eBook - ePub

The Granularity of Growth

How to Identify the Sources of Growth and Drive Enduring Company Performance

- English

- ePUB (mobile friendly)

- Available on iOS & Android

eBook - ePub

The Granularity of Growth

How to Identify the Sources of Growth and Drive Enduring Company Performance

About this book

While growth is a top priority for companies of all sizes, it can be extremely difficult to create and maintain—especially in today's competitive business environment. The Granularity of Growth will put you in a better position to succeed as it reveals why growth is so important, what enables certain companies to grow so spectacularly, and how to ensure that growth comes from multiple sources as you take both a broad and a granular view of your markets.

Frequently asked questions

Yes, you can cancel anytime from the Subscription tab in your account settings on the Perlego website. Your subscription will stay active until the end of your current billing period. Learn how to cancel your subscription.

No, books cannot be downloaded as external files, such as PDFs, for use outside of Perlego. However, you can download books within the Perlego app for offline reading on mobile or tablet. Learn more here.

Perlego offers two plans: Essential and Complete

- Essential is ideal for learners and professionals who enjoy exploring a wide range of subjects. Access the Essential Library with 800,000+ trusted titles and best-sellers across business, personal growth, and the humanities. Includes unlimited reading time and Standard Read Aloud voice.

- Complete: Perfect for advanced learners and researchers needing full, unrestricted access. Unlock 1.4M+ books across hundreds of subjects, including academic and specialized titles. The Complete Plan also includes advanced features like Premium Read Aloud and Research Assistant.

We are an online textbook subscription service, where you can get access to an entire online library for less than the price of a single book per month. With over 1 million books across 1000+ topics, we’ve got you covered! Learn more here.

Look out for the read-aloud symbol on your next book to see if you can listen to it. The read-aloud tool reads text aloud for you, highlighting the text as it is being read. You can pause it, speed it up and slow it down. Learn more here.

Yes! You can use the Perlego app on both iOS or Android devices to read anytime, anywhere — even offline. Perfect for commutes or when you’re on the go.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Yes, you can access The Granularity of Growth by Patrick Viguerie,Sven Smit,Mehrdad Baghai in PDF and/or ePUB format, as well as other popular books in Business & Finance. We have over one million books available in our catalogue for you to explore.

Information

PART I

Your growth ambition

THE “GROW OR GO” DYNAMICS we have just outlined represent an unforgiving environment for large companies. The odds of sustaining performance and growth over the long term are indeed long ones.

The first part of this book addresses the fundamental questions you face as a leader when you are defining your company’s ambition for long-term growth: Should we concentrate on growing the businesses we have? Build an institution that is capable of driving growth well into the future? Consolidate our industry? Diversify? Sell our company in the next few years?

Your answer will naturally shape your company’s agenda in many ways: your investment priorities and spending levels; your target markets; your decision to diversify or focus your business portfolio; your hiring; your organization structure; your use of leadership time; and your use of M&A, to name just a few.

Growth is a tricky topic, so it’s important that your company should have a view on the best way to think about it. We all know intuitively that growth is good. It creates healthy companies, opens up opportunities, excites talent, and rewards shareholders. But do we know how to achieve it?

Previous attempts to explore how companies can grow have depended largely on anecdotal evidence. Pankaj Ghemawat, a professor of strategy at IESE and Harvard Business School, notes that “It’s hard to assess the empirical validity of growth books because none of them focus on presenting data.”1 We have done our utmost to buck this trend; indeed, if anything, you may conclude that we may have provided too much evidence to support our claims. But we have tried to organize the book in such a way that readers who want a full account of our analysis can find it, while others who prefer to take in our main conclusions quickly can do so too.

What we will show in this book is that performance is granular, by which we mean driven by growth in the sub-segments and categories of industries in which a company competes as well as by the revenues that it acquires through M&A activity. We will also show that these drivers are generally much more important than market-share gains in determining how fast you grow.

This seemingly counterintuitive finding has important implications. A typical management team needs to change the way it thinks about company resources, not least its own time. It needs to pay more attention to which businesses the company is in, and particularly the sub-segments in which it competes.

There are four chapters in this part of the book, each intended to guide you as you think about your company’s growth ambition.

• In chapter 1, “A granular world,” we show that when you are searching for growth, analyses of industries and megatrends are usually pitched at too high a level to offer you any help. In order to identify growth opportunities, you need to get well below the industry level. We define five levels of granularity and show where the most valuable insights are to be found.

• In chapter 2, “Understanding your company’s performance,” we show that choices about where to compete account for nearly 80 percent of the differences in top-line growth among companies. We introduce a methodology for breaking down the sources of revenue growth into the three core components of portfolio momentum, market-share gain, and M&A—what we call the growth “cylinders.” We then examine how companies perform in terms of each one.

• In chapter 3, “Firing on multiple cylinders,” we demonstrate that most companies need to fire on more than one of these growth cylinders over time if they are to achieve excellent growth performance. We look at the relationships between growth cylinders, revenues, and shareholder returns, and compare the impact of different growth cylinder strategies at several companies. This enables us to formulate guidelines for defining exceptional, great, good, and poor growth performance.

• In chapter 4, “A granular company,” we combine the concept of firing on multiple cylinders with the idea of granularity to create a powerful tool, the growth MRI. Its purpose is to enable you to analyze your growth performance at the right level of detail.

NOTE

1 P. Ghemawat in “The growth boosters,” Harvard Business Review, July 2004, pp. 35-40, a review of three books: Chris Zook’s Beyond the Core, Ram Charan’s Profitable Growth is Everyone’s Business, and Adrian Slywotzky and Richard Wise’s How to Grow When Markets Don’t.

1

A granular world

“It’s a small world after all”

Song at a Disneyland ride

• Companies should base their growth strategies on granular views of their markets

• There’s no such thing as a growth industry; most so-called growth industries have mature segments, and most mature industries have granular growth pockets

• Once you adopt a granular perspective, “megatrends” such as aging vary enormously from market to market

PEOPLE TEND TO TALK about growth in sweeping terms. Terms such as “growth industry” and “mature industry”—while catchy and convenient —are loaded, imprecise, and often downright wrong. One of the most important empirical findings from our research is that there’s no such thing as a growth industry. The real definition of a growth market exists at a level much deeper than industry. Most so-called “growth” industries have sub-industries or segments that aren’t growing, and most “mature” industries and geographies have at least a few sub-industries or segments that are growing rapidly.

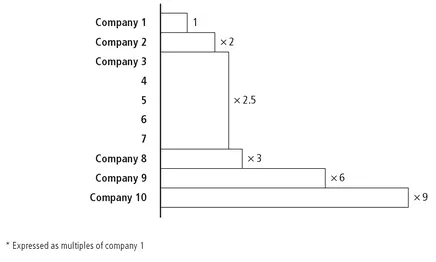

The histogram in Figure 1.1 illustrates this well. In Europe, telecommunications is generally regarded as a mature industry. Yet telecom companies show wide variations in their portfolio growth rates because there are broad differences in the growth of their underlying markets.

Wireless grows more quickly than wireline does, for example, and even within wireless and wireline there are significant variations. Wireless is growing more slowly in western Europe than in eastern Europe. Within wireline, broadband internet is experiencing rapid growth and voice is declining. In addition, the degree of exposure to fast-growing markets outside Europe varies from company to company. So within the European telecom industry as a whole, different companies have made different portfolio choices that have given them different levels of exposure to growth segments and countries.

Fig 1.1 Variations within a “mature” industry

Spread of market growth rates* for 10 telcos with EU HQs, 1999-2005

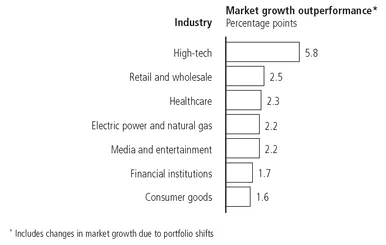

Fig 1.2 Growth giants have a clear edge

Average outperformance by growth giants of overall industry CAGR, 1999-2005

The same variability is evident in apparently high-growth sectors too. If we take a representative set of large high-tech companies, for instance, and calculate the weighted average growth rate of the market segments that each company participates in, we find that the results range from -6 to 34 percent. Clearly, what looks like a growth industry to some looks mature to others.

If we revisit the set of growth giants we described in the Introduction, we can see that even when they don’t operate in what we would consider to be growth industries or markets, they still outperform their industry peers. Figure 1.2 shows how well the growth giants do in some of the industries where we have the largest samples: high-tech, retail and wholesale, healthcare, media and entertainment, consumer goods, financial institutions, and electric power and natural gas (EPNG). In every case, the growth giants outclass their competitors in market growth: in EPNG, for instance, they have an edge of 2.2 percentage points over the industry as a whole.

So what does this tell us? One message is that there is hope for companies seeking to grow in seemingly mature industries. They don’t have to abandon their entire business in search of a new one with a better growth rate, even if they could. Instead, they need to look deeper into their current industry and businesses in order to identify pockets of potential growth, and then focus their time and resources on these faster-growing and more profitable segments.

This is where granularity comes in.

Why granularity matters

Granularity isn’t a term traditionally used in business. We’ve borrowed it from the world of science and engineering, where it is used to refer to the size of the components within a larger system. If we take what we might call a non-granular (or “coarse-grained”) view of the system, what we might see is the system as a whole or perhaps the larger sub-systems within it. In a granular (or “fine-grained”) view of the system, on the other hand, we might see some of the individual small components that go to make it up.

To make this more concrete, imagine we are looking at Google Earth. It shows a sequence of pictures from a satellite camera as it zooms in on the Earth from space. The first image we see is the whole planet. As the magnification increases and the field of view narrows, a continent comes into focus. Next we see the outline of an individual country, then a city, and finally a street or building. Before our eyes, the image of the Earth is progressively becoming more and more granular.

So why have we decided to apply the idea of granularity to business, and specifically to growth?

As we mentioned in the Preface, we want to get away from the broad-brush terms in which business opportunities are often described. Using the idea of granularity hel...

Table of contents

- Title Page

- Copyright Page

- Dedication

- Special thanks

- Acknowledgements

- Preface

- Introduction

- PART I - Your growth ambition

- PART II - Your growth direction

- PART III - Your growth architecture

- Conclusion: Choosing to lead growth

- Appendix 1 - Growth and value

- Appendix 2 - Two ways to grow, two ways to go

- Bibliography

- Index