- English

- ePUB (mobile friendly)

- Available on iOS & Android

eBook - ePub

About this book

Much new data and many new ideas have emerged in the area of ore geology and industrial minerals since publication of the second edition of this text in 1987. The overriding philosophy behind this new edition is the inclusion and integration of this new material within the established framework of the text. The third edition is re-presented in the modern double-column format.

Non-metallic deposits of industrial and bulk materials are fully covered to meet the changing emphasis of courses in applied geology. In addition, chapter 1 has been considerably enlarged to include a section on mineral economics covering metals, industrial minerals and bulk materials. In this section, the various aspects of economic exploitation of industrial and bulk materials are compared with those of metallic deposits. Other major revisions and additions include a section on fluid inclusions, expansion of the section on wall rock alteration, expansion of the material on isotope studies, and the inclusion of a section on hydraulic fracturing and seismic pumping.

Frequently asked questions

Yes, you can cancel anytime from the Subscription tab in your account settings on the Perlego website. Your subscription will stay active until the end of your current billing period. Learn how to cancel your subscription.

No, books cannot be downloaded as external files, such as PDFs, for use outside of Perlego. However, you can download books within the Perlego app for offline reading on mobile or tablet. Learn more here.

Perlego offers two plans: Essential and Complete

- Essential is ideal for learners and professionals who enjoy exploring a wide range of subjects. Access the Essential Library with 800,000+ trusted titles and best-sellers across business, personal growth, and the humanities. Includes unlimited reading time and Standard Read Aloud voice.

- Complete: Perfect for advanced learners and researchers needing full, unrestricted access. Unlock 1.4M+ books across hundreds of subjects, including academic and specialized titles. The Complete Plan also includes advanced features like Premium Read Aloud and Research Assistant.

We are an online textbook subscription service, where you can get access to an entire online library for less than the price of a single book per month. With over 1 million books across 1000+ topics, we’ve got you covered! Learn more here.

Look out for the read-aloud symbol on your next book to see if you can listen to it. The read-aloud tool reads text aloud for you, highlighting the text as it is being read. You can pause it, speed it up and slow it down. Learn more here.

Yes! You can use the Perlego app on both iOS or Android devices to read anytime, anywhere — even offline. Perfect for commutes or when you’re on the go.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Yes, you can access Ore Geology and Industrial Minerals by Anthony M. Evans in PDF and/or ePUB format, as well as other popular books in Physical Sciences & Geology & Earth Sciences. We have over one million books available in our catalogue for you to explore.

Information

Part 1

Principles

‘Here is such a vast variety ofphenomena and these many of them so delusive, that ’tis very hard to escape imposition and mistake’

These words, written about ore deposits by John Woodward in 1695, are every bit as true today as when he wrote them.

1 / Some elementary aspects of mineral economics

Ore, orebodies, industrial minerals, gangue and protore

‘What is ore geology?’ Unfortunately, it is not possible to give an unequivocal answer to this question if one wishes to go beyond saying that it is a branch of economic geology. The difficulty is that there are a number of distinctly different definitions of ore. A definition which has been current in capitalist economies for nearly a century runs as follows: ‘Ore is a metalliferous mineral, or an aggregate of metalliferous minerals, more or less mixed with gangue, which from the standpoint of the miner can be won at a profit, or from the standpoint of the metallurgist can be treated at a profit. The test of yielding a metal or metals at a profit seems to be the only feasible one to employ.’ Thus wrote J.F. Kemp in 1909. There are many similar definitions of ore which all emphasize (a) that it is material from which we extract a metal, and (b) that this operation must be a profit-making one. Economically mineable aggregates of ore minerals are termed orebodies, oreshoots, ore deposits or ore reserves.

The words ore and orebody have, however, been undergoing slow and confusing transitions in their meanings, which are still not complete, and the tyro must read the context carefully to discern the sense in which a particular writer is using these words. For example, in Craig (1989) the ore minerals are defined as those from which metals are extracted, e.g. chalcopyrite and galena from which we extract copper and lead respectively, and many authors use this term as a synonym for opaque minerals, which is actually a better description for them since they include pyrite and pyrrhotite, minerals that are discarded in the processing of most ores. Craig is by no means alone. Most economic geologists concerned with the extractive industries divide the materials they exploit into either ore minerals or industrial minerals. Nevertheless recent definitions of ore include both groups, so what are industrial minerals?

‘Industrial minerals have been defined as any rock, mineral or other naturally occurring substance of economic value, exclusive of metallic ores, mineral fuels and gemstones’ (Noetstaller 1988). They are therefore minerals where either the mineral itself, e.g. asbestos, baryte, or the oxide or some other compound derived from the mineral has an industrial application (end use) and they include rocks, such as granite, sand, gravel and limestone that are used for constructional purposes (these are often referred to as aggregates or bulk materials), as well as the more valuable minerals with specific chemical or physical properties, such as fluorite, phosphate, kaolinite and perlite.

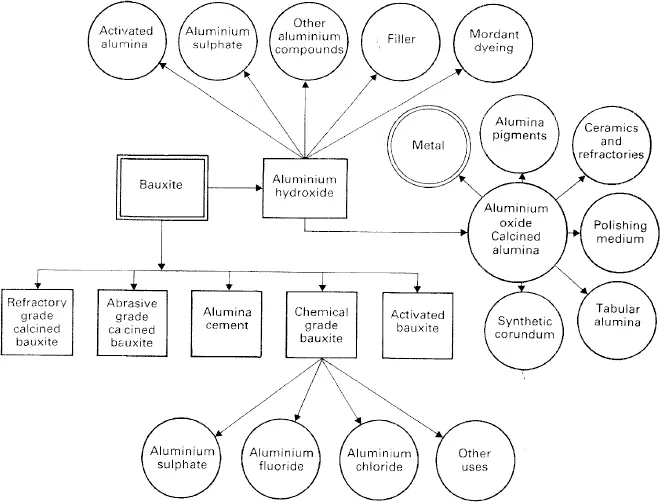

Although practically all industrial minerals (e.g. halite, NaCl) contain metallic elements they are frequently and confusingly termed non-metallics, e.g. Harben & Bates (1984). To add to the reader’s confusion it must now be noted that many ‘metallic ores’, such as bauxite, ilmenite, chromite and manganese minerals, are also important raw materials for industrial mineral end uses. In Fig. 1.1 some of the end uses of bauxite are displayed to illustrate this point and to give an idea of the diversity of end uses that characterize man’s utilization of industrial minerals. Depending on how far the path of a mineral through industrial uses can be traced, so the number of known uses increases. It has been estimated that halite is the starting point of about 18 000 end uses! In view of all the above discussion, how do we now define ore?

Two very useful discussions of this subject are to be found in Lane (1988) and Taylor (1989). Taylor’s discussion is an easier and better introduction for the beginner, Lane should be read by all industrial and mining geologists and advanced students. Taylor favours a wide and inclusive definition that will survive being ‘blown about by every puff of economic wind’, such as changes in market demand, commodity prices, mining costs, taxes, environmental legislation and other factors: ‘ore is rock that may be, is hoped to be, will be, is or has been mined; and from which something of value may be (or has been) extracted’. This is very similar to the official UK Institution of Mining and Metallurgy (IMM) definition: ‘Ore is a solid naturally-occurring mineral aggregate of economic interest from which one or more valuable constituents may be recovered by treatment’. Both these definitions cover ore minerals and industrial minerals and imply extension of the term orebody to include economic deposits of industrial minerals and rocks. This is the sense in which these terms will normally be used in this book, except that they will be extended to include the instances where the whole rock, e.g. granite, limestone and salt, is utilized and not just a part of it. Lane prefers the use of the term mineralized ground for such comprehensive usage of the word ore as that given in the definitions by Taylor and the IMM, and he would restrict ore to describing material in the ground that can be extracted to the overall economic benefit of a particular mining operation, governed by the financial determinants at the time of examination.

Fig. 1.1 Some end uses of bauxite. About 90% of aluminium oxide is used for the manufacture of aluminium metal but the other end uses are expanding rapidly, particularly in ceramics and refractories. (Modified from Anon. 1977.)

A further complication, which we may note in passing, is that in socialist economies ore is often defined as mineral material that can be mined for the benefit of mankind. Such an altruistic definition is necessary to cover those examples in both capitalist and socialist countries where minerals are being worked at a loss. Such operations are carried on for various good or bad reasons depending on one’s viewpoint! These include a government’s reluctance to allow large isolated mining communities to be plunged into unemployment because a mine or mines have become unprofitable, a need to earn foreign currency and other reasons.

A definition about which there is little argument is that of gangue. This is simply the unwanted material, minerals or rock, with which ore minerals are usually intergrown. Mines commonly possess mineral processing plants in which raw ore is milled before the separation of the ore minerals from the gangue minerals by various processes, which provide ore concentrates, and tailings which are made up of the gangue.

Another word that must be introduced at this stage is protore. This is mineral material in which an initial but uneconomic concentration of metals has occurred that may by further natural processes be upgraded to the level of ore.

The relative importance of ore and industrial minerals

There has always been an aura of romance about metallic deposits, especially those of gold and silver, which has stimulated the writing of heroic narratives such as that of Jason’s search for the Golden Fleece (undoubtedly an expedition to recover placer gold from the Black Sea region) right up to the recent novels of Joseph Conrad and Hammond Innes. Wars have been fought over metallic deposits and new finds quickly reach the headlines—‘gold rush in Nevada’, ‘silver fever in Mexico’, ‘nickel rush in Western Australia’, but never talc fever or sulphur stampede! The poor old industrial minerals tend to be overlooked by the public and cursorily treated in many geological textbooks, which commonly focus on metallic ores and fossil fuel deposits to the virtual exclusion of the industrial minerals; and yet, in the form of flints and stone axes, bricks, pottery, etc., these were the first earth resources to be exploited by man. Today industrial minerals permeate every segment of our society (McVey 1989). They occur as components in durable and non-durable consumer goods. In many industrial activities and products, from the construction of buildings to the manufacture of ceramic tables or sanitary ware, the use of industrial minerals is obvious but often unappreciated. With numerous other goods, ranging from books to pharmaceuticals, the consumer frequently is unaware that industrial minerals play an essential role.

Table 1.1 Average growth rates in world production. (After The Economist World Business Cycles 1982)

| Product | 1966–73 (%) | 1973–80(%) |

| Crude oil | 70 | 7 |

| Industrial minerals | 29 | 16 |

| Metals | 54 | 7 |

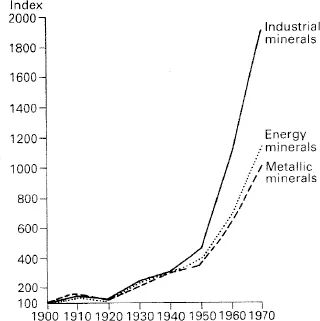

Fig 1.2 Growth comparisons for mineral products. In each case the index for 1900 is 100. (After Anon. 1977.)

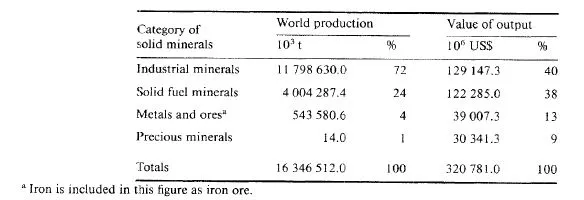

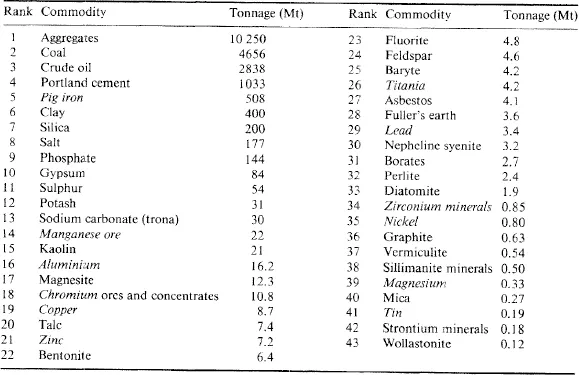

Both Bristow (1987a) and Noetstaller (1988) have drawn attention to the increasingly rapid growth in the production of industrial minerals compared with metals. Table 1.1 shows the growth rate of industrial minerals compared with two other mineral products, and Fig. 1.2 shows how the world production of industrial minerals is outstripping that of metals. The relative positions in terms of tonnage and financial value appear in Table 1.2.

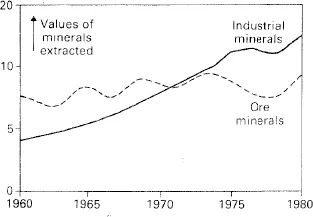

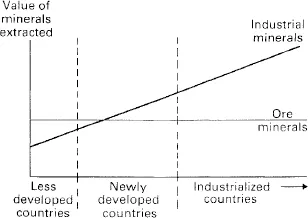

Bristow also has made the interesting remark that at some point in time during the development of an industrialized country, industrial minerals become more important in terms of value of production than metals. This happened in the UK in the nineteenth century, in the USA early in this century, in Spain in the early seventies (Fig. 1.3) and in younger economies, like Australia’s, it is only just happening. The time of the crossover, Bristow suggested, may be a rough measure of the ‘industrial maturity’ of that country, and that in nearly all mature industrialized countries the value of industrial mineral production is very much greater than that of ore minerals (Fig. 1.4). The world production of some individual mineral commodities ranked in order of tonnage produced is given in Table 1.3 and that of some other metals in Table 1.4.

Fig. 1.3 Spanish mining production. Mineral values are in millions of constant pesetas indexed to 1970. (After Bristow 1987.)

Table 1.2 Tonnage and value of mineral products in 1983. (From Noetstaller, 1988)

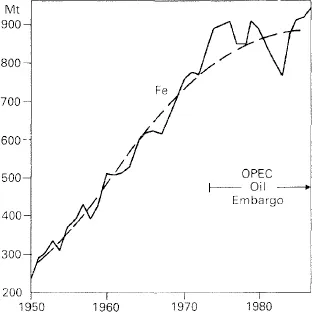

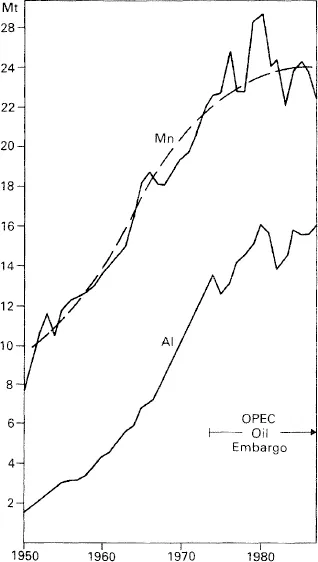

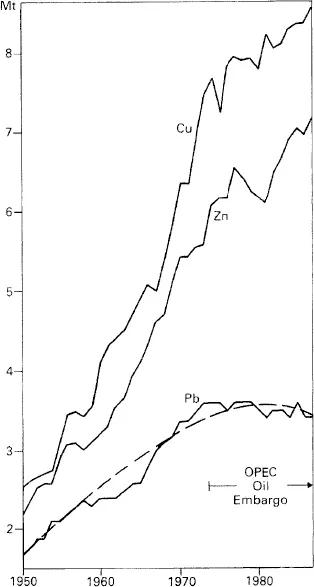

Graphs of world production of the traditionally important metals (Figs 1.5–1.7) show interesting trends. The world’s appetite for the major metals appeared to be almost insatiable after World War Two, and post-war production increased with great rapidity; however, in the mid 1970s an abrupt slackening in demand occurred, triggered by the coeval oil crisis but clearly continuing up to the present day. These curves suggest that consumption of major metals is following a wave pattern in which the various crests may not be far off in time. Lead, indeed, may be over the crest. Various factors are probably at work here; recycling, more economical use of metals and substitution by ceramics and plastics—industrial minerals are much used as a filler in plastics. Production of plastics rose by a staggering 1529% between 1960 and 1985 and a significant fraction of the demand behind this is attributable to metal substitution. In Table 1.5 the increases in production of selected metals and industrial minerals provide a striking contrast and one that explains why for some years now many large metal mining companies have been moving into industrial mineral production, an example being the RTZ Corporation, probably now the world’s largest mining company, which in 1989 derived 30% of its net earnings from industrial mineral operations compared with 58.4% from metal mining. Are we soon to pass onwards from the Iron Age into a ceramic–plastic age? Readers are urged to monitor this tentative prophecy by keeping these graphs up-to-date using data from the same or a similar source, which includes production from eastern-bloc countries as well as that from non-communist countries; be warned, some compilations ignore this latter production but still pose as world production figures. A factor of small but growing importance is the demand for non-ferrous metals in the non- OECD countries; this has grown by over 6% per annum during the present decade, compared with less than 1% in the OECD countries and it may increase sufficiently in the coming decade to influence present trends in demand for these metals. This demand too should be monitored. Finally, although the increase in demand for the major, high-tonnage production metals is decreasing at the present time, the future is bright for certain minor, low-tonnage metals such as cobalt, platinum group metals (PGM), rare earth elements (REE), tantalum and titanium.

Table 1.3 World production of some mineral commodities in 1987. Metals are marked with italics. (Compiled from various sources and with considerable help from Mr D.E. Highley of the British Geological Survey)

Fig. 1.4 Relative importance of industrial and ore mineral exploitation in evolving economies. (After Bristow 1987a.)

Fig. 1.5 World production of iron ore from 1950 to 1987 with general trend superimposed. (After Lofty et al 1989.)

Table 1.4 World production of selected metals in 1987

| Metal | Amounta |

| Molybdenum | 0.089 |

| Antimony | 0.059 |

| Tungsten | 0.040 |

| Uranium | 0.038 |

| Vanadium | 0.032 |

| Cadmium | 0.019 |

| Lithium | 0.007 |

| Mercurv | 0.006 |

| Silver | 14 133 |

| Gold | 1610 |

| Platinum group | 264 |

a In Mt except silver, gold and the platinum group metals (t).

Table 1.5 Increases (%) in world production of some metals and industrial minerals, 1973–1988; metals are given in italics. Recycled metal production is not included

| Aluminium | 27.5 |

| Feldspar | 81.5 |

| Lead | ‒5.5 |

| Phosphate | 42.5 |

| Sulphur | 19.0 |

| Trona | 44.0 |

| Cobalt | 34.6 |

| Gold | 8.8 |

| Mica | 18.9 |

| PGM | 80.8 |

| Talc | 44.0 |

| Zinc | 26.7 |

| Copper | 16.2 |

| Gypsum | 37.6 |

| Molybdenum | 8.3 |

| Potash | 39.1 |

| Tantalum | 143.0 |

| Diatomite | 29.1 |

| iron ore | 12.0 |

| Nickel | 16.8 |

| Silver | 13.9 |

| Tin | ‒9.8 |

Fig. 1.6 World production of manganese and aluminium from 1950 to 1987 with general trend for manganese superimposed. (After Lofty et al. 1989.)

Fig. 1.7 World production of copper, zinc and lead from 1950 to 1987. General trend for lead superimposed. (After Lofty et al. 1989.)

Commodity prices—the market mechanism

Most mineral trading takes place within the market economies of the non-communist world and the prices of minerals or mineral products are governed by the factors of supply and demand. If consumers want more of a mineral product than is being supplied at the current price, this is indicated by their ‘bidding up’ the price, thus increasing the profits of companies supplying that product and, as a result, resources in the form of capital investment are attracted into the industry and supply expands. On the other hand if consumers do not want a particular product its price falls, producers make a loss and resources leave the industry.

World markets

Modern transport leads to many commodities having a world market; a price change in one part of the world affects the price in the rest of the world. Such commodities include wheat, cotton, rubber, gold, silver and base metals. These commodities have a wide demand, are capable of being transported and the costs of transport are small compared with the value of the commodity. The market for diamonds is worldwide but that for bricks is local.

Formal organized markets have dev...

Table of contents

- Cover

- Contents

- Title Page

- GeoScience Texts

- Copyright

- Preface to the third edition

- Preface to the second edition

- Preface to the first edition

- Units and abbreviations

- Part 1: Principles

- Part 2: Examples of the more important types of ore deposit

- Part 3: Mineralization in space and time

- Appendix

- References

- Index