![]()

Chapter 1

TD Sequential

Defining the Trend and Identifying Exhaustion Points

When I started looking at the DeMark indicators in the early 1990s, it was TD Sequential that first piqued my interest. I had previously come across other technical studies that identified trading opportunities well when prices were trending, and still other indicators that were particularly suited to ranges, but I had found it frustrating that none of these approaches was sufficiently dynamic to distinguish between these two very different types of price action.

TD Sequential appeals to me because it addresses that problem, having both momentum (TD Setup) and trending (TD Countdown) components. Furthermore, it’s completely objective and incorporates disciplined money-management rules, and (because it’s based on relative price action) you can apply it to any market or time frame, regardless of the market’s underlying volatility, without having to change any of the default indicator settings.

For those of us brought up in the computer age, it may seem hard to believe, but Tom DeMark developed TD Sequential by hand, through a process of trial and error, in the 1970s. It never ceases to amaze me how something originally created to analyze daily price data can be applied so effectively, more than thirty years later, to any time frame—from one minute to one year—and to any market.

Since the majority of people are trend followers, it’s hardly surprising that “the trend is your friend” is one of the most widely quoted trading mantras. While it may seem counterintuitive, given that most people do follow trends, TD Sequential attempts to isolate prospective exhaustion points in ranges, to anticipate market tops and bottoms when it believes prices are overbought or oversold and during trends when sentiment is invariably at an extreme. Even if you are not inclined to the technical, TD Sequential can be helpful for market-timing purposes, as an adjunct to your existing arsenal of trading tools. Traders oriented to fundamentals tell me it helps them determine take-profit levels when they would otherwise be reliant on a less-efficient price-reversal pattern to close out a profitable position. TD Sequential also highlights, at the time the signal is generated, points where one should refrain from establishing or adding to an existing position in the direction of the underlying trend. Once you’re comfortable with the methodology, however, you can use TD Sequential as I do, to fade trends.

Let’s look at the components of TD Sequential in order to understand how and why it manages to be so versatile. The indicator has two components: TD Setup, which relies on momentum to define price ranges, and TD Countdown, which is trend based, and looks for low-risk opportunities to fade established directional moves. As TD Sequential is probably the most-talked-about TD indicator, I’ll explain it in detail for both bullish and bearish scenarios, as well as answer some frequently asked questions.

TD Setup

TD Setup is one component of TD Sequential; the other component, TD Countdown, cannot come into play until a TD Setup formation is complete. TD Setup, however, is not only a prerequisite for the broader-trend-reversal TD Countdown signal; it is also an indicator, one that can help determine whether a market is likely to be confined to a trading range or starting a directional trend. TD Setup, of course, has both buy and sell indicators, and I will address them separately.

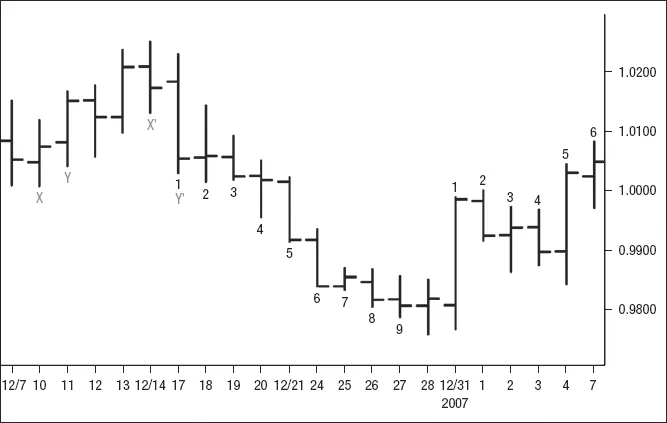

The prerequisite for a TD Buy Setup is a Bearish TD Price Flip, which indicates a switch from positive to negative momentum (Figure 1.1).

- - - - - - - - - -

Bearish TD Price Flip

A Bearish TD Price Flip occurs when the market records a close greater than the close four bars earlier, immediately followed by a close less than the close four bars earlier.

- - - - - - - - - -

- - - - - - - - - -

TD Buy Setup

After a bearish TD Price Flip, there must be nine consecutive closes, each one less than the corresponding close four bars earlier.

- - - - - - - - - -

Since the indicator was originally designed to look at daily price data, a comparison of the closing price with the closing price four bars earlier represents a rolling week.

Interruption of a TD Buy Setup

If, at any point, the sequence—of nine consecutive closing prices less than the closing price four bars earlier (up to and including the close of TD Buy Setup bar nine)—is interrupted, the developing TD Buy Setup will be canceled and must begin anew.

Having to start all over again can test one’s patience, because it postpones the appearance of a signal. But the delay is meaningful, because it suggests a change in market dynamics, which the indicator acknowledges by changing its behavior.

Completion of the First Phase of TD Sequential

Once a TD Buy Setup successfully reaches nine, the first phase of TD Sequential is complete, and a TD Buy Countdown can begin.

TD Sell Setup

For a prospective sell situation, before a TD Sell Countdown can begin, we need to see a bullish TD Price Flip—a switch from negative to positive momentum (Figure 1.2)—in order to initiate a TD Sell Setup.