![]()

Part 1

The Foreign Exchange Markets

![]()

Chapter 1

The World of FOREX

Introduction—What Is FOREX?

YOU ARE HERE—Before you can test the waters with a demo account, learning basic information about the FOREX markets is essential. Part 1 will accomplish this task with discussions of history, terminology, and regulations.

Foreign exchange is the simultaneous buying of one currency and selling of another. Currencies are traded through a broker or dealer and are executed in currency pairs, for example, the European Euro and the U.S. Dollar (EUR/USD) or the British Pound and the Japanese Yen (GBP/JPY). If you buy the GBP/JPY, you are long the GBP and short the JPY; if you sell the GBP/JPY, you are short the GBP and long the JPY. An account is typically funded with the currency of your resident country. A few FOREX brokers offer the option of funding with a non-local currency.

It is important to understand a FOREX transaction is effectively a spread between two currencies. You cannot simply buy the USD or sell the JPY—the purchase or sale must be in relationship to another currency. This is one of two important facts to remember as we delve into the world of foreign exchange trading.

The FOReign EXchange market (FOREX) is the largest financial market in the world, with a turnover volume of $4 trillion daily. This is more than three times the total amount of the stocks and futures markets combined and almost a doubling in the past five years.

Unlike other financial markets, the FOREX spot market has neither a physical location nor a central exchange. It operates through an electronic network of banks, corporations, and individuals trading one currency against another. The lack of a physical exchange enables the FOREX market to operate on a 24-hour basis, spanning all time zones across the major financial centers. This fact—that there is no centralized exchange—is the second important fact permeating all aspects of the FOREX experience.

What Is a Spot Market?

A spot market is any market that deals in the current price of a financial instrument. Futures markets, such as the Chicago Board of Trade, offer commodity contracts whose delivery date may span several months into the future. Settlement of FOREX spot transactions usually occurs within two business days. There are also futures and forwards in FOREX, but the overwhelming majority of traders use the spot market. Thanks to the ability to automatically roll over from one trading session to the next, spot FOREX traders may hold a position for as long as they like.

In addition to spot, forward, and futures, options trading in FOREX has become very popular at the retail level. You may also participate in the spot market with spread betting. These all have both advantages and disadvantages, which I discuss in Chapter 3, “Five FOREX Markets.”

Which Currencies Are Traded?

In theory, any currency backed by an existing nation can be traded against any other currency. In practice, trading volume of the major currencies dominate the action. Given in descending order (along with their symbols), they are the U.S. Dollar (USD), the Euro Dollar (EUR), the Japanese Yen (JPY), the British Pound Sterling (GBP), the Swiss Franc (CHF), the Canadian Dollar (CAD), and the Australian Dollar (AUD). See Table 1.1. All other currencies are referred to as minors and those from smaller countries, exotics. The New Zealand Dollar (NZD) is often included with the majors. The Chinese Yuan is the only currency of a major player not represented in the interbank market today. The Chinese have used this to great advantage, but there is a yin and yang in everything. . . .

TABLE 1.1 Major FOREX Currencies

| USD | United States | Dollar |

| EUR | Euro members | Euro |

| JPY_ | Japan | Yen |

| GBP | Great Britain | Pound |

| CHF | Switzerland | Franc |

| CAD | Canada | Dollar |

| AUD | Australia | Dollar |

There are 21 [6 + 5 + 4 + 3 + 2 + 1] possible pairs to trade with just these seven currencies. Adding the New Zealand dollar—NZD—brings that total to 28.

FOREX currency symbols are almost always three letters, by which the first two letters identify the name of the country and the third letter identifies the name of that country’s currency. (The CH in the Swiss Franc acronym stands for Confederation Helvetica.)

Once again: A FOREX transaction is always between two currencies. This often confuses new traders coming from the stock or futures markets in which every trade is denominated in dollars. The price of a pair is the ratio between their respective values. Pairs, crosses, majors, minors, and exotics are terms referencing specific combinations of currencies. I discuss these terms in Chapter 5, “The Language of FOREX.” They are also defined in the Glossary.

Who Trades on the Foreign Exchange?

There are two main groups that trade currencies. A minority percentage of daily volume is from companies and governments that buy or sell products and services in a foreign country and must subsequently convert profits or protect costs made in foreign currencies into their own domestic currency in the course of doing business. This is primarily hedging activity. The majority percentage now consists of investors trading for profit, or speculation. Speculators range from large banks trading 10,000,000 currency units or more to the home-based operator trading 10,000 units or fewer. Retail FOREX, as much as it has grown in the past 10 years, still represents a small percentage of the total daily volume but its numbers and significance are growing rapidly.

Today, importers and exporters, international portfolio managers, multinational corporations, high-frequency traders, speculators, day traders, long-term holders, and hedge funds all use the FOREX market to pay for goods and services, to transact in financial assets, to reduce the risk of currency movements by hedging their exposure in other markets or to simply attempt to profit by price movements.

A producer of widgets in the United Kingdom is intrinsically long the British Pound (GBP). If he signs a long-term sales contract with a company in the United States, he may wish to buy some quantity of the USD and sell an equal quantity of the GBP to hedge his margins from a fall in the GBP.

The speculator trades to make a profit by purchasing one currency and simultaneously selling another. The hedger trades to protect her margin on an international transaction (for example) from adverse currency fluctuations. The hedger has an intrinsic interest in one side of the market or the other. The speculator does not. Speculation is not a bad word. Speculators add liquidity to a market, making it easier for everyone to transact business. They also absorb risks that exist in the marketplace and help set efficient prices. This latter differs from the gambler, who creates risks in order to take them.

Speculators may trade at different price and time levels. Activity ranges from high frequency (HF) and ultra-high frequency (UHF) trades that may have a duration of just seconds to position trading, which may have a duration of weeks or months. Most speculators at the retail level are in between those two extremes.

Retail refers to the individual trader using one of the many online currency broker-dealers to work the FOREX markets. At one end are small part-timers playing mostly at a hobby with 10,000 mini lots. At the other end are large professional traders trading 250,000 bank lots.

Institutional refers to the big boys and girls trading for banks and hedge funds in lots of 10,000,000 or more. To a degree, they provide the liquidity so you and I can participate at the retail level.

How Are Currency Prices Determined?

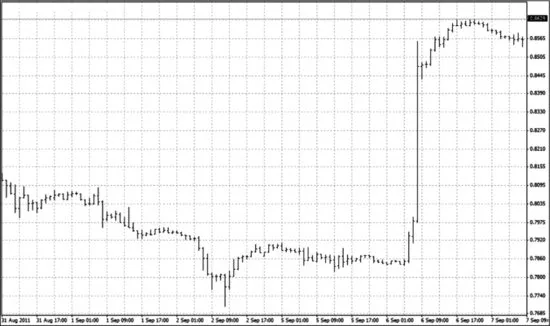

Currency prices are affected by a large matrix of constantly changing economic and political conditions, but probably the most important are interest rates, government intervention, economic conditions, international trade, inflation or deflation, political stability, and in some cases, armed conflict. Governments sometimes actually participate in the foreign exchange market to influence the value of their currencies. Governments do this by flooding the market with their domestic currency in an attempt to lower the price or, conversely, buying in an effort to raise the price. This process is known as central bank intervention and it can result in dramatic, if short-lived, movement for the currency involved. See the USDCHF chart in Figure 1.1 as an example. Prices soared 500 pips in less than one hour.

The USD appreciated over 500 pips in just one hour on September 6, 2011. This represents a $5,000 move on a standard 100,000-lot trade of the USDCHF.

Any of these factors, as well as large market orders, can cause high volatility in currency prices. Reports of sudden changes in such factors as unemployment can drive currency prices sharply higher or lower for a short time. In fact, news traders specialize in attempting to capitalize on such surprises. Technical factors, such as a well-known chart pattern, may also influence currency prices for brief periods. The size and volume of the FOREX market, however, make it impossible for any one entity or factor to drive the market for any length of time. Crowd psychology and expectations also figure in the equation, determining the price of a currency relative to another currency. As in all financial markets, perception may be reality at any given time. A factor that may have traders’ attention for weeks may suddenly fall to the side as another factor grabs attention. There are an enormous number of correlations between all these factors and they are almost certainly nonlinear in nature. That means they are constantly changing and rearranging themselves, sometimes in ways simply not quantifiable or predictable. Now you see it, now you don’t. If you focus on one or a few of them, the others might change unnoticed. Quantum theory comes to mind.

Tip: Money ultimately flows where it can get the best return with the least risk; this is also true of currencies. As the equation changes, the flow moves back and forth, causing prices to move up and down. This also explains why currencies move in bands—however large—rather than trends. Unless a country goes ...