![]()

CHAPTER 1

History

In our view, however, derivatives are financial weapons of mass destruction, carrying dangers that, while now latent, are potentially lethal.

—Warren Buffett, letter to shareholders, 2002

Derivatives have often been characterized as dangerous tools of financial speculation, invented by mathematicians who are out of touch with reality, then sold by unscrupulous salesmen to gullible customers who do not understand the risks they are taking. They have been blamed for most periods of modern financial turmoil, including the 1987 crash, the bankruptcy of Barings Bank, the meltdown of Long Term Capital Management, and the current “subprime crisis.” Like many populist misconceptions, there are germs of truth in this straw man, but the full truth is far more nuanced, complex, interesting, and profitable to those who understand.

Derivatives are as old as recorded history. The first reference we have to derivatives is in Genesis 29. Jacob entered an agreement that obligated him to work for seven years in exchange for the hand of Rachel. However, after Jacob had fulfilled his part of the contract, Rachel’s father, Laban, defaulted on his obligations and made Jacob instead marry his elder daughter, Leah. So Jacob entered another agreement in which he again worked for seven years in order to marry Rachel.

• This was a forward agreement where Jacob paid (in labor) in return for something (Rachel) to be delivered at a certain time in the future for something (Rachel) to be delivered at a certain time in the future (seven years).

• Laban defaulted, by not carrying out his obligations under the contract, making this not only the first derivative we know of but also the first default.

• Jacob may not have been a great trader. He entered a contract at a high price, was cheated, and then did the same thing again.

The first unambiguously historical reference to options is in “The Politics” by Aristotle. He tells the story of the philosopher Thales of Miletus who lived from 624 to 527 B.C. It seems that Thales eventually grew tired of hearing variants of the question, “If you are so smart why aren’t you rich?” and resolved to show that learning could indeed lead to riches. According to Aristotle:

He, deducing from his knowledge of stars that there would be a good crop of olives, while it was still winter raised a little capital and used it to pay deposits on all the oil-presses in Miletus and Chios, thus securing an option on their hire. This cost him only a small sum as there were no other bidders. Then the time of the harvest came and as there was a sudden and simultaneous demand for oil-presses, he hired them out at any price he liked to ask.

Thales actually bought a call option. The deposits bought him the right, but not the obligation, to hire the presses. If the harvest had been poor, Thales would have chosen not to exercise his right to rent the presses and lost only the initial deposit, the option premium. Fortunately, the harvest was good and Thales exercised the option. Aristotle concludes,

He made a lot of money and so demonstrated that it is easy for philosophers to be rich, if they want to.

I do not doubt that the trade was profitable, but at the risk of contradicting a philosophical giant, I need to emphasize that making money is never easy. However, Thales clearly shows that being smart is helpful when trading options.

We can also find other examples of option contracts in the ancient world. Both the Phoenicians and the Romans had terms in their maritime cargo contracts that would today be considered options. It seems likely that options were commonplace in the shipping industry, so we should not be too surprised when their use spread geographically, particularly to another nation with a seafaring history.

The United Kingdom is now one of the world’s great financial centers, but the medieval English church was not particularly pro-business. It specifically forbade charging interest for loans. To get around this, a loan would be structured synthetically using the principles behind the put-call parity theorem that we shall encounter later. It could therefore be argued that options are thus more fundamental than mortgages.

The first modern financial scandal involving derivatives took place in another prominent marine trading nation: Holland in 1636. This is an interesting case. Trade in tulips was conducted through a futures market. Dealers and growers would agree on prices before the crop was harvested. As prices rose throughout the 1630s, many German burgomasters began to purchase futures contracts as pure speculation. In February 1637, prices crashed.

Sometimes the reason for this crash is given as the defeat of the Germans by the Swedes in the Battle of Wittstock of October 1636. According to this theory, demand for tulips collapsed as the German nobles had more important things to attend to. However, this is probably a case where we are trying to find a single cause for an event that does not have one. The Battle of Wittstock took part well into the Thirty Years War (1618-1648). In this war, somewhere between 10 and 20 percent of the German population was killed. One could well guess that the German nobles were already concerned about this. Why one battle would cause a crash in the tulip market is not obvious.

Whatever the reason for the crash, the Dutch local politicians were now faced with paying above-market prices for their bulbs and they responded in the typical way for their profession: they changed the rules. After initially trying to renege on their commitments, they turned them into options. Now they would not have to buy the tulips unless the crop prices were higher. As compensation to the short futures holders, they arranged a small premium payment to be made. After this, these options became traded speculative vehicles. One of the most important things for derivative traders to remember is that the contracts exist only as legal contracts. They are hence subject to changes through the legal system. Traders who have forgotten this have apparently been getting hurt since at least 1636, and probably far earlier than that.

The other famous bubble of the period that featured options was the South Sea bubble of 1720. In return for a loan of £7 million to finance a war against France, the House of Lords granted the South Sea Company a monopoly in trade with South America. The company underwrote the English national debt, which stood at £30 million, on a promise of 6 percent interest from the government. Shares rose immediately. Common stock in this company was held by only 499 people, with many members of parliament amongst them. To cash in on the speculative frenzy, the company issued “subscription shares,” which were actually compound call options. These fueled the fire, but in September of 1720 the market crashed as the management realized that the share price was wildly inflated. As news of insider selling spread, the price tumbled 85 percent. Many people were ruined. Isaac Newton was rumored to have lost 20,000 pounds (this is equivalent to over one million pounds in today’s money). As a result of this crash, trading in options was made illegal in the United Kingdom and remained so until 1825.

Options need not be considered in isolation. Financial engineering is the construction of hybrid derivative products with features of multiple asset classes. This is also not new practice. Early examples were confederate war bonds. The antebellum South had one of the lowest tax burdens of contemporary societies. The hastily assembled Confederacy did not have the infrastructure in place to collect taxes for war financing. In 1863 the Confederacy issued bonds that allowed them to borrow money in pounds. There was also an embedded option that allowed the bondholder to receive payment in cotton. The cotton option gave the bondholder more certainty of payment, as cotton was the south’s largest crop. The catch was that the cotton would be delivered in the Confederacy. This bond was probably more important as a political tool rather than a source of financing. These bonds financed only about 1 percent of the military expenditures, but they were seen as a way of conferring legitimacy upon the breakaway states by being listed in London and having William Gladstone, the Chancellor of the Exchequer and future British Prime Minister, among the holders. Of course, the Union won the war and the Confederacy ceased to exist—and defaulted on all of its obligations.

In the United States options began trading in the eighteenth century. By the nineteenth century an active over-the-counter business in equity options had developed. This market had a well-defined structure. Wealthy individuals would sell blocks of puts and calls to brokers who would in turn sell them to smaller speculators. This arrangement helped to mitigate against credit risk, as the smaller traders were only allowed to purchase options and had to pay in full for the options up front. These options were commonly referred to as “privileges,” because the purchaser had the privilege of exercising the option and calling (or putting) the stock but was under no obligations.

While the market was active, it was not considered socially acceptable. In 1874 the Illinois state legislature made option trading illegal. Other states followed, often because of the idea that speculation was harmful to “real” businesses and was nothing more than a form of gambling. Option trading was generally considered no more legitimate than trading in bucket shops or even participating in outright financial frauds.

Due to the counterparty risk, this market was mainly one of issuance. The options would trade in a secondary market, but this was far more illiquid. Over the next hundred years, this market developed in size but remained over-the-counter.

During this time, traders gradually developed many of the rules of thumb that we still use today. The equivalence of puts and calls was well understood, as were the ideas behind hedging with the underlying and other options. There were also several option pricing models being used by the more advanced traders. In fact it is likely that traders were using the essential features of the Black-Scholes-Merton model in this period.

The first exchange to list standardized contracts was the Chicago Board Options Exchange (CBOE). These started trading on April 26th, 1973. The publication in the same year of the famous Black-Scholes pricing model (now more correctly referred to as the Black-Scholes-Merton model) also boosted the market as more and more people thought they could now successfully price and hedge options. Initially options were listed on 16 stocks. Today options on thousands of stocks, indices, currencies and futures trade on at least 50 exchanges in over 30 countries.

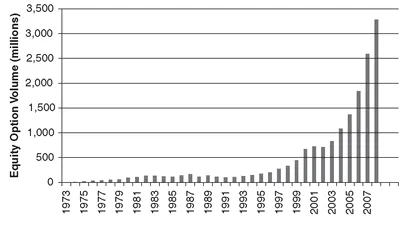

In addition to this enormous expansion of the universe of underlyings, the total activity has increased exponentially. Figure 1.1 shows the total volume in U.S. stock options annually since 1973.

It is currently popular to advocate a dangerous form of financial Luddism in which derivatives are banned, but we can see that even during the turmoil of 2008, volume continued to rise. The main reason for this large and consistent growth is that derivatives are useful and their users like them. They can indeed be used for foolish speculation, but they can equally be used for prudent risk reduction and profitable trading. Even if the dominant use of options was for speculation, this would seem to be a weak argument against them. Practically anything can be used for speculation. There have been speculative bubbles in baseball cards, stamps, classic cars, wine, and coins. The subprime crisis was initiated by people buying property they could not afford. Options may well have been a tool in the speculative bubble, but they were not the root cause.

FIGURE 1.1 The Total Annual Volume in U.S. Stock Options

Another thread of this argument against financial options is that no one really understands them. Actually this argument is normally advanced by people who think they understand options but no one else does. As with all areas of human knowledge, there are indeed things that we do not understand, but many traders have, through study and experience, developed robust, conservative trading methods. In fact, most professional option traders had a relatively good year in 2008, as the high volatility levels increased the spreads they could charge.

Derivatives are an exceptionally useful tool. They have made financial products such as fixed-rate mortgages with early prepayment options widely available and much cheaper than they would otherwise be. They also allow users to tailor their portfolios toward their ideal level of risk. We could not return to a “simple” financial system without also returning to a “simple” economy with a far higher cost of capital and the lower growth that this would generate.

In any case, as a practical matter, derivatives cannot be uninvented. It seems very likely that acquiring a solid understanding of vanilla options will remain useful and profitable.

SUMMARY

• Derivatives are not a modern invention. They have a longer history than either stocks or bonds.

• They have consistently gained in popularity, particularly since they were listed on major exchanges.

• Arguing that they are “too complex” is neither logically or financially sensible.

![]()

CHAPTER 2

Introduction to Options

No one said life would be interesting.

—My parents

—“Squid,” with 15 years’ worth of option-trading experience

The fact that many people try to trade without understanding basic contract specifications has been illustrated several times in the ETF space recently.

Consider the case of the ultra-short ETFs. These are funds designed to return a multiple of the negative daily return of an index. They do this fairly well. However, due to the ways that returns compound, they will not deliver the negative return if we look over a longer period. Table 2.1 looks at the returns of FXI and FXP (which is intended to deliver negative two times the daily returns of FXI) in October and November of 2008.

We can see from this data that the ETF does a reasonable job of delivering the negative two times return each day. The relationship is not perfect, as FXP actually averages −1.75 times the daily return of FXI. This is mainly due to the large bid ask spread slightly distorting the closing prices. But the important point to notice is that over the full period, the FXI total return was 9.0 percent and FXP returned −49.2 percent. This is clearly nowhere close to negative two times the return of FXI. This is not due to any nefarious activity on the part of the fund manager. It is purely the ...