![]()

PART 1

THE CREDIT RISK FRAMEWORK

![]()

CHAPTER 1

Definitions and Concepts

Learning objectives

After studying this chapter, you should be able to:

1 Discuss what credit is and the different types of credit

2 Understand the evolution of credit markets

3 Define what credit risk is and the various frameworks for evaluating and managing it

4 Outline the key components of credit portfolio risk analysis and how they are applied in practice

5 Describe methods and systems for measuring portfolio performance

Introduction

“Credit,” the English writer Charles Dickens famously said, “is a system whereby a person who can’t pay gets another person who can’t pay to guarantee that he can pay.” The near collapse of the U.S. financial system in 2008 under the weight of an enormous and growing pile of bad housing loans suggests that Dickens had a point. Extending credit to anybody or any business or group entails risk.

To be successful and stable, any bank needs to have a clear understanding of the risks it is taking with each loan or extension of credit, evaluate those risks, and manage them as a portfolio. The aim is to take on only as much risk as the financial institution can sustain, given the capital it has available.

In this chapter,1 we discuss the basic frameworks and concepts of credit risk management—what credit is, the various types of credit, and the many ways and means of evaluating and managing credit risk. We will also examine the fundamental components of credit portfolio risk analysis and performance measurement. This will lay the necessary groundwork for deeper discussions in later chapters of credit instruments including credit derivatives and structured credit products and the wide range of credit risk management tools.

What is Credit?

Credit is usually defined in terms of the borrowing and lending of money. The most basic form is a loan granted to a borrower, who may be a consumer or a company. Credit can also take the form of a financial instrument that entails fixed payments determined up front and made over a set time period.

These traditional credit instruments include fixed-coupon bonds and floating-rate loans. The coupon payments are determined by adding a spread, or interest rate differential, to an underlying benchmark rate such as the U.S. Treasury rate or the London Interbank Offer Rate, or Libor, the rate at which large banks lend to each other.

Types of Obligors

Lending to consumers—individuals taking out home mortgages, putting on credit card balances, and asking for consumer loans—is expanding across Asia, especially in China and India, where economic growth is expanding the ranks of the middle class. Economic growth is also driving the rise in corporate borrowing.

In addition to direct borrowing, corporations are also the most frequent issuers of the types of debt instruments referenced here. They are not the only borrowers, also referred to as obligors, in the financial system. Other borrowers include governments (commonly referred to as sovereigns) and supranational organisations such as the World Bank.

The credit risk of all these instruments depends on the ability of the sovereign, corporation, or consumer to generate enough cash flow through earnings, operations, or asset sales to meet the future interest and principal payments of the outstanding debt.

As innovative financial instruments have been developed in recent years, the definition of credit has expanded to cover a wider variety of exposures including those involving derivative contracts, whose risk and payoffs depend on the credit risk of some other instrument or entity. The obligors of these instruments are usually investment banks and other financial institutions (the protection seller, which is effectively the borrower) that isolate the credit risk of a reference obligor by linking the value of the debt instrument to the solvency of that reference obligor and to that alone.

A credit default swap (CDS) is an example of such an instrument. The contract requires the protection buyer (effectively the lender) to pay a regular fee (or spread) to the protection seller. In the event the reference obligor defaults as specified in the CDS contract, the protection seller is required to make the protection buyer whole, or pay compensation or whatever obligations are required by the terms of the contract.

While a CDS refers to a single named reference obligor, derivative contracts on indexes of many named such obligors can also be purchased as contracts on a specific basket of assets. These instruments expand the ability of credit portfolio managers to manage a large number of exposures without always having to resort to hedging on a single specific obligor’s risk or selling assets outright.

Credit Exposures

The bank exposes itself to credit risk when it lends money directly, buys debt instruments issued by corporates, sovereigns, and supranational organisations, and invests in CDS and other derivatives.

Sometimes a credit exposure does not reflect actual cash being loaned right away. Instead of a straight term loan, a bank may extend a commitment to lend with a variety of conditions on the borrower. We typically refer to loans where cash is actually disbursed as funded and commitments to lend as unfunded. A contractual commitment to lend exposes the bank to risk even if funds have not actually been transferred to the obligor.

Credit exposures like these can be deconstructed into a risk-free debt instrument and a collection of other options including default, prepayment, and interest rate adjustment, among others. Most credit instruments represent a portfolio of options.

Credit exposure also arises in the case of more traditional derivative transactions such as equity options and interest rate swaps. When such a derivative is in-the-money, or can be exercised at a profit by one part to the contract, the market risk—the risk arising from changes in quantities driving the value of the derivative—must be considered separately from the credit risk. The implicit credit risk may become significant when systemic events impact the entire market.

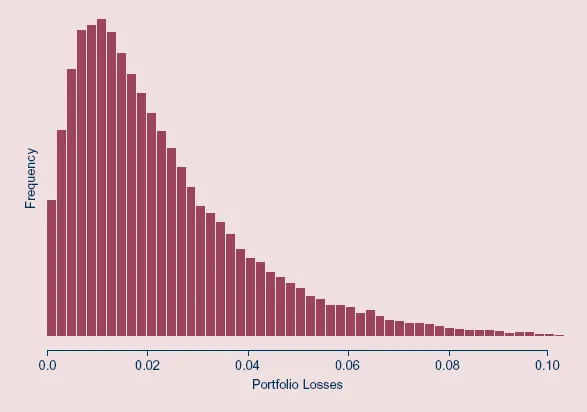

The main feature of these different types of credit exposure is the shape of the distribution of losses. Credit exposures are typically characterised by skewed, fat-tailed return distributions. That is, the lender or originator of an exposure has a high probability of receiving its principal back plus a small profit over the life of the exposure and a low probability of losing a significant portion of the exposure. Figure 1.1 shows a sample credit loss distribution.

What this means is that there is a high chance that many borrowers will repay, but that if they do fail to repay, they tend to do so severely. The correlation or interconnection among credit exposures tends to be quite low compared with, say, the correlation of equity exposures.

This low correlation coupled with the chance of losing a substantial amount on any one exposure makes these securities particularly well suited for management in the context of a large, well-diversified portfolio. If a bank’s portfolio contains only small bits of each exposure, the occasional extreme loss for any one exposure will tend not to affect the portfolio’s overall performance. Thus, diversification can buy stability in the portfolio’s loss profile.

Credit Asset Classification

There are credit asset classifications that are employed to assess credit risk:

- Sovereign exposures: These include credit extended to governments or sovereign states, regional groupings such as the European Community, central banks such as the U.S. Federal Reserve Bank or the European Central Bank, and international or regional financial institutions such as the International Monetary Fund, the World Bank, the Asian Development Bank, and the Bank for International Settlements (BIS), which acts as something of a bank for central banks.

- Bank exposures: These are exposures to banks and financial institutions including securities firms that are subject to supervisory and regulatory frameworks such as risk-based capital requirements similar to those that apply to banks. In other cases, securities firm exposure is treated as a corporate asset.

- Corporate exposures: These include exposures to companies, both those with or without a credit rating, including insurance firms.

- Residential mortgage loans: These are credit exposures secured by residential or rental properties and include second mortgage insurance. In Hong Kong, the HKMA requires homebuyers to make a down payment of 30% of the purchase price (40% for homes valued above HK$20 million) to secure a mortgage.

- Regulatory retail exposures: These include exposures that meet or are subject to a range of market-specific qualifying criteria or regulatory requirements set by the Hong Kong Monetary Authority (HKMA) relating to:

i. orientation – These include exposures to individuals or small businesses, defined as enterprises with a turnover of less than HK$50 million

ii. product – These include retail products such as a revolving line of credit but exclude securities including bonds, equities, and mortgage loans

iii. granularity – To ensure diversification of risk, no aggregate exposure to one counterparty can exceed 0.2% of the entire regulatory retail portfolio

iv. value of individual exposure – Aggregate single counterparty exposure must be less than HK$10 million

- Classified debts: These include such exposures as past due loans including unsecured portions of loans and those overdue by over 90 days, claims on corporations rated below BB−, claims on sovereigns, non-central government public sector entities (PSEs), banks and securities firms rated below B−, and securitisation tranches rated between BB+ and BB−.

Evolution of Credit Markets

The modern notion of credit began in pre-industrial Europe in the context of commercial payments. Credit was typically extended by deferring payment for goods sold or advancing payment for future delivery of goods purchased. Over time, these debts began to be treated as fungible or exchangeable for similar instruments and could be assigned to other merchants.

Eventually, settlement systems evolved. Deposit banking developed in response to the need for assignment of third-party debt among strangers. Since the bank became the counterparty for multiple transactions, it could net a large number of payments without resorting to final cash settlement.

This enabled pre-industrial banks to offer a solution to the problem faced by merchants, that of liquidity risk, a short-term lack of cash preventing completion of a particular transaction.

Since depositors in the bank found it convenient to leave their money with the banker so that settlement of transactions could be done without having to lug around actual coins, the bank now had a store of deposits to use as the basis for making an overdraft loan. The bankers discovered that they could extend credit beyond the quantity of actual coins or gold on deposit since most depositors did not demand access to all of their deposits most of the time.

Rise of Leverage

This is how leverage in financial institutions began. Since the banker knew his clients well, the bank could use its knowledge of the capacity of a potential borrower, who is likely to be a depositor, to repay a loan and allow this individual to periodically overdraw his account. Eventually, these short-duration, relatively small overdraft loans were supplemented and then overtaken by longer, larger commercial loans.

Credit has evolved in many different ways. It can now be extended not only in the form of loans, but also in the form of bonds traded in a global capital market. Computers have replaced written ledgers and money has become virtual, represented as digitised bits stored in computer hard drives. Along with technologi...