- English

- ePUB (mobile friendly)

- Available on iOS & Android

eBook - ePub

About this book

What does 'rich' mean to you? Perhaps a huge mansion and an overseas holiday every year? A wardrobe and entourage to rival Victoria Beckham's? Or maybe a simple, comfortable house, no debt and a healthy investment portfolio?

However you define it, $0 to Rich will guide you towards achieving your financial goals in five easy steps and show you how to turn $0 into $1000, then $5000, then $10 000!

Written specifically for women by the best-selling author of Shopping For Shares, $0 to Rich is the personal financial coach every girl should have. It will show you how to work out what rich means to you, how to articulate exactly what you want, then how to go about realising that vision over a set period of time.

You'll discover:

- how to create a no-fuss budget to fast-track your financial success

- what the right amount to be saving is

- investment options, from savings accounts to property and everything in between

- how to safeguard your money (after all, it's not enough to just get rich--the trick is staying there!).

Frequently asked questions

Yes, you can cancel anytime from the Subscription tab in your account settings on the Perlego website. Your subscription will stay active until the end of your current billing period. Learn how to cancel your subscription.

No, books cannot be downloaded as external files, such as PDFs, for use outside of Perlego. However, you can download books within the Perlego app for offline reading on mobile or tablet. Learn more here.

Perlego offers two plans: Essential and Complete

- Essential is ideal for learners and professionals who enjoy exploring a wide range of subjects. Access the Essential Library with 800,000+ trusted titles and best-sellers across business, personal growth, and the humanities. Includes unlimited reading time and Standard Read Aloud voice.

- Complete: Perfect for advanced learners and researchers needing full, unrestricted access. Unlock 1.4M+ books across hundreds of subjects, including academic and specialized titles. The Complete Plan also includes advanced features like Premium Read Aloud and Research Assistant.

We are an online textbook subscription service, where you can get access to an entire online library for less than the price of a single book per month. With over 1 million books across 1000+ topics, we’ve got you covered! Learn more here.

Look out for the read-aloud symbol on your next book to see if you can listen to it. The read-aloud tool reads text aloud for you, highlighting the text as it is being read. You can pause it, speed it up and slow it down. Learn more here.

Yes! You can use the Perlego app on both iOS or Android devices to read anytime, anywhere — even offline. Perfect for commutes or when you’re on the go.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Yes, you can access $0 to Rich by Tracey Edwards in PDF and/or ePUB format, as well as other popular books in Business & Women in Business. We have over one million books available in our catalogue for you to explore.

Information

STEP 1

I wanna be ‘RICH’!

There was a time about 15 years ago (when I was very young and naive) that I was in a relationship with a guy who was obsessed with being rich. Everything was about money, about controlling it, keeping it and acquiring it.

He was so obsessed about it that he even tried to control my money. He’d take my pay before I got hold of it and actually give me an allowance from my own money! We had a strict budget for grocery shopping and only bought what was on special; going shopping for clothing or other luxury items was a rarity. We lived very modestly in a small three–bedroom house, and to an outsider we would have looked like any other working–class couple.

So were we rich? No. You see, he didn’t have a plan or any real idea of what ‘rich’ meant. He just thought that if he penny–pinched and controlled every aspect of the finances, one day he’d be wealthy.

Worse, because he didn’t have a plan he was often sucked into really bad schemes that promised, but never delivered, untold riches. I remember one time he spent nearly $8000 on a computer program that was meant to tell you with a degree of accuracy which horse would win a particular race. Of course, you and I both know that was a foolish decision. Yet, even after that failed, he continued to buy into scheme after scheme.

We haven’t been together for a long time, and my life has turned out infinitely richer because of it, but I sometimes wonder how different our lives would have been if we’d sat down, worked out our goals together and made a realistic plan. You see, he could have got rich if he’d wanted to — if he’d just understood the steps needed to get there.

Chapter 1

Defining ‘rich’

By the end of this chapter, you’ll have:

- created a goal sheet listing your dreams for the future

- defined what ‘rich’ means to you

- committed to making changes to control your financial destiny.

Rich, adj. having wealth or great possessions; abundantly supplied with resources, means, or funds; wealthy <www.dictionary.com>

Nice, huh? Who wouldn’t want ‘great possessions’ or to be ‘abundantly supplied with funds’? But the definition seems a little vague. What actually are ‘great possessions’? I mean, ‘great possessions’ would mean something completely different to a Masai warrior than to a family in country Victoria, wouldn’t it? How much ‘wealth’ does it take to be ‘rich’?

‘Rich’ is one of those words that means different things to different people, so defining it can be a bit of a challenge. But if you want to move forward toward a better future, it’s time to think about what it means to you. Throughout this book I’ll be guiding you and helping you to increase your knowledge (and hopefully your bank balances!), but as I can’t be physically there with you, you’re going to have to do some things yourself. So every so often throughout this book I’m going to ask you to do some homework. I want you to do some for me now, in fact! Don’t worry, it’ll be fun — lots of fun actually.

Homework

Get out a pen and some paper, preferably something pretty. A journal would be good, or some patterned letter–writing paper. It doesn’t matter what you pick, as long as it’s something that won’t get confused with an old shopping list and get thrown out by mistake!

Now, I want you to imagine that you’re already rich. You’re living a rich lifestyle, living in your dream house and holidaying at the best places, without a worry about money. Let your dreams run wild and picture yourself surrounded by all the things that you want from life, both financially and emotionally. What do you see? What do you have? How does it feel?

Imagine your perfect future. Do you want to live in a huge mansion with servants at your beck and call, or would you prefer a cosy cottage by the sea? Are you surrounded by books? Family? Plasma TVs? What are you wearing? Eating? Doing? ‘Rich’ doesn’t have to mean a Hollywood lifestyle, though it could if you like.

Now, write down all those things you’d like in your future: everything that you think you’d have if you were rich. They don’t need to be in any sort of order, and you can use words or draw pictures, whatever you want. Just get down on paper what you hope your future will look like, and most importantly, be specific. Don’t just write, for example, ‘a fast car’, or ‘servants’. Do you dream of owning a convertible or a Mini? Do you want your garden professionally landscaped and maintained, or does your ideal life involve spending days pottering in the vegie patch?

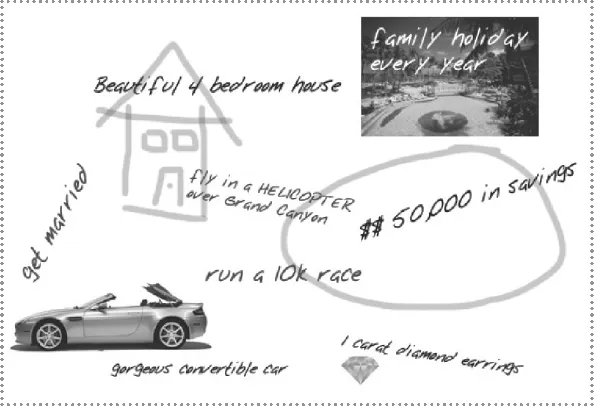

Your worksheet might look something like this:

No two people’s goal sheets are going to look the same, because everyone is different.

Take a closer look at your sheet. Congratulations — you’ve just defined ‘rich’ for you. It’s the first step in creating a fantastic future for yourself. I bet not everything on your list can be bought, because being rich isn’t just about money. Sure, there are probably things on your list that will cost you a penny or two, but I bet there are also things that won’t cost much, if anything.

I know what you’re thinking: ‘i dream about this stuff already and I’m nowhere closer to getting it, so how on earth will writing it down get me closer to being rich?’ Ah, the magic of goals. Once we make them official by writing them down, all of a sudden they become easier to achieve. I don’t really know how it works (The Secret fans will probably swear you’re manipulating the universe’s energy or something); all I know is that it does seem to. If you don’t believe me yet, think of it this way: you need to know your destination before you can begin the journey. Writing down your goals means the plan is in motion.

It’s really empowering to know what you want from life. It means you can ignore all the little distractions that don’t fit in with your plan, and just focus on what’s important to you. And that is what will help you create a rich future.

So now that you know what you want, it’s time to get it — you just need to set some goals, and after all, goals are just your dreams with deadlines added. If you’re willing to take action, I promise you that your life will change.

Chapter 2

Goal–setting 101

By the end of this chapter, you’ll have:

- chosen a goal to start working toward

- determined whether it’s really what you want or just what you think you want.

Long ago, before I got interested in the sharemarket, a friend I’d known since high school excitedly told me that she was buying a house. She’d saved enough money for a deposit and was putting a down payment on a lovely white three–bedroom weatherboard in a trendy Melbourne suburb. Of course, my immediate reaction was, ‘How on earth did she do that?’ I was definitely pleased and excited for her, but also a little bit jealous of her good fortune. How could one of my friends afford to buy a house, when I had nothing to show for my years of working? I think I’d even got into a tiny bit of credit card debt, if I remember right. I’d dreamed of buying my own home, but I never took any steps to make it happen.

That’s the difference between dreaming and planning. My friend and I had the same dream: she was just a little bit smarter than I was then. She knew that if she wanted something, she needed to work out a way to get it, not just dream about it. So she made a plan to buy a house and started saving for the deposit. A few years passed and voila! She was the proud owner of a house in the suburbs.

A few years later, I started setting goals myself, and went from having nothing to buying a car and a house (in expensive Sydney!), and giving up full–time work — because part of ‘being rich’ to me was never having to turn up to a nine–to–five job again. I did all that in five short years, because I had a plan. I also had a plan to write a best–selling book — that’s how my first book Shopping for Shares came about.

Is it really that simple? You just start planning and working on your goals, handle your money responsibly and end up fulfilling your dreams? I think so. I don’t believe that anyone gets rich by accident or luck (unless they were born into a wealthy family, and even then, there’s no guarantee), but that it has everything to do with planning well. It’s not like you wake up one day and say, ‘Oh cool, I got rich today!’ Even lottery–winners need a plan to deal with the money they win — how many do you hear about that have lost the lot within three or four years? It takes careful planning and some good sense to get and stay rich. That’s not to say it’s not fun — it is. What could be more fun than seeing your dreams start to come true? But it takes commitment.

The difference between my life now and my life 10 years ago (apart from a few kilos on my thighs — I really need to make a new plan for that!) is that before I knew better I just let life happen to me. If some money came my way, great, but I certainly didn’t go out of my way to achieve financial freedom. Like a lot of people, I just went with the flow. The trouble with that is you might not like where you’re flowing. If you plan for nothing, you’ll probably achieve nothing.

What you do with your money now will determine if you have any in the future: you need to make a plan about which direction you’re going to take to reach your goals. Look at it this way: at worst, you’ll still end up much further ahead than you are now. So what have you got to lose?

Goal–setting is pretty much the same whether your goal is to bake a cake, take a holiday or save for a house deposit. When you break it down, there are four main components to setting your goals (in no particular order):

1 Work out your final destination, what you want to achieve—your goals

You did most of the work for this step in the last chapter, by writing down everything you’d like to achieve in the future. The dreaming part of goal–setting is always the most fun, because it doesn’t matter if you think it’s realistic or not. You never know what you’ll be able to achieve if you don’t try—who knew I’d be the published author of two great books about achieving financial success?

As I said in the last chapter, it’s important to be specific: be clear about what you want and how much it’ll cost (more on this in a moment), as this will make it easier to work out how long it’ll take you to reach your goals.

2 Determine where you’re starting from

You need to know your financial position before you can decide on the steps needed to reach your goals. I’ve assumed in this book that you’re starting from zero, but you could be ...

Table of contents

- Cover

- Contents

- Title

- Copyright

- Introduction

- About the author

- Dedication

- Step 1: I wanna be ‘RICH’!

- Step 2: Creating a budget

- Step 3: Saving goals

- Step 4: Investing in the big guns: shares and property

- Step 5: Keeping your money safe

- Conclusion

- Index