![]()

Chapter 1

Drucker on Managing Growth

THE NEED FOR BUSINESS GROWTH AND STRATEGY

Growth will continue to be a desirable and indeed a necessary business objective.1

Peter F. Druckera

I start the journey of exploring Peter Drucker’s views on strategy and strategic management with a discussion of growth. After all, what is the purpose of developing a strategy if it is not to provide the direction for the future growth of the firm? As Drucker stated in Management (1973), “Growth will continue to be a desirable and indeed a necessary business objective.” He went on to add, “In a growing economy there is plenty of room. Industries that have passed their peak decline slowly and are being held up by the overall buoyancy of the economy. New industries can grow well and grow more by accident than by management. But when the economy as such does not grow, changes in the economy are bound to be abrupt and sharp. Then indeed a company or an industry that does not grow will decline. Then there is even more need for a strategy that enables a management to plan for growth and to manage growth.”2 Needless to say, the banking and mortgage industries need a strategy.

In his discussions of the need for marketing, Drucker also spoke about what contributed to a growth company. The quotation below is just one aspect of what Drucker suggested needed to be asked of customers and non-customers. (Non-customers is a term he came up with to describe those who are not buying from your company.)

Management has to ask which of the customer’s wants are not adequately satisfied by the products or services offered him today. The ability to ask this question and to answer it correctly usually makes the difference between a growth company and one that depends on the rising tide of the economy or of the industry. But whoever contents himself to rise with the tide will also fall with it.3

Peter F. Druckerb

The Falling Tide

As the first decade of the 21st century draws to a close, the US economy can be best described as having no growth, or only marginal growth, depending on whose numbers we are given, or as Drucker once commented on statistics, “Tell me what you want to prove and I will develop the numbers.”4 This lack of economic growth can be attributed to many factors including the credit crisis as a result of the greed and stupidity of those who ventured into the subprime mortgage market (as lenders, investors and customers)—compounded by the collapse of the housing market and the highest number of home loan foreclosures since the Great Depression; oil; the falling value of the dollar against most currencies; the huge national debt increasing every day with the cost of US military commitments in lraq and Afghanistan, and a volatile capital market witnessing triple digit swings in the stock markets depending on what day it is, to name but a few factors.

Despite the weak economy, the “Street” (the Wall Street analysts) is still ever critical of the companies that do not meet their growth expectations. Take as an example a report by Reuters (April 25, 2008) with the headline, “3M revenue growth disappoints, shares fall.” The article cited 3M’s first-quarter growth increased 8.9 percent of which foreign currency translation accounted for 6.1 percent. According to Adam Fleck, a Morningstar analyst, “A lot of the growth of this quarter was from currency translation. That’s positive for the company but not as positive as true organic growth.”5 The article went on to add that 3M’s first-quarter net income was $988 million, or $1.38 per share, beating analysts’ average forecast of $1.35 per share. Despite these results Reuters concluded that although “3M reported better-than-expected quarterly profit on Thursday, its shares fell amid investor concern that the weak dollar accounts for too much of the company’s growth.” 3M shares did fall 86 cents in that afternoon’s trading to $79.95, down 17 percent from their 52-week high of $97.

In this article we see the typical short-term expectations of the “analysts.” Although the company (3M) beat its first-quarter 2008 net income expectations of $1.35 per share with actual results of $1.38 per share, analysts were disappointed with the firm’s “organic growth” of only 2.8 percent compared with 6.1 percent in currency translation, or a total of 8.9 percent. Can you place yourself in the 3M headquarters conference room the following Monday morning when the chairman states to all the executives present, “We beat the quarterly sales forecast by 2.8 percent and earnings per share expectations by 2 percent. What are we going to do in the second quarter?” Never mind discussing whether the strategy is appropriate for the current environment and asking some of Drucker’s key questions, which we will review in the next chapter. Who is the competition here—the analysts?

Dimensions of Business Growth

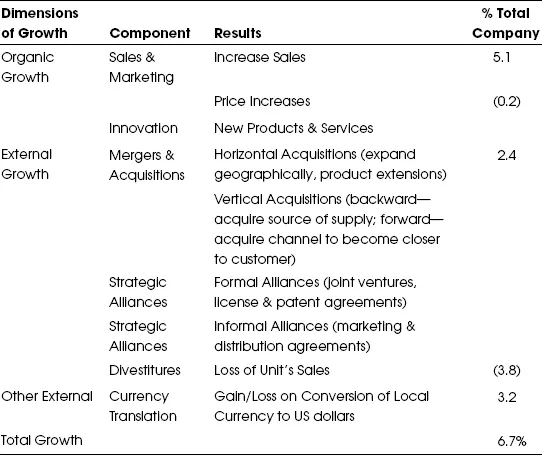

The following is a brief description of the elements of a business that can contribute to growth. These include both Organic and External Growth Dimensions.

Organic Growth Dimension: An increase in sales revenues attributed to sales and marketing, including price increases, and innovative efforts of the firm in developing new products or services. This will be covered in Chapters 2 through 5.

External Growth Dimension: An increase in sales revenues as a result of mergers and acquisitions. Horizontal acquisitions include expanding geographically or acquiring new products to complement the firm’s present product line. Backward vertical acquisitions involve acquiring a source of supply, while forward vertical acquisitions involve acquiring a part of the marketing channel to reduce sales and marketing expenses as well as get closer to the customer. Strategic alliances, both formal and informal, also provide opportunities for growth. Divestitures will show a temporary increase in revenues as a result of a business unit’s sale but will also result in a decline of product sales of that business unit. M&A and alliances as a growth strategy will be covered in Chapter 6.

Other External Dimension: Currency Translations will result in a gain or loss in revenues depending on the exchange rate between local currencies the firm is charging for its products and the eventual exchange into US dollars.

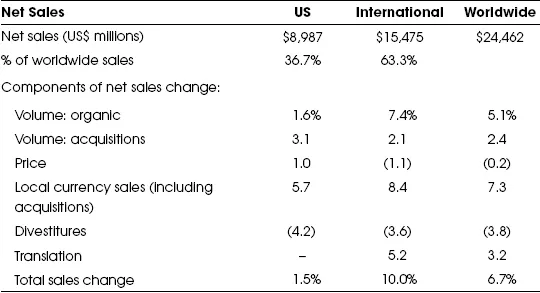

Table 1.1 is a snapshot of 3M’s 2007 SEC 10-K Report and the Dimensions of Business Growth as reported by the company. This is an excellent example of being able to quickly ascertain how the company is growing in each of these dimensions.

Table 1.1 3M Results of Operations

Source: 2007 SEC 10-K Report

As can be seen in Table 1.2, a significant percentage of the firm’s growth was attributed to currency translations as a result of a weaker dollar compared to the euro in the EU, the pound in the UK and the yen in Japan.

Table 1.2 3M Dimensions of Business Growth

Source: Developed by Robert W. Swaim (2006)

The reported Dimensions of Business Growth for the firm coupled with the criticism from the “analysts” forced George Buckley, the chairman and CEO of the firm to respond with the following statements at the firm’s May 13, 2008 shareholder’s meeting.

“The US is by far the largest single market for us. And so it’s obvious that for 3M to meet its long-term growth aspirations, the US business has to grow faster. It’s increasingly clear to all of us that driving growth in the United States will continue to be challenging in the near term.”6 To achieve this growth, Buckley commented that “3M will try harder to differentiate its products from competition, innovate more, and improve service to squeeze growth out of its US markets.” The article went on to comment on 3M’s international business that comprised 63 percent of its sales in 2007 and could be 70 percent by 2010. Also, of this, 30 percent, or $7 billion, came from emerging markets where sales were growing at nearly 20 percent per year. The article added that, “3M shares fell 49 cents to $77.18 Tuesday.”

As an added note, 3M was selected as an example in our discussion of growth since 63.3 percent of its total revenues were derived from outside the US, the firm reports its growth in accordance with the Dimensions of Business Growth, it is a Fortune 500 company, and also a component of the firms that comprise the Dow Jones Industrial Average. The chairman’s comments in the last article on the need for differentiation and innovation tie directly into Drucker’s views on the two most important functions of the organization, marketing and innovation, and will be covered in detail in this book.

Despite the chairman’s positive outlook relative to the firm’s future growth opportunities, apparently the “analysts” were not impressed, and the firm’s shares price declined. The question here is—does 3M need a better investor relations manager or a better strategy? Drucker’s and others’ views on the important role the CEO plays in strategy and strategic planning is covered in more detail as well.

Druck...