![]()

Chapter 1

Freeing Your Estate from Conventional Thinking

Here’s an example of conventional thinking. Talking head after talking head preaches that you make extra payments and pay off your mortgage early. You’ll save tens of thousands of dollars in interest and will own your home outright sooner.

What are you doing by paying extra into the home? You are creating a situation that makes the mortgage holder salivate. Each time you pay extra, you place more money in their hands for them to invest for THEIR wellbeing, and you also lower THEIR risk. Let me repeat this. As you put more equity into the home, the mortgage gets smaller, and there is more equity protecting the lien holder in case you can’t make your mortgage payment for whatever reason. Death, disability, and divorce are common unforeseen reasons. If their risk is decreasing, what is happening to your risk? It is going up! You have the most to lose if you can’t pay your mortgage, and they take your home to auction and only cover what is owed to them, the mortgage balance. Auctions are not meant to protect the seller; they are meant to protect the lien holders.

I had a physician client who had not made a payment to the bank in 28 months on a $1.6M mortgage due to health issues that kept him from working. His monthly payment was around $9,000 and again, he stopped paying it twenty-eight months prior. The amazing thing was the lender, instead of sending him foreclosure notices, was sending him get well cards. The primary reason was his house that was located in Beverly Hills California was currently only worth around $1.4M, and the lender knew they would take a significant loss if they tried to foreclose.

Conversely, I saw another situation where a senior was not able to make her mortgage payments, and like clockwork the foreclosure process in her case was painfully expedient. The reason, as you can probably ascertain, was she had lots of equity in her house. She had dutifully paid down the mortgage balance over 20 years, as conventional financial wisdom commonly suggests. Because her financial situation deteriorated and she couldn’t keep up with the payments, she was forced to sell her house in a fire sale before the lender repossessed it.

An Unconventional Approach

Here is what I call unconventional or uncommon knowledge. Instead of paying extra equity into your home, make the exact same payment into a side investment account—something that can potentially earn 5 to 6 percent each year and compound on itself, and is fairly liquid. Even something with surrender charges will work. In the same time you would have paid off your house, the side investment account will have grown to equal your remaining mortgage balance—in actuality, faster. At that point, you can take your side account, pay off your mortgage all at one time and own your home outright. I’ll explain ways to help earn the 5 to 6 percent in Chapter 6, but for now, assume you can achieve those results.

There are many advantages to this financial strategy.

First, you have an emergency reserve of immediate cash. Is equity in your home more liquid than a side account? No way. Unless you have a line of credit already established and it hasn’t been taken away, like so many have been since 2009, then your equity in your home is stuck.

Without a pre-existing line of credit, you could apply for a line of credit, refinance your mortgage, or sell your home to unlock the equity to pay for your emergency. Today, all three choices are exceptionally difficult and time consuming. In an emergency, you usually do not have the luxury of time.

Second, by not paying down your mortgage, you will retain more mortgage interest to deduct on your tax returns, which will give you greater tax rebates from Uncle Sam. If you really want to be aggressive with your saving, take the rebate generated from the interest deduction and deposit it in your side account. There is a limit to mortgage interest that is deductible, but most homeowners are not affected by the limit.

In Summary

The point of this example is this: An idea might sound good on the surface, but only until you dive in and begin to analyze the logic behind it do you get the right answer, which can be very different or even the exact opposite. Conventional thinking in finance has caused a lot of pain and hardship for people, and often it has been promoted by the groups that have a vested interest in staying the course.

![]()

Chapter 2

The Best Portfolios Are Mixtures of Many Different Asset Classes

The only guarantee in finance is something will go wrong.” This is the Wealth Code Golden Rule and a statement I like to make to every client who joins my firm or comes in for financial education. I tend to repeat it time and time again to reinforce the concept that everything has risk and at some point something will not go as planned.

Take a certificate of deposit at your local bank. FDIC insured, correct? It’s comforting to know you have that guarantee as long as you stay below the protection limits. The sad part, when looking at the assets of the FDIC, or really the lack thereof, is that the FDIC really boils down to being a front for the Federal Reserve which will essentially cover any losses that are FDIC protected in case your bank goes belly up.

In 2005 you probably felt pretty good about the 5 percent the banks were paying on the typical one-year certificate of deposit (CD). You might have looked at your income needs and calculated that at 5 percent you would be doing okay. The problem of course is when that one year term ended and the new rate dropped to 2 percent; now you were in a pickle and the income you counted on took a hit. The previous rate was not guaranteed forever. The drop in the CD rate from 5 percent to 2 percent in 2006 and even lower to 1 percent in 2009 and possibly even lower in the foreseeable future really put a damper on your income and financial well-being.

The other likely outcome of CDs is losing to inflation. There’s only been one decade where CDs have outperformed inflation and that was in the 1980s. Oh, the days of neon and hairspray.

The Real Meaning of Portfolio Diversification

Knowing that the only guarantee in finance is that something will go wrong can be a very powerful tool to have in your financial tool chest. Most people will say they understand it, yet when I look at their portfolios, which are comprised of only one or two asset classes, I would beg to differ.

Take for instance the word diversification. You may have been told that if you have lots of stocks, bonds, and mutual funds, you are diversified. In actuality, your portfolio has a lot of only one asset class-equities.

There are many asset classes to invest in, and I believe the best portfolios are mixtures of many different asset classes.

Basketball is a great way to demonstrate the concept of a True Asset Class diversified portfolio.

Does it seem a bit unfair that in the Olympics the USA basketball team has the best players from the NBA all working together? By cherry picking the superstars from each team—knowing their statistics, their abilities, and track records—and crafting them together to make a super team, Team USA fields the most competitive team available.

I was watching a game between team USA and team Argentina in the 2012 Summer Olympics; the final score was 126 to 97. Pretty close compared to other matches that team USA had already played. I noticed during the game that players would substitute in and out. At one point Kobe Bryant, the superstar from the LA Lakers, took a five-minute break. Lo and behold, the score became more and more imbalanced, even though one of the greatest players in the NBA was not on the court. Why? Because LeBron James, Kevin Durant, and others were still playing, and each was a superstar in his own right. I would argue that if Kobe Bryant had broken his leg in this game, LeBron and the rest of the guys still would have won and eventually still would have captured the gold medal.

If Kobe broke his leg during the regular season with the Lakers, it would have a devastating outcome for his team because Kobe is the all-star of his team. His team is not really diversified. But, on the Olympic team, he is one of many all-stars, and it would have been a minor setback for Team USA at best.

The difference in skill between the Lakers and the all-star Olympic team is the same as the difference between a portfolio that got crushed in 2008 and one that survived the storm and actually grew because of true diversification.

True diversification is the philosophy of a Wealth Code portfolio. It requires bringing many different asset classes together for the purpose of consistent wealth building.

Diversification is a word that means different things to different people. It is supposed to make people feel better about their investments and believe that they are doing the right thing. The problem is the viewpoint of the person promoting the idea. As previously discussed, most financial advisors view the world in two colors: stocks and bonds.

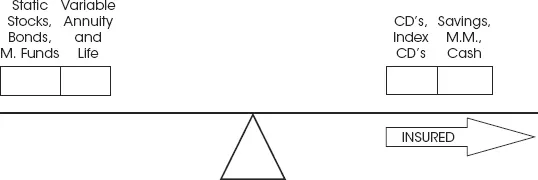

I will proceed to show you one prevalent view of diversification and then my own view. One common viewpoint of the financial world looks like the teeter-totter in Figure 2.1.

This example of diversification includes stocks, bonds, mutual funds, ETFs, variable annuities, and CDs, which I jokingly call Certificates of Depreciation or Disappointment. More on that later.

If I were a carpenter and I had a business building one-legged dining room tables, it’s easy to imagine that these tables would fall over due to instability at the slightest push, and my business wouldn’t last very long (Figures 2.2 and 2.3). No one would be silly enough to buy a one-legged table because ultimately it would not do the job intended—provide a stable platform for eating.

Stocks, bonds, mutual funds, ETFs and variable annuities represent essentially one asset class, or one leg of a multi-leg financial table. The other le...