![]()

PART I

ETF BASICS

![]()

CHAPTER 1

ETFs from Evolution to Revolution

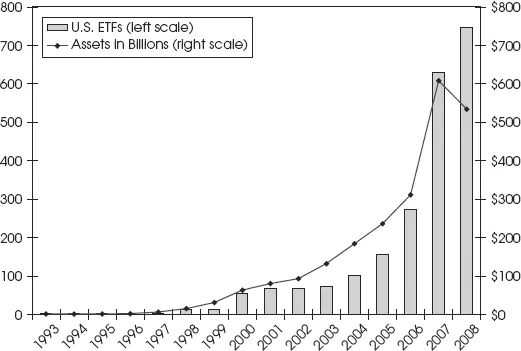

Exchange-traded funds (ETFs) have emerged from their fledgling beginnings in 1993 to a full-blown revolution in the mutual fund industry. The number of ETF offerings increase by the hundreds each year. ETFs available for investment rose more than tenfold between December 2003 and December 2008, from 71 to 747, including a 221-fund increase in 2008, during a brutal bear market. It is not possible to predict when the growth will slow. New ways of using ETFs in portfolios as well as product innovation will ensure a robust new issue market going forward for many years. There are reasons to believe that the total number of ETFs will double or triple again before any slowdown occurs.

There are many different types of exchange-traded products including exchange-traded funds (ETFs), exchange-traded notes (ETNs), grantor trusts, and unit investment trusts (UITs). Chapter 3 has a detailed discussion on these types and others. For convenience, all exchange-traded products in this book are referred to as ETFs unless otherwise indicated.

The best place to begin a study of ETFs is at the beginning. This chapter highlights the events that led to the creation of ETFs and how the marketplace has evolved over the decades. The chapter takes us to a point in the evolution where we are today and looks at where the industry is likely to go in the future.

ETFs Are a Growth Industry

There was only one ETF on the market at the end of 1993, and it had assets of $464 million. There were still only two ETFs trading on U.S. exchanges by the end of 1997, with assets totaling $6.2 billion. Then the idea started to catch on. ETF issuance began to accelerate as more investment companies entered the marketplace. Today, more than 25 companies issue ETFs, and many new entrants entering the marketplace. The acceleration in the growth of the ETF marketplace has been impressive, as is illustrated in Figure 1.1. Several hundred offerings await Securities and Exchange Commission (SEC) approval.

ETFs are the big growth story in the mutual fund industry. At the present time, more than 50 percent of all U.S.-traded ETFs have been on the market for less than three years and the new-product pipeline is filled to the brim as hundreds of new funds await SEC approval. Old-line mutual fund companies, such as PIMCO, are entering the market, and new ETF companies are being created by venture capital firms looking to gain a foothold in the industry. A few of those new companies will stay independent while others will be gobbled up by large mutual fund providers as they scramble to get into the business. Table 1.1 lists the major players in the market and their position in the industry.

Table 1.1 Major U.S. ETF Providers

Source: State Street Global Research, February 2009.

| Manager | Number of ETFs | Market Share |

| BlackRock∗ | 180 | 47% |

| State Street Global Advisors | 83 | 28% |

| Vanguard | 38 | 9% |

| PowerShares | 119 | 3% |

| Bank of NY | 6 | 4% |

| ProShares Advisors | 76 | 5% |

| Rydex Investments | 40 | 1% |

| WisdomTree | 50 | 1% |

| Claymore | 34 | 1% |

Certainly there will be fund failures and fund mergers as the number of ETFs outstrips demand. A critical level of assets is needed to make a fund profitable. That level of assets, however, tends to be lower than for other types of mutual funds because ETF operational expenses are lower (see Chapter 4). There were 46 fund closures in 2008, as Northern Trust and XShares exited the marketplace. Neither company had attracted more than $40 million in total fund assets.

A Short History of Mutual Funds

Understanding how ETFs evolved begins with a brief history of the mutual fund industry and the laws that govern it. Mutual funds are not a new investment. In fact, historians believe the idea is as old as the country itself. The first mutual fund originated in the Netherlands at the same time the United States was fighting for its independence from Great Britain.

Where It Began

The introduction of the mutual fund and the American Revolution had nothing to do with each other, except that after the Revolution, some of the money needed for U.S. reconstruction was financed by mutual fund investors from abroad. At that time, the United States was a fledgling emerging market, and foreign investors were speculating that the country would succeed. The idea is no different from U.S. investors today placing money in emerging countries that have just come through a political revolution.

A 2004 paper titled The Origins of Mutual Funds by K. Geert Rouwenhorst of the Yale School of Management documents the industry through the early 1900s. Rouwenhorst found that in 1774, a Dutch merchant and broker invited subscriptions from the public to form a pooled investment trust named Eendragt Maakt Magt, “Unity Creates Strength.” The creation of the trust followed a financial crisis that occurred in that country during 1772 and 1773. It is common in the financial trade for innovation to follow financial crisis. We will later see how a financial crisis in the twentieth century led to the innovation of ETFs in the United States.

Eendragt Maakt Magt was created to provide small investors with limited means to invest in profitable ventures and control risk through diversification. The trust was surprisingly transparent and well managed. The fund was composed of securities from Austria, Denmark, Germany, Spain, Sweden, Russia, and a variety of colonial plantations in Central and South America. More than 100 different securities were regularly traded on the Amsterdam exchange, and at one time or another, most of those investments were part of the trust. Prices of the most liquid securities were made available to the general public in a biweekly publication, which also listed local real estate transactions and announced dividends paid by securities traded on the Amsterdam exchange and any new security offering.

The trust existed for nearly 120 years and still holds the record for the longest investment of its kind to have existed. The fund survived many financial and political crises, including a steep decline in the value of U.S. assets as that emerging market engaged in a costly civil war. The trust also passed through several management changes and a number of name changes before officially dissolving in 1893.

Eendragt Maakt Magt was not the only way for foreigners to invest in emerging markets. During the 1780s and 1790s, more than 30 investment trusts emerged with a single objective: speculation on the future credit of the United States. Together with France and Spain, the Netherlands was one of the major financiers of the young United States.

Funds Come to the United States

Investment trusts were first introduced to U.S. investors during the 1890s. The Boston Personal Property Trust was formed in 1893 and was the first “closed-end” fund to trade on the U.S. stock market. It operated the same way today’s closed-end funds work. The new fund offered shares to the public for a limited time, and then the offering was closed. Investors could not withdraw money from the fund, but they could sell shares on the stock exchange and in private transactions. Investors thus had liquidity when they needed it.

Closed-end mutual funds raise cash for investment by selling a fixed number of fund shares. Then a fund manager invests the cash from the sale of shares in accordance with the fund’s investment objective and policies. The shares are then listed on a physical stock exchange or trade in the over-the-counter market.

A closed-end fund does not need to liquidate securities to meet investor demands for cash or to purchase securities to invest the proceeds of investor purchases. Because the fund is not subject to the demands of investors for cash, it may invest in less liquid portfolio securities. For example, a closed-end fund can invest in securities traded in countries that do not have fully developed securities markets. Many closed-end funds used leverage to potentially boost returns (and always boost management fees). Leverage is still common in closed-end funds that trade on the markets today.

Like other publicly traded securities, the market price of closed-end fund shares fluctuates on the basis of supply and demand for the fund shares. The market price of a closed-end fund may not be the same as its underlying net asset value (NAV) because demand for the fund may be different from the demand for the underlying securities in the fund. By law, the fund company cannot make a market in its own fund, or issue or redeem shares when there is a difference in price between the shares and the underlying NAV. The premiums and discounts in price that occur in closed-end funds is a major disadvantage of that structure and have prevented them from becoming more popular.

Open-End Funds Introduced

The creation of the Alexander Fund in Philadelphia, Pennsylvania, in 1907 was an important step in the evolution toward an open-end mutual fund and solving the problem of price discrepancy in the closed-end structure. The Alexander Fund featured semiannual issues and allowed investors to make withdrawals directly from the fund at NAV prices. It was the first time a mutual fund had windows where old shares could be redeemed and new shares created at regular intervals.

The Massachusetts Investors Trust (MIT) became the first U.S. mutual fund with a modern open-end structure in 1924. MIT allowed for the continuous issue and redemption of shares by the investment company at a price that is proportional to the NAV. Each day after the markets closed, open-end mutual fund companies computed the NAV of the underlying stocks, bonds, and cash in their funds and determined a fair price per share. Investors received the NAV when they redeemed mutual fund shares. The NAV price was also quoted in newspapers on a regular basis.

The open-end method allows each fund company to create or redeem shares as needed to satisfy investor demand. Creation and redemption was done only once per day, at the end of the day, based on the fund’s ending net asset value. The open-end structure quickly became the standard for mutual fund organization in the United States as State Street was quick to launch its open-end fund in the same year as MIT.

Investors paid a commission to buy shares of an open-end fund. That commission went to the salesperson selling the shares. During the 1920s, banks were the leading issuers of open-end funds and closed-end trusts. Tellers sold shares to depositors, and sometimes the banks would let depositors borrow up to 100 percent of the money to buy shares. The liberal lending practices of banks ultimately led to the downfall of many small investors and the introduction of the first Glass-Steagall Act. For nearly 75 years, banks have been prohibited from selling stocks and mutual fund investments.

There continued to be innovation in the mutual fund industry during the Roaring Twenties. Scudder, Stevens and Clark launched the first no-load fund in 1928. A no-load fund has no commission. It is purchased and redeemed by the fund company at its NAV. That same year also saw the launch of the Wellington Fund, which was the first mutual fund to include both stocks and bonds. Only stock funds existed before that time.

By 1929, there were 19 open-end mutual funds competing with nearly 700 closed-end funds in the United States. After the stock market crash, however, from 1929 to 1932, many highly leveraged closed-end fund investors were wiped out. The deep discounts to NAV at which closed-end funds were sold during the early years of the depression caused dissent among investors, and that allowed open-end funds that redeemed at NAV to take center stage when the stock market recovered in the mid-1930s.

Government regulators also began to take notice of the antics in the mutual fund and trust industry. The creation of the Securities and Exchange Commission led to the passage of the Securities Act of 1933 and the enactment of the Securities Exchange Act of 1934. These regulations put safeguards in place to protect investors. Companies issuing stocks had to submit regular financial statements. Mutual funds were required to register with the SEC and to provide disclosure in the form of a prospectus. A few years later, the Investment Company Act of 1940 put in place additional regulatio...