![]()

Chapter 1

The New Investors in Energy

For the average investor the energy industry has always offered oppor-tunities to profit through the publicly traded securities available on the world's stock markets. Indeed, many multinational oil companies have long been considered “blue chip” stocks with both reasonable dividend and appreciation characteristics. Mutual funds have also provided investors opportunities to indirectly invest in the energy equities, although until recently usually as part of a more diversified approach. More sophisticated investors have had other options, including the use of options on securities and access to commodity trading through CTAs, hedge funds, and other alternative investment vehicles.

However, over the last two years, the energy industry has literally been transformed into the “hot” investment sector. Today, with high and volatile energy commodity prices impacting everyone, energy is in the news headlines 24/7. On a daily basis, new investment opportunities in the energy industry are offered in the form of energy or natural resource-specific mutual funds, exchange traded funds (ETFs), income and royalty trusts, master limited partnerships (MLPs), and other vehicles. The average investor now has a broader set of opportunities to participate in the booming energy sector. Yet these new vehicles only scratch the surface of the opportunities provided through the alternative investment universe via energy and environmental hedge funds.

NEW ENERGY INVESTORS

The new investors in energy are what we refer to as “the triangle of trading.” These comprise investment banks, hedge funds, and multinational oil companies. Today, utilities are being increasingly marginalized in energy markets as they drop back into trading around their assets and pursue a strategy of optimizing those assets for shareholders if they trade at all. With the energy merchants long gone after the fall of Enron and the others, a vacuum was left that these new investors have stepped in to fill.

The investment banks have been in and out of energy over the years to varying degrees, but over the last 18 months, the banks have increased their interest in and exposure to energy across the board. Almost every sizable investment bank now has a position in energy, while only Goldman Sachs and Morgan Stanley have had some form of presence for over 20 years. Other banks, including UBS, Barclays Capital, Lehman Brothers, Citigroup, Deutsche Bank, and ABN AMRO, among others, have all increased the size of their energy trading desks; and others, such as Merrill Lynch and Bear Sterns, have created joint ventures with, or even acquired, existing energy trading firms.

Investment banks continue to play a role on the distressed asset side of the energy business, too, while some have actually acquired significant energy assets and now operate those assets. For example, Goldman Sachs added to its energy portfolio with the purchase of East Coast Power and the acquisition of Cogentrix Energy in the United States. Both Goldman Sachs and Morgan Stanley can handle physical trading and take actual physical delivery of product. Goldman also holds a large renewable energy generation portfolio, too. Some investment banks have even bought oil and gas reserves in the ground.

The multinational oils have also moved in to fill the space left by the energy merchants in recent years. British Petroleum (BP) is now the largest trader of natural gas in North America, and it and other multinational oil companies have reported huge profits from their energy trading activities over the last 12 months.

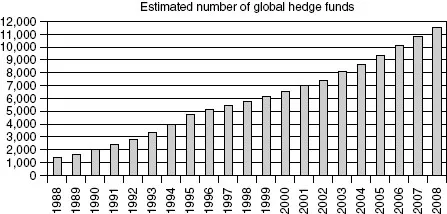

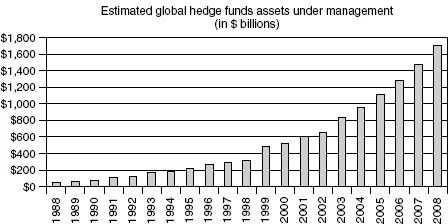

However, the key area of interest and the topic of this book is the evergrowing and “secretive” hedge fund community. Despite increased interest from regulators such as the US Securities and Exchange Commission (SEC) and others, hedge funds are being funded at a record pace. Once the exclusive domain of private wealthy individuals, institutional money is now flooding into hedge funds seeking promised better returns (Figures 1.1 and 1.2). The $38.2 billion that flowed into the funds in Q1 2004 was a record and that pace has continued as public and corporate pension funds now allocate an average of 5-7% of their assets for investment in hedge funds. Van Hedge Fund Advisors1 recently issued a report in which it expects assets under management at hedge funds to double to $2 billion by 2009.

But as hedge funds gain access to increasing amounts of capital, so too has the average hedge fund return declined to something less than spectacular. Hedge funds returned less than 9.64% in 2004, compared to 15.44% in 2003, and under-performed more conventional asset classes according to the CSFB Tremont hedge fund index.2 Hedge fund managers attributed their lower performance in 2004 to low volatility and low interest rates. As a result, hedge funds have been looking for other asset classes to invest in. Seeking new opportunities where the sparkle can be put back on their reputation for producing a significant return on investment, they have identified the energy industry as having that potential. Early indications have only served to raise energy's profile since some of the better performing funds last year were focused on energy.

As a result, those ex-energy traders from the merchant era are now back in demand. Energy traders are being snapped up by hedge funds, multinational oil companies, and investment banks, and, in some instances, they have formed their own hedge funds based on their energy trading expertise. Indeed, the number of specialist energy commodity trading funds with between $1 million and $25 million in assets under management is growing rapidly. Not all the energy funds are so small. Several of the better known energy-focused funds are quite large, between $400 million and over $1 billion in assets under management. But we are also seeing a trend for much larger (greater than $1 billion under management) macro funds to switch more of their assets into energy, too. Today, our research has identified over 450 hedge funds that are active in the energy industry and that number continues to grow. Their assets under management range from $1 million to $2 billion.

WHY NOW?

Perhaps those of us in the energy industry have been too comfortable and too close to the business to notice the lack of sustained investment in our industry over the last 15 or so years. Whether it is oil and gas exploration, development of new reserves, or investment in the power industry, we are now seeing supply-demand tightness in all energy commodity markets and a historical under-valuation of energy companies and their assets. At the same time, demand has continued to grow robustly, and we are now at a stage where unforeseen events such as acts of terrorism, industrial disputes or accidents, weather-related events, and transmission constriction can be enough to create considerable concern about supply. This has resulted in increased price volatility, particularly in oil markets, and the funds love that price volatility.

There is now a growing awareness and even acceptance that in global oil markets supply tightness is such that OPEC no longer holds the swing vote on oil price formation. Today, oil prices are set by the trader's views on the NYMEX as much as anything else. News events such as those that occur in Iraq, Nigeria, Russia, and Venezuela over the potential for or actual supply disruptions, combined with reserve estimate reductions bymajor oil companies and the lack of transparency into the true nature of OPEC's own reserves, are now sufficient to cause $2+ daily swings in the oil price. Over the last two decades, oil companies have been more interested in buying back their stock to increase share price and please share holders than in investing in new exploration or production activities. Wall Street just hasn't rewarded explorers and risk-takers, and the majors have not significantly increased their exploration and production budgets partly because other commodity markets, like steel, have also risen accordingly, adding to the expense side.

For each energy commodity the picture is similar. While oil is a global market and impacted by global events, regional natural gas, coal, and electric power markets are now often subject to similar supply tightness. The rush to natural gas-fired generation has helped to increase the perception of supply tightness in gas markets and the 2003 black outs did likewise for electric power.

Hedge funds like volatility. They like to identify trends and bet on those trends. Today they see that the trend in commodity prices has been largely up, and as they place their bets they are accentuating those trends. They are also followers and will follow each other, chasing the money and the returns. Some of the energy commodity trading funds had returns of over 40% during the past year and that has not gone unnoticed.

Similarly, as oil companies made money on increased commodity prices, their equities looked undervalued. Energy stocks, including oilfield services, looked the same. Also, the collapse of the merchant sector in the industry has created a significant distressed asset and debt play for the funds. As ex-merchants seek to raise cash by selling perfectly good assets, so the hedge funds have seen their opportunity, and today hedge funds are among the leading holders of ex-merchant debt backed by valuable collateral. Even as the industry seeks answers to its own problems, the hedge funds see opportunities in renewables and green trading, for example.

WHAT IS A HEDGE FUND?

A hedge fund is a type of “alternative” investment. The term “hedge fund” is a general, non-legal term that was originally used to describe a type of private and unregistered investment pool that uses sophisticated hedging and arbitrage techniques to trade in the corporate equity markets. While hedge funds have traditionally been limited to sophisticated, wealthy investors, over time, their activities have broadened into other financial instruments and activities. Today, the term “hedge fund” no longer really refers to their hedging techniques, which they may or may not use, but it simply refers to their status as private and unregistered investment pools. They are usually unregulated.

Hedge funds are somewhat similar to mutual funds in that they are both pooled investment vehicles that accept investors' money and generally invest it on a collective basis. However, hedge funds differ significantly from mutual funds because they are not required to register under all of the federal securities laws. They have this status because they generally accept only financially sophisticated investors and do not publicly offer their securities.

Hedge funds are also not subject to many of the numerous regulations that apply to mutual funds for the protection of investors, such as those requiring a certain degree of liquidity, that mutual fund shares be redeemable at any time, protecting against conflicts of interest, assuring fairness in the pricing of fund shares, disclosure regulations, limiting the use of leverage, and more. This freedom from regulation allows hedge funds to engage in leverage and other sophisticated investment techniques to a much greater extent than mutual funds. Hedge funds are subject to the antifraud provisions of the federal securities laws.

Part of the difficulty in defining what constitutes a hedge fund is that other investors engage in many of the same practices. For example, investment bank proprietary trading desks take positions, buy and sell derivatives, and alter their portfolios in the same manner as hedge funds. Individuals and institutions buy stocks on margin, and even commercial banks will use leverage. For these reasons the line between hedge funds and many other types of institutional investors is blurred.

However, there has been a change in the status of hedge funds recently.On December 2, 2004, the US SEC adopted Rule 203(b)(3)-2 and related amendments under the Investment Advisors Act of 1940. The new rules will require most h...