Agreement