- English

- ePUB (mobile friendly)

- Available on iOS & Android

eBook - ePub

Business Valuation and Bankruptcy

About this book

An essential guide to business valuation and bankruptcy

Business Valuation and Bankruptcy helps you-whether you are an accountant dealing with a troubled company, a lender, an investor, a bankruptcy and restructuring lawyer/financial advisor, or a private equity player-to focus on solving everyday and case determinative disputes when creditors, lenders, and debtors have differing views of value.

Introducing valuation issues early on in the restructuring/bankruptcy process so you can plan accordingly, this book offers

- Many real life case examples, case descriptions, and tables to demonstrate the applicable sections of the Bankruptcy Laws

- A review of the methods, applications, pros and cons of restructuring with the basic tools to understanding it

- A description of the life cycle of a troubled company and the various stages of a restructuring

- An analysis of the valuation issues that confront practitioners in the real world of application of the law

Business Valuation and Bankruptcy is written in terms that are common to bankruptcy professionals and is essential, timely reading for players in the bankruptcy and restructuring environment.

Frequently asked questions

Yes, you can cancel anytime from the Subscription tab in your account settings on the Perlego website. Your subscription will stay active until the end of your current billing period. Learn how to cancel your subscription.

No, books cannot be downloaded as external files, such as PDFs, for use outside of Perlego. However, you can download books within the Perlego app for offline reading on mobile or tablet. Learn more here.

Perlego offers two plans: Essential and Complete

- Essential is ideal for learners and professionals who enjoy exploring a wide range of subjects. Access the Essential Library with 800,000+ trusted titles and best-sellers across business, personal growth, and the humanities. Includes unlimited reading time and Standard Read Aloud voice.

- Complete: Perfect for advanced learners and researchers needing full, unrestricted access. Unlock 1.4M+ books across hundreds of subjects, including academic and specialized titles. The Complete Plan also includes advanced features like Premium Read Aloud and Research Assistant.

We are an online textbook subscription service, where you can get access to an entire online library for less than the price of a single book per month. With over 1 million books across 1000+ topics, we’ve got you covered! Learn more here.

Look out for the read-aloud symbol on your next book to see if you can listen to it. The read-aloud tool reads text aloud for you, highlighting the text as it is being read. You can pause it, speed it up and slow it down. Learn more here.

Yes! You can use the Perlego app on both iOS or Android devices to read anytime, anywhere — even offline. Perfect for commutes or when you’re on the go.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Yes, you can access Business Valuation and Bankruptcy by Ian Ratner,Grant T. Stein,John C. Weitnauer in PDF and/or ePUB format, as well as other popular books in Betriebswirtschaft & Bewertung. We have over one million books available in our catalogue for you to explore.

Information

CHAPTER 1

Introduction

THE TROUBLED COMPANY CONTINUUM

Companies can have four stages in their life cycle: the start-up or development phase, the growth phase, the maturity or stabilization phase, and in many cases, the disruption or decline phase.

Start-up or development-stage companies are early stage companies seeking financing for product development and market testing. In many cases commercialization of the companies’ products or services is not fully established. During this early stage of development, proof of concept is the goal. Once companies live through the start-up stage, they move on to the growth stage, where they have gained momentum in sales and market acceptance. During this stage, companies hire experienced management, and some form of permanent financing has been obtained. Mature companies have an established customer base, vendor network, business processes, and products or services. Mature companies often expand to new regions or attempt to grow in a horizontal or vertical manner both organically and through mergers and acquisitions. During this period, private companies often deal with wealth and ownership transfer issues.

If all companies followed the process just described and the economy maintained a stable growth rate, business would be less complicated, and there would be no need for this book. However, there is usually a disruption or period of decline either at some stage of a company’s development, or as part of a general economic cycle that affects companies in the same industry or region. Business professionals and economists agree that it is highly unlikely for any company (or the economy) to maintain an upward trend indefinitely. This truth is playing out in the current downturn of the global economy.

Not all problems are similar or have the same level of severity; troubled companies move along a continuum. The continuum goes from a short-term liquidity crunch to the realization that the existing business model is simply no longer viable. When this happens companies are faced with the challenge of restructuring or being liquidated.

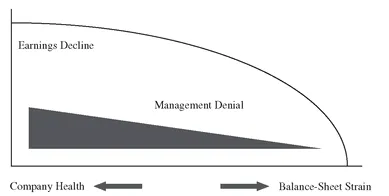

EXHIBIT 1.1 Business-Decline Curve

The business-decline curve (shown in Exhibit 1.1) is a graphical representation of challenges faced by troubled companies along the continuum. When faced with financial or operational stress, even experienced managers often assume that the impairment is temporary and that performance will return to the norm. During this denial phase, management is more likely to focus on tracking performance for signs of expected recovery than to investigate and correct the root cause of the decline. This reaction is akin to treating the symptom of a disease without addressing the cause. The time wasted during the denial phase often allows the root cause to manifest itself in the form of balance-sheet strain. Continued losses, or even reduced margins in the case of a high-growth company, can quickly result in increased leverage and working-capital shortages. As the financial strain increases, management becomes more reactionary than proactive and typically lacks the time and resources necessary to resolve the root causes that brought on the decline. Unfortunately, the further down the curve management allows a company to travel, the less control management has over the outcome. Ultimately, as the situation evolves, control may be taken from the company and placed in the hands of other stakeholders or proceed in a judicial setting such as a bankruptcy.

The most controllable variable on the business decline curve is the time spent in the management denial phase. Excessive time spent in the denial phase makes the remainder of the trip down the curve almost inevitable.

Typically, troubled companies have roots in either operational stress or financial stress and most of the time some combination of both.

OPERATIONAL AND FINANCIAL DISSTRESS

Operational stress may occur for a number of reasons, including competition from other companies, competition from replacement products and services, the departure of key employees or management, rapid changes in raw material quality or availability, changes in cost structure that cannot be passed on to consumers, or a change in the demand for the company’s products or services. Whatever the reason for the operational stress, the financial outcomes are typically declining revenues or market share, increasing operating expenses, decreasing operating margins, and liquidity constraints. If the troubled company is unable to address the business issues causing the operational stress and react to reduce expenses, increase revenues, raise capital to meet short-term requirements, or some combination, then the business will soon inevitably experience financial stress and possibly insolvency.

Financial stress is likely to occur when the company’s existing leverage is excessive, and the company finds it hard or impossible to make scheduled debt or principal payments. This is often the case when a company has been subject to a leveraged buyout transaction or other leveraged transaction. Financial stress is also evident in companies whose capitalization ultimately does not support its operations going forward. One common example of this type of capitalization is a company that has financed long-term assets, such as plant and equipment, through short-term financing, such as accounts payable and short-term lines of credit. When this happens, the business will starve for working capital because all the working capital sources are being consumed to sustain the long-term assets.

The expression, “good company with a bad balance sheet,” is often used to describe a company that has a strong operational base but is in financial stress. If the troubled company is unable to refinance its existing debt or to divest noncore assets to cover its interest expense, then the company may face insolvency.

Operational and financial stresses are not mutually exclusive, meaning that a company with a strong financial position may be struggling operationally, and a company with strong operating activity may be struggling financially.

THE TROUBLED COMPANY RESPONSE

Prebankruptcy Options for the Troubled Company

Troubled companies do not immediately file for bankruptcy. Instead, once the operational or financial distress is recognized, the troubled company can take corrective steps.

Sometimes, instead of promptly analyzing and addressing operational problems, management is unwilling or unable to face the problems and make the hard choices necessary to tackle the problems. As a result, creditors concerned about the company’s future will often require, as a condition to any forbearance agreement or loan amendment, that the company retain an outside consultant. Many companies can and have accomplished a successful operational turnaround outside of bankruptcy.

Financial distress can sometimes be relieved by one or more techniques, such as:

• Sale of part of the company

• Strategic acquisitions by the company

• New equity investments in the company

• Tender offer for debt

• Recapitalization of the business

• Interim forbearance by lenders

• Exchange offers, either debt for debt, debt for equity, or debt for debt and equity

Valuations are often needed by a troubled company before bankruptcy as part of the efforts of the company and its creditors to solve operational or financial distress. For instance, if operational distress has caused a company to miss financial ratio covenants contained in its loan agreements, as part of an amendment or forbearance, lenders may obtain or require the company to provide a valuation of its business. Similarly, efforts to sell the company or portions of the company’s business will be preceded by a valuation of same as part of the due diligence process.

In some cases, deleveraging transactions can be achieved only through a Chapter 11 bankruptcy case.

Bankruptcy and Similar Remedies for the Troubled Company

When the troubled company cannot correct its operational or financial distress it may have no choice but to (1) surrender its assets to its secured creditors (or be subject to foreclosure by the secured creditors) and/or (2) cease operations, liquidate its remaining assets, and satisfy its debts to the extent possible. Where foreclosure or liquidation is the only option, many companies will choose to file a Chapter 7 bankruptcy case and allow the liquidation to be handled by a court-appointed trustee pursuant to the applicable provisions of the Bankruptcy Code.

In cases in which a company’s financial distress can be addressed through the reorganization provisions of the Bankruptcy Code, the troubled company may file a Chapter 11 case. The goal of a Chapter 11 case is the confirmation of a plan of reorganization, which results in the business that filed Chapter 11 continuing to operate postbankruptcy and being successfully reorganized. The fundamentals of a Chapter 7 and Chapter 11 bankruptcy are discussed in Chapter 6, Overview of U.S. Bankruptcy.

VALUATION IN REORGANIZATION OR BANKRUPTCY

Regardless of whether a troubled company can successfully reorganize prior to bankruptcy, or in bankruptcy, or is ultimately liquidated, there is significant need for business valuations at different points during the continuum.

Valuations prior to bankruptcy will be required on many occasions for different users. Equity investors considering an investment in a troubled company may require a valuation to determine the impact on value that their investment could make on the company and assist them in developing yield expectations on their potential investment. Lenders may require a valuation to assess their loan-to-value position. For example, during the workout process, a lender will make decisions based on the value of the business versus the amount of debt outstanding. Management contemplating the divestiture of a portion of the business will require a valuation to assess the viability of the potential divestiture and the impact it would have on the company’s financial situation. Entities or individuals acquiring troubled companies prior to bankruptcy also require a valuation to assist them in their decision-making process. Finally, any prebankruptcy global reorganization will require a valuation.

At many times during the bankruptcy process, valuations of the debtor’s business (or specific assets owned by the debtor) are necessary. For example, valuations are needed in connection with a motion to lift the automatic stay (discussed at Chapter 7), to obtain adequate protection (discussed at Chapter 7), to seek or oppose confirmation of a plan of reorganization (discussed at Chapter 7), to prosecute or defend actions to recover preferential transfers (discussed at Chapter 8), or to recover fraudulent transfers (discussed at Chapter 8).

Often, the valuation question is, What is the value now? When answering that question, the expert delivers his or her opinion of current value (the valuation date) at a court hearing (the opinion date), and the court decides the current value of the business or asset. In this situation, the valuation date and the opinion date are the same.

In other situations, the valuation question is, What was the value then? When answering that question, the valuation date is a specific date in the past, but the expert gives his or her opinion now, at a court hearing or the date of his or her report. Then, the valuation date and the opinion date are different.

CONCLUSION

The valuation discipline is equally important in the troubled company space as in any other phase of a business’s life cycle. Business valuations for troubled companies or companies in the bankruptcy process present a unique set of challenges for professionals involved with them. This book will delve into these challenges and the business valuation environment in the context of troubled companies, both before and during bankruptcy.

CHAPTER 2

Industry Practitioners and Standards

Valuations are performed by a wide variety of practitioners for an even wider variety of purposes including solvency opinions, plan confirmations, and other matters that arise in bankruptcy cases. These practitioners may be certified in business valuation or appraisal by a professional organization or may simply have experience in negotiating and executing transactions. Regardless of who prepares business valuations, the reliance on judgment and the art of financial analysis is central to the process. As such, a valuation of a specific business by two different practitioners may produce widely different results and be the subject of contention between interested parties. Understanding the need for generally accepted business valuation or appraisal practices, various organizations have adopted developmental and reporting standards and certification programs. These programs and standards provide guidance and training to member practitioners but more importantly provide users a level of confidence in the valuation approach and conclusions reached.

This chapter will describe who is preparing valuations for bankruptcy purposes, the various professional organizations that have established business valuation standards, what those standards are, how they differ, and why standards are important to the valuation industry and to interested parties in a bankruptcy.

PROFESSIONAL ORGANIZATIONS AND BUSINESS VALUATION STANDARDS

Each of the credentialed valuation practitioners identified in the sections that follow are affiliated with a professional organization and must adhere to the professional, ethical, and procedural standards established by that particular or...

Table of contents

- Title Page

- Copyright Page

- Preface

- CHAPTER 1 - Introduction

- CHAPTER 2 - Industry Practitioners and Standards

- CHAPTER 3 - The Basics of Business Valuation

- CHAPTER 4 - Income Approach

- CHAPTER 5 - Market Approach

- CHAPTER 6 - United States Bankruptcy Code

- CHAPTER 7 - Valuations in Bankruptcy as of the Date of the Hearing

- CHAPTER 8 - Valuations in Bankruptcy at a Time in the Past—Avoidance Actions

- CHAPTER 9 - Solvency Opinions

- CHAPTER 10 - Daubert

- APPENDIX - AICPA Statement on Standards for Valuation Services No. 1, Valuation ...

- Index