- English

- ePUB (mobile friendly)

- Available on iOS & Android

Misconceptions of Risk

About this book

We all face risks in a variety of ways, as individuals, businesses and societies. The discipline of risk assessment and risk management is growing rapidly and there is an enormous drive for the implementation of risk assessment methods and risk management in organizations. There are great expectations that these tools provide suitable frameworks for obtaining high levels of performance and balance different concerns such as safety and costs.

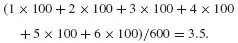

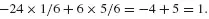

The analysis and management of risk are not straightforward. There are many challenges. The risk discipline is young and there area a number of ideas, perspectives and conceptions of risk out there. For example many analysts and researchers consider it appropriate to base their risk management policies on the use of expected values, which basically means that potential losses are multiplied with their associated consequences. However, the rationale for such a policy is questionable.

A number of such common conceptions of risk are examined in the book, related to the risk concept, risk assessments, uncertainty analyses, risk perception, the precautionary principle, risk management and decision making under uncertainty. The Author discusses these concepts, their strenghts and weaknesses, and concludes that they are often better judged as misconceptions of risk than conceptions of risk.

Key Features:

- Discusses common conceptions of risk with supporting examples.

- Provides recommendations and guidance to risk analysis and risk management.

- Relevant for all types of applications, including engineering and business.

- Presents the Author's overall conclusions on the issues addressed throughout the book.

All those working with risk-related problems need to understand the fundamental ideas and concepts of risk. Professionals in the field of risk, as well as researchers and graduate sutdents will benefit from this book. Policy makers and business people will also find this book of interest.

Tools to learn more effectively

Saving Books

Keyword Search

Annotating Text

Listen to it instead

Information

- For some experts ‘risk’ equals expected loss of life expectancy (HM Treasury, 2005, p. 33).

- Traditionally, hazmat transport risk is defined as the expected undesirable consequence of the shipment, that is, the probability of a release incident multiplied by its consequence (Verma and Verter, 2007).

- Risk is defined as the expected loss to a given element or a set of elements resulting from the occurrence of a natural phenomenon of a given magnitude (Lirer et al., 2001).

- Risk refers to the expected loss associated with an event. It is measured by combining the magnitudes and probabilities of all of the possible negative consequences of the event (Mandel, 2007).

- Terrorism risk refers to the expected consequences of an existent threat, which, for a given target, attack mode, target vulnerability and damage type, can be expressed as the probability that an attack occurs multiplied by the expected damage, given that an attack occurs (Willis, 2007).

- Flood risk is defined as expected flood damage for a given time period (Floodcite, 2006).

Table of contents

- Cover

- Title Page

- Copyright

- Preface

- Acknowledgements

- 1: Risk is equal to the expected value

- 2: Risk is a probability or probability distribution

- 3: Risk equals a probability distribution quantile (value-at-risk)

- 4: Risk equals uncertainty

- 5: Risk is equal to an event

- 6: Risk equals expected disutility

- 7: Risk is restricted to the case of objective probabilities

- 8: Risk is the same as risk perception

- 9: Risk relates to negative consequences only

- 10: Risk is determined by the historical data

- 11: Risk assessments produce an objective risk picture

- 12: There are large inherent uncertainties in risk analyses

- 13: Model uncertainty should be quantified

- 14: It is meaningful and useful to distinguish between stochastic and epistemic uncertainties

- 15: Bayesian analysis is based on the use of probability models and Bayesian updating

- 16: Sensitivity analysis is a type of uncertainty analysis

- 17: The main objective of risk management is risk reduction

- 18: Decision-making under uncertainty should be based on science (analysis)

- 19: The precautionary principle and risk management cannot be meaningfully integrated

- 20: Conclusions

- Index

Frequently asked questions

- Essential is ideal for learners and professionals who enjoy exploring a wide range of subjects. Access the Essential Library with 800,000+ trusted titles and best-sellers across business, personal growth, and the humanities. Includes unlimited reading time and Standard Read Aloud voice.

- Complete: Perfect for advanced learners and researchers needing full, unrestricted access. Unlock 1.4M+ books across hundreds of subjects, including academic and specialized titles. The Complete Plan also includes advanced features like Premium Read Aloud and Research Assistant.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app