- English

- ePUB (mobile friendly)

- Available on iOS & Android

eBook - ePub

Convergence Guidebook for Corporate Financial Reporting

About this book

As a result of the global convergence of financial reporting standards, U.S. GAAP is changing profoundly. U.S. GAAP is also being abandoned by many public and private companies, and will eventually be replaced by a higher-quality set of global standards. The Convergence Guidebook for Corporate Financial Reporting provides the timely, practical guidance that CFOs, controllers, and other financial managers need in order to prepare for the impact of Convergence on their companies, departments, and careers. Guidebook readers will also learn why they must begin preparing for "the next big challenge in corporate financial reporting" now.

Frequently asked questions

Yes, you can cancel anytime from the Subscription tab in your account settings on the Perlego website. Your subscription will stay active until the end of your current billing period. Learn how to cancel your subscription.

No, books cannot be downloaded as external files, such as PDFs, for use outside of Perlego. However, you can download books within the Perlego app for offline reading on mobile or tablet. Learn more here.

Perlego offers two plans: Essential and Complete

- Essential is ideal for learners and professionals who enjoy exploring a wide range of subjects. Access the Essential Library with 800,000+ trusted titles and best-sellers across business, personal growth, and the humanities. Includes unlimited reading time and Standard Read Aloud voice.

- Complete: Perfect for advanced learners and researchers needing full, unrestricted access. Unlock 1.4M+ books across hundreds of subjects, including academic and specialized titles. The Complete Plan also includes advanced features like Premium Read Aloud and Research Assistant.

We are an online textbook subscription service, where you can get access to an entire online library for less than the price of a single book per month. With over 1 million books across 1000+ topics, we’ve got you covered! Learn more here.

Look out for the read-aloud symbol on your next book to see if you can listen to it. The read-aloud tool reads text aloud for you, highlighting the text as it is being read. You can pause it, speed it up and slow it down. Learn more here.

Yes! You can use the Perlego app on both iOS or Android devices to read anytime, anywhere — even offline. Perfect for commutes or when you’re on the go.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Yes, you can access Convergence Guidebook for Corporate Financial Reporting by Bruce Pounder in PDF and/or ePUB format, as well as other popular books in Studienhilfen & CPA-Studienführer (Certified Public Accountant). We have over one million books available in our catalogue for you to explore.

Information

PART I

Phenomenon of Convergence

In order to provide a solid foundation for the remainder of this book, Part One describes and explains the phenomenon of Convergence. This part consists of three chapters:

• Chapter 1 will introduce you to the phenomenon of Convergence.

• Chapter 2 will summarize how Convergence will impact U.S. companies and their financial managers.

• Chapter 3 will explain why you must prepare for Convergence now.

To get the maximum benefit from this book, be sure to read the preface, then read this part thoroughly. Your investment in understanding the origin, nature, and scope of Convergence, along with other fundamental concepts covered in this part, will be well rewarded as you continue through the rest of the book.

CHAPTER 1

Introduction to the Convergence of Financial Reporting Standards

This chapter provides an in-depth introduction to the phenomenon of Convergence. In this chapter, you will learn exactly what Convergence is—and isn’t. You will also learn why Convergence is happening.

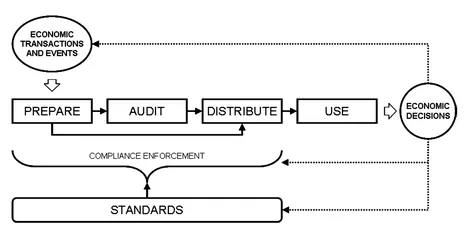

Financial Reporting Supply Chain

To understand the phenomenon of Convergence, it is helpful to begin by looking at the financial reporting supply chain, which refers to “the people and processes involved in the preparation, approval, audit, analysis and use of financial reports.”1 Just as the supply chain for tangible products is the network of parties that manufacture, inspect, distribute, and use the products, the financial reporting supply chain is the network of parties that prepare, audit, distribute, and use financial reports.

In the financial reporting supply chain, financial information flows through various stages. The flow of information starts with raw data about the financial effects of transactions and events on an enterprise. That raw data is processed progressively until it is eventually presented to end users in a highly filtered, summarized, and structured fashion.

As financial information flows from one stage to the next in the financial reporting supply chain, the various supply chain participants (preparers, auditors, etc.) add value to the information. This is analogous to the way in which manufacturers of tangible products add value to raw materials by transforming raw materials into finished goods, or the way in which distributors add value to finished goods by transporting specific goods to specific locations at specific times in order to meet the demand of end users.

While it is universally agreed that the financial reporting supply chain starts with the enterprises that prepare financial reports for use by parties outside of those enterprises, there is less agreement on who the primary end users of the financial reporting supply chain are. However, in the United States and increasingly throughout the world, the primary end users in the financial reporting supply chain are assumed to be investors and creditors, that is, individuals and institutions who seek to profit from allowing enterprises to use their financial capital.

In the United States, for example, the primary objective of external financial reporting is considered to be providing “information that is useful to present and potential investors and creditors and other users in making rational investment, credit, and similar decisions.”2 Of course, there are other users of financial reports, such as government agencies and academic researchers, who may use financial reports for different purposes. But meeting the information needs of such users is of secondary importance to meeting the information needs of investors and creditors.

Thus, the financial reporting supply chain exists in the United States and elsewhere in the world primarily to provide investors and creditors with information that is useful in making economic decisions about the allocation of capital to the enterprises that operate within our economy. Investors and creditors obviously benefit directly from the financial reporting supply chain, but it should be noted that a well-functioning financial reporting supply chain also serves the public interest. By helping investors and creditors to make sound capital allocation decisions, the financial reporting supply chain makes our economy more efficient at satisfying people’s needs and wants with our scarce resources. This is true on a both a national and global scale.

Even though financial reports are only one source of information that investors and creditors use in making economic decisions, they are a very important source of information for the economic decisions that investors and creditors make. Many of the economic decisions made by investors and creditors result in transactions or events that are accounted for and reported by the enterprises in the financial reporting supply chain that prepare financial reports. But other economic decisions affect how the financial reporting supply chain itself works, that is, the ways in which supply chain participants add value to raw data about the transactions and events that enterprises account for and report.

One of the most pervasive ways in which economic decisions affect the working of the financial reporting supply chain is through the imposition of standards on the supply chain’s participants (i.e., preparers, auditors, and distributors of financial reports), processes (i.e., preparing, auditing, and distributing financial reports), and products (i.e., information having specific content and format that is passed from one participant in the supply chain to the next). Today, the economic decisions that individuals and institutions are making with regard to financial reporting supply chain standards are causing those standards to change in the United States and throughout the world in profound ways. Because those economic decisions and the resulting changes in standards are the very essence of the process of Convergence, the next section of this chapter will further explore the role of standards in the financial reporting supply chain as well as the economic decisions that individuals and institutions make with regard to such standards.

Role of Standards in the Financial Reporting Supply Chain

Both users of financial reports and institutions that exist to serve the public interest have strong economic incentives to impose standards on the various participants, processes, and products of the financial reporting supply chain. For example:

• The existence and enforcement of high-quality financial reporting supply chain standards improves the usefulness of financial reports, and therefore helps investors and creditors make better economic decisions regarding the allocation of their capital. This in turn improves investors’ and creditors’ returns and makes our economy as a whole more efficient at satisfying people’s needs and wants.

• The existence and enforcement of high-quality financial reporting supply chain standards lowers the risk that investors and creditors perceive to be associated with making capital allocation decisions, which provides investors and creditors with a greater number of less risky opportunities to deploy their capital profitably and which ultimately produces broad benefits to society from economic growth.

Thus, standards that pertain to the financial reporting supply chain have the potential to deliver significant economic benefits to both users of financial reports and society in general. But the economic benefits of standards do not come automatically. This is because standards do not occur naturally—they must be created and updated. Also, participants in the financial reporting supply chain cannot be relied on to comply automatically with pertinent standards—enforcement is needed. Without effective compliance enforcement, standards themselves have little value.

Because the activities of creating, updating, and enforcing standards require economic resources, those activities will not happen unless someone chooses to sacrifice economic resources in order to make them happen. Specifically, people who expect to benefit from the existence and enforcement of financial reporting supply chain standards must make economic decisions regarding how much of their scarce economic resources they are willing to sacrifice in order to obtain the benefits.

EXHIBIT 1.1 Financial Reporting Supply Chain

At this point, you may wish to review Exhibit 1.1 for a graphical summary of the financial reporting supply chain and the ways in which economic decision making by financial report users influences the supply chain through the existence and enforcement of standards.

Investors, creditors, and governmental bodies generally recognize that it is in their economic interest to sacrifice economic resources to some degree in order to develop, maintain, and enforce standards that apply to the financial reporting supply chain. In developed economies, standard-setting and standard-enforcing activities are typically carried out on behalf of investors, creditors, and the general public by formally organized bodies. Various funding mechanisms are employed to transfer economic resources from the beneficiaries of standards to standard-setting and standard-enforcing bodies.

In the United States, for example, the Financial Accounting Standards Board (FASB) is the recognized financial reporting standard setter for private-sector entities. Also, the U.S. Securities and Exchange Commission (SEC) enforces compliance with financial reporting standards by the entities that are under its jurisdiction (typically, those whose securities are issued to or exchanged among members of the general public).

Due to the existence of intermediaries such as the FASB and the SEC, most end users in the financial reporting supply chain do not participate directly in standard-setting and standard-enforcing activities. However, they generally have opportunities to participate indirectly through a “due process” that many intermediaries follow. Even though most end users in the financial reporting supply chain are not directly involved in the setting and enforcing of standards for the supply chain, it is important to recognize that standards are still set and enforced primarily to serve the information needs of those end users.

Of the many standards that pertain to the financial reporting supply chain, financial reporting standards are the most fundamental in terms of ensuring that the information needs of investors and creditors are met. Because financial reporting standards are at the center of the phenomenon of Convergence, the next section of this chapter will provide a working definition of the term financial reporting standards as that term will be used throughout the rest of the book.

Financial Reporting Standards

Financial reporting standards pertain specifically to preparers of financial reports, the process of preparing financial reports, and the products of the preparation process (e.g., traditional financial statements such as the balance sheet). Financial reporting standards are distinct from other standards such as auditing and distribution standards that pertain to participants, processes, and products downstream from the preparation stage in the financial reporting supply chain.

In common usage, the terms financial accounting standards and financial reporting standards are sometimes used interchangeably with each other and are sometimes used in contrast with each other. When used interchangeably with each other, both terms refer broadly to standards that pertain to any aspect of preparing financial reports. When used in contrast with each other, the term financial accounting standards refers specifically to standards for the recognition and measurement of items of economic significance, whereas the term financial reporting standards refers specifically to standards for the presentation and disclosure of recognized and measured items in financial reports.

Because there is little need to distinguish between “accounting” and “reporting” standards in this book, the term financial reporting standards as used throughout the book refers broadly to any prescriptive guidance that pertains to:

• Preparers of financial reports

• The process of accounting for items of financial significance

• The process of preparing financial reports

• The content of prepared financial reports

• The format of prepared financial reports

Understanding that financial reporting standards can and do differ throughout the world is essential to understanding the phenomenon of Convergence, and so the next section of this chapter will examine how financial reporting standards differ among countries.

How Financial Reporting Standards Differ among Countries

There are several dimensions on which financial reporting differs among countries. Naturally, the language (e.g., English, Spanish) and currency units (e.g., dollars, euros) used in financial reports vary from country to country. Standards that pertain to the financial reporting supply chain also differ among countries, as does the enforcement of compliance with those standards.

In particular, companies in different countries have traditionally used different country-specific sets of financial reporting standards in preparing financial reports. In some countries, companies are legally required to use a country-specific set of financial reporting standards. In other countries, companies have more freedom to choose the financial reporting standards that they use, but as a practical matter, companies within a country typically gravitate toward using the same set of standards—standards that often differ from the standards used in other countries.

Different sets of financial reporting standards often go by different names around the world. In the United States, financial reporting standards are collectively known as generally accepted accounting principles (GAAP). While many observers disagree with the characterization of U.S. standards as “principles,” that is what our standards have traditionally been called.

Other countries, such as Canada, have also traditionally referred to their standards as GAAP. But, over time, many standard setters throughout the world have moved from referring to their standards as GAAP or accounting principles or even accounting standards in favor of the term financial reporting standards, which reflects the evolving sense that “accounting” and “reporting” standards are largely inseparable from each other in practice and that both kinds of standards exist to support sound, informative financial reporting as an end goal. As explained earlier, this book uses the term financial reporting sta...

Table of contents

- Title Page

- Copyright Page

- Dedication

- Acknowledgements

- Preface

- PART I - Phenomenon of Convergence

- PART II - Impact of Convergence on Financial Reporting in the United States

- PART III - Impact of Convergence on U.S. Labor Markets

- PART IV - Preparing for the Impact of Convergence

- Index