- English

- ePUB (mobile friendly)

- Available on iOS & Android

eBook - ePub

About this book

A comprehensive private trader? guide to the Australian markets. This is the second edition of the hugely successful Art of Trading, by high-profile private trader and author Chris Tate. The first edition sold 20, 000 copies. Fully revised and updated, this second edition includes information on charting and technical analysis, money management and risk management.

Frequently asked questions

Yes, you can cancel anytime from the Subscription tab in your account settings on the Perlego website. Your subscription will stay active until the end of your current billing period. Learn how to cancel your subscription.

No, books cannot be downloaded as external files, such as PDFs, for use outside of Perlego. However, you can download books within the Perlego app for offline reading on mobile or tablet. Learn more here.

Perlego offers two plans: Essential and Complete

- Essential is ideal for learners and professionals who enjoy exploring a wide range of subjects. Access the Essential Library with 800,000+ trusted titles and best-sellers across business, personal growth, and the humanities. Includes unlimited reading time and Standard Read Aloud voice.

- Complete: Perfect for advanced learners and researchers needing full, unrestricted access. Unlock 1.4M+ books across hundreds of subjects, including academic and specialized titles. The Complete Plan also includes advanced features like Premium Read Aloud and Research Assistant.

We are an online textbook subscription service, where you can get access to an entire online library for less than the price of a single book per month. With over 1 million books across 1000+ topics, we’ve got you covered! Learn more here.

Look out for the read-aloud symbol on your next book to see if you can listen to it. The read-aloud tool reads text aloud for you, highlighting the text as it is being read. You can pause it, speed it up and slow it down. Learn more here.

Yes! You can use the Perlego app on both iOS or Android devices to read anytime, anywhere — even offline. Perfect for commutes or when you’re on the go.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Yes, you can access The Art of Trading by Christopher Tate in PDF and/or ePUB format, as well as other popular books in Business & Investments & Securities. We have over one million books available in our catalogue for you to explore.

Information

Part I

PSYCHOLOGY

PSYCHOLOGY

“I can calculate the motions of the heavenly bodies but not the madness of people.”

Sir Isaac Newton, 1720

1

THE PSYCHOLOGY OF TRADING

AT THE START OF THIS SECTION on the psychology of trading I need to make a blunt point; only an amateur believes that trading is about indicators, company reports, shareholder meetings and broker recommendations. Trading is a psychological endeavour. Markets are little more than herds of humans, each with competing beliefs and underlying biases. As such, markets are loaded with emotional energy, all of it irrational in nature. It is easy for traders to become infected with this irrationality and behave in exactly the same manner as the crowd. You may argue with this if you wish but in doing so you will merely betray your status as a novice. Even Sir Isaac Newton, whose quote opens this book, fell victim to this irrationality when he was caught in the collapse of the South Sea Bubble.

I do not follow the crowd, so I have written this book in the reverse order to what you might traditionally expect—the section on indicators has been placed at the end. Before moving onto the psychology of trading I will ask you to think about the graphic below and see if you can work out what it represents. I have placed the answer at the end of this chapter.

THE EMOTIONAL JOURNEY

Shown below is a roller-coaster, which reflects the emotional journey of the amateur trader; each win is greeted with exaltation and each loss with absolute despair. Such swings are indicative of a complete lack of control over the emotions that come from trading.

THE AMATEUR TRADER’S EMOTIONAL JOURNEY

It is impossible for a trader to control the market. The only arena of control traders have is self-control; without self-control the trader is lost. Markets are ruthless; they do not care if people cannot control themselves. As a colleague of mine once stated, when the market runs people over it not only reverses over them a few times, it gets out, tap dances on their heads and then drives off, only to return and repeat the process all over again just in case they didn’t get the message to get out of the way the first time.

Professional traders display emotions that are more in line with this image; calm and relaxed, without any enormous peaks or troughs. Each win or loss is greeted with the same degree of emotional evenness. It should be your aim to achieve this state of emotional control.

THE PROFESSIONAL TRADER’S EMOTIONAL JOURNEY

THE LEARNED BEHAVIOUR OF TRADERS

There are, I believe, ten significant blunders that all poor traders are prone to make, and—in no particular order of importance—they are as follows.

Tate’s Ten Significant Blunders

1. Undercapitalisation

Most traders come to the market with grandiose dreams of what can be done. I have had people approach me in seminars convinced that they can make $1,500 per day from a $10,000 trading float.

Many accounts are undercapitalised from the start, and as such they suffer from an inability to withstand many drawdowns before they collapse. This is particularly true in derivatives markets. The available evidence suggests that in futures markets an account under $50,000 has little hope of survival, yet traders are repeatedly drawn to the Share Price Index contract with under $10,000 in their accounts.

One of the joys of trading is that you are your own boss (although for many this is hard to take), and therefore you are the quintessential small business. But many small businesses fail from being undercapitalised—trading is no different.

2. Reliance on external sources

If brokers, financial planners or fund managers knew what they were doing they would be doing it, not talking to you. The failure rate in trading is high—in futures markets the rate of failure is as high as nine out of ten—so simple statistics dictate that your chances of finding someone who knows more than you are remote. Listen to others at your own peril.

3. Lack of a trading plan

When it comes to trading there are no rules. The stock exchange does not impose rules on how you should trade (apart from the normal rules of business conduct), nor will the market teach you how to trade. You must have a comprehensive plan for engaging the market. No plan, no profit—it is that simple.

4. Inconsistent application of a trading plan

Some traders have a plan of sorts but it is little more than a collection of random meanderings that are applied on an inconsistent basis.

5. Not taking losses

I never met a big loss that was not once a small loss.

6. Cutting profits too soon

I never met a big profit that was not once a small profit.

7. Misunderstanding how markets operate

Many novice traders enter the market without the slightest knowledge of how it actually works. They do not properly understand how to place an order nor do they have any idea of basic terminology. Novices are also easily swayed by conspiracy theories as an explanation of why they are unable to make money.

8. Lack of confidence

Trading is a difficult business. There are moments when things do not go as planned. This is to be expected, but a chronic lack of confidence can lead to pre-emptive moves out of positions or a failure to act when required.

9. Performance anxiety

Successful traders accept that they will have losing trades but these are not a reflection of who they are. Everyone makes mistakes.

10. Fear of the unknown

Markets present us with a unique challenge. We never know the outcome of a trade until we close it down. We constantly operate in the unknown and this is too much for some people. We are creatures of comfort. The unknown can fill us with trepidation and fear.

The intriguing thing about these ten behaviours is that each one has largely been learned. Traders often look to the market to learn how to trade, but it has often been said that the market will teach you how not to trade simply because it will draw out and reinforce all those areas of your personality that guarantee failure.

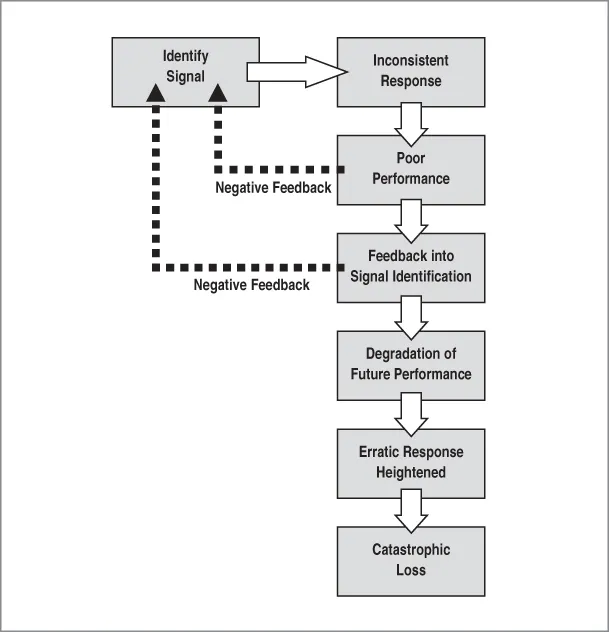

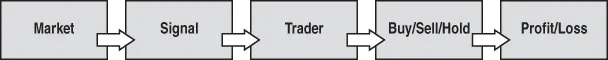

It is necessary to understand how traders have learned to do the wrong thing at the wrong time so that we can then see how to rectify these errors. The flow chart opposite is a schematic of how a poor trader makes a trading decision. You will notice that the key to this entire chain of events is the identification of a signal and an inappropriate initial response to that signal.

FIGURE 1.1 THE DECISION-MAKING TREE OF A POOR TRADER

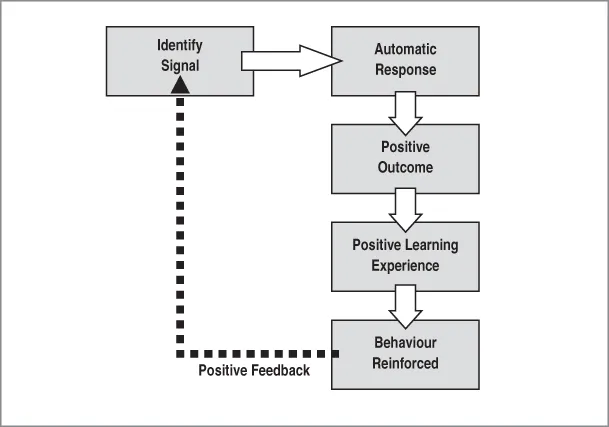

Now compare this with the decision-making tree of a good trader (overleaf ). The differences between the way good and poor traders make decisions were identified by Jake Bernstein, author of The Investors Quotient. Notice how this tree is arranged around the positive reinforcement of all aspects of the trading process. Each time a trade is successfully completed the natural tendency is for this successful behaviour to be reinforced.

FIGURE 1.2 THE DECISION-MAKING TREE OF A GOOD TRADER

There are two key areas that separate the poor trader from the good trader; signal identification and the response to the signal that is received. Top traders are better at recognising signals and have a series of pre-programmed responses that do not vary. In essence their trading is automatic; they see a signal and they act. Poor traders don’t do this since they suffer from the blunders highlighted earlier. They are not as good at recognising the signals and their responses are inconsistent.

The Perfect World

To understand how this dichotomy between the good and poor trader has occurred it is necessary to have a look at the way traders have built up their battery of responses. To do this we need to break the world up into the real world and the perfect world.

In the perfect world a trader learns to trade in the following way:

The market presents the trader with a signal, the trader then acts upon this signal by either buying, selling or holding a given instrument and this action results in a profit or loss. This chain is very similar to the trading process of the successful trader. This is to be expected since the responses of top traders have been optimised by experience. It would be impossible to find a top trader who did not have an approach to trading that was similar to this perfect-world view.

As an example, let’s assume we have a trader using a simple moving average crossover system with appropriate money management. If this system were profitable then in a perfect world the trader would only act upon the signals generated by the trading system. As such the trader would become more and more profitable. But this is not what happens. In the real world successful traders become more and more successful whilst poor traders remain poor traders until they eventually self-destruct.

The perfect-world view encounters difficulty in the area of signal identification. The trader must have a trigger for taking any action. This trigger must reflect the individual’s own system or way of doing things. However, it is possible to receive a signal to act but then to encounter a conflicting signal; this conflicting signal can come from something that the trader has read or been told. It is a natural tendency for humans to abrogate responsibility to what is perceived as a higher authority. The question I am most-often asked is, “What is your view about ABC?” This is a question that is asked countless times every day in chat forums around the world. It is a plaintive cry for reinforcement and justification for taking any given action. It also betrays a trader’s status as an amateur. It is a question to which I never respond since I know that it interrupts the trader’s natural decision-making process. It also does not matter what others think, just as it does not matter what I think. We may all be wrong and you may be right.

This signal conflict has two possible outcomes. Firstly the external source can be ignored and the trader acts on the original signal. This is the best outcome. If the original signal turned out to be correct then a positive learning experience takes place and the successful behaviour is reinforced. Even if the signal does not give a profitable result this is a positive experience because the trading system used is being tested under real-world conditions.

The second possible outcome is that the conflicting signal is taken. If a loss is then incurred then this is not a bad result; this is actual...

Table of contents

- Cover

- Title page

- Copyright page

- Preface

- Part I: Psychology

- Part II: Money Management

- Part III: Charting

- Part IV: Indicators

- Part V: Getting Started

- Appendix: Candlestick Interpretation

- Glossary

- Index